The big question we've seen is: where does SURGE yield come from? In this blog post, we'll dive into the economic design of SURGE and whether or not SURGE Yield is sustainable in the long-run.

Yield has been an interesting conversation in the crypto universe. There's been all sorts of products over the years that have offered yield. Some are still around today and thriving. Others like UST floundered and blew up. The key to building a great yield product is to build something that is economically sound on a bedrock foundation.

SURGE is designed to be a perpetual preferred tokenized share of LSTR. If that sounds like a mouthful, let's break it down simply.

Refresher: What is SURGE?

SURGE Is a perpetual preferred tokenized share of LSTR. Let's break each word of this sentence down: 1. Perpetual because SURGE's yield never ends. If you hold it forever, you get paid yield until you convert it to LSTR 2. Tokenized because it is a token on a blockchain(s) 3. Preferred because it lives at the top of the preference stack. This means that 1 SURGE = $1 no matter what. In the unlikely event of the LeoStrategy fund dissolving, SURGE holders get paid back FIRST and FOREMOST at the stated value of $1 per SURGE. This creates a floor price for SURGE at $1 (but no capped upside - SURGE can trade at $2, $3 or even $30 based on the LSTR price appreciating)

In short, SURGE is a convertible note on the LSTR token. 1 SURGE = 0.02 LSTR and this means that as LSTR's price rises, SURGE's price rises as well.

While you hold SURGE, you get capped downside. This comes from the liquidation preference at $1 per SURGE. Anyone who sells SURGE at under $1 is selling SURGE beneath its floor price which is quite illogical. It would make more sense to either: 1. Hold SURGE until it inevitable goes up with the LSTR Price 2. Hold SURGE for the unlikely event of a liquidation (where you'd get $1 per SURGE you hold)

