We've seen a discussion circulating about how SURGE Yield is paid out. We published a blog post yesterday which talked about Where SURGE Yield Comes From. Today, let's talk about how SURGE Yield is calculated and distributed.

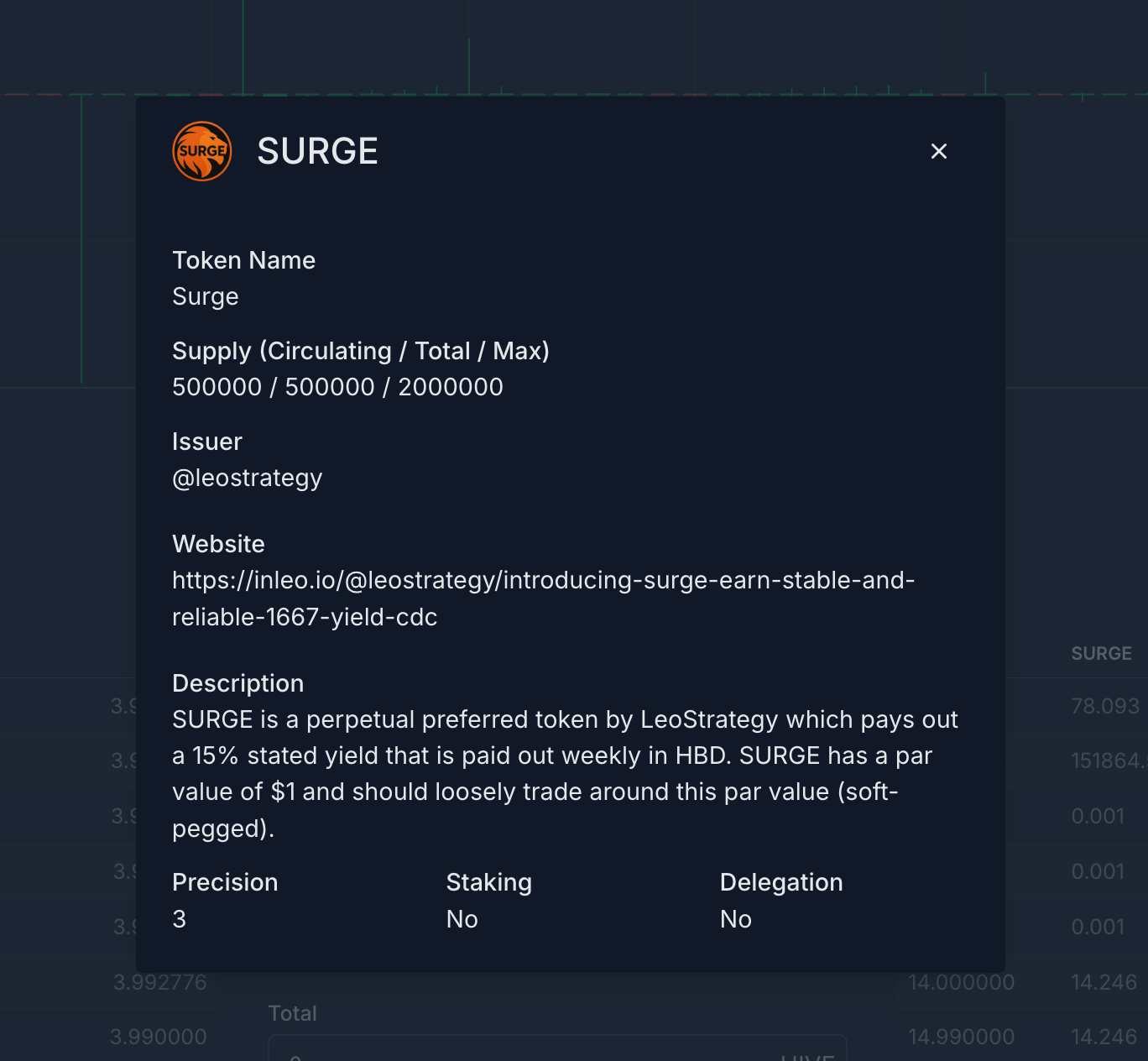

What is SURGE?

SURGE is a perpetual preferred token that can convert into LSTR at any time. While holding this perpetual preferred token, you are entitled to a $0.15 yield per 1 SURGE held in your wallet every year. This yield is paid every week (Monday at 0:00 UTC).

SURGE is currently available in a limited quantity through Hive-Engine. Once it is sold out, the SURGE discount will be removed and a $50,000 liquidity pool(s) will launch which will price SURGE at $1 per SURGE.

How is SURGE Yield Calculated?

Every Monday at 0:00 UTC, SURGE yield is distributed. In order to distribute SURGE yield, the @surge.yield agent must calculate how much SURGE Yield it needs to distribute to each user who is holding SURGE in their wallet.

To do this, the @surge.yield agent takes a snapshot of all wallet balances. Another caveat is that we added a randomization window to the snapshot. We added this after SURGE went live as we noticed some users were gaming the snapshot (i.e. buying SURGE right before the distribution and selling right after).

In order to prevent this gaming of the system, the snapshot is randomized 24 hours before SURGE's yield is distributed. Nobody (including us) knows exactly when the snapshot will get taken. All we know is that it happens sometime between Sunday at 0:00 UTC and Monday at 0:00 UTC (24 hours before the payout occurs to the exact moment the payout occurs).

