LeoStrategy is a permanent capital vehicle that is designed to acquire LEO and permanently stake it on our balance sheet. Our core business is to build a financial second layer for the LEO Token Economy by offering financial products and services to the LEO community and ecosystem. The revenue we generate from this business acquires LEO and stakes it on our balance sheet in addition to various capital offerings.

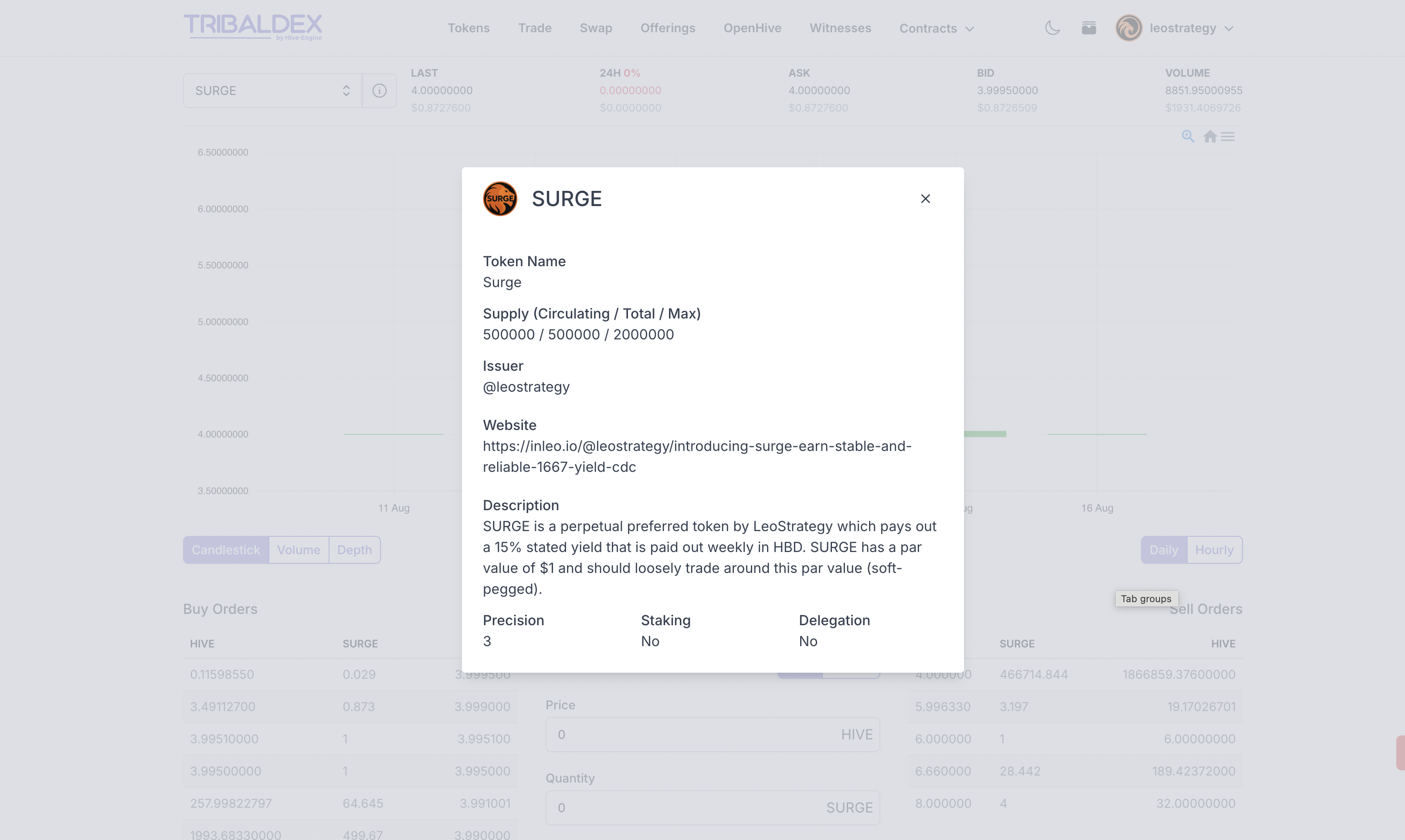

SURGE is the first derivative we have launched. SURGE is similar to HBD in certain ways but has significantly greater upside: 1. $1 floor price because of the liquidation preference (SURGE can be liquidated for no less than $1 per SURGE). This gives buyers mitigated downside exposure and a stable-priced asset 2. Dividend of $0.15 per SURGE (paid in HBD every Monday at 0:00 UTC). At presale prices, this gives SURGE a ~17.75% effective APR which not only outpaces HBD by 2.5% but since you can theoretically compound weekly, the compounded rate is ~20% 3. Unlimited Upside because of the conversion option. 1 SURGE can be converted to 0.02 LSTR (1 LSTR per 50 SURGE) at $50 per LSTR. When combined with a $1 floor price, this gives you effectively a perpetually-dated call option on the LSTR token. This means that if LSTR trades above $50 at any point in the future, your SURGE will trade higher than $1. If you are interested in more details on how this works, check out the SURGE introduction post we published a few days ago on @leostrategy 4. Instantly liquid once SURGE's presale sells out, a $50k liquidity pool will be launched. This pool offers instant liquidity and there is no staking for SURGE. If you hold the token, you'll get your dividends paid weekly to your account which is superior to the 3.5 day lockup of HBD

How Are SURGE Dividends Paid Out?

Right now, about 32,000 SURGE have been sold from the initial sale at ~$0.90 per SURGE. This is about $92 per week in dividends that we are obligated to pay every week.

When the full SURGE initial sale is sold out, we will have a weekly obligation of $1,442 per week in dividend payments to SURGE holders ($75k per year).

Many have asked "how does LeoStrategy afford to pay these dividends?" aka "where does the dividend money come from?"

This is a fantastic question. We addressed it in our launch post but it is worth exploring in more detail. We follow a very similar playbook to Microstrategy for this aspect of the fund:

