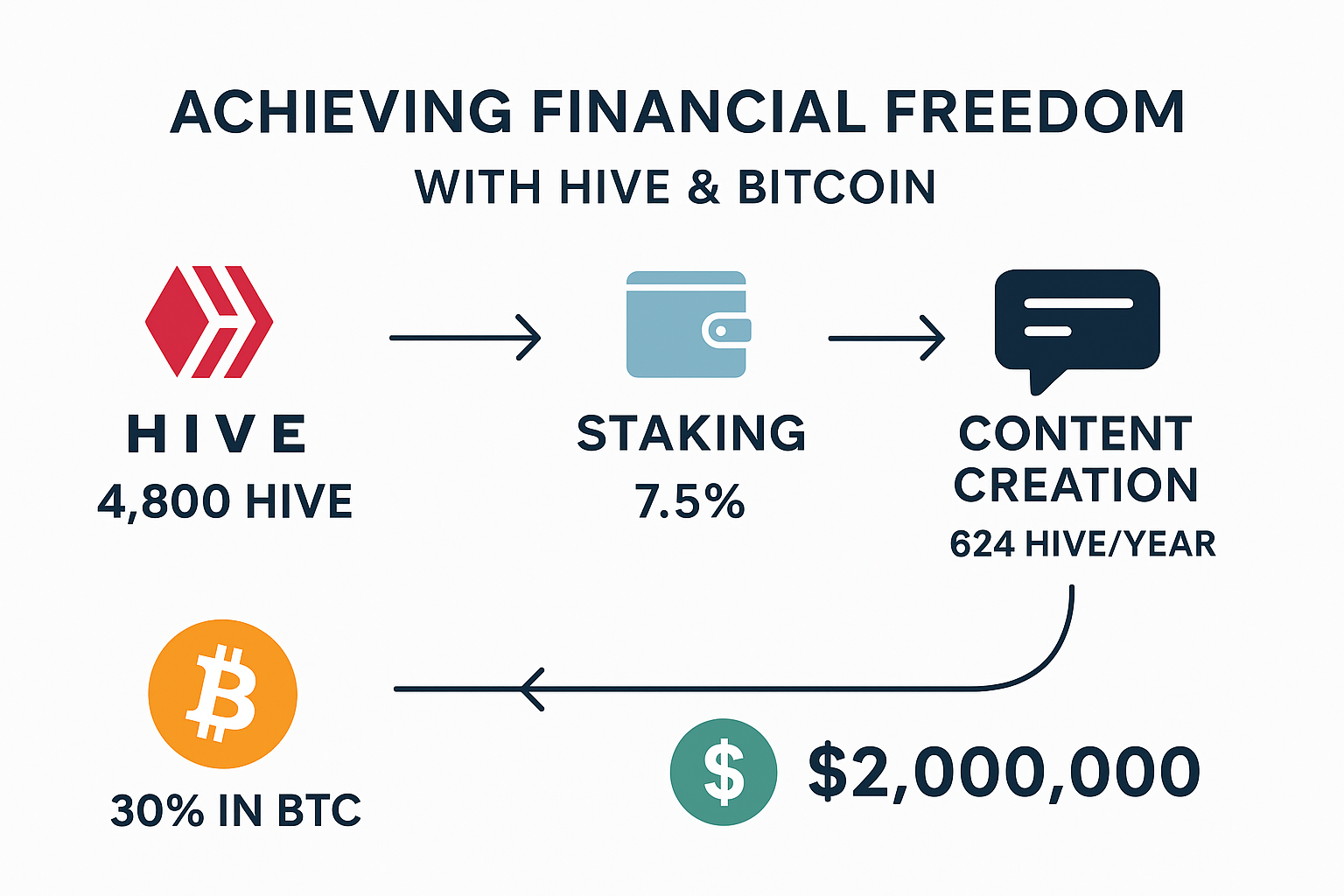

A realistic scenario that combines Hive staking, consistent content creation, and a disciplined 70/30 reinvest/diversify strategy — with monthly contributions — to reach a $2M portfolio.

Summary: the big picture

This post demonstrates, with clear assumptions and year-by-year logic, how a creator starting with 4,800 HIVE (≈ $960 at $0.20/HIVE) can combine staking rewards, regular posting income, and steady monthly contributions to build a portfolio worth $2,000,000. We assume a reinvestment strategy that keeps 70% of generated Hive value in Hive and converts 30% into Bitcoin for long-term diversification. The key variables are Hive staking yield, content income, and the assumed price growth of Hive and Bitcoin.

Baseline assumptions (transparent and explicit)

- Starting balance: 4,800 HIVE (starting price $0.20 → $960).

- Content income: 3 posts/week × 4 HIVE each = ~624 HIVE/year.

- Staking (Hive Power) yield: 7.5% per year (rewards distributed in HIVE).

