LSTR is a permanent capital vehicle with one very specific purpose: acquire and permanently stake as much $LEO as possible.

The LSTR token's initial sale sold out yesterday around 10 AM EST. This marks the true starting point of LeoStrategy. If you've enjoyed the ride so far, just wait until you see what is around the corner.

How Does LSTR Maintain its Equity Value?

The #1 question we see is "how does LSTR maintain its equity value" - in other words, how does the price of LSTR on the open market reflect the value of the fund?

LSTR trades based on its mNav. This is how Microstrategy - for example - trades as well. MSTR tends to trade at a premium to its mNav.

What is mNav? mNav stands for market cap to net asset value. The simple calculation is to take the market cap of LSTR (100,000 outstanding tokens * current_price) and the value of the LEO we hold (LEO * current_price).

As the value of our LEO holdings rise, the mNav may trade at a discount or premium. When its trading at a discount, it means that LSTR is trading below the value of the LEO that our fund holds. When its trading at a premium, it means that LSTR is trading above the value of the LEO that our fund holds.

Why Do Strategy Companies Tend to Trade at an mNav Premium?

Typically, Strategy companies trade at a premium to their mNav. There are a lot of reasons for this. Namely, the operational capabilities of the Strategy business - how capable they are of generating more BTC (in our case, LEO).

Microstrategy has proven to find numerous ways of generating accretive BTC yield (that is, more BTC Per Share of MSTR stock) and this has led to people buying MSTR at a premium. Buyers value the current BTC held but they also factor in the future BTC accumulation that MSTR is capable of.

Strategy Companies Are Typically Valued at an mNav Premium.. What About LSTR?

Using the same lens for LeoStrategy: the market will learn to value the fund at an mNav premium. This isn't something that is built overnight. Over long timeframes, LeoStrategy must prove our capability of generating LEO Per Share (LPS).

