Most ecosystems aim to build something sustainable. In crypto, we've seen thousands upon thousands of tokens and communities come and go. The moving goal post of creating an economically sound project that grows while the team builds the fundamentals is extremely difficult to accomplish. Few projects have lasted over the years and even fewer have continued to innovate while growing their community and improve their economics.

LEO 2.0 represented a massive shift in LEO's economy. We successfully transitioned from an inflationary rewards economy to a deflationary flywheel economy.

What exactly is a deflationary flywheel economy? 1. Rewards paid are sustainable: generated from real inflows as opposed to minting and paying 2. Deflation is consistent: generated from real inflows as opposed to minting and burning 3. Flywheels are constant: removing float from the supply using real economic inflows 4. Supply is finite: there can never be more tokens than what exist today

In this post, let's talk about the 5 major flywheels that are driving LEO 2.0 economics toward our $10B Market Cap Vision.

5 Flywheel Driving Economic Inflows

- LeoDex

- INLEO

- LeoStrategy

- POL

- LeoBridges

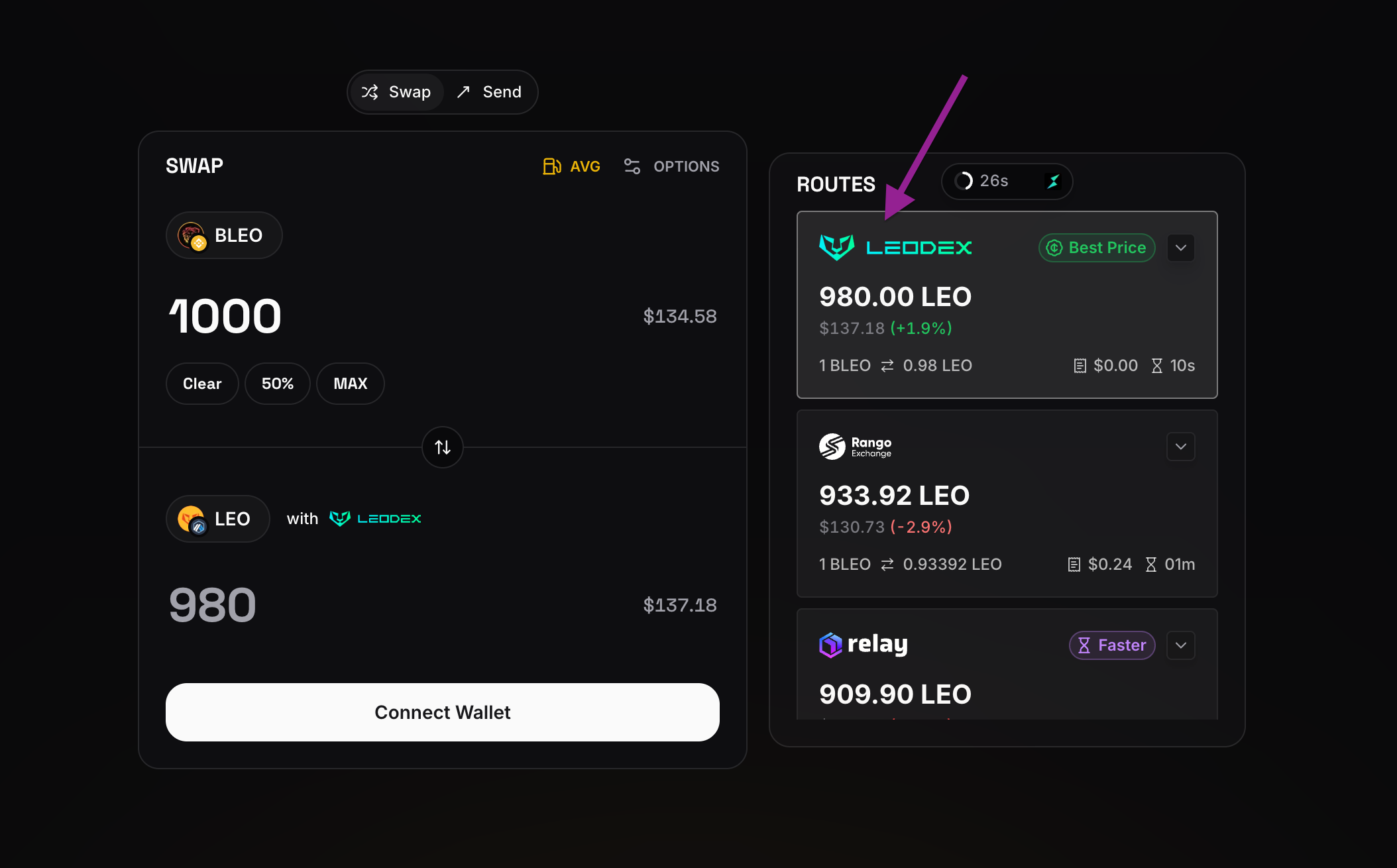

1. LeoDex is the Everything DEX

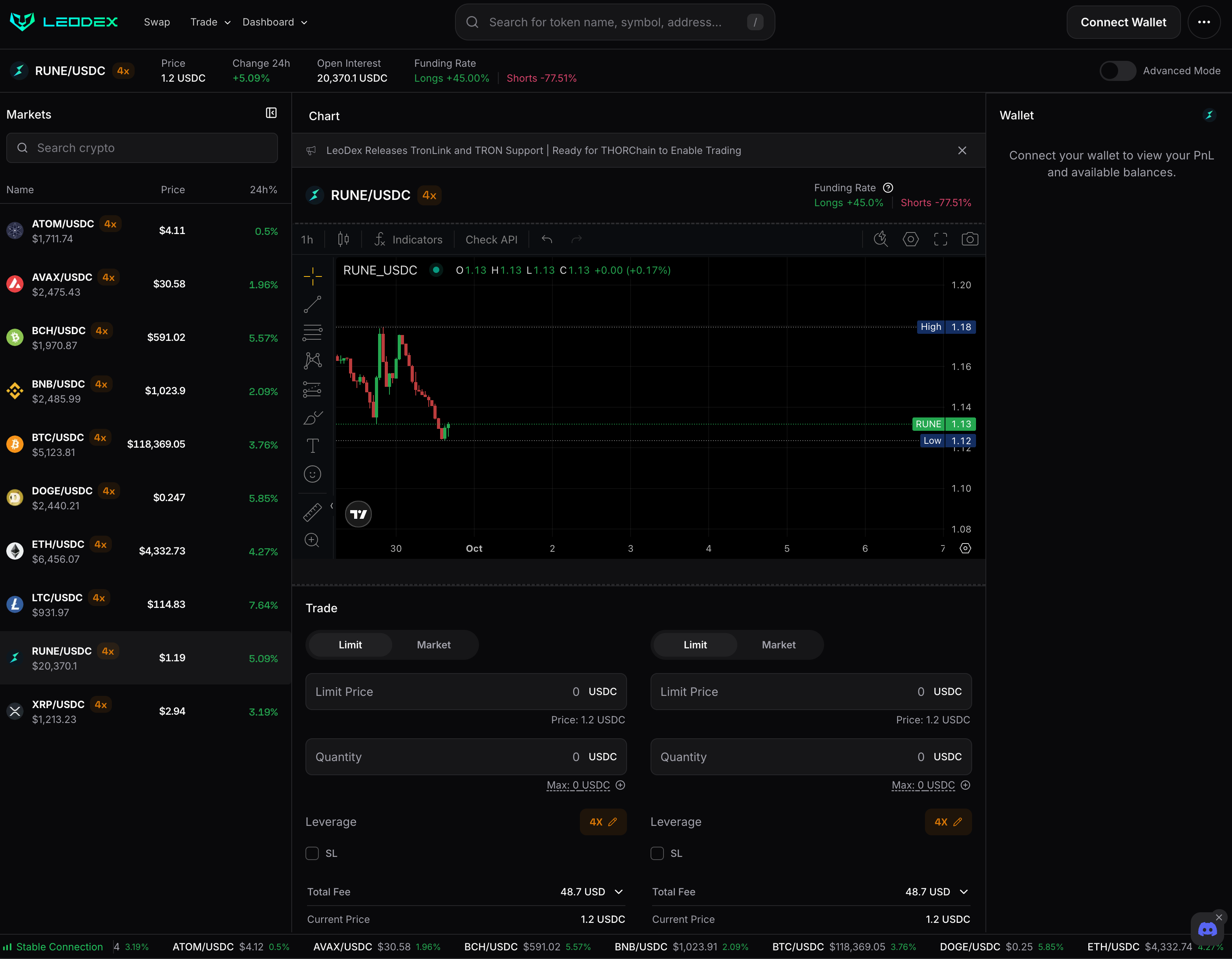

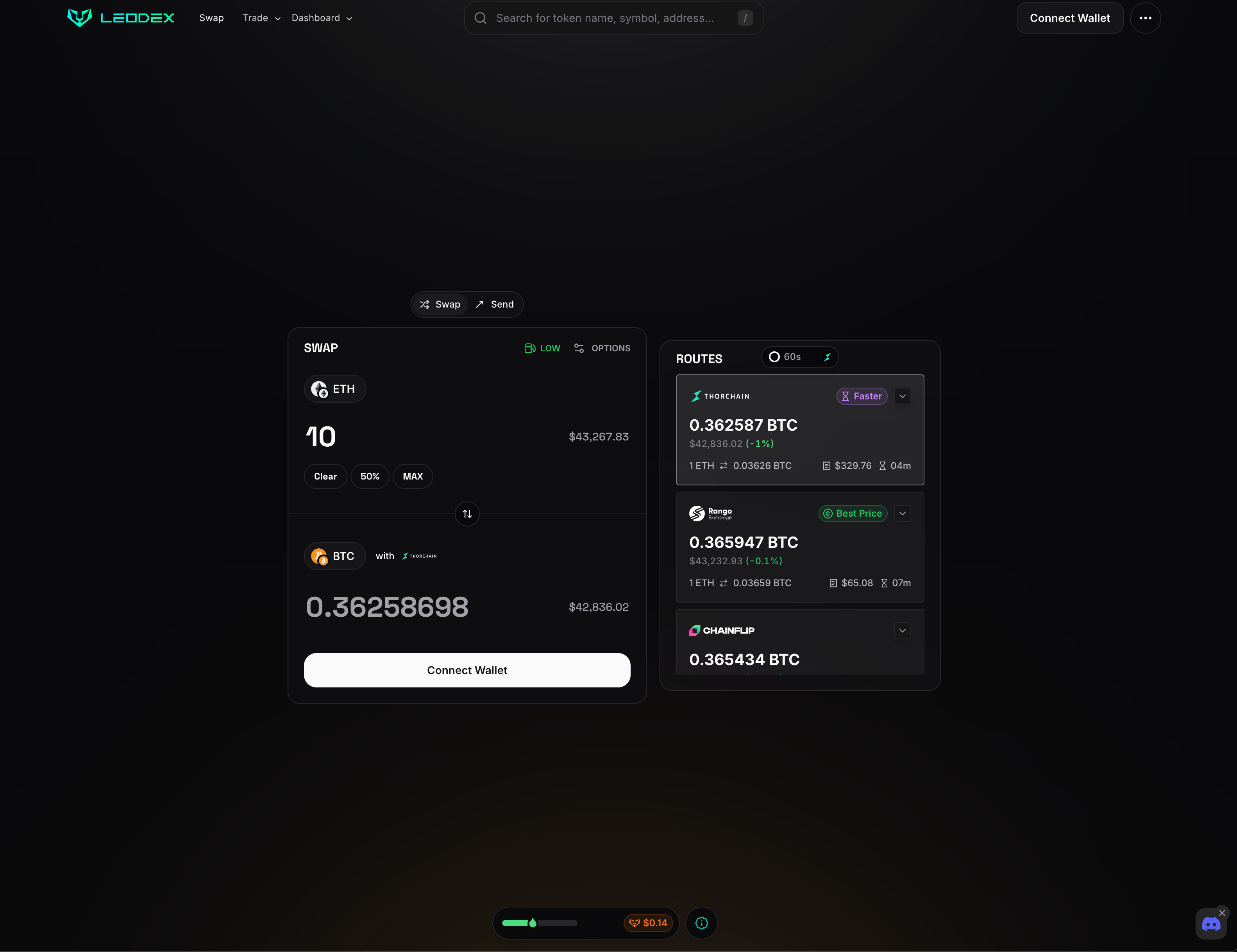

LeoDex supports nearly every crypto on the planet now and continues to grow in terms of adding more protocols, crypto assets and features. Last week, we launched support for THORChain Perpetual Futures (Perps). This is a huge leap forward in terms of what LeoDex can be used for.

