During the last bear cycle, while many chartists were talking about 4,000 BTC, the last article on valuation published here, and based on fundamental mathematical methods, expressed then that the downcycle was already likely over. The comments on that thread still speaks for itself here:

2018-04-08: https://steemit.com/bitcoin/@kenraphael/math-based-fundamental-value-analysis-has-been-right-about-bitcoin-bear-trend-so-far-what-does-it-tell-us-about-when-sustained

Since then, as a computational exercise, we have improved the models even more with real time API calls, and real time calculations to see if it were possible to even capture the smaller time scale variations in modeled values with the fundamental variables we were tracking.

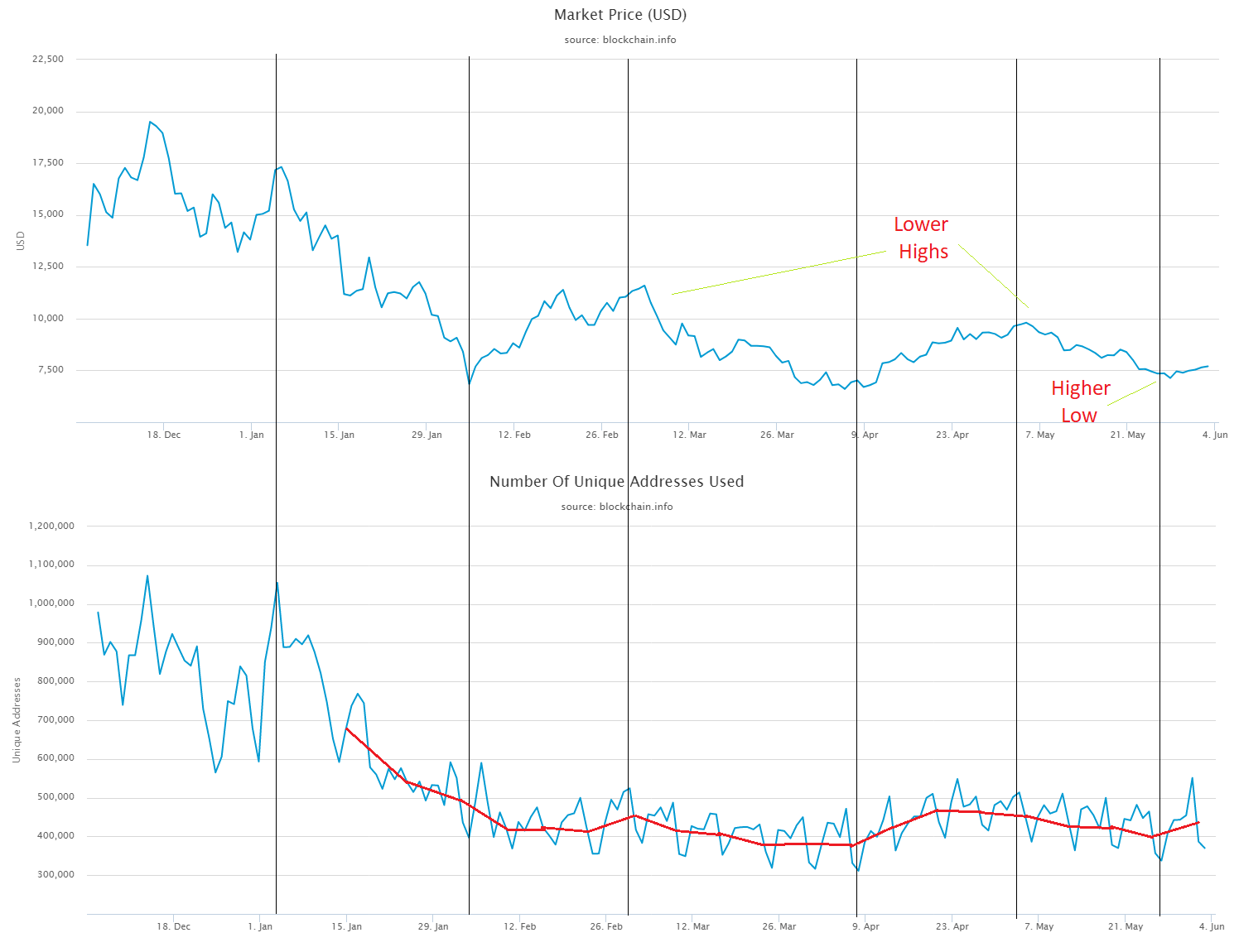

Here is what one of the longer time scale variables is showing. We see that the demand side has stopped falling since around 5/24. Other fundamental metrices that could drive values down further (see prior articles) remain stable. We also see an inexplicable bounce in DUA on 5/31/2018 that only likely points to TRX that day, and EOS release next day - which itself promptly saw a bounce. Let's remember that the a currently significant BTC (and ETH to a great extent) use case is as a medium of exchange to purchase other cryptocurrencies. In essence, you almost can not get EOS without first getting BTC or ETH (granted a few exchanges like Binance do now offer EOS/USD pairings.) The same is true of TRX. So in essence, activities and progress in other projects in the cryptocurrency space is pointing to an end to the recent cycles of higher lows and lower highs.

