The Key Performance Indicator (KPI) of LeoStrategy is LEO Per Share (LPS). Tracking this metric is how you can determine how well LeoStrategy is performing as a fund. LeoStrategy is a permanent capital vehicle with a singular driving purpose: acquire as much LEO as possible.

We acquire LEO by utilizing our expanding balance sheet of LEO holdings to offer financial products and services to the industry. The LEO on our balance sheet allows us to build and offer an array of financial products that generate accretive revenue. This revenue is captured and used to buy more LEO, expand our balance sheet further and therefore; offer even more products/services that can capture more revenue and purchase more LEO.

This is the same model being used by Strategy and other companies with Bitcoin but is applied to LEO.

The KPI of LeoStrategy | LEO Per Share (LPS)

The KPI - or Key Performance Indicator - of all Strategy companies is super simple: tokens per share.

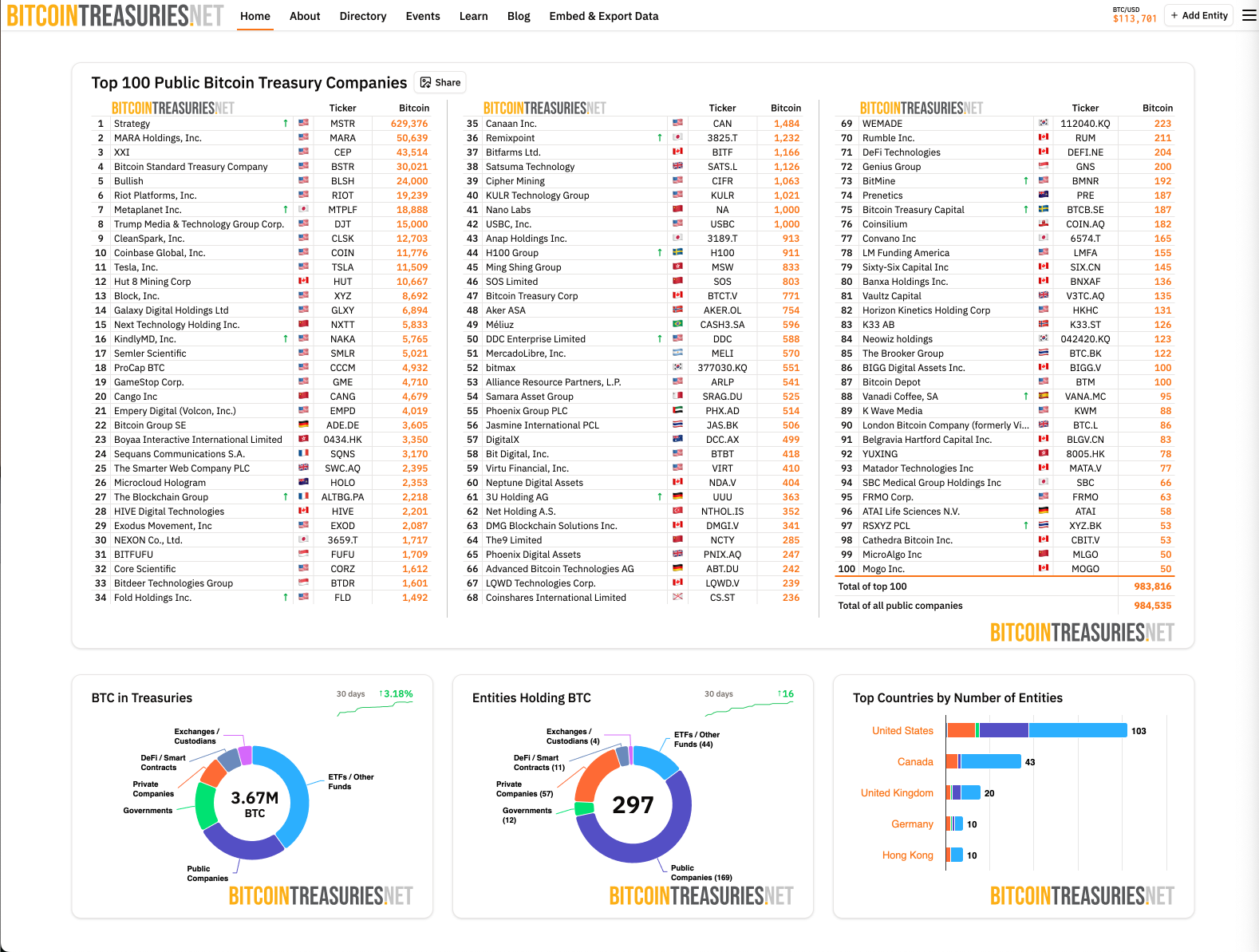

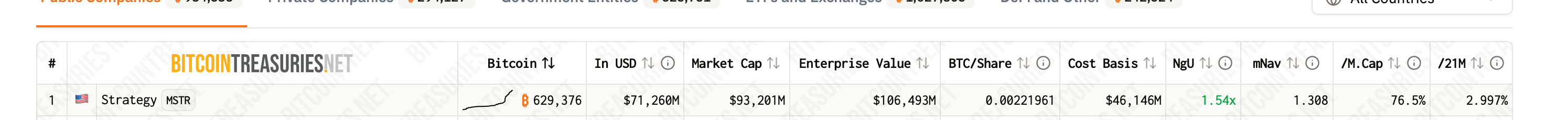

In Microstrategy's case, this is Bitcoin Per Share (BPS). People measure MSTR's success based on their Bitcoin holdings today as well as their ability to generate more BTC per share of MSTR stock in the future.