The volume is already growing. This creates the largest net economic inflows that the LEO Ecosystem has ever seen.

100% of affiliate fees flow to the sLEO contract where active LEO stakers can harvest USDC.

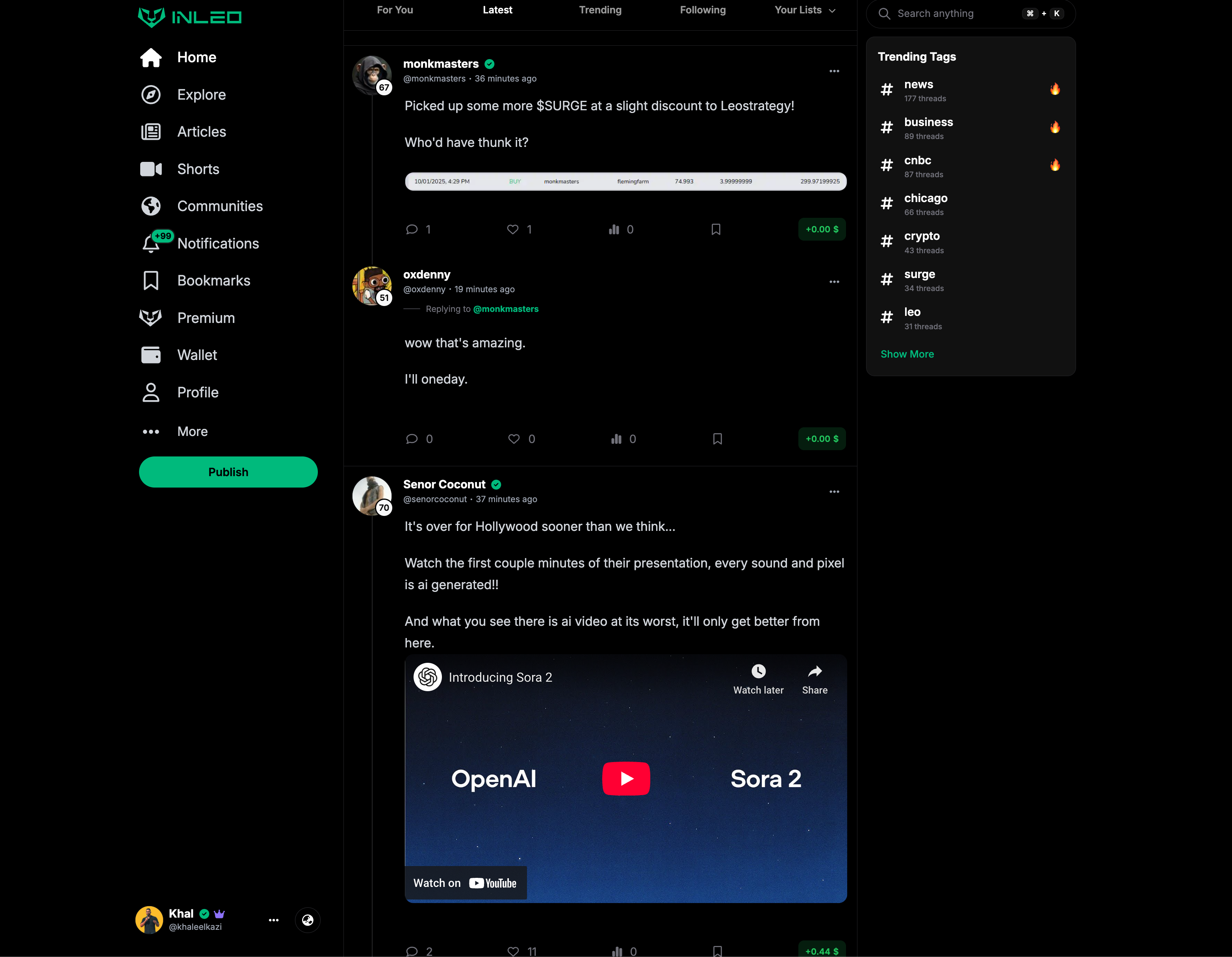

2. INLEO is the Everything App

INLEO is the ultimate Web3 App. Tokenized content on the blockchain where our community gathers to discuss great ideas. INLEO rewards Threads & Blogs using a fully sustainable model called SIRP.

