LeoStrategy is a permanent-capital vehicle designed to build products, services and derivatives that tokenize financial products and back them with LEO. The revenue we generate has one path: purchase LEO and add it permanently to our balance sheet.

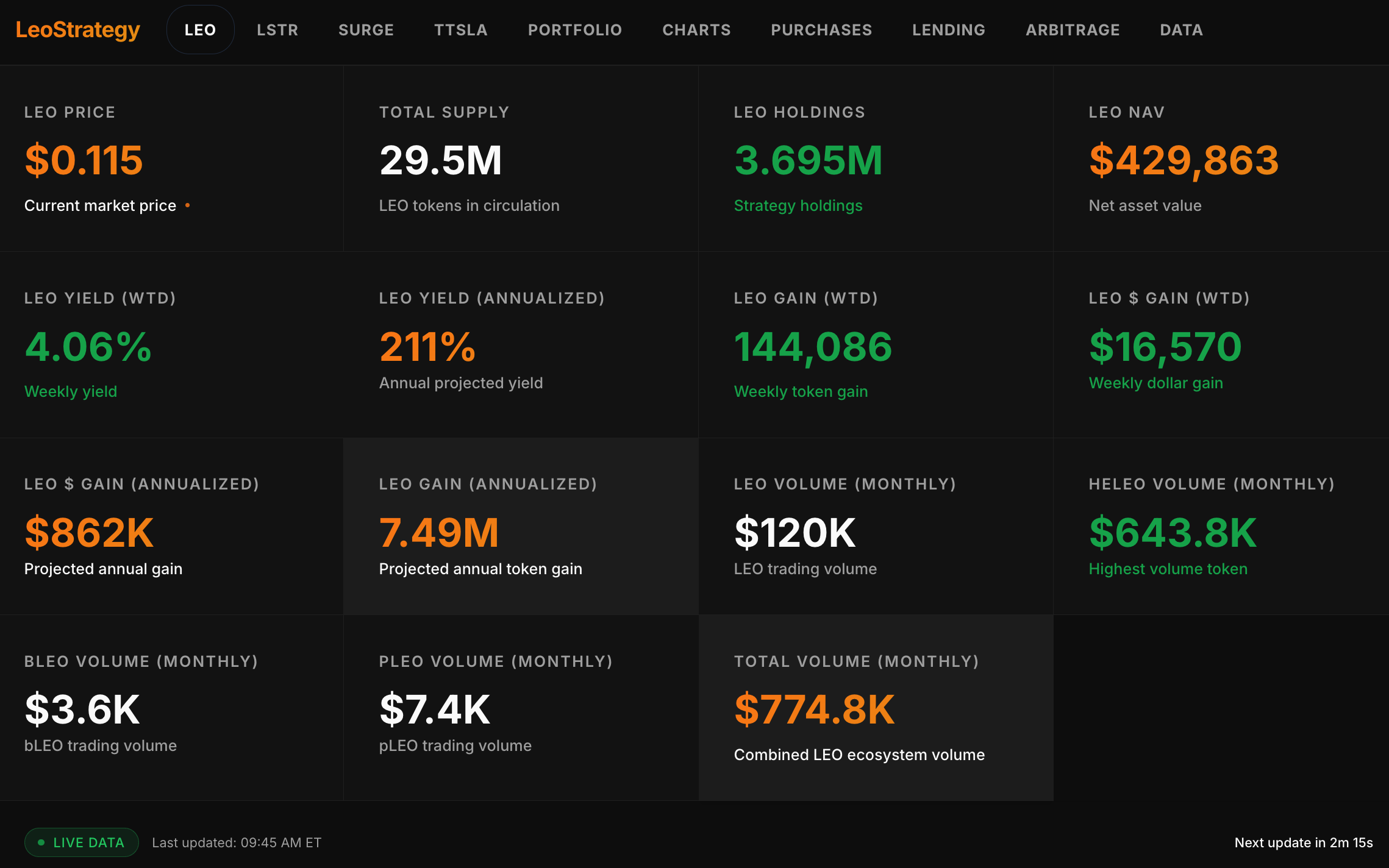

LEO we purchase is effectively removed from circulation and perma-staked. The max supply of LEO is 30M tokens. LeoBridges burn a % of the supply each day from real revenues. The current supply of LEO is 29.5M and it can never rise (it can only decrease).

