Michael Saylor said "Volatility is Vitality" for a Strategy company. He was obviously referring to his Bitcoin strategy company which has the mission of turning USD fiat into BTC and holding it on their balance sheet to try and capture the 20-30% average yearly gains of BTC/USD.

For LeoStrategy, Volatility is a reactor that generates infinite potential energy that can be harvested for profits that purchase more LEO on a daily basis. The LEO we purchase is perma-staked on our balance sheet as Staked LEO (sLEO) on Arbitrum via https://LeoDex.io. This sLEO earns USDC every day from the Arbitrum-Staking contract which we also plow into more daily LEO purchases.

Volatility Fuels our Flywheel

In the featured image of this post, we show the LeoStrategy Flywheel. The size of the balance sheet kickstarts the flywheel momentum. A bigger balance sheet means a faster flywheel.

LeoStrategy leverages our balance sheet to raise additional capital to purchase additional LEO. This LEO expands our balance sheet's core KPI: LEO Per Share (LPS). The more that LPS increases, the more valuable LSTR and LSTR-derivatives become.

The rise in value leads to pair volatility and depth across blockchains (LEO on the 4 chains it lives on, LSTR on Hive, SURGE on Hive and soon LSTR & SURGE on Base as well).

This cross-chain volatility is then harvested into pure profit by LeoStrategy's Market Makers.

The profits are then used to purchase LEO. Combined with the USDC we earn daily from our existing sLEO and other revenue generating products we build in the future (like @lstr.voter), we utilize all of this revenue to further expand our balance sheet. This pushes the flywheel harder on the next turn.

Engineering Volatility

- Tokens generate volatility (LEO, LSTR, SURGE, future derivatives).

- Onchain & cross-chain market makers harvest profits.

- Profits recycled into LeoStrategy → accumulate more LEO.

- Increasing LEO per share → compounding flywheel.

Volatility is Engineered by LeoStrategy. We engineer this volatility through LSTR, SURGE and future derivatives built by the fund.

LSTR is the first proof-point of our capabilities. LSTR is now the #1 pair for LEO trading on Hive-Engine.

LSTR launched about 38 days ago at a price of $0.90 and with a LSTR:LEO liquidity pool of $5,000.

Just 1 month later, LSTR:LEO liquidity is at $106,798 and has traded $173,168 in volume since inception. This pool is the largest pool for LEO trading on Hive today. Surpassing even the LEO:SWAP.HIVE pool.

SURGE will launch very similarly but this time, with a $50,000 USD seeded liquidity pool. Will the LP rise 20x like LSTR's did? Perhaps not quite so dramatic, but it is reasonable to assume a minimum of $150k in SURGE liquidity across the various pools we develop after the presale is sold out.

The launch to Base will be one major way we engineer volatility. We will engineer this volatility using a triangular arbitrage base pair design.

In simple terms, we will launch 2 new pools for both LSTR & SURGE on the Base blockchain: 1. LSTR:USDC 2. LSTR:WETH 3. SURGE:USDC 4. SURGE:WETH

Notice that we are pairing both LSTR & SURGE with USDC. By pairing with a stablecoin, we create what is called an "Anchor Pool".

The Anchor pool sets a USD-denominated, low-volatility anchor for LSTR & SURGE. By having an Anchor pool, we can conduct triangular arbitrage.

For example, imagine a scenario: 1. $1,000 of LSTR is traded on Hive-Engine against the LEO pair 2. LSTR's price goes up 1% on HE 3. Assume WETH is down 0.50% that day 3. LSTR:WETH must be arbitraged up 1.50% to match this HE pair 3. LSTR:USDC must be arbitraged up 1% to match this HE & WETH pair

Volatility is vitality. We turn Volatility into profits that are then used to purchase more LEO and expand our balance sheet which then leads to more volatility and a repeating flywheel.

Predictable Scenarios: How Much Profit Will LeoStrategy Generate From Engineered Volatility?

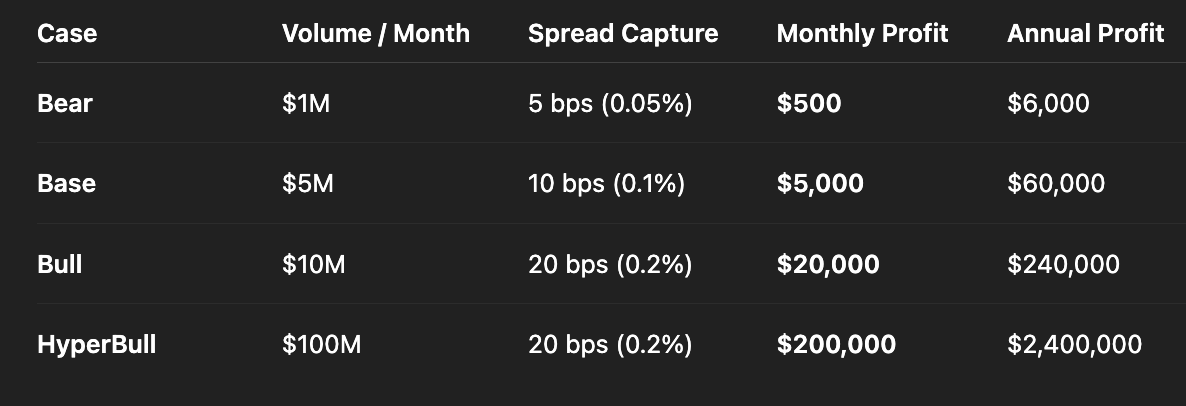

We have modeled a handful of financial scenarios for LeoStrategy's market maker. Note that Volume/month is the total volume of LEO, LSTR and SURGE combined.