With LEO 2.0 we transitioned from an Inflationary Rewards Pool model (where rewards are minted and distributed daily) to a System Income Rewards Pool model (where rewards are purchased off the market using real inflows from the system: such as Premium Subs, Creator Subs, Ads, etc.).

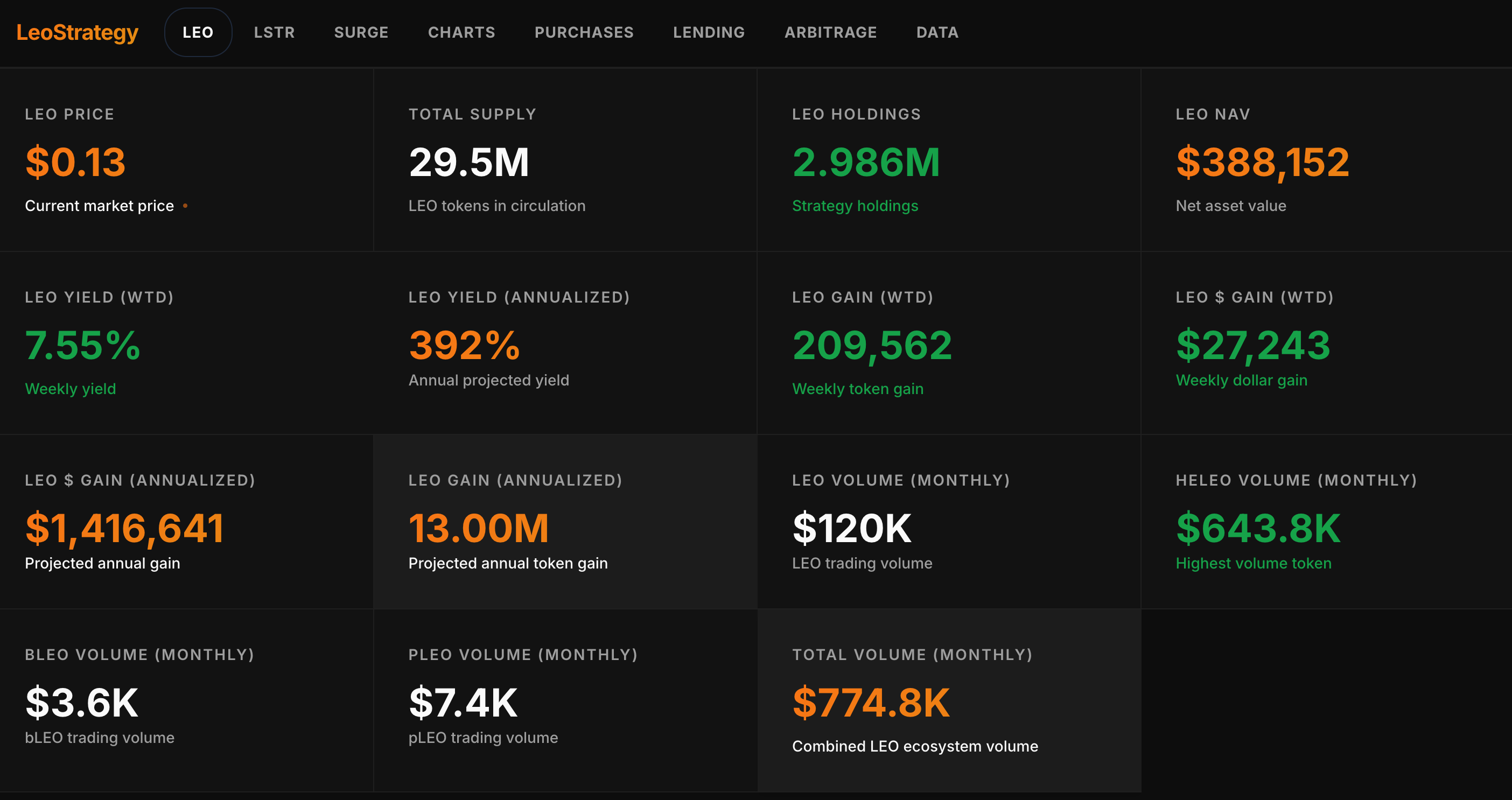

3. LeoStrategy is a Community-Operated Permanent Capital Vehicle

@leostrategy was formed by a coalition of hyper-active LEO Whales and community members. It is a permanent-capital vehicle that generates revenue + capital to fund LEO purchases. Then it stakes LEO into sLEO permanently (never sells) and leverages the sLEO stake it has to create products, services and tools for the ecosystem. All of these products have one goal in mind: generate accretive revenue to purchase more LEO and perma-stake it for sLEO.

As this sLEO grows, the product suite grows. As that product suite grows, it creates more room for new products/services/derivatives/tools. LeoStrategy is the ultimate flywheel of flywheels. Their LSTR & SURGE products have already taken off in a major way and now they have cross-chain market makers operating on LEO Pairs. Soon, LSTR & SURGE will be cross-chain and met with cross-chain market making operations as well.

LeoStrategy will continue to strategically scale and absorb capital into the fund to fuel more LEO Purchases and push momentum into their flywheel. Reducing float by 3M LEO (current fund size) and counting. That is more than 10% of all LEO that is FOREVER GONE from the market.