LeoStrategy now owns 12.525% of all LEO. This means that 12.525% of all the LEO in existence CAN NEVER be sold on the open market nor used for liquidity or any means other than staked as sLEO and autocompounding for more LEO daily.

LeoStrategy Has Acquired an Additional 144,086 LEO This Week

This week, we acquired an additional 144,086 LEO using SURGE and TTSLA proceeds. The proceeds from our presales purchase LEO and add it to our balance sheet. LEO is used as pristine collateral to over-collateralize all LeoStrategy products.

LeoStrategy's Market Makers are generating significant revenue on a daily basis while providing more efficient markets to trade all LEO Ecosystem tokens.

When TTSLA is sold out, it will proceed to the open market with ~$20k in liquidity pools seeded at launch. TTSLA represents our venturing into the world of RWAs.

We believe that TTSLA will bring more Arbitrage Windows to all 4 (LEO, LSTR, SURGE and TTSLA) Cross-Chain Market Makers.

The thesis is simple: TSLA has a different volatility profile and correlation than all other LEO Ecosystem assets. Injecting External Volatility to the vertically integrated stack of LeoStrategy products will lead to volatility across the board. Volatility = Vitality as LeoStrategy generates the vast majority of our profits from Market Making the cross-chain liquidity pairs for LEO, LSTR, SURGE and (soon) TTSLA.

Not only will TTSLA bring a 4th market maker into the mix, it will also bring a completely uncorrelated asset to the mix that will make the other 3 MM's that much more profitable.

