LeoStrategy has been insanely excited about the release of Tokenized TSLA (TTSLA). We believe this is the first real step in tokenizing real-world assets on the blockchain and backing them by LEO, for LEO.

Each asset we tokenized is over-collateralized by LEO. Each asset generates revenues for LeoStrategy via our Cross-Chain Market Makers. The revenue is used to pay the yield on each RWA (i.e. TTSLA). Any profits after yield are then used to purchase additional $LEO and stake it, which further over-collateralizes each asset issued in our stack.

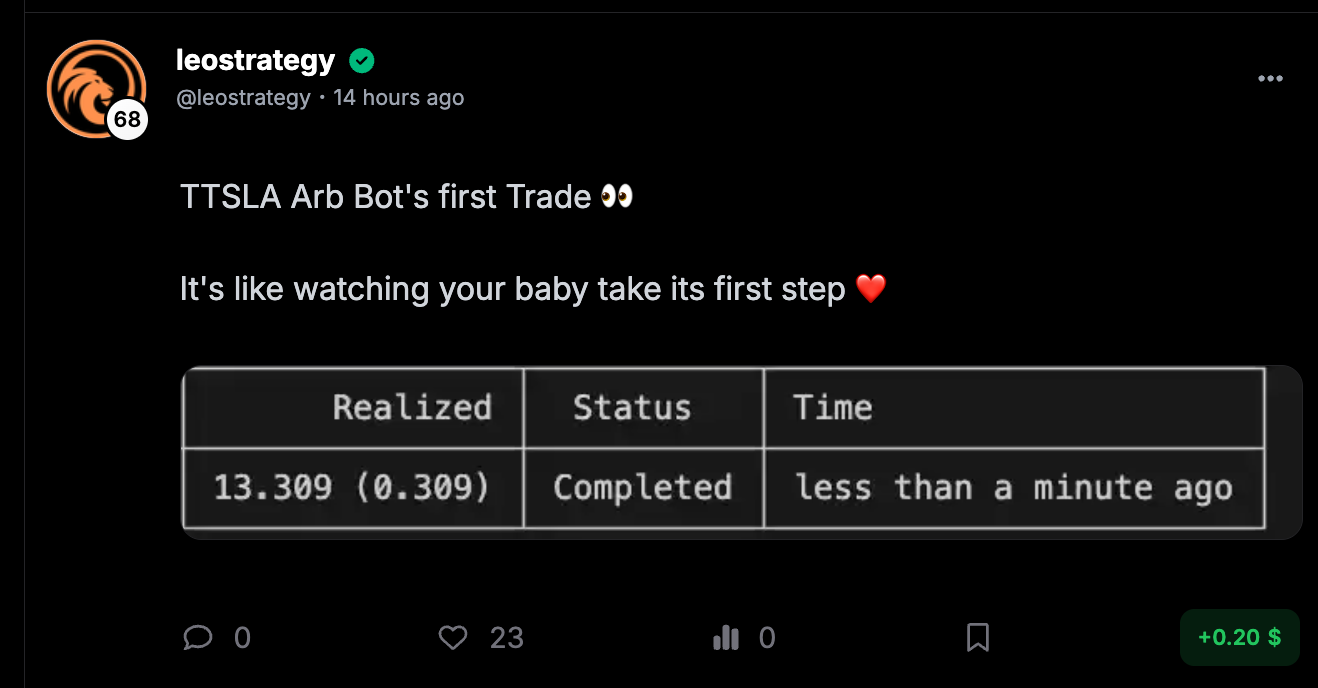

TTSLA's Cross-Chain Market Maker launched yesterday and made its first trade!

TTSLA Launched Yesterday

TTSLA launched yesterday and it was accompanied by massive success. This was our smoothest launch to-date and it is clear to us that the team is getting far more efficient at launching assets. This is very important as our 10-year vision is to launch hundreds of RWAs that are backed by LEO and generating value for LEO.

To do this, we need to have a launch cadence that allows for assets to be continuously released and successfully launched to the market. Each RWA launch is accompanied by a myriad of items.

