Lions,

Many cryptos in the space are mooning. It started with BTC but now has started to trickle into the top altcoins in the market. If your altcoin isn't rising dramatically in price, it is likely not going to go up this season. It's a tough statement to wrap your head around but it feels true in this cycle.

ETH and other altcoins have started to rise dramatically and it may be wise to take some profits slowly on the way up. I am a big believer in Dollar-Cost Averaging (DCA).

DCA is the way.

SURGing LEO

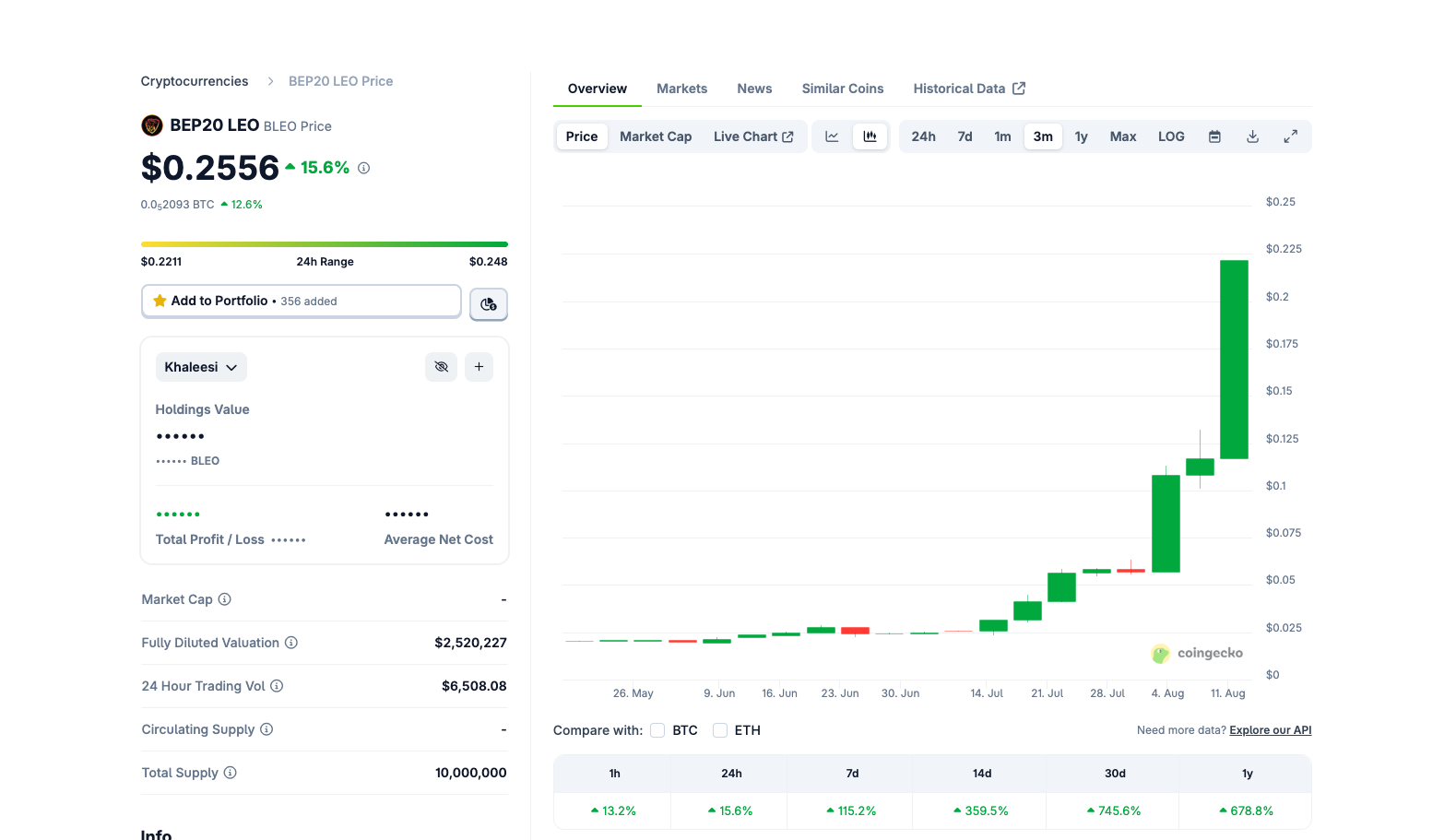

LEO has been rising more than any other altcoin out there. We are up more than 700% in the past 30 days. Many are wondering if a dramatic increase like this could possibly be sustainable.