- Initial 6 month reserve from SURGE sales

- Market Making on SURGE, LSTR, LEO Pairs and other derivatives

- Future offerings and ATM

1). Initially, a portion of our SURGE presale will be set aside and held as HBD. This will cover at a minimum no less than 6 months worth of dividend payments to SURGE holders.

For example, if 100,000 SURGE is sold by Monday of this week, we will hold no less than $7,500 USD to service the dividend payments.

By this coming Monday, feel free to verify the amount of dividend capital we are holding in reserves on the @leostrategy wallet (will be held primarily as HBD).

This ensures that dividend payments are always funded without any concerns over liquidity or ability to make on-time payouts.

2). Market Making on SURGE, LSTR, LEO Pairs and Other Derivatives

This is becoming and will become the #1 revenue driver for LeoStrategy. Microstrategy has already become a massive maker of their own MSTR stock + derivative asset markets.

We believe that as LeoStrategy matures, this will continue to drive massive accretive profits to the fund. A portion of these profits can be utilized to bolster dividend reserves for products like SURGE.

We also have a moat around market making particular pairs such as the bLEO, pLEO, heLEO and LEO (Arbitrum) pairs as we are whitelisted with a discount which allows us to frontrun/defeat other competing market makers. This unique advantage because of the status of LeoStrategy gives us the ability to have a moat around market making now and in the future - especially as we look to expand our offerings to other chains outside of Hive in the future and build bridges with the LEO Team to seamlessly connect those tokens to other chains.

3). Future Offerings and ATMs

ATM stands for "At the Market". This has become a primary driver of cash to the Microstrategy playbook. Essentially, they are simultaneously playing market maker and issuer of new shares. This allows them to strategically "tap the ATM" to raise more cash to fuel: 1. More BTC purchases 2. Cash to pay dividends

LeoStrategy can and will deploy the same strategy as needed. When it makes sense following rigid guidelines, we will "tap the ATM" of the markets we are creating. This will allow us to raise cash to fund future LEO purchases as well as dividend payouts.