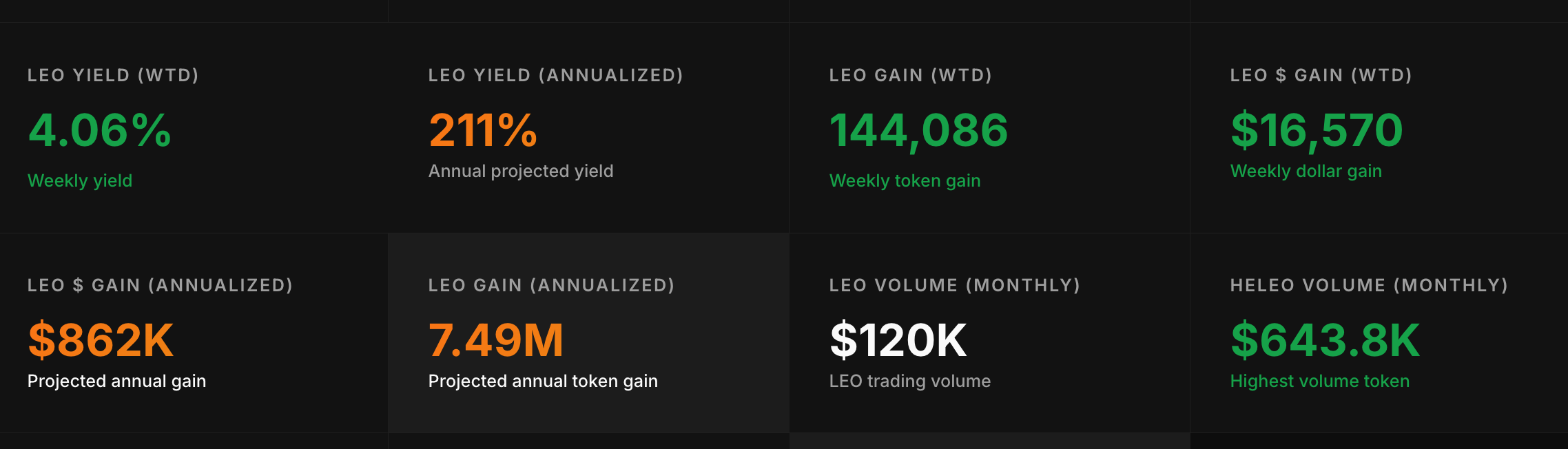

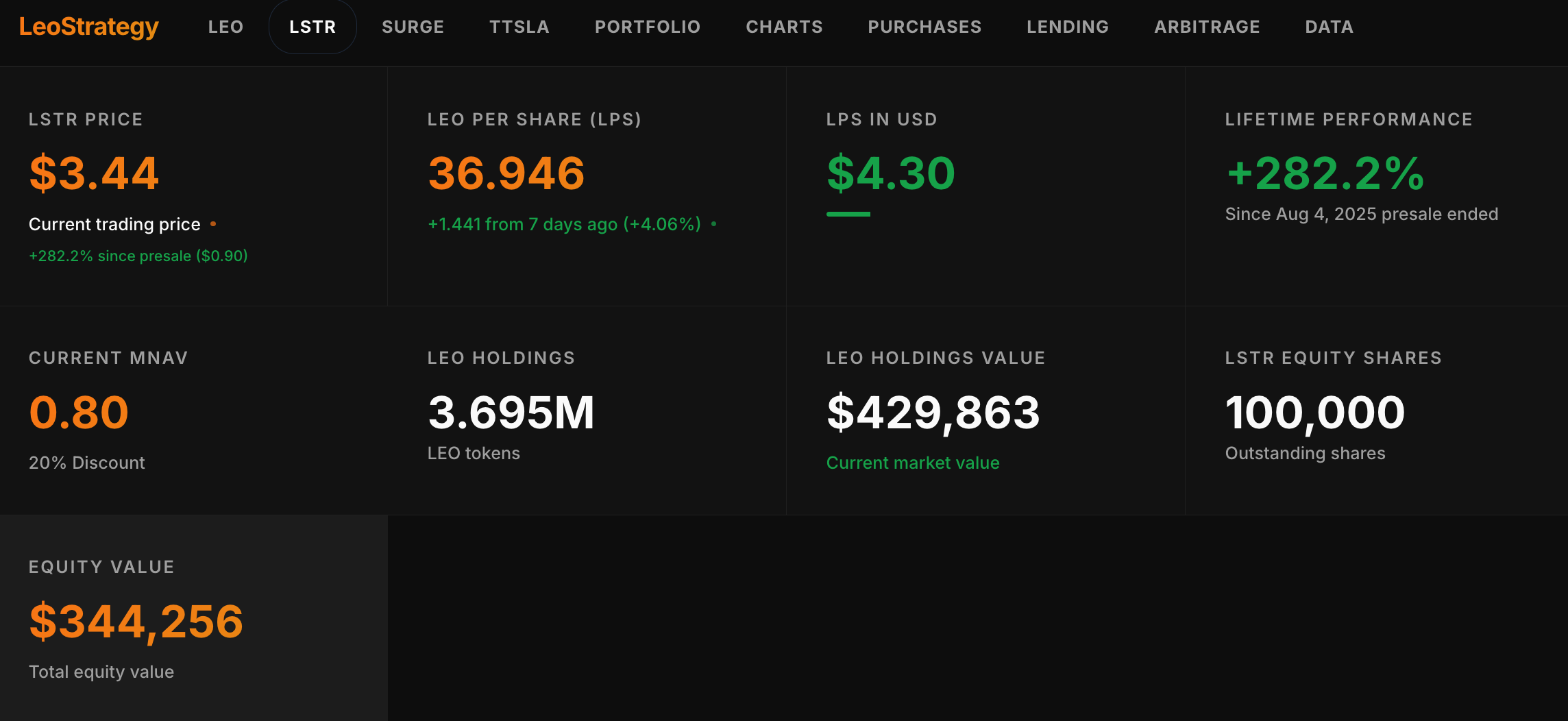

LeoStrategy Delivered a 211% APR for LSTR Holders

By purchasing this amount of LEO, we delivered a LEO Yield of 211% APR to all LSTR holders. If you are holding LSTR, your exposure to LEO is growing by 211% APR without lifting a finger.

The altcoin market has been hit hard lately. HIVE is down over 50%, BTC has dropped by ~$20,000. Most major altcoins are down double digit %'s as well.

This downturn has created volatility which is opportunity for LeoStrategy to harness in our for-profit operations. We generate income from volatility and use that income to purchase LEO. This LEO we buy leads to more LEO Per Share (LPS). By increasing LPS, we also increase the intrinsic value of LSTR.

In other words: the price of the market dipping actually leads to more profits for LeoStrategy while LEO is cheaper which means our purchases are more effective. LSTR Equity is now trading at a 0.80 mNAV which means it is 20% discounted to the fund's holdings of LEO.

While LEO holdings are worth $429,863 the LSTR Market Cap is only $344,256. Typical BTC Strategy companies trade at significant mNAV multiples ranging from 2x to 10x. We believe LSTR is undervalued by an order of magnitude (10x) given the velocity of accumulation as measured by LEO Yield.

