Update time for LBI, and there is lots to talk about. Taken some profits and added to other stacks quite aggressively this week. We finish the week up $4500 in value. Here is how things look this week.

Here are the asset prices at the cut-off time for this report:

And here is last weeks report for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-59-week-ending-14-september-2025-3t6

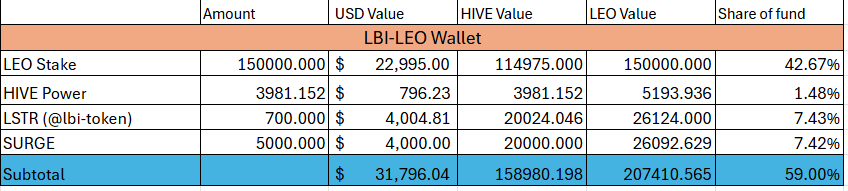

@lbi-leo wallet

The short version here is that I've sold down a chunk of our LSTR holding, added some extra SURGE, and moved some profits (from LSTR) out to other wallets. Firstly, I think SURGE fits our fund a bit better at the moment. I'm looking for ways to boost our weekly income, and SURGE works better for that than LSTR. Second, I feel LSTR is overvalued currently and I'm happy to take profits at these prices.

Despite the sales, the wallet is up $3K for the week in value, as LEO and LSTR have had a good week.

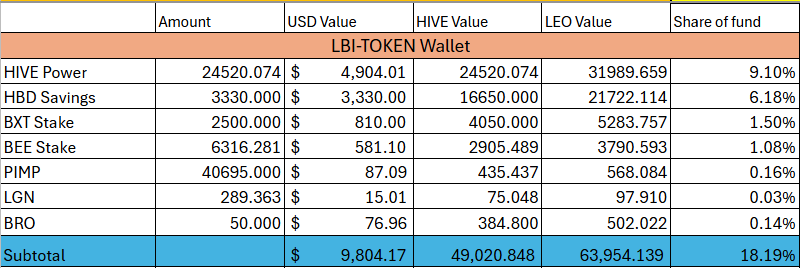

@lbi-token wallet

I've boosted our HBD balance this week, by around 800 to 3330 HBD in savings total. This gives us around 1.35 HBD in daily interest, which is nice safe easy money for the distribution wallet. Not much else changed for this wallet except adding a little extra BEE.

Wallet gained $500 net in value, despite a drop in HIVE's price, thanks to the extra funds added.

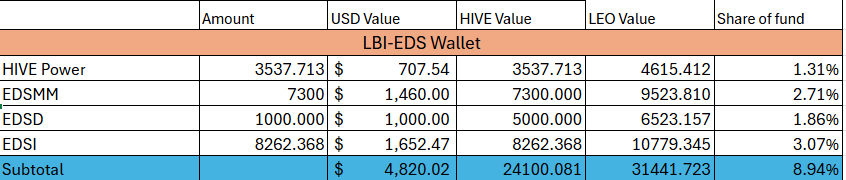

@lbi-eds wallet

Big boost for this wallet over the week, with around 5000 EDSI purchased across the week, to more than double our position. We have moved to become one of the biggest EDSI wallets now, behind only @mathfortress and @spi-store. Added 200 more EDSD also. All the EDSI bought were at 1 HIVE each or below, which is the asset backed value for EDSI. My focus now will be on boosting HP and EDSD in this wallet with spare funds, to help the EDS project reach the flippening point sooner. Expecting a solid drop in APR on EDSI soon, but after that we should see better days ahead for the project and if LBI can help move EDSI into APR gain territory, then with he bag of EDSI we now have it is in our best interests to do so.