- Reinvestment policy: of yearly Hive-generated income (staking + posts), 70% is reinvested into Hive, 30% is converted to BTC.

- Price growth assumptions: Hive price +10% p.a.; Bitcoin scenarios of +7%, +10%, +15% p.a.

- Extra contributions: we compare three cases — no extra contributions, $500/month (=$6,000/year) at 70/30 split, and $300/month (=$3,600/year) at 70/30 split.

- Target: total portfolio value (Hive + BTC) ≥ $2,000,000.

Why these numbers matter

The core idea: Hive generates real recurring yield — both via content rewards and staking. Reinvesting most of that yield compounds your Hive holdings. Converting a portion to Bitcoin gives you exposure to a global, scarce store-of-value that historically has produced outsized long-term returns. The combination is a yield-plus-growth strategy.

Key numeric starting points

Start: 4,800 HIVE (~$960 at $0.20). Posts: 624 HIVE/year. Staking: 7.5% p.a.

Simulated results — how long to $2M?

>A. No extra monthly contributionsIf you simply start with 4,800 HIVE, post consistently, and follow the 70/30 reinvestment split without adding extra fiat capital:

- Bitcoin growth 7% → ≈ 45 years to $2M

- Bitcoin growth 10% → ≈ 44 years

- Bitcoin growth 15% → ≈ 42 years

Conclusion: without extra capital, the compounding is real but slow — measured in decades.

>Add disciplined monthly contributions of $500 (→ $6,000/year), split 70% to Hive and 30% to BTC:- Bitcoin growth 7% → ≈ 27 years

- Bitcoin growth 10% → ≈ 27 years

- Bitcoin growth 15% → ≈ 25 years

Impact: consistent saving plus crypto reinvestment dramatically shortens the timeline.

>C. $300 per month extra (70/30 split)If you commit $300/month (→ $3,600/year) split the same way:

- Bitcoin growth 7% → ≈ 34 years

- Bitcoin growth 10% → ≈ 33 years

- Bitcoin growth 15% → ≈ 32 years

Even smaller monthly contributions matter — they shave nearly a decade off the no-extra baseline.

Why $2,000,000 is a good financial-freedom benchmark

Using the widely used 4% safe withdrawal rule, a $2M portfolio supports roughly $80,000/year of spending (2,000,000 × 0.04 = 80,000). That’s around $6,600 per month — enough for comfortable living in many regions and allowing flexibility to travel, pursue projects, or reduce work hours. The 4% rule is a guideline, not a guarantee: adapt to your lifestyle and risk tolerance.

Risks, caveats, and practical advice

No model can predict the future. Key risks to keep in mind:

- Price risk: Hive might not grow 10% annually; Bitcoin is volatile.

- Reward variance: Content rewards are noisy — you could earn more or less than 4 HIVE/post.

- Network risk: Shifts in user adoption, protocol changes, or tokenomics adjustments can change results.

Practical tips:

- Be consistent with content — rewards compound over time.

- Reinvest early and often to capture compounding.

- Diversify — small BTC positions provide resilience and long-term growth exposure.

- Track metrics yearly and adapt allocations if assumptions change.

Conclusion — a realistic, long-term plan

Reaching $2,000,000 with a mix of Hive and Bitcoin is a long-term goal, not a sprint. Without extra capital it can take 40+ years, but disciplined monthly contributions — even modest amounts such as $300/month — make the outcome realistically achievable in a lifetime. With $500/month the target compresses to around 25–27 years in our assumptions. The combination of staking income, content earnings, and steady dollar-cost averaging into both Hive and Bitcoin produces a powerful compounding effect.

If you’re a creator on Hive, this plan aligns your content work with an investment strategy: create value, capture rewards, reinvest most of them, and let time do the heavy lifting.

I'm a freelance Filmmaker in Zurich, looking forward to meeting you here on HIVE and explore visual Art. All my posts are original content when not stated otherwise.

Check out my Portfolio and Links. Website: http://isnz.ch/ YouTube: https://goo.gl/rQaiFV Instagram: https://www.instagram.com/isnz.ch/ TikTok: https://www.tiktok.com/@isnz.ch

Travel Where I book hotels: https://bit.ly/riohotel Where I book the cheapest flights: https://goo.gl/HRhxoy Credit card with best commissions for travels: http://bit.ly/travelcreditcard Editing software: http://bit.ly/editing_software

Disclaimer This is no financial advice. Everything written is my opinion only and you should do your own research. Investing in Bitcoin and other cryptos, lending, DeFi, liquidity mining are high risk investments. You could lose everything, only invest what you can afford. Bear in mind that some links in this post are affiliate links and if you go through them to make a purchase, I will earn a commission. Keep in mind that I link these companies and their products because of their quality and not because of the commission I receive from your purchases. The decision is yours, and whether you decide to buy something is completely up to you.