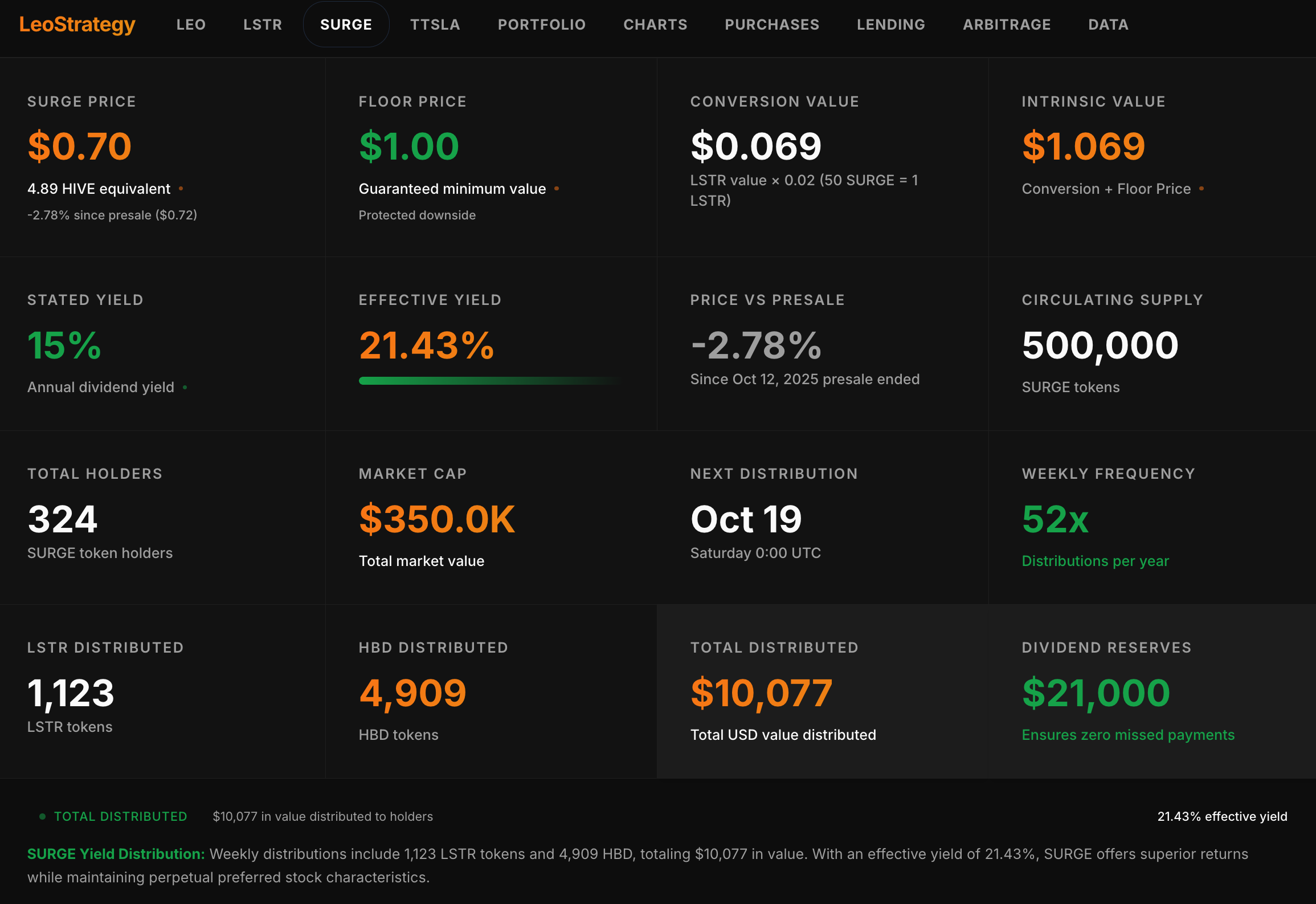

SURGE is Trading at a $0.30 Discount - Failure to Launch?

SURGE is trading at a $0.30 discount to its floor price. This means that SURGE is currently valued at $0.70 in the open market but the floor price is $1.

We've seen a handful of users who are concerned about this. Stating that "the $1 floor price is nonexistent".

Well, let's clear this up.