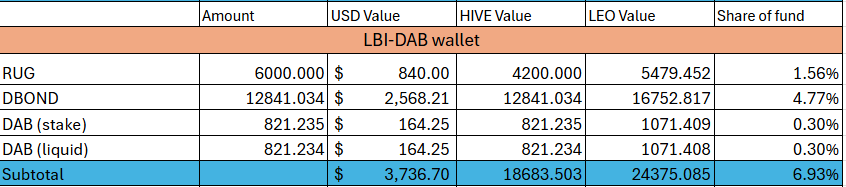

@lbi-dab wallet

Less dramatic than the EDS wallet this week, we have bought another 1000 or so DBONDS. Everything else is unchanged. Across the week we minted around 40 DAB, and I continue to hold half staked for DBOND growth, and half liquid for HIVE income.

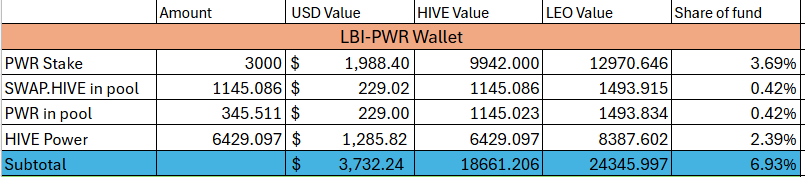

@lbi-pwr wallet

Small additions this week of new funds into the pool. The project's LP has had its incentives renewed, and the APR is lower than the previous round, but some bonuses are in place to encourage long term liquidity. I'll keep working to grow our pool position, but would like to add a bunch more HP into the wallet to earn PWR faster. A reminder that the value of PWR is ultimately based on the value of ETH, so we cheer for ETH to go up so this investment does well.

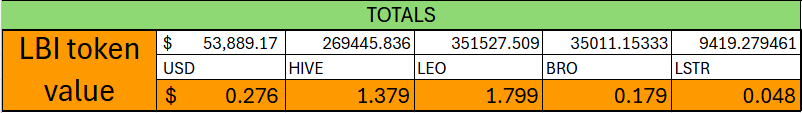

Totals

An up week, with $4500 rough value increase across the week, despite HIVE dropping a bit. LEO is doing well, and looks like it will keep going up for a while. LSTR went up heaps over the week, giving us some nice profits to work with to boost some long term positions, and strengthen our balance sheet. LBI is all assets, no debt at all so we good. The only leverage we have anywhere in LBI's asset base is indirect, with PWR have a leveraged ETH position, and LSTR having SURGE which I feel should be classed as a debt on their balance sheet. For LSTR, this is why I have a different view on it's value than the broader market at the moment, as I feel they should report "NET assets" rather than just LPS (LEO per share). The model they are operating is good, but I just think the token is overvalued currently.

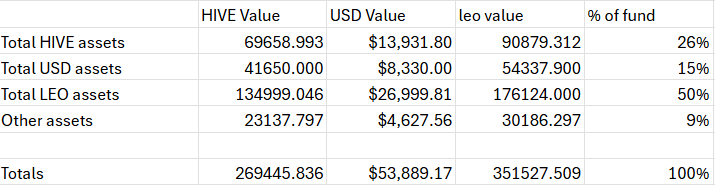

I have made another little way to divide up our assets to see our position currently:

It basically goes through all wallets, and splits assets into 4 categories: 1. HIVE - this includes our HP, plus assets pegged to HIVE in value (EDS,EDSMM, DAB, DBOND, HIVE in LP) 2. USD - This includes our HBD, SURGE, and EDSD as USD "pegged" holdings 3. LEO - This is our LEO and LSTR 4. Other - all the rest (BRO, PWR, BEE, BXT, RUG and anything that doesn't fit the above categories.

I think it is a pretty clear way to demonstrate our allocation of funds overall. Let me know if you like it and should keep it in future reports.

