If you put people in a position where they can print money, and they are never checked, eventually they will... _ Unknown

Maybe. A new research article was released today that pulled extensive data from the bitcoin blockchain and the omnilayer that issues tether, that if true, purports to show that tethers were being printed and used when bitcoin prices were dropping and then being sold at the top and end of month.

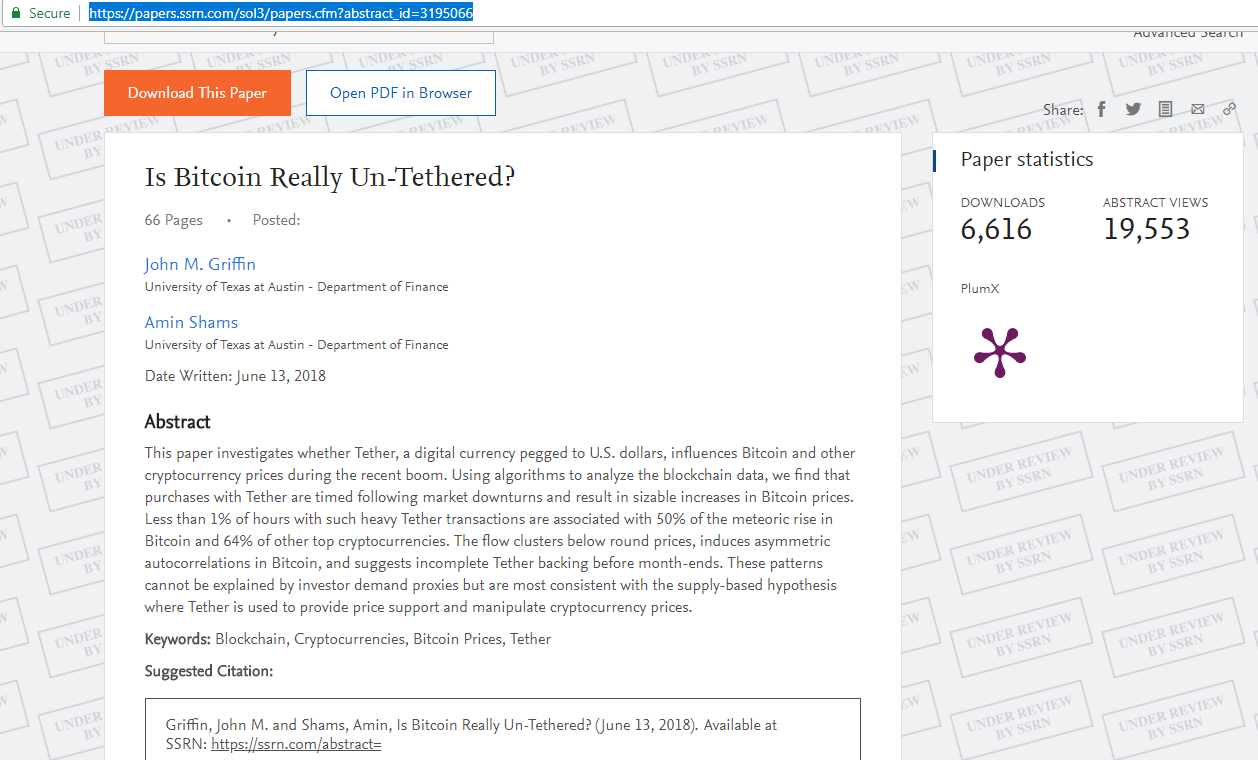

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3195066

Source: SSRN

Source: SSRN

In a prior article, using statistical analysis here, we had presented data that seems implausible to explain based on organic demand alone: https://steemit.com/bitcoin/@kenraphael/audit-the-teths-a-macro-case-for-why-tethers-need-to-be-audited-for-confidence-to-return-to-the-market

This article, and this new research, as well as the inability of Tethers to produce a clean independent audit should make anyone in the space be uncomfortable with the current state. Is it that it is not possible to have an unregulated system without someone or groups of people either attempt to game it at the expense of others or at best refuse to be as transparent as the market demands? Maybe the market is not demanding transparency? If it is, then most people in the space should demand a clean accounting of any peg currency that is in the position to print demand in the cryptocurrency space.

What does all the trading analysis and prognostications and strategies mean if everything is all just being manipulated? (And by the way, the analysts have been wrong during the earlier part of the 2018 and we could well be looking at possibly at least a year before bitcoins returns to the possibly drunken ATH of Dec 2017.)

Hopefully, all this leads to a clear response from tethers or a clean up, or more users demanding the same through their choice of exchange and peg currency.

Why critic and flee from a system that prints supply (money) to one that prints demand with same or even worse effect?

April 8 2018: Math-Based Fundamental Value Analysis Has Been Right About Bitcoin Bear Trend So Far - What Does it Tell Us About When Sustained Growth Will Return? https://steemit.com/bitcoin/@kenraphael/math-based-fundamental-value-analysis-has-been-right-about-bitcoin-bear-trend-so-far-what-does-it-tell-us-about-when-sustained

Mar 17 2018: Lightning Was Released This Week – What Will be the Impact for the Bitcoin Network and the Cryptocurrency Market? https://steemit.com/bitcoin/@kenraphael/lightning-was-released-today-what-will-be-the-impact-for-the-bitcoin-network-and-the-cryptocurrency-market

Mar 16 2018: Social Media Trading Analysts Are Likely Mostly Doing a Disservice to the Blockchain Community https://steemit.com/bitcoin/@kenraphael/social-media-trading-analysts-are-likely-mostly-doing-a-disservice-to-the-blockchain-community

Mar 09 2018: Blockchain Technology Potential (Series 1) – A Review of a Recent PAYPAL CryptoCurrency Patent Filing and What It Means for the Future of the Technology https://steemit.com/bitcoin/@kenraphael/blockchain-technology-potential-series-1-a-review-of-a-recent-paypal-cryptocurrency-patent-filing-and-what-it-means-for-the

Mar 07 2018: Audit the Teths – A Macro Case for Why Tethers Need to be Audited for Confidence to Return to the Market https://steemit.com/bitcoin/@kenraphael/audit-the-teths-a-macro-case-for-why-tethers-need-to-be-audited-for-confidence-to-return-to-the-market

Feb 24 2018: A Review of a Few Fundamental Metrices that Drive Bitcoin Value and What They Currently Indicate https://steemit.com/bitcoin/@kenraphael/a-review-of-a-few-fundamental-metrices-that-drive-bitcoin-value-and-what-they-currently-indicate

Feb 17 2018: Bitcoin Has Not Yet Fundamentally Recovered At This Time – A Mathematical Case https://steemit.com/bitcoin/@kenraphael/bitcoins-have-not-yet-fundamentally-recovered-at-this-time-a-mathematical-case

Feb 12 2018: There is Little Chance Bitcoins can Sustain any Real Recovery Until This Fundamental Metric Begins to Turn Upwards Again https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again

Feb 09 2018: This Single Metric Seems to Correlate More with CryptoAsset Values The Past Two Weeks Than Most Predictive Methods https://steemit.com/cryptocurrencies/@kenraphael/this-single-metric-seems-to-correlate-more-with-cryptoasset-values-the-past-two-weeks-than-most-predictive-methods

About the Author Ken has a doctorate in Engineering, and a master’s in Computer Aided Engineering, An IT professional, programmer and published researcher with over thirty publications in various fields of technology, including several peer reviewed journals and publications.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs. This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Upvote/Resteem/Comment. All comments are upvoted. Everyone that resteems gets a 100% upvote on comment here or their own blog. Let's start a conversation.