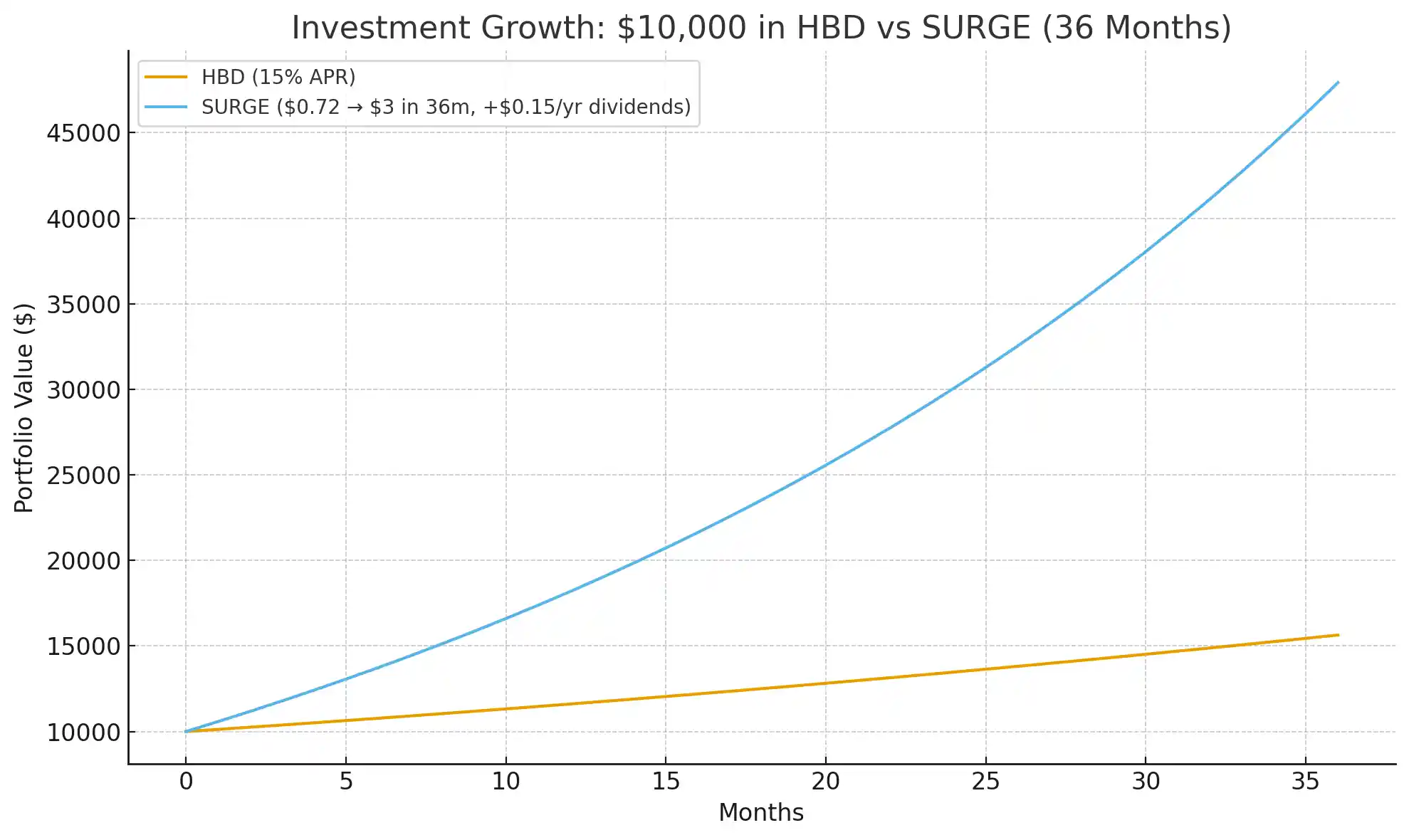

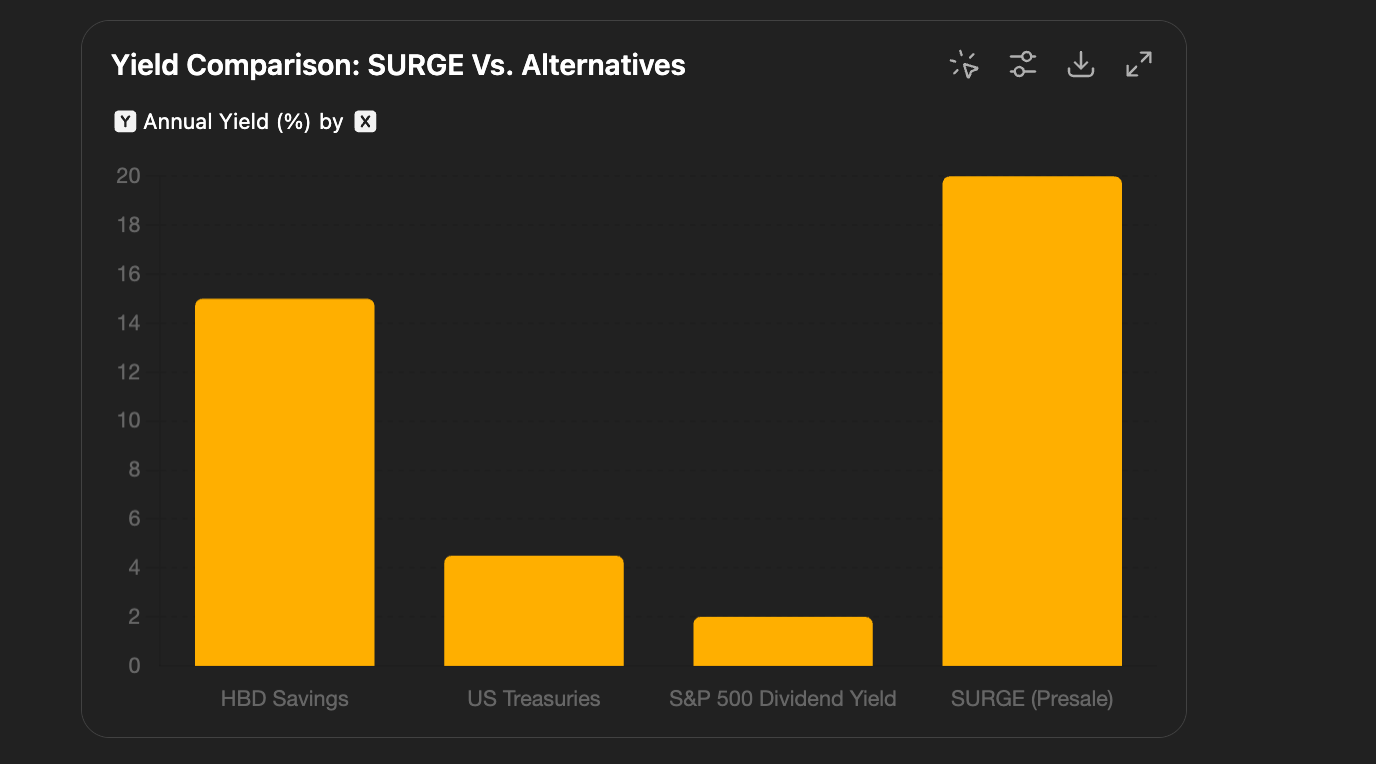

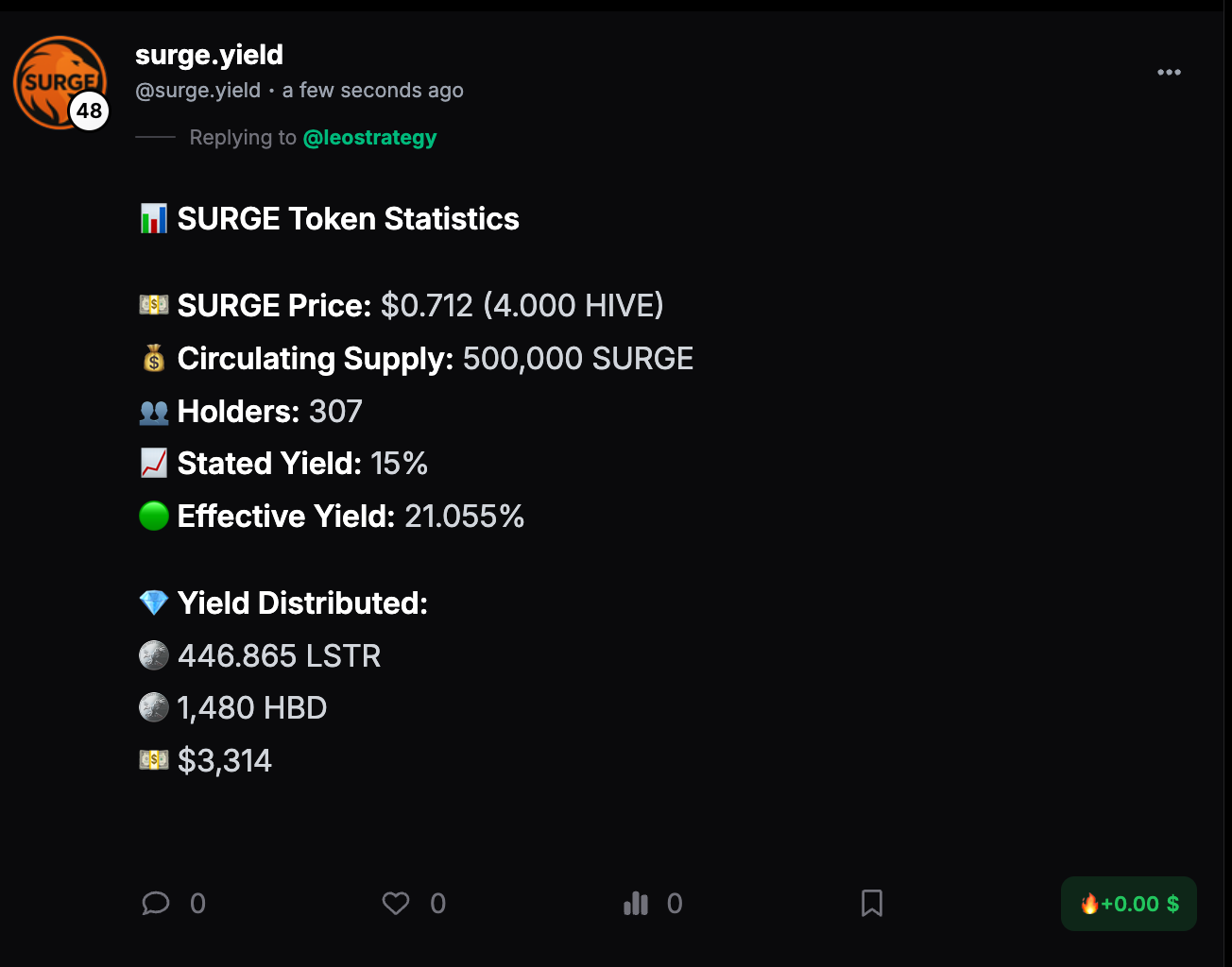

While you hold SURGE, you get paid a dividend. This dividend is $0.15 per SURGE. This gives a stated yield of 15% APR (and can never change) or an effective yield of 20.80% in the presale (because if you buy 1 SURGE for less than $1, you still get $0.15 per 1 SURGE = higher % yield on your principle investment).

@surge.yield is an onchain SURGE Yield Manager. Any SURGE holder can use this bot directly on INLEO Threads in order to manage their SURGE Position, see their yield, change their preferences, etc.

Once the presale is over, the discount for SURGE will end. This means that SURGE will be repriced to $1 per SURGE (the floor price). There may be some volatility right after the presale, but we expect SURGE to trend upwards after that. The $1 floor price does not mean that SURGE is pegged to $1. It means that SURGE should not trade below $1 because it would be financially illogical to sell something for less than its liquidation price.