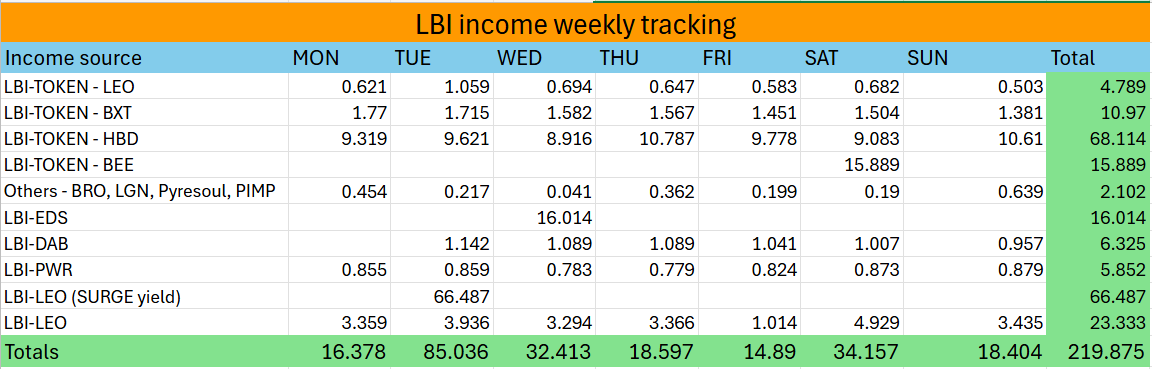

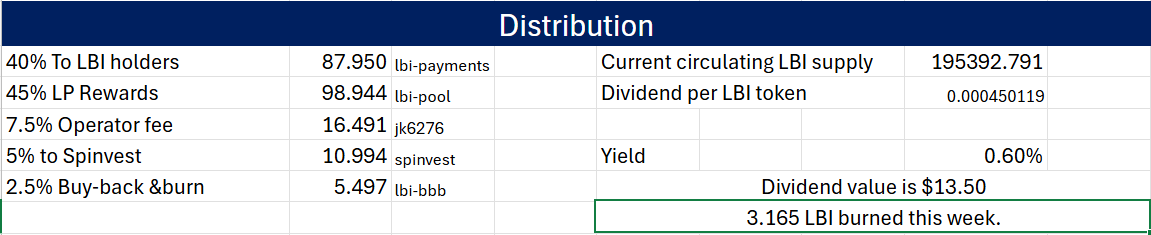

Income report

220 LEO in total for the week, which is ok at current prices. The dividend value is up a bit, at $13.50. My goal is to increase this over time, and find ways to boost the income you all receive for holding LBI. Nearly 100 LEO set aside to fund future LP incentives. We burned another 3.165 LBI this week.

The dividend run has happened and it has been fixed to include liquidity providers in the LBI/HIVE pool. You don't miss out on dividends when you add funds to any of our pools now.