What is a $1 Floor Price? A $1 floor price means that SURGE has a minimum value of $1. When you convert it to LSTR in the future, you will get no less than $1 for it. In the unlikely event of a fund liquidation (dissolving LeoStrategy), SURGE lives at the top of the preference stack to get paid back first. Every 1 SURGE you hold will receive $1 BEFORE any other token holders are paid out. This means that SURGE holders are effectively the "1st in line debt holders" when it comes to LeoStrategy.

What a $1 Floor Price is NOT. A $1 Floor Price is not a guaranteed market value. That is, if you want to sell SURGE to the open market Before conversions to LSTR or before an unlikely liquidation event then you are NOT guaranteed to get $1. As with any asset: you will get what the market is willing to pay.

While it is our belief that SURGE should trade no less than $1 in the open market, it doesn't mean that others see it that way. Since the SURGE presale ended with SURGE being bought for ~$0.55 per token, we believe that presale buyers are still taking early profits. Some people who buy presales only buy them to flip the token. Not hold it for its true economic value.

SURGE has a $1 floor price which means that in the future, you know for an undisputed fact that you will get $1 for each SURGE you hold. Not from the market, but from LeoStrategy itself: 1. Via Conversion to LSTR 2. Via an Unlikely Dissolution of the Fund Event

Does this make sense to you? Buy SURGE if you want an asset that will be worth no less than $1 in the future. Not guaranteeing the market will pay you that but guaranteeing that LeoStrategy WILL.

We hope this clears the confusion and also encourages you to look at SURGE as a Yield Curve Trade. When SURGE is trading below $1, you should trade it based on the effective APR.

The Effective APR is 21.43% right now. This yield is paid out weekly. To calculate the effective APR, you can either use the "SURGE Manager" by calling "!Surge Stats" on INLEO Threads OR you can do it manually: simply take $0.15 (the yearly yield of 1 SURGE token) / $0.70 (the current price of SURGE in the open market) = Effective APR.

When you trade SURGE like a bond in the yield curve, the trade starts to make sense: 1. You're buying a "bond-like instrument" that has a stated floor value of $1 (uncapped upside, capped downside) 2. You're buying a "bond-like instrument" that pays you yield every single week as HBD, USDC or LSTR (soon, we are adding the option to autocompound for more SURGE as well) 3. You're buying a "convertible bond-like instrument" that also has the feature of being able to convert to LSTR at a 50:1 ratio. When LSTR is trading over $50, SURGE will start to rapidly climb in price ($1, $2, $5, $10). SURGE has uncapped upside as LSTR succeeds

TLDR; SURGE is violently undervalued. The market is pricing it at $0.70 likely because the altcoin market has decreased significantly in value. Typically, market volatility to the downside can lead to people selling safe assets and buying risk-on assets (if they believe they can make more money speculating than hedging).

SURGE is an asset that is designed to protect your downside, give you long-term upside and yield while you wait. Watch the fundamentals and you will see that SURGE is performing exactly as it should.

