It's that time of the week again, where we go through all of LBI's wallets and update our token holders on what's been happening over the week. The main news this week is the establishment of our fifth liquidity pool, being a pair with swap.btc. More on the LP's near the end of the report.

For now, lets get on with this weeks update.

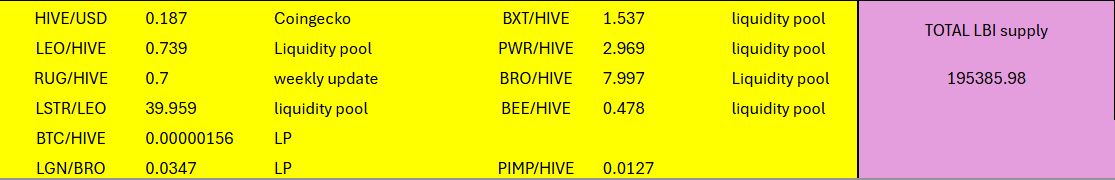

Here are the token prices at the cutoff time for this report:

And here is the link to last weeks update for comparison: https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-61-week-ending-28-september-2025-jof

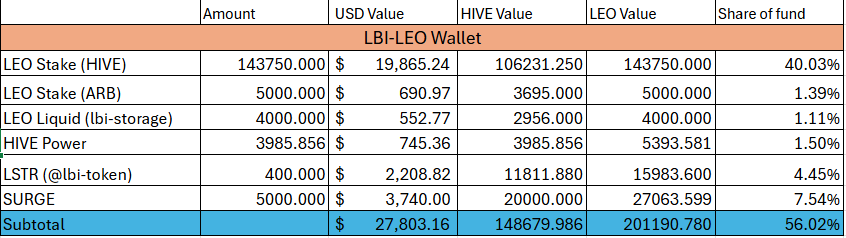

@lbi-leo wallet.

Value is up a little over the week. We are holding some liquid LEO in the @lbi-storage wallet again. I have got 5000 staked on ARB, but not a fan of the huge bridge fee. APR is small so far so the urgency to get more stake is not there. I'd rather wait till the bridge fees come down and not lose funds unnecessarily. Yield on SURGE is awesome, and really helps our funds overall income each week.

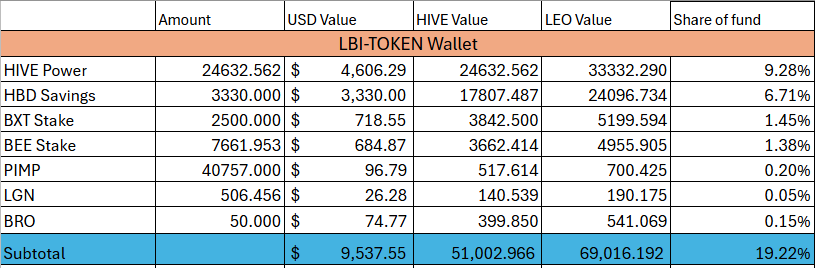

@lbi-token wallet.

No changes for this wallet this week. We add some LGN from the delegations, and a little PIMP. HP grew by around 55 for the week which is pretty standard these days.

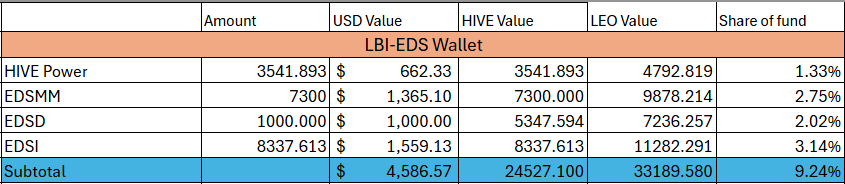

@lbi-eds wallet.

36 EDSI growth for the week, from organic sources with no purchases or changes for this wallet this week.

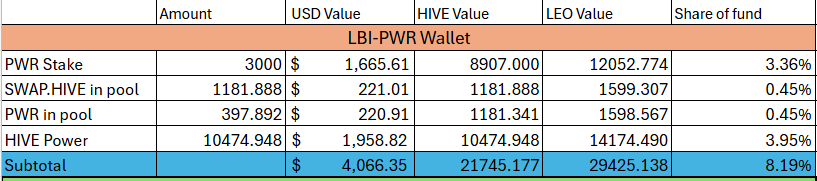

@lbi-pwr wallet.

Probably the biggest change for the week is the addition of close to 4000 HP to this wallet over the week. Those funds came from some profit taking in the LEO division. My goal is to have this wallet with a big amount of HP increase over coming weeks, and I'd love to build this up to double or even triple the current HP amount. This will mean we earn more PWR, which means we can grow our LP position faster and thus our income.

30K HP by end of year? Not a bad target but obviously it depends on selling other assets so it's only a soft target, not a firm goal. If LEO has another big rise in value I will continue to rebalance the fund so it's possible.