During the snapshot process, @surge.yield captures your SURGE holdings. If you hold SURGE in two places, your balance counts toward yield: 1. Liquid in your wallet (as SURGE tokens) 2. Providing liquidity in the Liquidity Pool (LP'ing with another asset)

If your SURGE is held anywhere other than these two places, then it cannot be seen by @surge.yield and therefore will not earn yield.

This is all outlined in the original SURGE launch posts 1, 2, 3.

Once your SURGE balance is snapshotted, you are all set to earn yield. Even if you sell your SURGE after the snapshot but before the distribution; you technically held the SURGE at the time of the snapshot. You will still earn yield for that SURGE (but whoever bought it from you will not). This ensures that SURGE yield can't be double spent (i.e. if you bounce your SURGE to 50 accounts to try and earn multiple yield payouts per 1 SURGE, then you will fail to succeed at cheating our system.

At 0:00 UTC on Monday, @surge.yield pays HBD to all SURGE holders who have chosen HBD as their payout asset.

Afterwards, @surge.yield looks at everyone who chose LSTR as their payout asset and then swaps HBD to LSTR and then pays the LSTR to all SURGE holders with that preference.

Then the clock resets until the next Sunday at 0:00 UTC when the SURGE Snapshot window re-opens for the next week of payouts.

Why Don't I Get Paid Yield If I Am Selling My SURGE?

This discussion started as two SURGE holders put up SURGE Sell Orders before the snapshot last week. They are wondering why they did not get SURGE Yield.

As the original documents outline (and we refresh you on here), if your SURGE is not held in these two places then you will not earn yield: 1. Liquid in your wallet (as SURGE tokens) 2. Providing liquidity in the Liquidity Pool (LP'ing with another asset)

If your SURGE is in a sell order, then it is not in one of these two places

What's the difference between LP'ing and placing an order book sell?

There are two quite important differences between LP'ing and a sell order on the order book

LP'ing means you provide liquidity to the market. This can be seen as a service to the market since you are not only putting your SURGE up for immediate sale, you are also pairing it with USDC out of your wallet which is also for immediate sale. When you provide liquidity, you provide net economic value to the SURGE economy

Someone who LP's SURGE with USDC (for example) is investing twice-over in the SURGE Economy. They are giving their SURGE to the market to have immediate liquidity AND they are giving their USDC to the market to have immediate liquidity matched to their SURGE.

Someone who is placing a sell on the order books on the other hand is doing no service to the SURGE economy. They are merely placing an order at some future price. The SURGE no longer is in their wallet and the second someone else buys it, that SURGE belongs to someone else. 1. It provides no liquidity to the market 2. It is not paired with USDC (exogenous capital) to give the market better volume/volatility

This can also be highlighted by how the SURGE Yield is paid to an LP'er: you get paid SURGE yield based on the SURGE side of your LP (not the USDC side).

Example

User A puts a sell order for 1,000 SURGE at $100 per SURGE on the Hive-Engine Order Book.

User B adds liquidity to the SURGE/USDC Liquidity Pool with 1,000 SURGE and matches that 1,000 SURGE with $1,000 USDC.

User A is waiting for someone to buy their SURGE if SURGE 100x's. It provides no immediate liquidity to the market and merely sits on the books idle until someone buys it.

User B's SURGE is providing immediate liquidity to the market and also adds $1,000 in additional capital investment to User B's balance sheet toward SURGE (since their extra $1,000 USDC is being used for liquidity).

If SURGE is trading for $1 per SURGE and User C comes in to buy SURGE; is it a service to the market that User A's sell order is at $100 per SURGE? User C either: 1. Will not buy their SURGE (as its overly expensive) 2. Will buy their SURGE not realizing it can be bought cheaper elsewhere 3. Will buy SURGE from a sell order that is more accurately priced

IF User C buys SURGE from a more accurately priced sell order, then User C now owns said SURGE and gets the yield from that SURGE.

Let's say User D comes in and buys SURGE from the liquidity pool. They swap $10 USDC into the pool and get 10 SURGE out of it.

User B's position just decreased by 10 SURGE and increased by 10 USDC. They provided immediate liquidity to User D. User B also will get less dividends (10 SURGE * 0.15 / 52 less) in the next payout round since their position is now 990 SURGE and 1,010 USDC. Meanwhile, User D will get 10 SURGE worth of yield.

Working As Intended

This process is working as intended and forethought went specifically into "should we pay SURGE yield to sell orders?" "should we pay SURGE yield to Liquidity Providers?"

We approached this problem with the following mindset:

Originally, SURGE's designed required you to stake SURGE. That is, in order to get dividends, we originally intended the system to require you to stake your SURGE inside of your HE or Base Wallet.

We decided that this added additional complexity to the system and additional wallet actions for no real purpose. Thus, we decided to make SURGE a liquid staking token where simply holding it liquid is good enough to be considered eligible for yield.

However, consider the impact of this. IF we required staking, then you would not earn yield by having a sell order on the order book. You would have to hold SURGE in your wallet as staked SURGE (sSURGE) in order to get yield.

During the design process, we knew that we wanted SURGE holders to get dividends if they LP'd. Why? Because LP'ing is a massively beneficial thing for the SURGE economy. It: 1. Increases liquidity 2. Attracts new buyers 3. Increases volatility and therefore; creates more arbitrage opportunities for the LSTR Market Makers

If SURGE required staking, we had a model designed that would've let you stake your LP Tokens in order to continue to participate in SURGE Yield.

Consider how this would have worked for SURGE Sell Orders. The simple answer is that you would get paid yield if you staked for sSURGE or staked sSLP (Staked Surge Liquidity Pool) tokens. There is no way to stake tokens that are on the order books.

Posted Using INLEO