TTSLA Presale

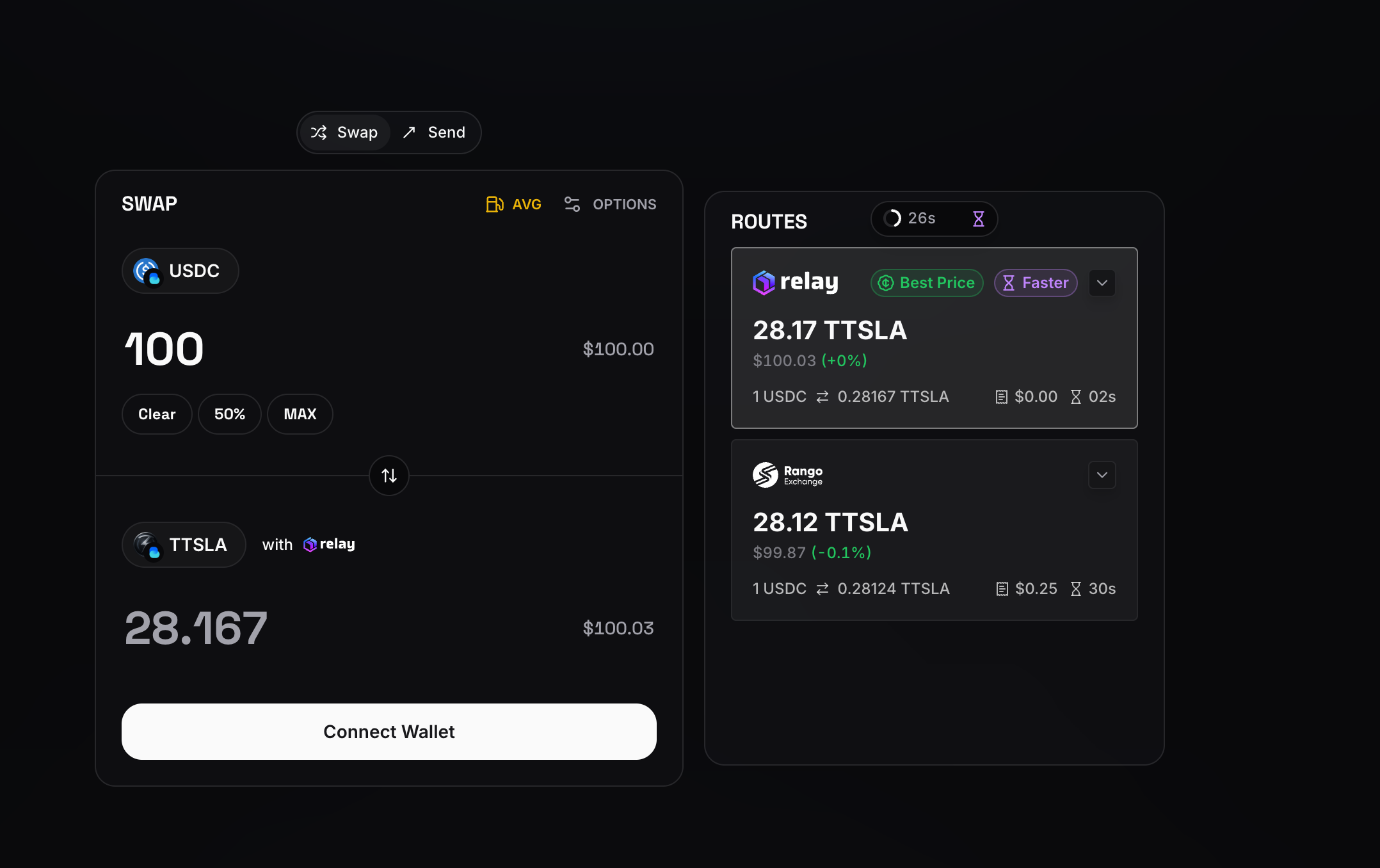

The TTSLA presale is LIVE on both LeoDex and Hive-Engine.

For a limited time, you can buy TTSLA at a 20% discount to its 1:100 peg to TSLA. When TTSLA is sold out of the presale, 2 liquidity pools will be launched to peg TTSLA at a 1:100 ratio to TSLA.

For example, if TSLA is $470 (what it is right now), then TTSLA will be $4.70.

From there, our onchain yield policy will govern the peg. If TTSLA trades below its peg, the yield increases. If TTSLA trades above its peg, then the yield decreases.

TTSLA is designed to trade very close to its peg. Our Cross-Chain Arb Bot will arbitrage the cross-chain pools while our yield policy arb bot will predictable arb the rate policy. Creating tight markets and a peg that works in all situations while allowing us to profit and stick to our mandate: hold only LEO and use all profits to purchase additional LEO.