The Harsh Reality

The truth is that none of us actually know where LEO will go in price. Just like we don't know for BTC. BTC could drop to $75k. Or it could rise to $200k. We truly don't know. This is what makes a market... a market.

That being said we all believe BTC will be worth exponentially more in the long-run than it is today, right? My price target is north of $500k - BTC flipping Gold in terms of market cap.

With LEO, we now have a limited supply of 30M tokens. There can never be more than this. We also have dozens upon dozens of methods of generating revenue into the LEO token economy. Between this and our approach to building radically innovative technologies, I believe LEO will be worth north of $1B in market cap in the years to come. This puts LEO's price at about $33 per token or a greater than 100x+ return from current prices.

Currently, LEO is trading at a ~$8M market cap. LeoDex did $500k in swap volume yesterday, generating nearly $2,000 in revenue for the LEO Token Economy buybacks in a single day. This is only one stream of revenue and it has quickly become our biggest. LeoAI is taking shape as well, driving revenue and economic value into our economy every single day.

Meanwhile, LeoStrategy is scooping up tokens and building a financial network of products on the LEO economy with one singular purpose: add permanent LEO holdings to their balance sheet. This LEO can never be sold as it is staked as sLEO to earn USDC. They've stated a plan to acquire at least 10M LEO by the end of 2025 and they have already crossed the 2M mark. As LEO continues to rise, it will get more and more scarce and harder for them to hit the 10M mark. They'll need to start launching very creative products that generate accretive revenue (aka LEO Per Share of LSTR) in order to hit this target.

We're also launching LeoMerchants to enable merchants IRL to accept crypto payments using any crypto. Converting it in real-time via LeoDex. We're also building a Mobile Wallet app to help manage all of your crypto and seamlessly trade within the secure wallet via LeoDex integration.

This all being said, LEO may not continue rising in price... or maybe it will. Again, this is the point of markets. We don't know where they are headed.

LeoStrategy did something super smart in my opinion and that was launching SURGE. 1. Buy SURGE 2. Their Announcement Post for SURGE

What is LeoStrategy?

LeoStrategy is a Permanent Capital Vehicle that aims to not only replicate, but outmatch the strategy being built by Microstrategy and Michael Saylor.

What Microstrategy has done is take a pristine asset - BTC - added it to their balance sheet and then built financial products around that balance sheet which generate revenue. They use 100% of the revenue + perpetual capital raises to buy more BTC.

As they buy more BTC, their balance sheet expands. This allows them to expand their financial product offerings and therefore, generate more revenue which allows them to acquire more BTC which later allows for .. yet again.. more expansion.

LeoStrategy is doing the same thing but they're doing it on the LEO Token Economy. They're using LEO as their pristine asset. Why? 1. 30M max supply (LEO 2.0 capped the supply by permanently burning the ability to mint more LEO and changing INLEO to a buyback-based rewards pool model) 2. LeoDex 3. LeoAI 4. LeoDex Mobile Wallet 5. LeoMerchants 6. LeoDex B2B SDK 7. ...

There is a lot in the pipeline to make LEO a $1B+ market cap ecosystem. Doing $500k in trading volume on LeoDex yesterday alone is a great lens into our vision. This is just the start and LeoStrategy knows this.

They are building a financial network on top of the LEO token economy which is now a deflationary token with a max supply of 30M and dozens of streams of revenue. All of which buyback the token and either burn it or permanently lock it to accrue yield and buyback more (Protocol Owned LEO, for example - which can be seen at the bottom of https://leodex.io/leo).