SURGE should trade above $1 as the intrinsic value of the LSTR conversion grows (0.02 LSTR today = ~$0.11). As LSTR's price appreciates, this will grow and add to the $1 floor price of SURGE. In the future, SURGE will trade north of $2, $3, $5, etc. until all SURGE has been converted to LSTR by holders.

Sources of Yield (The Engine)

SURGE's presale designates a small portion of the initial capital raise to create a 6 month runway for dividend yield. This 6 months runway can be verified onchain so SURGE holders know with 100% reliability that they will never miss a weekly dividend payment.

- Permanent Capital Vehicle (LSTR)

- Market Maker Profits

- Base Bridge & LeoDex Inflows

- ATM Issuance

Over the coming weeks and months, these 4 aspects of LeoStrategy's SURGE design ensure that dividends for SURGE never miss a beat.

1. The Permanent Capital Vehicle is the LeoStrategy fund itself. The LSTR token accretes value over time by adding LEO Per Share (LPS) for all LSTR holders. Last week, we generated a 7.55% yield (392% annualized) for LSTR holders. This LEO Yield generation results in the continual value accrual of the LSTR token.

LPS just hit 30 for the first time today. This means that each share of LSTR has 30 LEO backing it. LPS is the main metric for valuing the LSTR token. You can (and should) use the current LPS as a lens at the today value of LSTR but then look at the LEO Yield (which effectively is the velocity of LPS Growth) as the metric at valuing LSTR tomorrow.

If you plug the growth rate of LeoStrategy by using our recent blog posts into ChatGPT (or your favorite AI), you can model out future growth scenarios along with what AI thinks the fund should be valued at today. This is a fun exercise and we've seen a few of you posting threads of this. The growth rate of LeoStrategy is measured as LEO Yield. As LeoStrategy's fund increases the LPS of LSTR shares, LeoStrategy becomes immensely more valuable. As LSTR becomes more valuable it increases our ability to launch new assets, scale current assets and generate accretive revenue for the fund.

All of these products, services and tools lead to more capital generation for the fund in the form of profit inflows and also capital raises. All of these tools can be leveraged to increase our treasury for dividend payments.