We call this our launch checklist:

✅ TTSLA Presale Is Over ✅ TTSLA:USDC Launched on Base at $4.29 per TTSLA ✅ TTSLA:LEO Launched on HE at $4.29 per TTSLA ✅ TTSLA Oracle Bridge (@ttsla.oracle) is now LIVE ✅ TTSLA Cross-Chain Market Maker is now LIVE ✅ TTSLA 2x Yield Boost (Daily) for All TTSLA Presale Buyers In Effect

You'll notice the two liquidity pools that get launched at the peg for TTSLA (+20% instant profit for presale buyers): 1. TTSLA:USDC is LIVE on Base and is trading at $4.27 currently 2. TTSLA:LEO is LIVE On Hive-Engine and is trading at $4.33 currently

These two pools are efficiently market made by our cross-chain TTSLA MM. This MM generates profits every single day and we utilize those profits to purchase additional LEO and add it to our balance sheet.

TTSLA Manager

@ttsla.yield is the onchain AI Agent that tracks and manages TTSLA's Yield. Yield is paid daily to all TTSLA holders.

The APR for yield is programmatic, predictable and onchain. If you remember the docs of the TTSLA token, then this chart will look familiar to you:

If this looks complicated, DO NOT WORRY. @ttsla.yield has you covered!