The bear case is that volume drops (it is already above $1M/month and that is without SURGE's presale sold out, which means $0 trading volume for our derivative).

Even with the bear case, we generate $500/mo to purchase more LEO. This also assumes the absolute worst case scenario in terms of capturing the volatility (0.05% capture rate).

Assume the bear case would be the case in the absolute worst crypto winter scenario.

The Base Case assumes that volume ~2.5x's from where it is today. We believe this is very likely to happen in the next 30-60 days. The spread capture is a more likely 10 BPS (though we believe it will be significantly higher. Possibly 50 BPS).

This creates $5,000 in monthly profits at 10 BPS or $25,000 monthly at 50 BPS.

The Bull Case assumes that volatility is on the rise and we see LEO, LSTR and SURGE pairs continuing to scale upwards. This scenario is likely to happen before the end of 2025. We believe that we will capture no less than 20 BPS on these pairs which means $20,000 per month ($240k per year) in profit to purchase more LEO.

At 50 BPS, this would be $50,000 per month ($600k per year).

The HyperBull Case is what we believe will happen as the bull case plays out for several months. As the bull case creates $20k - $50k per month in profits for LeoStrategy, we utilize all of this revenue to buy LEO and expand our balance sheet.

The very expansion of our balance sheet (reference the featured image flywheel) leads to volume expansion on all LEO Pairs.

Khal has also said that the LEO Team is working on getting LEO listed on Rujira. This means that LEO Perpetual Futures are on the way. With perps in the mix, LEO volume will skyrocket 10-fold.

Assuming the flywheel continues to spin at any modest rate, the LSTR, SURGE (and future derivatives) pairs will skyrocket alongside LEO. The triangular arbitrage pools will create continuous opportunities for spread capture which will lead to more profits which will lead to more balance sheet expansion which will lead to more volume.

Our endgame vision for LeoStrategy's Engineered Volatility Model is: - HyperBull = $2.4M/year recycled into LEO accumulation (and growing daily) - Rapid float reduction (goal: 10M+ LEO in LeoStrategy by EOY 2025) - LeoStrategy as the premier market maker for LEO, LSTR, SURGE and future derivatives markets surrounding the LEO Economy - Path to a $1,000 LEO price by 2035 is our mission

Potential Risks to the Model

No model is without risk. We must bear these risks in mind so that we can avoid pitfalls and ensure that our volatility harvesting model is successful.

- Sustainability of spreads: If liquidity grows too fast, spreads compress → profits fall unless volume keeps pace. Liquidity must be well-managed and volatility is the #1 KPI for all pairs

- Funding requirements: Maintaining deep inventory across chains requires significant working capital

- Competition on Market Making

- Market depth dependency: Engineered volatility only works if there’s sufficient counterparties trading and pair dynamics driving price discrepancies we can harvest

Let's quickly tackle each one of these: 1. The triangular pool model (USDC anchor pair, LEO pair on Hive-Engine and WETH volatility pair on Base) is designed to manage pool depth and vol dynamics 2. Funding of the pairs is made easier due to our connection to the LEO Economy and the fact that we are essentially the "central bank" of LSTR and SURGE. Illiquidity on inventory is likely to be the last of our worries 3. Competition is solved through the cross-chain moat. We have this thanks to the whitelist on our Arb bot on the LEO Bridges as well as LSTR & SURGE bridges. While Hive-Engine is not controllable in terms of competition, the cross-chain pairs will have an environment for LeoStrategy to market make more efficiently and effectively than any other arb bot. This means a deep moat that is unshakeable 4. Volume volume volume. Volume is the key to this model as volume creates volatility. The critical part is the setup of these pairs. Then we must scale and find traders to create volume. That amplifies the built-in nature of the triangular arb dynamics. Perpetual Futures and other derivative products can scale volume. Volume is the lifeblood of this model and will be the core KPI for the success of market making

As you can see LeoStrategy's core revenue driver will come from Market Making. We have other products like @lstr.voter already live or in the pipeline for the future.

Our mission is simple: acquire as much LEO onto our balance sheet as possible. Perma-stake that LEO in a way that it is physically impossible to sell the LEO. The perma-staked LEO also earns USDC which autocompounds into more LEO.

We reduce the float of LEO by acquiring 10M this year and more the year after. Then more every year that follows. LEO's hyperscarce design and constant inflows lead to rapid price appreciation. By 2035, we predict 1 LEO will be worth more than $1,000.

- Support us by helping to sell out the SURGE presale and kickstart more volatility harvesting: https://tribaldex.com/trade/SURGE

Posted Using INLEO