Source: blockchain.info.

Source: blockchain.info.

However, using the data from blockchain.info means this plot is looking about 2 days back.

Looking at values from APIs down to the nearest hour, we do already see the slight uptick in demand continuing.

(For reference: It's 8:41pm Jun 5 2018, right now EST, and BTC is currently 7430 and just declined by about 200 points the last 24 hours. And the blockchain is immutable which is why this medium is the best for writing so edits can be verified with the times they are made.)

Overall, the lowest level in the current cycle is likely the roughly 7050 of around May 28th. However, we might also continue to see fluctuations but the base demand curve looks to have already turned back upwards. But please note that trading with this level of data is gambling rather than investing, as it is quite susceptible to news and events. The bigger picture is that the higher low of this cycle is likely already in.

Short Term

Looking at all the different projects releasing some test net or main net in June, and the uptick in demand around the EOS and TRX main net release would lead one to believe that medium term the current month might experience a net stable to higher value. Since Bitcoin tends to function as a gateway to all those other assets, demand for those will also mean some demand for the gateway or reserve asset. Some of those projects are compelling enough that their followers will likely pitch in more resources as those projects reveal some of their promised milestones.

Medium Term

Longer term the demand levels still remain very weak. Even after factoring in increased use of batching, and some more use of offchains and side chains for transaction, the current demand level will continue to put downward pressure on values until they increase. If the demand does not pick up, we could very well be looking at the rest of 2018 where bitcoin will not reach their ATH of nearly 20,000 that was reached late last year.

Other Articles by the Author

April 8 2018: Math-Based Fundamental Value Analysis Has Been Right About Bitcoin Bear Trend So Far - What Does it Tell Us About When Sustained Growth Will Return? https://steemit.com/bitcoin/@kenraphael/math-based-fundamental-value-analysis-has-been-right-about-bitcoin-bear-trend-so-far-what-does-it-tell-us-about-when-sustained

Mar 17 2018: Lightning Was Released This Week – What Will be the Impact for the Bitcoin Network and the Cryptocurrency Market? https://steemit.com/bitcoin/@kenraphael/lightning-was-released-today-what-will-be-the-impact-for-the-bitcoin-network-and-the-cryptocurrency-market

Mar 16 2018: Social Media Trading Analysts Are Likely Mostly Doing a Disservice to the Blockchain Community https://steemit.com/bitcoin/@kenraphael/social-media-trading-analysts-are-likely-mostly-doing-a-disservice-to-the-blockchain-community

Mar 09 2018: Blockchain Technology Potential (Series 1) – A Review of a Recent PAYPAL CryptoCurrency Patent Filing and What It Means for the Future of the Technology https://steemit.com/bitcoin/@kenraphael/blockchain-technology-potential-series-1-a-review-of-a-recent-paypal-cryptocurrency-patent-filing-and-what-it-means-for-the

Mar 07 2018: Audit the Teths – A Macro Case for Why Tethers Need to be Audited for Confidence to Return to the Market https://steemit.com/bitcoin/@kenraphael/audit-the-teths-a-macro-case-for-why-tethers-need-to-be-audited-for-confidence-to-return-to-the-market

Feb 24 2018: A Review of a Few Fundamental Metrices that Drive Bitcoin Value and What They Currently Indicate https://steemit.com/bitcoin/@kenraphael/a-review-of-a-few-fundamental-metrices-that-drive-bitcoin-value-and-what-they-currently-indicate

Feb 17 2018: Bitcoin Has Not Yet Fundamentally Recovered At This Time – A Mathematical Case https://steemit.com/bitcoin/@kenraphael/bitcoins-have-not-yet-fundamentally-recovered-at-this-time-a-mathematical-case

Feb 12 2018: There is Little Chance Bitcoins can Sustain any Real Recovery Until This Fundamental Metric Begins to Turn Upwards Again https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again

Feb 09 2018: This Single Metric Seems to Correlate More with CryptoAsset Values The Past Two Weeks Than Most Predictive Methods https://steemit.com/cryptocurrencies/@kenraphael/this-single-metric-seems-to-correlate-more-with-cryptoasset-values-the-past-two-weeks-than-most-predictive-methods

About the Author Ken has a doctorate in Engineering, and a master’s in Computer Aided Engineering, An IT professional, programmer and published researcher with over thirty publications in various fields of technology, including several peer reviewed journals and publications.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs. This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Upvote/Resteem/Comment. All comments are upvoted. Everyone that resteems gets a 100% upvote on comment here or their own blog. Let's start a conversation.