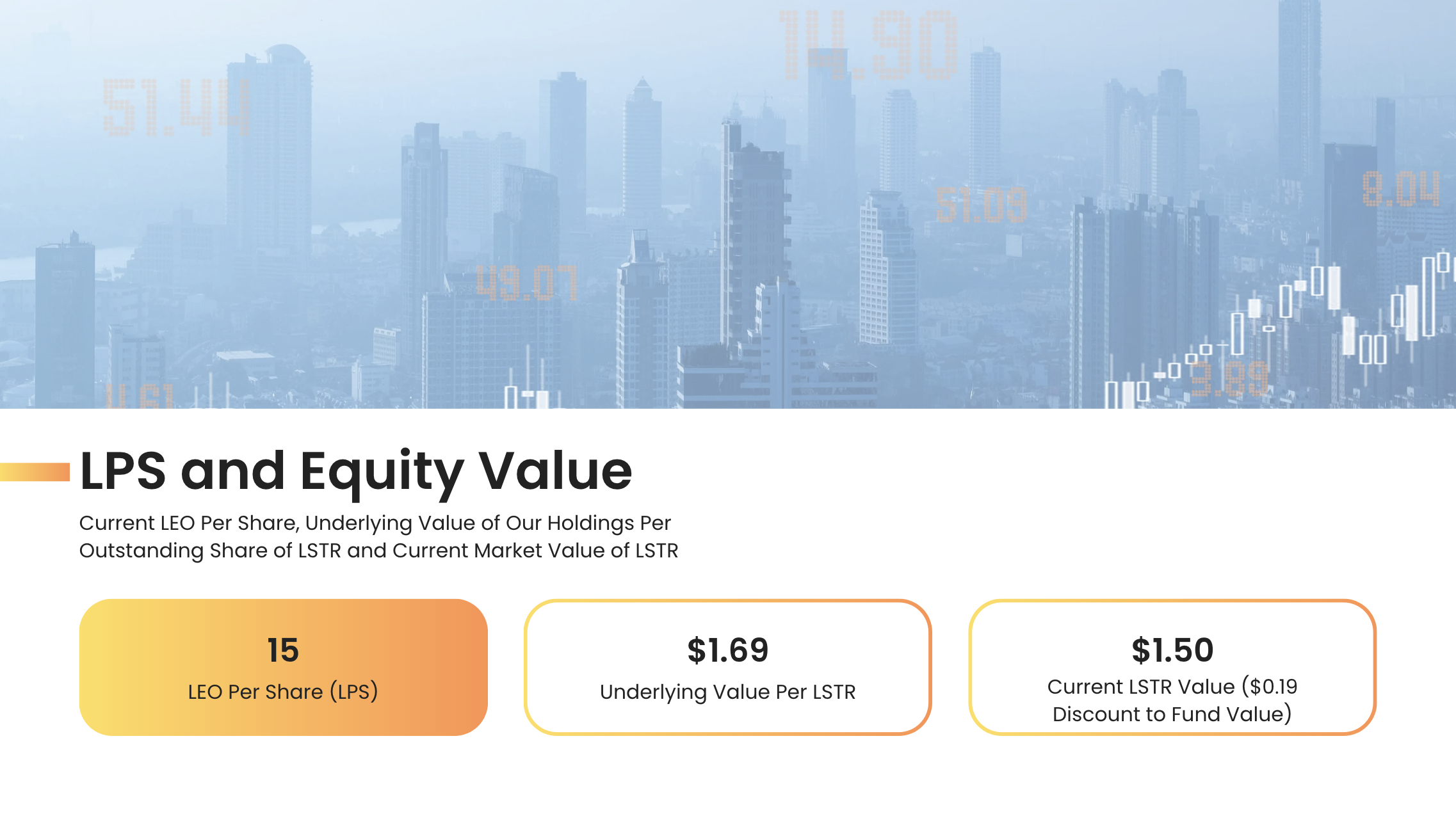

In simple terms, LPS means acquiring more LEO inside of the fund than the outstanding shares of LSTR. Right now, our LPS is ~15 LEO.

15 LEO at the current price of $0.1125 = $1.69. This means that the market cap of LSTR if we were fairly valued based on our underlying holdings would be $169,000 (there are 100,000 shares of LSTR that exist today).

This means 1 LSTR share should trade for $1.69. Yet, LSTR is trading for $1.50 right now. This represents a $0.19 per share discount to anyone who buys LSTR today.

Buying LSTR when we're trading at a discount means effectively buying discounted LEO exposure.

Discounted LEO Exposure and LPS

The best way to look at this is to take the current value of LSTR shares - $1.50 as of this writing

Now take our current LPS (the total LEO we hold / outstanding LSTR shares) - 15 LEO per 1 LSTR share

Now consider the value of 15 LEO - $1.69 right now

If you can buy LSTR for $1.50, it means you are buying effective LEO exposure for $0.10 per LEO. This is why you could consider the current price of LSTR to be a discount.

LPS and its Importance

The true importance of a Strategy company is its ability to generate accretive yield in the underlying asset of the fund. In our case, the underlying asset of LeoStrategy is the LEO token.

Our first revenue-generating service goes live in about 2-4 days. This service will allow users on INLEO to delegate their LEO POWER and earn passive yield. It will also create utility for LSTR token holders in two ways: 1. If you hodl LSTR, you will get 1 upvote per day from @lstr.voter 2. As an LSTR holder, you will also get exclusive access to onchain commands (via Threads) such as "!vote" to call @lstr.voter to vote on other users' content

Note: you do not need to hold LSTR to delegate LEO POWER. You do need to hold LSTR in order to use the commands + receive stake-weighted upvotes (based on how much LSTR you hodl).

Our Future

The launch of this service should give you a glimpse into the future of LeoStrategy. Imagine a future where LeoStrategy is operating dozens of services like this one both on INLEO, LeoDex and other platforms. Some services / products we have in our roadmap: 1. Delegation service for LEO POWER (launching in 2-4 days) 2. Collateralized lending service for sLEO stakers (a collaboration with LeoDex, operated and managed by LeoStrategy) 3. Volatility harvesting aka market making bots for the LSTR pool/orderbook 4. Volatility harvesting aka market making bots for the LEO pairs on other blockchains (bLEO, pLEO, heLEO, LEO, etc.) 5. Derivatives products such as bonds that can raise capital + generate accretive yield through volatility and ATM harvesting 6. ...and many more!

We have taken the Microstrategy framework and supercharged it via other revenue-accreting means.

Don't forget that while we build all of these revenue models, 3 key things are happening as well: 1. We use our revenue to buy LEO and stake it for sLEO in the leodex.io/leo contract 2. sLEO earns daily USDC rewards from LeoDex Affiliate Fees 3. We autocompound for more LEO buy swapping our USDC into LEO and staking it for more sLEO

The more revenue we can generate from the 5+ methods mentioned above, the greater the autocompounding effect as our sLEO stake continuously grows and compounds.

LeoStrategy is the ultimate permanent capital vehicle for LEO accumulation. LSTR initial sale buyers are up over 65% in just 24 hours since the initial sale sold out.. even though LSTR is trading at a discount to our holdings.

These economic effects are just a glimpse into the future we are building as a permanent capital vehicle that accumulates LEO.

Keep your eyes open for our release of the lstr.voter service that generates LEO yield for our fund in 2-4 days and prepare to delegate some LEO POWER to it.

If you are an LSTR holder, we will also release the commands that you will be able to call onchain via INLEO Threads in order to use @lstr.voter to vote on other users' threads. We built @lstr.voter to not only generate accretive yield for LSTR shareholders in the form of more LPS (LEO Per Share), we also built it to increase engagement and curation on INLEO Threads which makes LEO more valuable.

Posted Using INLEO