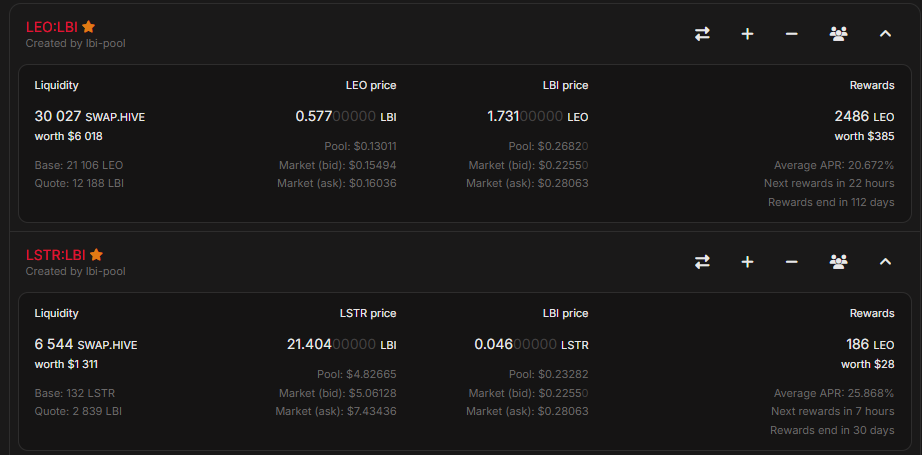

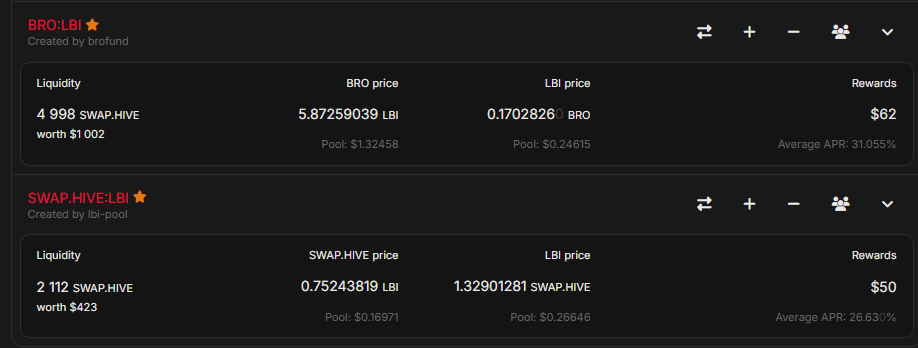

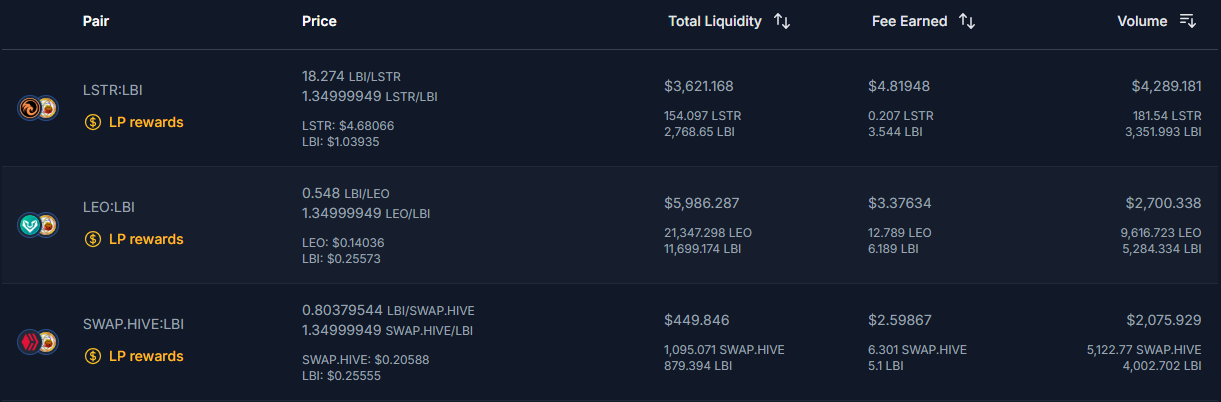

Liquidity report.

There are some nice APR's available in these pools, and as they are paid in LEO they increase when LEO goes up. Impermanent Loss has been high on the LSTR pool in particular, with LSTR outperforming LBI significantly leading to LP's having significant changes to their position. You really do have to like both sides of the pool to make providing liquidity an option.

There has been decent volume traded through all the pools over the last week, with all 4 pools much busier than last week. The LSTR pool has seen the biggest volume of trade, which is unsurprising given the volatility and price action LSTR has had this week. Lots of arbitrage activity across the pools mean more fee income for the pools to help LP's earn a little extra on top of the APR's from incentives.

Conclusion

A big week for us, with a nice value gain thanks to LEO and LSTR. My decision to sell down our LSTR position may be controversial, but I stand by it. Not doubting their ability to grow their balance sheet significantly in the months and years to come, just think that the token itself is a sell at current prices. I'm pretty sure there will be both positive and negative feedback in the comments, if anyone actually reads through this post. I welcome all opinions, whether you hold LBI or not.

Thanks everyone for a great week, see you all next time.

Cheers,

JK. @jk6276

Posted Using INLEO