How Does This Make Financial Sense?

Well let's model out the SURGE presale. SURGE is offering 500,000 SURGE tokens to the market for ~$450,000. This is a maximum potential obligation of $75,000 per year in dividend payments.

If SURGE's entire presale sells out by next week, then we will have $75,000 in obligatory dividend payments over the next 12 months. We will set aside $37,500 of the ~$450,000 in capital that is raised from the SURGE presale.

This leaves $412,500 in cash to purchase LEO. At the current price of $0.19, this would purchase 2,171,052.63.

If LEO appreciates by a bare minimum of 20% per year, this would yield a $82,500 per year increase in fund value just based on the LEO bought using the SURGE presale capital.

This does not include: 1. The yield we earn by staking this LEO as sLEO on LeoDex and earning USDC yield (which based on current estimates should be $100-$200 per day = $36,500 - $73,000 per year) 2. The fact that LEO is likely to appreciate at a pace much greater than 20% per year 3. The two forms of generating more cash on our balance sheet (Market Making our derivatives/LEO/LSTR as well as ATM sales)

Between just the 20% base appreciation of the LEO bought using presale proceeds and the expected yield of ~2M LEO on LeoDex, we are nearly 2x'ing the dividend obligation in yearly income without even accounting for Market Maker profits as well as ATM offerings.

In short, the opportunity of purchasing ~2M LEO while it is cheap and permanently holding it on our balance sheet is far greater than the $75,000 in potential dividend obligations.

0 Worry Obligation

The goal of all of these is that LeoStrategy offers tools like SURGE with a 0 worry obligation around the dividend payout.

By seeing that we have 6 months worth of reserves to make good on our dividend obligations, we ensure that SURGE buyers know their dividends can't/won't be missed.

Since Monday is fast-approaching and signifies the first dividend payment to SURGE holders, track the @leostrategy wallet's HBD holdings to verify that we have enough working capital to fund 6 months worth of dividend payments at all times. You'll see the initial "set-aside" followed by regular capital deposits from the forms mentioned above to maintain the 6 month dividend fund.

24 Hours Left!

Part of the SURGE dividend payout process is that SURGE holders are snapshotted at a random time starting 24 hours prior to the SURGE Dividend payout.

Every Sunday at 0:00 UTC, a randomized snapshot is taken of all SURGE holders to verify holdings and prepare for the dividend payout on Monday.

Every Monday at 0:00 UTC, SURGE holders are paid $0.15 HBD per 1 share of SURGE they hold.

*The Sunday snapshot is designed to avoid people gaming the system - namely, buying SURGE right before the dividend distribution at 0:00 UTC on Monday and then selling it a minute later.

We are about to publish this post on Saturday just before 0:00 UTC which means we are just about 24 hours out from the snapshot window.

Remember: the snapshot window opens at 0:00 UTC on Sunday but in theory, can happen at any random time between 0:00 UTC Sunday and 0:00 UTC Monday. This randomization prevents gaming of our dividend distribution system.

If you want to earn the first SURGE dividend payout, you'll need to buy and HODL SURGE before tomorrow at 0:00 UTC if you don't, you may miss the payout this Monday.

SURGE payouts now happen every single Monday in perpetuity (as long as at least 1 SURGE is circulating and held by a user).

SURGE Manager!

Our new SURGE Manager will go live in the next 12-24 hours. SURGE Manager is an AI Agent that works on Threads to service your needs around SURGE.

You can: 1. Receive daily stats updates every 24 hours (or call the Manager manually) 2. Manage your SURGE payout preference (get paid in HBD or switch to LSTR payouts - LSTR is bought and paid using HBD which effectively just lets you earn LSTR instead of HBD by saving you some steps) 3. See your lifetime earnings from SURGE dividends 4. Track other key data related to SURGE and your specific holdings

Posted Using INLEO