Dive into the world of DeFi index products: how to mint yTCY and yRUNE on LeoDex — earn yield and automated rebalancing with Rujira Network (THORChain) index products.

yTCY & yRUNE on LeoDex: New DeFi Index Products on THORChain

The THORChain ecosystem is rapidly evolving, and one of the most exciting developments is the rise of Rujira Network — a second-layer financial network that powers innovative DeFi products. Within Rujira, Nami Index is leading the way with groundbreaking auto-rebalancing index products.

We’re excited to announce that LeoDex now supports two of these products — yTCY and yRUNE.

In this post, we’ll explain what they are, how they work, why you might want them in your portfolio, and exactly how to mint and redeem them on LeoDex.

What is yTCY and yRUNE?

yTCY (Yield Bearing TCY)

yTCY stands for “Yield Bearing TCY”.

It’s an auto-rebalancing basket of 80% TCY and 20% RUNE, designed to maximize returns through:

- Yield income → TCY earns 10% of THORChain’s protocol revenue.

- Volatility harvesting → automatic rebalancing captures upside swings.

As of August 2025, the total value locked (TVL) in yTCY is:

- $203,750 USD worth of TCY (80%)

- $51,351 USD worth of RUNE (20%)

For full details, read Nami’s yTCY Docs.

yRUNE (Yield Bearing RUNE)

yRUNE is the reverse index product — 80% RUNE and 20% TCY.

It offers liquid staking yield for RUNE holders, something not previously possible without bonding or LPing.

Key benefits of yRUNE:

- Earn yield while staying liquid (via TCY exposure).

- Volatility harvesting through automated rebalancing.

- Diversified exposure: hold RUNE while still capturing system income.

As of August 2025, the TVL in yRUNE is:

- $219,704 worth of RUNE

- $54,158 worth of TCY

Read more in Nami’s yRUNE Docs.

Why yTCY or yRUNE?

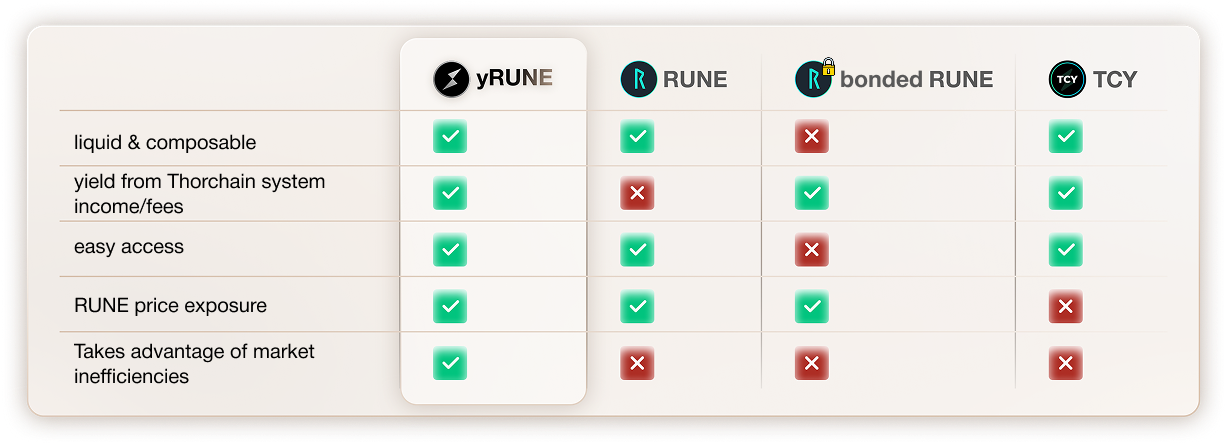

When compared side-by-side, yTCY and yRUNE show distinct advantages:

- yTCY → favors income generation from TCY while capturing RUNE upside.

- yRUNE → favors RUNE exposure while still capturing income from TCY.

Think of them as automated portfolio strategies:

- Hold 80% TCY + 20% RUNE (via yTCY).

- Hold 80% RUNE + 20% TCY (via yRUNE).

Instead of manually rebalancing, Nami Index automates the process: rebalancing at key moments, reinvesting yield, and maximizing returns without user intervention.

- yRUNE = more volatility exposure

- yTCY = more income stability

How to Mint and Redeem yTCY & yRUNE on LeoDex

Both products can be accessed via the TCY Manager page on LeoDex. This is where you can mint, redeem, and manage TCY-based products.

Minting

Minting means converting your assets into the index tokens:

- Convert TCY → yTCY

- Convert RUNE → yRUNE

Redeeming

Redeeming means converting back:

- yTCY → TCY

- yRUNE → RUNE

Fees

- LeoDex interface fee → 0.45%

- Nami minting fee → none

- Nami withdrawal fee → 1%

- Nami management fee → 1% (deducted block by block from profits)

Why Use LeoDex for yRUNE & yTCY?

- ✅ Native THORChain integration

- ✅ Seamless mint/redeem UX

- ✅ Trusted DeFi gateway

- ✅ Earn yield without locking your RUNE

- ✅ Automated portfolio rebalancing via Nami Index

Try yTCY and yRUNE on LeoDex Today

Visit LeoDex.io/tcy to mint your first yTCY or yRUNE.

Discover how auto-rebalancing DeFi index products can help you maximize yield and exposure inside the THORChain + Rujira ecosystem.

Related Resources:

- Nami Index Documentation

- THORChain Ecosystem Report (Q2 2025)

- LeoDex Home

Posted Using INLEO