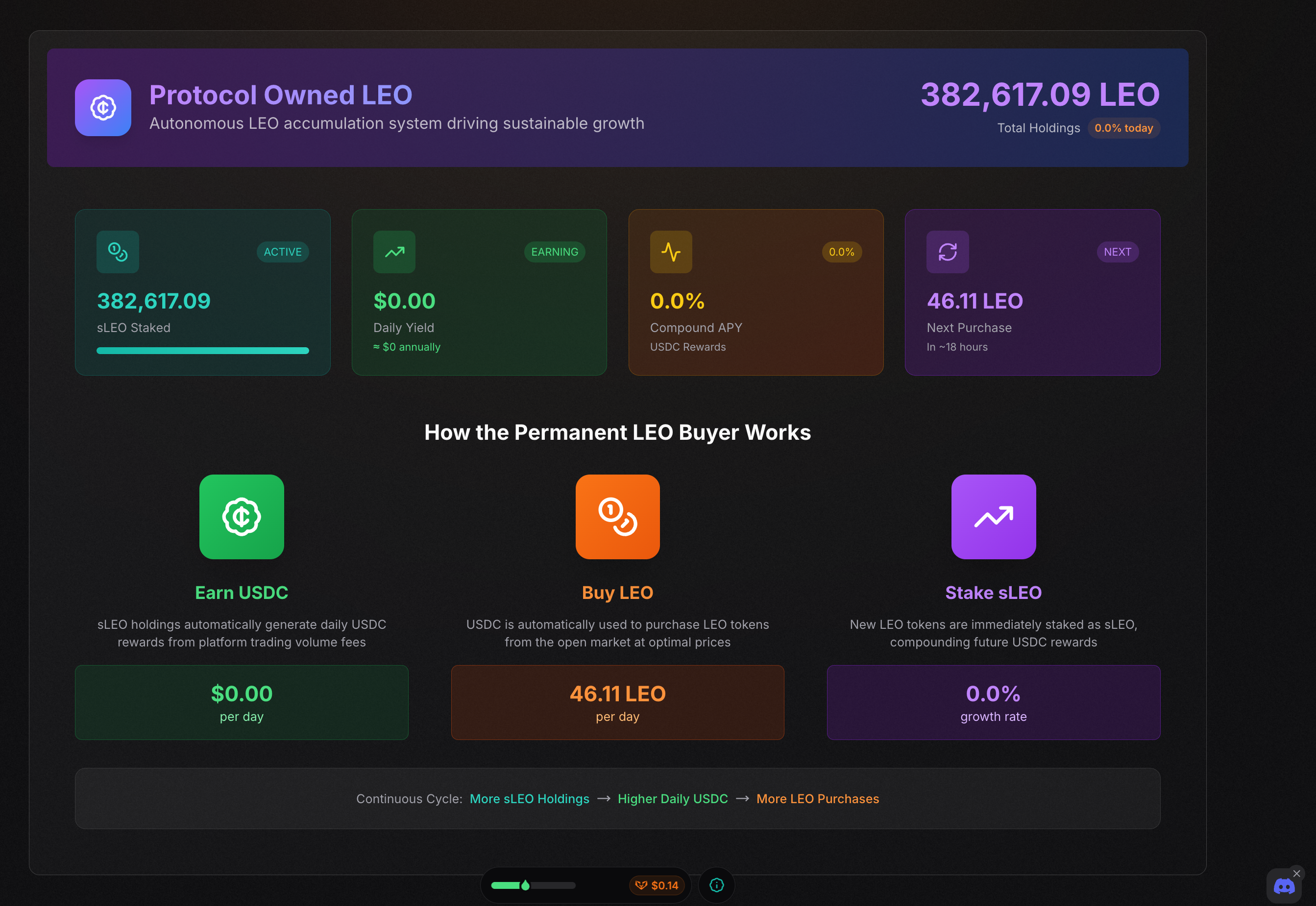

4. POL is Protocol Owned LEO

POL is LIVE on LeoDex and was purchasing LEO every day for the past ~90 days using USDC inflows from LeoDex. This POL vault now sits perma-staked in sLEO. It earns USDC alongside all other sLEO stakers. Right now, the POL owns about 10% of all sLEO staked.

It uses 100% of its USDC earnings each day to buy LEO and autocompound into more sLEO stake. This creates a long-term permanent buyer. As long as LeoDex is generating inflows, POL is earning some material % of those inflows and putting a bid on the market every day to acquire more LEO and perma-stake it as sLEO. Then the next day, it earns an ever-larger share of the USDC rewards.

5. LeoBridges Are Deflating the LEO Supply

LEO is a fully cross-chain token. It is agnostic to the blockchains that it operates on and is fully fungible across chains. This means that anyone can move LEO to any chain that is connected via LeoBridge.

Whenever you cross bridges, you pay a small fee to the bridge oracle. The bridge oracle autonomously sends you LEO on the other chain and burns 100% of the fee it charges. The fee is variable based on market volatility and liquidity. Right now the fee can be as high as 10.50% to bridge.

This means that if a user bridges 10,000 LEO, ~1,000+ LEO might get burned by the bridge. The normal Bridging fees are closer to 2% when the market isn't quite as volatile / liquidity is higher.

LeoBridges are continuously removing LEO from the supply. Now that LEO has a max supply of 30M and no inflation, this has a massive impact.