SURGE is a genius move by LeoStrategy. You see, Microstrategy is able to generate massive value for their balance sheet by launching new and exciting financial products leveraging the BTC on their balance sheet to acquire more BTC for their balance sheet.

LeoStrategy is in the infant stages of doing this. The initial sale of LSTR sold out last Monday and raised $100k to buyback LEO. LeoStrategy's balance sheet of LEO is now worth over $500k (and growing fast).

Then, they launched @lstr.voter which is an autonomous voting protocol that LEO POWER holders can delegate to and earn passive yield. A 10% management fee is earned by @leostrategy and you guessed it.. they put that yield onto their balance sheet as permanently staked LEO. This increases the LEO Per Share (LPS) of each outstanding LSTR share.

LPS is the KPI for Strategy companies (for Microstrategy, its BPS or Bitcoin Per Share). LeoStrategy has already: 1. Launched their initial sale and sold out successfully - by the way, all early buyers are now up nearly 5x on the initial sale price 2. Launched their first autonomous revenue-generating product (lstr.voter) which generates a 10% management fee for the @leostrategy fund and adds LEO to their balance sheet every single day at a $0 cost per LEO acquired. This lowers their average price of purchase while expanding their balance sheet with more LEO 3. Launched SURGE which is their first derivative financial product on top of the LEO Token Economy

What is LeoStrategy's SURGE and Why Should Anyone Buy It?

SURGE is a perpetual preferred offering by LeoStrategy. In english, it is basically a token that is worth a minimum of $1 and pays a weekly yield of 16.67% APY. Where it differentiates itself is the conversion option.

50 SURGE can be converted to 1 LSTR at any time. Since SURGE has a floor price of $1, this makes the economically viable conversion price $50+ per LSTR.

Effectively, this is a long-dated call option. You have the right (but not obligation) to convert SURGE to LSTR at some point in the future when LSTR is worth more than $50.

What does this mean?

It means that you: 1. Get a stable asset that is worth at least $1 at all times 2. Earn 16.67% yield while you wait for LSTR to rise above $50+ and then you'll see SURGE's value skyrocket in lockstep with LSTR (or you can simply convert to LSTR and realize all those gains)

The timing of LeoStrategy's launch of SURGE couldn't be any more perfect. They're launching it after LEO has risen 700%+ in value, LSTR has 5x'd in value and the rest of the strong altcoins (and BTC) are rising exponentially in value.

This means that anyone in weak altcoins can easily rotate to SURGE to enjoy some yield.

It means that anyone in strong altcoins can easily rotate to SURGE to enjoy some yield and downside protection while still getting long-term upside because of the conversion option.

Long-Term

Long-term, this is immensely valuable for LeoStrategy. They get to raise capital to fund more LEO purchases today which will be worth exponentially more in the future. In addition, they launch a derivative that can be added to their volatility harvesting engine. This vol harvesting engine is basically market making the volatility of the derivatives they build.

This is how Micrsotrategy generates billions of dollars in yield each year. They HODL a lot of BTC. They launch derivatives based on that BTC they HODL. They market make those derivatives. They profit immensely and use 100% of the profits to purchase more BTC so they can launch even more derivatives.

Is LeoStrategy starting to make sense to you?

If you're a LEO holder, you're probably watching your wallet skyrocket in value. You probably also have some other altcoins that are strong and are rising in value. SURGE is there to actually lower your portfolio's risk by giving you a $1+ stable-priced asset that earns 16.67% yield while still letting you participate in long-term upside.

It's a call option that pays you ridiculously high income.

The LEO Team and I are hard-charging on making LeoDex the #1 DEX Web App on the planet. While we do this, its exciting to see another team emerge from the community (LeoStrategy) to build and release massively valuable projects that are aligned with the LeoTeam's mission: drive as much value to LEO as humanely possible.

With both our teams and the community working so hard, LEO is rising exponentially. I won't be surprised if we see the trend continue, but having some SURGE on the sidelines to hedge some volatility risk is always a good idea.

- Buy SURGE

- Their Announcement Post for SURGE

Posted Using INLEO