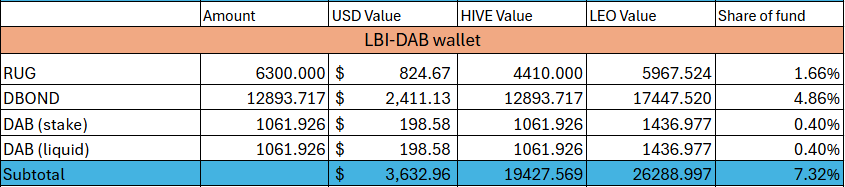

@lbi-dab wallet.

Made a purchase here for this fund just this morning, picking up a few hundred more DAB. I continue to stake half to earn DBOND and keep half liquid to go generate some income. I keep an eye out, and whenever DAB becomes available on the market at or below 1 HIVE each, I'll try to buy more.

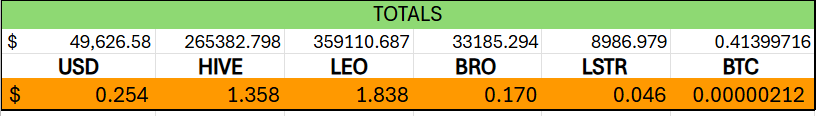

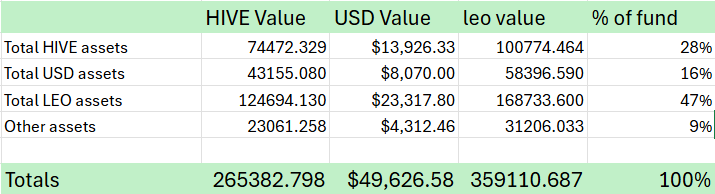

Totals

As you can see, I have included the BTC valuation for LBI also now, as we have a BTC liquidity pool now. USD value is up a few thousand on last week, with the other valuations pretty similar to last week. We got back close to $50K which is a nice amount really for our little fund.

Pretty similar shares of the total fund here from last week.

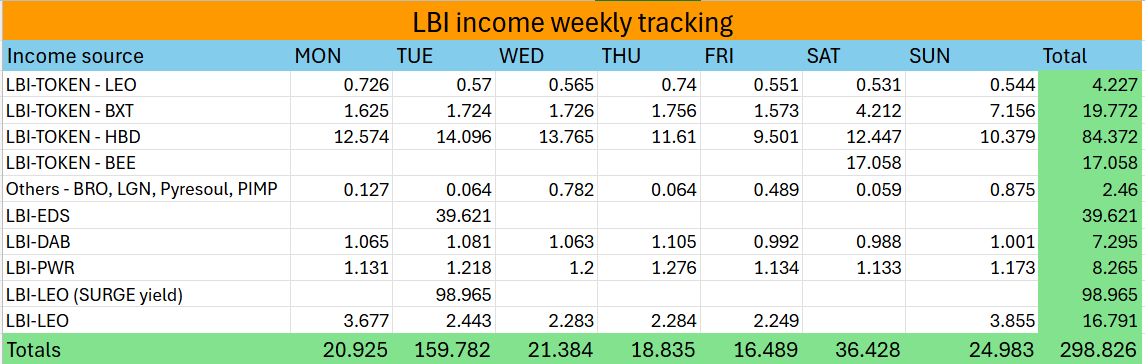

Income report

A good week for income overall, and slightly up on last week in terms of token numbers, and the $$value is up also. I'm working more and more on boosting our income producing assets, to try and drive yield up a bit.

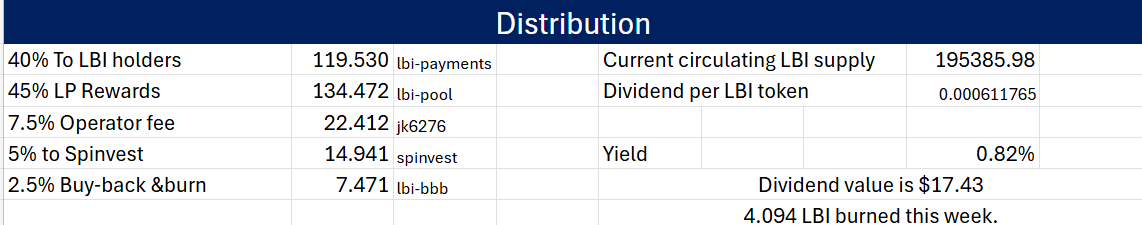

4 LBI burned for the week and $17.43 sent out for dividends is a good week for us.

Liquidity report

For last weeks report, our four LP's had a total liquidity value of $8776, and a volume over the previous week of $4842 in trades for the week.

This week, liquidity value across the five pools is $8884, and the total 7 day volume is $4601. All of our pools offer over 20% APR paid as LEO, plus the LBI in the pools still counts for the weekly dividend.

Conclusion

A solid week for us. The new BTC pool is slowly gaining some trade volume and liquidity. I've said that one of the goals for year two since the LBI relaunch is to improve the liquidity of the token. LP's are the best way to do this and I will continue to work on boosting these pools.

That's it for now, see you all next week.

Cheers, JK.

Posted Using INLEO