Since LEO 2.0, the LeoBridges have already burned 1% of the max LEO Supply (over 300k LEO has been burned). The bridges will continue to generate fees every day and burn the LEO they absorb. This reduces the float and makes LEO even scarcer than it already is on a daily basis. Imagine that there's a new BTC wallet created every day and someone pays 0.01 BTC to it to do some activity on Bitcoin. Then that wallet is destroyed. The bridges effectively do that: every day, people bridge LEO and pay a small fee to the Bridges. Then the Bridges destroy that LEO by sending it to @null (or 0xDead on Arbitrum). Each day, there is less and less LEO in the circulating supply.

LEO is the Final Boss of Flywheels

These 5 flywheels add up to LEO being the final boss of economic flywheels. LEO 2.0 happened on June 25th of this year. Since then, the LEO token is up more than 6x in price and continues to grind up on its moving averages.

Since LEO is now a scarce asset and these flywheels are working every day to both reduce the float and add permanent bids to the market, its possible for LEO to succeed as the fundamentals succeed (development, usage, community growth, etc.). Nothing but fun is guaranteed and I personally am looking forward to building LEO to a $10B Market Cap over the next 10 years with these 5 flywheels in conjunction with our next releases: 1. LeoDex Mobile Wallet 2. LeoMerchants IRL Payment Processing 3. .. and much much more!

Posted Using INLEO