Microstrategy owns "0.00221961" BTC per Share of MSTR stock that is circulating. They have an mNav of 1.308 which means that MSTR is trading at 1.308x the value of the BTC held on their balance sheet. In USD terms, they hold $71.59 Billion Dollars worth of BTC and their Market Cap is $93.524B.

This signals that the market is valuing MSTR at a premium to their Net Asset Value.

Why would anyone value them at a premium? Because of the velocity of their acquisition of Bitcoin. AKA: how fast can they grow their BTC Per Share of MSTR?

Velocity of Accumulation

The velocity at which a Strategy company can accumulate the underlying asset is essential to the valuation of the stock.

In our case, the velocity at which we can accumulate LEO is absolutely critical to valuing LSTR tokens.

Right now, LeoStrategy owns ~20 LEO per share of LSTR outstanding. We hold ~2M LEO and have 100,000 LSTR shares circulating.

This is up from 15 LEO per Share of LSTR just about 1-2 weeks ago. So in the past 1-2 weeks, we have expanded the LEO Per Share of LSTR by over 33.33%.

This velocity of accumulation is unheard of in the broader Bitcoin Strategy company space. A lot of this has to do with: 1. How early we are to LEO (imagine being in BTC when it was $0.14 instead of $114,000) 2. Our accumulation methodologies (building with a revenue-first mindset) 3. The recent dip in LEO price 4. SURGE and Preferred Offerings at a young stage (in the broader market, only Strategy has really done Preferred offerings thusfar. It takes companies a while to get to market with Preferred offerings. But here at LeoStrategy, we aim to build fast like the LEO Core Team - getting a preferred offering - SURGE - to market so quickly has expanded our velocity of accumulation ten-fold)

Valuing LSTR

When you value LSTR, look at our LEO/Share right now and consider the LEO/Share velocity as well.

LEO/Share is a metric that is perpetually up and to the right. Why? Because LeoStrategy never sells LEO and only seeks to accumulate it through: 1. Revenue generation 2. Market Making 3. Offerings 4. Staking

If we accumulate even 1 LEO per day while never selling LEO, then the LPS can only increase.

With the recent dip in the LEO price we are extremely excited. Our ability to accumulate LEO is even better when the LEO Price Dips. We're seeing a lot of old Hive users sell off their LEO now that its getting powered down. The SURGing LEO price lead to a lot of people initiating LEO POWER power downs in order to take profits.

We find this very healthy for the ecosystem. Khal has called it "the great rotation".

What is happening now is LeoStrategy is accumulating toward our initial milestone of 10M LEO held on our balance sheet. We are already 20% of the way there. We will not stop at 10M.

The major milestone at 10M will be Collateralized Lending. With 10M LEO on the balance sheet + the market forces - we believe LEO will be worth well north of $1 - we'll be able to release our Collateralized Lending product.

This will allow LEO holders to take collateralized loans on their sLEO holdings. 1. Stake your LEO to sLEO on Arbitrum using LeoDex 2. Use a new LeoDex page that we build in collaboration with the LeoTeam to stake your sLEO into a lending contract owned and operated by LeoStrategy 3. Take a loan in stablecoins against your sLEO position 4. Pay back the loan at any point in the future to get your sLEO back

LeoStrategy will earn yield from your sLEO along with some small interest rate on the loan. 100% of these inflows are revenue that is generated for the fund and are used to purchase more LEO and add it to our ever-expanding balance sheet.

As LeoStrategy continues to accumulate more LEO, we are effectively removing it from the market. It can never be sold in the future since LeoStrategy can never sell our LEO.

Imagine a future where LeoStrategy accumulates 10M LEO. That is 1/3rd of the total LEO circulating supply that can never be sold. Now 20M LEO is outstanding (not including the POL and ongoing burns).

As time goes on, LeoStrategy continues to accumulate. The POL continues to accumulate. Burns continue to accumulate.

The result?

LEO is incredibly scarce. Scarcer than Bitcoin.

Scarcity is the engine, demand is the fuel.

If you can dump a bunch of fuel into a highly efficient engine, what happens? You take off for the moon.

Fuel the LeoStrategy Flywheel

Want to fuel the LeoStrategy flywheel, make 20% instant profit and earn 18.5% effective yield?

The SURGE presale is ongoing for a limited time and a limited amount. Similar to the LSTR presale, the SURGE presale will end with a liquidity pool launched at $1 per SURGE (higher than the current presale price).

The floor price of SURGE is $1. We expect it to trade around $1 and in the future, much higher than $1 due to the conversion to LSTR option (which increases the SURGE floor price over time).

LSTR initial sale buyers saw their shares 4x right after the presale ended. The presale sold out 60% of the shares in just 5 days. We expect something similar with SURGE where the sales are consistent for a time and then suddenly sell out. Likely a lot faster than LSTR now that people have seen and felt the effect of the way we built these presales to relentlessly attract buy pressure.

The SURGE:LEO liquidity pool will be seeded with $50,000 - donated graciously by Khal who also donated the LSTR:LEO liquidity pool ($5k) after the LSTR presale ended.

To buy SURGE's limited presale, go here: https://tribaldex.com/trade/SURGE To Learn More about SURGE, go here: https://inleo.io/@leostrategy/introducing-surge-earn-stable-and-reliable-1667-yield-cdc

Posted Using INLEO