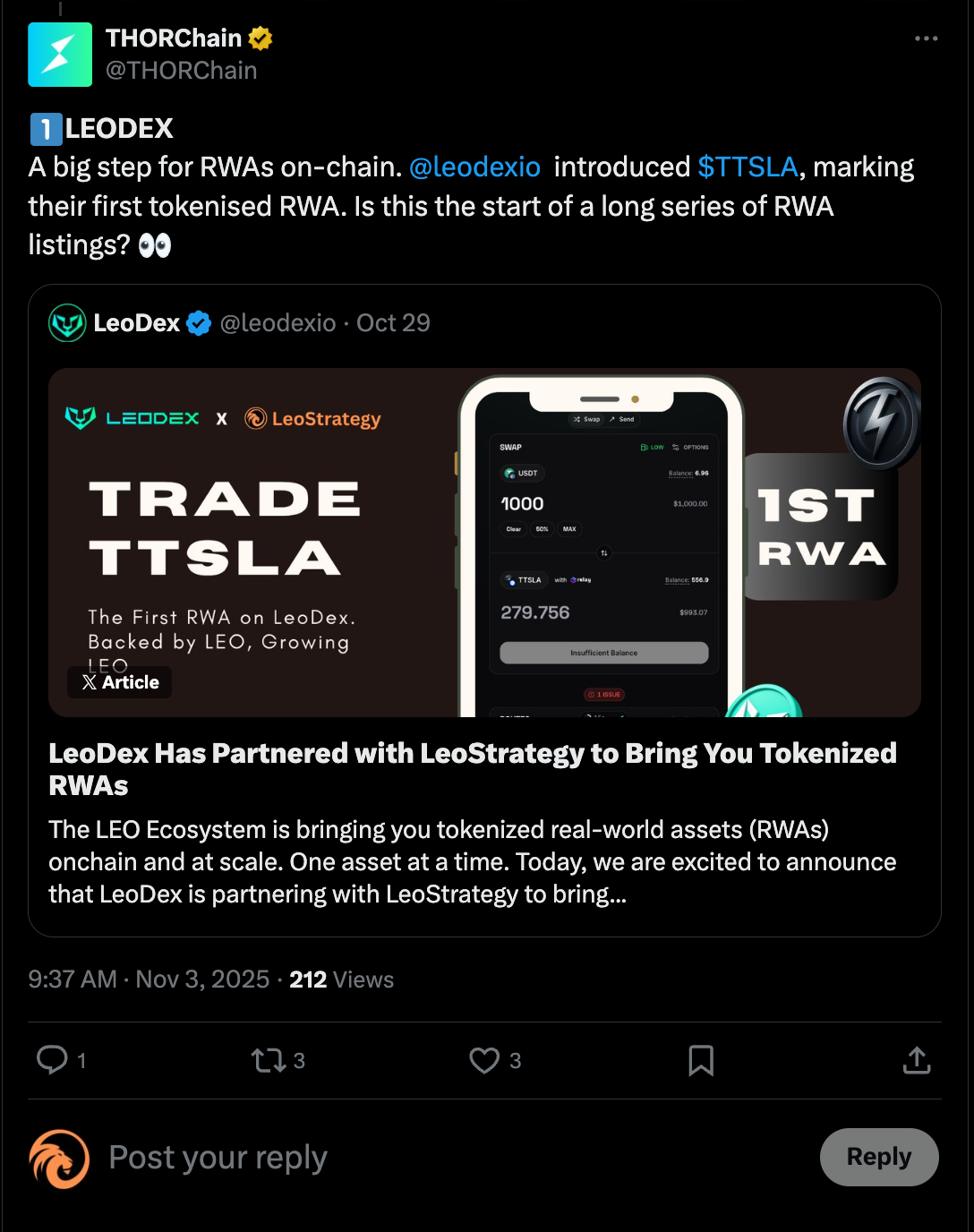

THORChain Mentions LeoDex x LeoStrategy's TTSLA Product

As we're writing this, THORChain just featured LeoDex #1 on their weekly protocol spotlight. They featured the launch of Real-World Assets (RWAs) on LeoDex, powered by LeoStrategy.

The first RWA we've released is TTSLA (Tokenized TSLA). We love seeing the team-up happening with THORChain mentioning our release of this on LeoDex.

Let this be a lens of the future we are building: a future where all major assets are tokenized, onchain and backed by LEO. Every asset generated profits for LeoStrategy and those profits are used to purchase LEO on the open market.

THORChain is taking notice which means the broader world of crypto is taking notice. How much longer will the TTSLA Presale last with this many new eyeballs on us? Not long, we imagine. The base side of the presale has been accelerating quite rapidly.

Support LeoStrategy's Vision to Grow LEO

We are tokenizing the world and putting assets onchain. Backed by LEO and growing LEO. Every product, service and derivative we build is designed with a simple ambition: provide token buyers with the asset exposure they're looking for while generating accretive profits to LeoStrategy. Use the profits to relentlessly purchase LEO on a daily basis and permanently lock up the supply in our perma-staked vaults.

Want LEO to grow? Want LeoStrategy to expand? Want demand for LEO to grow?

Support LeoStrategy's growth by buying TTSLA: 1. On Base Through [LeoDex)(https://leodex.io/?in_asset=BASE.USDC-0X833589FCD6EDB6E08F4C7C32D4F71B54BDA02913&out_asset=BASE.TTSLA-0xe4868a135c8e1e21ffb5f611f5104ac9d492db0d&in_amount=100) 2. On Hive-Engine Through TribalDEX or Beeswap or any other Hive-Engine UI

Posted Using INLEO