In case you miss it, the Congress recently passed the Konektadong Pinoy Act which liberalize the broadband transmission industry by removing the legislative franchise requirement for entities that want to build and operate internet infrastructure. It creates a tiered system for data transmission (international, national, and regional networks), and lowers barriers so new players can enter the market.

At its core, the law mandates free internet access in public spaces such as parks, transport terminals, government offices, and schools. This is a crucial step in ensuring that citizens, regardless of their socioeconomic status, can participate in the digital economy. For students, this means better access to online learning materials; for entrepreneurs, this opens more opportunities to reach markets; and for ordinary citizens, this provides a platform to stay connected, informed, and empowered.

At its core, the law mandates free internet access in public spaces such as parks, transport terminals, government offices, and schools. This is a crucial step in ensuring that citizens, regardless of their socioeconomic status, can participate in the digital economy. For students, this means better access to online learning materials; for entrepreneurs, this opens more opportunities to reach markets; and for ordinary citizens, this provides a platform to stay connected, informed, and empowered.

So what does this mean for TEL, GLO, CNVRG, and DITO?

GLO

Globe Telecom (GLO) benefits from its diversified services across mobile, broadband, and digital platforms, alongside a strong brand and cross-selling capability. Yet, like PLDT, Globe faces cost pressures, regulatory risks, and heightened competition from low-cost entrants. A re-rating in valuation remains possible if data ARPU growth consistently outpaces expense growth and service quality improvements become evident to investors.

Globe Telecom (GLO) benefits from its diversified services across mobile, broadband, and digital platforms, alongside a strong brand and cross-selling capability. Yet, like PLDT, Globe faces cost pressures, regulatory risks, and heightened competition from low-cost entrants. A re-rating in valuation remains possible if data ARPU growth consistently outpaces expense growth and service quality improvements become evident to investors.

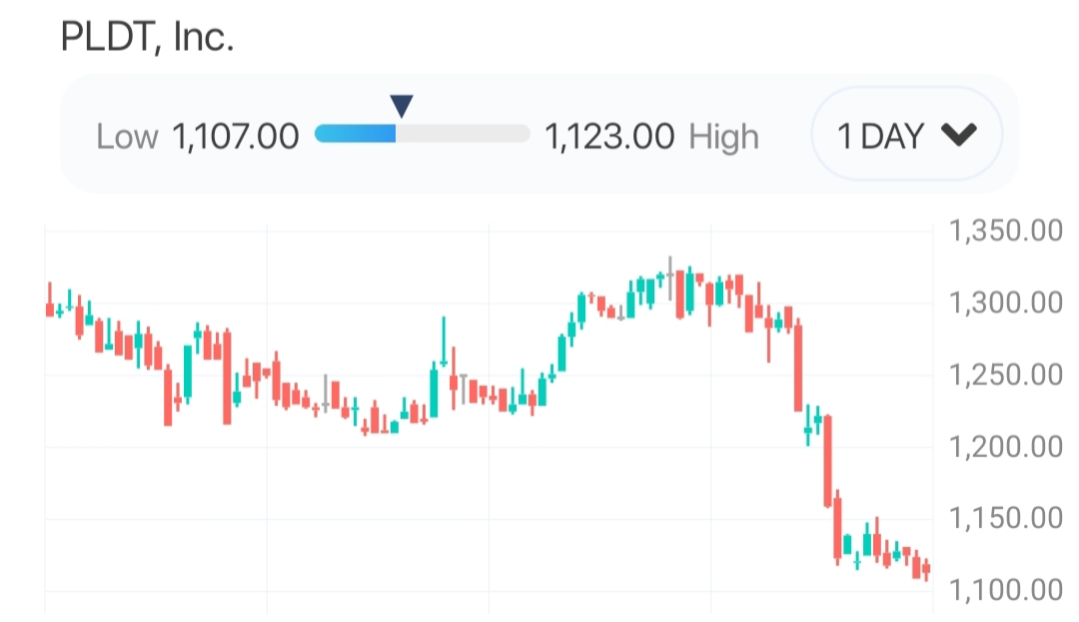

TEL

PLDT (TEL) stands out under the Konektadong Pinoy Law due to its deep fiber and mobile infrastructure, extensive subscriber base, and strong cash flows that can support future capital expenditures. However, the company faces legacy cost structures, potential increases in regulatory compliance costs, and risks of margin erosion under possible price controls. From a valuation perspective, TEL could see multiple expansion if it successfully demonstrates lower costs per user and accelerates rural fiber rollout, with CapEx efficiency and rollout speed serving as key triggers.