Breaking Down the TTSLA Manager's Hourly Threads

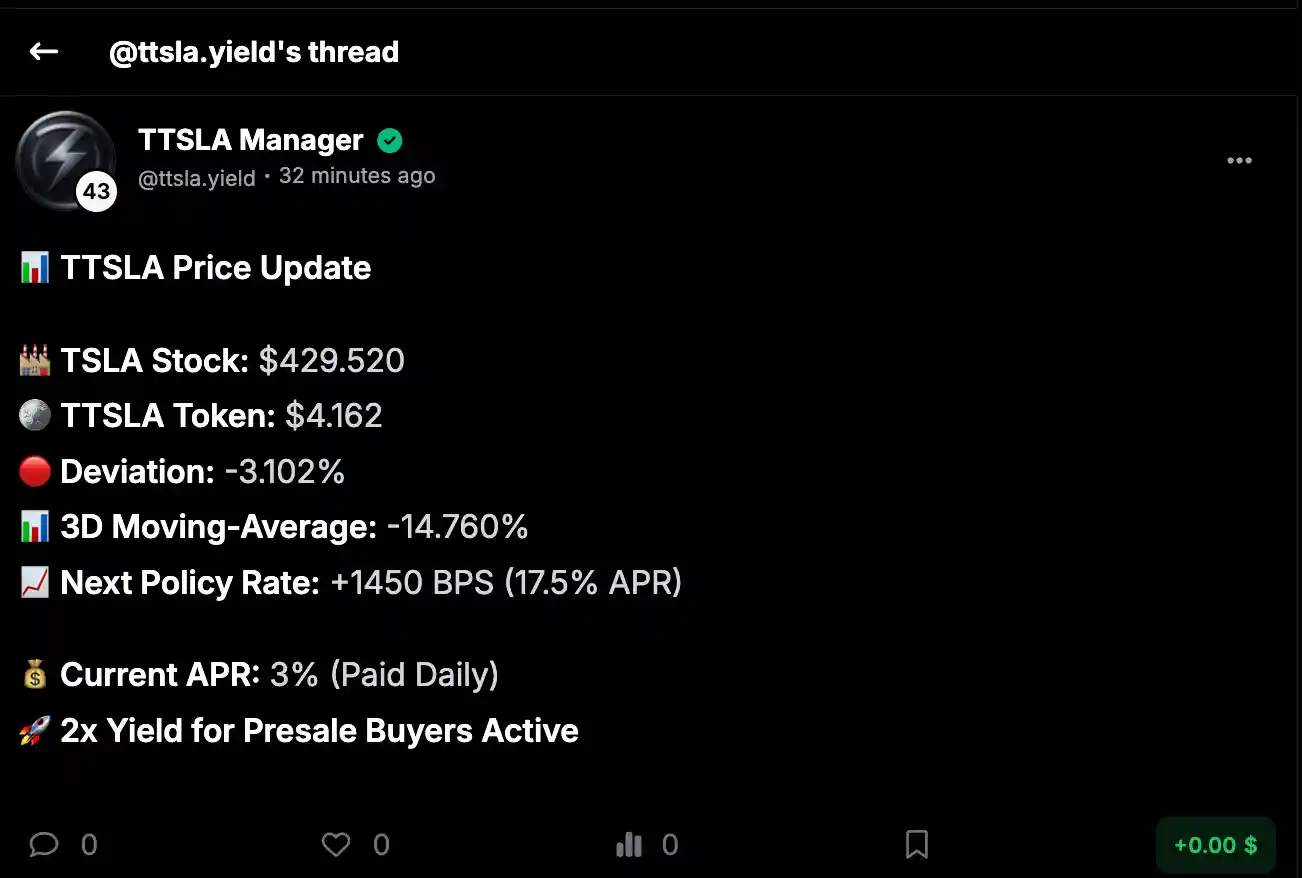

Every hour, you're going to see a thread like this one from @ttsla.yield. If you've already seen these, you'll notice that the threads have changed since the end of the presale.

Now, these threads show the 3 Day Moving Average of the TSLA:TTSLA 1:100 Correlation (Peg). It also shows you what the next Policy Rate will be.

- Yield is Paid Daily based on the current policy rate

- The policy rate is set weekly based on the 3D Moving Average of TSLA:TTSLA correlation

If the correlation deviates, then the yield is autonomously and predictable adjusted.

Since the TTSLA presale had the token selling for a 20% discount, the 3D Moving Average is currently -14.76% off its peg.

As you can see in the above thread, the Next Policy Rate is predicting a +1,450 BPS raise.

Since the current APR is 3% (the baseline APR), this means that the APR will increase to 17.50% next week.

Now, TTSLA is trading right at its 1:100 peg since the presale has ended. If you track @ttsla.yield's hourly threads, you'll notice that the 3D Moving Average is now coming down as it is catching up to the current price.

Think of this like a price feed. The price feed is a 3D Moving Average of the TSLA:TTSLA correlation. As the correlation trends in one direction or another, it sets the stage for the next rate policy meeting (every Monday).

Every Monday, a new rate is set based on this 3D Moving Average. You can look at the table above to see what 3D Moving Average = What Rate Policy (APR).

Predictable, Onchain Rate Policy Leads to Predictable, Tokenized Assets Onchain

TTSLA is designed to give you TSLA exposure. When you own TTSLA, you predictably know that the token will trade with a 1:100 correlation to TSLA in long timeframes.

This correlation can most certainly deviate in short timeframes but the rate policy is designed to close the gap on those correlations and lead to long-term price stability.

As TTSLA trades in the open market and the yield policy is now live and in full effect, TTSLA owners and prospective buyers will start to see how our model for Synthetic RWA's that are governed by rate policy will work going forward.

It's a beautifully simple model - although it may not seem simple at first glance.

The simple way to put it: TTSLA has a 1:100 TSLA correlation that is governed by a dynamic daily yield payout.

In long timeframes, this correlation holds because demand is either heated or cooled based on the 1:100 correlation using a completely predictable, onchain rate policy.

Questions?

We know this is a lot to unpack and TTSLA is the first RWA we have released. This model is unique and we haven't seen many (if any) RWA's in the space doing something like this.

We designed this model using the foundations of how governments manage currencies. They manage demand and supply using rate policy. Albeit, they have an inefficient "human" element which we have removed in our model. Our rate policy is 100% transparent, onchain and instantly predictable.

YOU KNOW what the next rate policy will be before it even happens. If TTSLA starts deviating from its peg, the rate policy drives demand now and in the future. This can be tracked by anyone either on your own or simply by seeing @ttsla.yield's threads.

Drop any questions below!

Posted Using INLEO