PLDT (TEL) stands out under the Konektadong Pinoy Law due to its deep fiber and mobile infrastructure, extensive subscriber base, and strong cash flows that can support future capital expenditures. However, the company faces legacy cost structures, potential increases in regulatory compliance costs, and risks of margin erosion under possible price controls. From a valuation perspective, TEL could see multiple expansion if it successfully demonstrates lower costs per user and accelerates rural fiber rollout, with CapEx efficiency and rollout speed serving as key triggers.

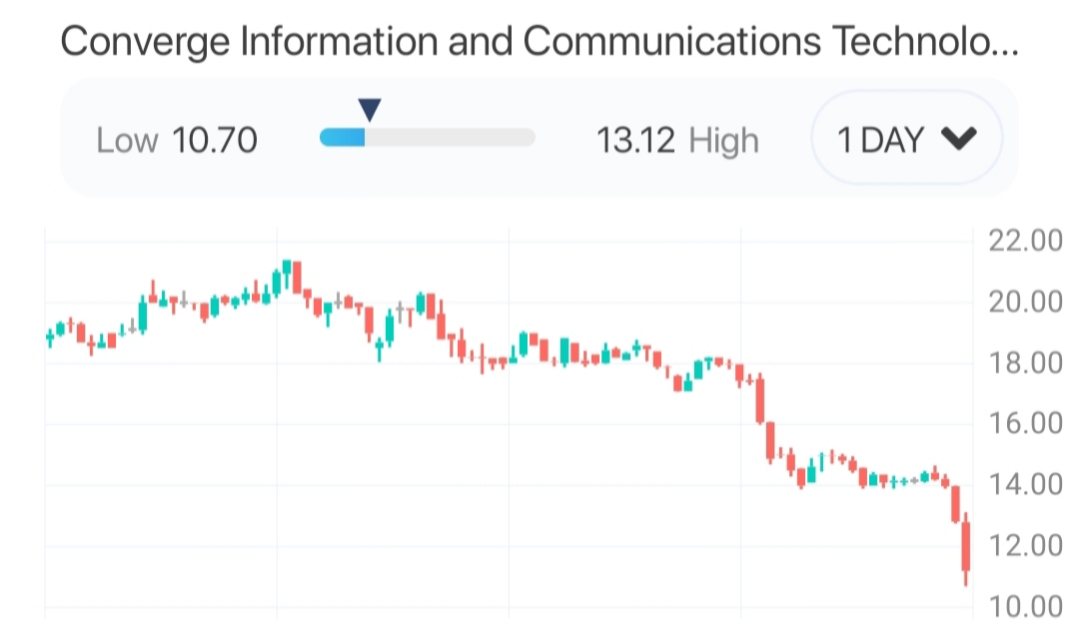

CNVRG

Converge ICT (CNVRG), as a pure broadband player, is well positioned to meet the law’s connectivity objectives, with its fiber-focused model and access to underserved markets providing strong growth opportunities. On the flip side, CNVRG must manage heavy upfront investments, potential delays due to permitting and infrastructure hurdles, and margin risks if pricing caps are imposed. If the company succeeds in scaling to new areas, optimizing last-mile delivery, and sustaining favorable unit economics, meaningful upside could be unlocked. It is also important to note that with the current dip of its stock price, it's clear that the market is moving base on sentiments and not on fundamentals. As they say, "don't catch a falling knife".

Converge ICT (CNVRG), as a pure broadband player, is well positioned to meet the law’s connectivity objectives, with its fiber-focused model and access to underserved markets providing strong growth opportunities. On the flip side, CNVRG must manage heavy upfront investments, potential delays due to permitting and infrastructure hurdles, and margin risks if pricing caps are imposed. If the company succeeds in scaling to new areas, optimizing last-mile delivery, and sustaining favorable unit economics, meaningful upside could be unlocked. It is also important to note that with the current dip of its stock price, it's clear that the market is moving base on sentiments and not on fundamentals. As they say, "don't catch a falling knife".

Meanwhile, DITO CME Holdings (DITO), being a newer entrant, is positioned to benefit from incentives to expand coverage, while carrying a lighter legacy burden compared to incumbents. This opens opportunities for market share gains. However, the company faces steep challenges, including persistent funding losses, regulatory and competitive pressures, and high infrastructure costs. Its valuation is highly execution-dependent, hinging on its ability to narrow cash flow deficits, grow its subscriber base, and improve coverage reliability. Notably, its recent stock performance reflects investor caution, with a visible downtrend that underscores the execution risk priced in by the market.

Personally, I see this law as more than just a catalyst for my portfolio—it’s a vision of a future where Filipinos no longer treat good internet as a luxury but as a right. As an investor, I’m optimistic. As a consumer, I’m even more excited. After all, better connectivity benefits us all.

That's it for today's blog. See you in my next one!

Sending some love and light

With love, Jane