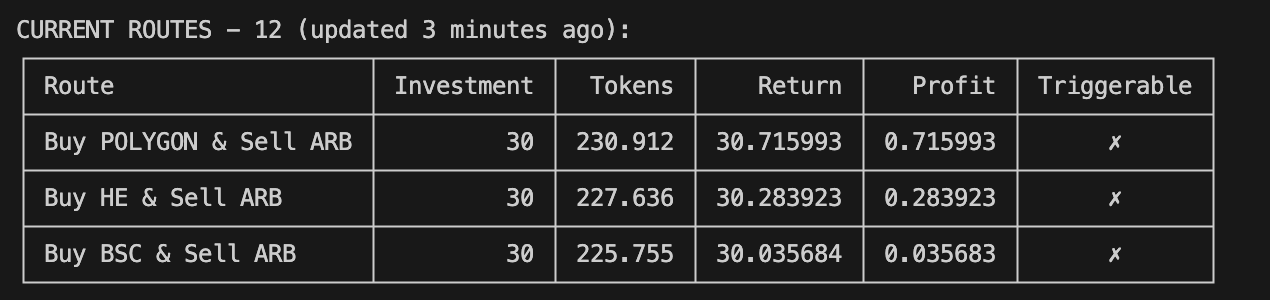

2. Market Maker Profits is likely to be the #1 driver of profitable inflows for LeoStrategy. The Market Makers in their current form are already on their way to generating $100+ per day in profits for the LeoStrategy fund. We have: 1. HE Market Makers -> trading the Hive-Engine Orderbooks and Pools 2. Cross-Chain Market Makers -> trading LEO Cross-Chain Pairs (and soon, SURGE & LSTR cross-chain pairs when they go live on Base)

Market Making is a hyper-profitable business but there are some key caveats: 1. Volume and Volatility -> volatility is vitality. We need volume and volatility for the market makers to have arbitrage windows. More arbitrage windows = more opportunities to make markets, profit and increase the fund's inflows 2. Competition -> Market Making is hyper competitive. LeoStrategy solves this in two ways: for the Hive-Engine Market Makers we must prioritize speed and execution. Our MMs compete alongside other MMs and need to be superior in order to be profitable. Our Cross-Chain Market Makers are a different story and we believe the CC MM's will be the most profitable. Why? Because we have a moat on market making LEO/LSTR/SURGE cross-chain pairs. A whitelisted bridge fee that is lower than other market makers allows our arbitrage bots to trade the cross-chain pairs more cheaply than any other Arb Bot

While we are focused on making the best/fastest cross-chain arb bot that we are capable of, we also don't need to worry about other MMs competing with us. Our arb bot closes arbitrage windows faster than any other bot can because we hit profitable targets before they can.

Look at it this way (and this is an actual screenshot of our LEO Cross-Chain Arbitrage Bot Right Now):

A profit window opens when a swap is profitable. For Market Makers on LEO Pairs right now, they must make more than 10.50% profit for a swap to make money.

For LeoStrategy's MM, we can market make pairs for 50% of the cost of other MMs. This means that another MM needs to wait for LEO Pairs to be 10.50% out of balance to break even while LeoStrategy's MM can market make that same route when it is 5.25% out of balance.

As our Market Maker improves, the LeoBridging fees should come down (as the Bridges won't be losing economic value to draining MMs). This will allow LeoStrategy to get even more efficient and make LEO Cross-Chain pairs more accessible. More accessible = more trading volume = more arbitrage windows.

LSTR & SURGE cross-chain bridges are built using nearly identical technology to what the LEO Team used for LEO Cross-Chain Bridges.

These LSTR & SURGE pairs on Base will be market made using the same dynamics as the LEO Cross-Chain Pairs: LeoStrategy's MM will pay a signficantly cheaper fee than other arb bots when bridging. This gives us a unique advantage to market make cross-chain pairs and have a moat around it forever.

This should give you a lens at the future of LeoStrategy: our vision is to create a wide-ranging suite of derivatives based on the LEO Economy on multiple blockchains. These derivatives all require market making and give varying risk profiles and volatility metrics. As we market make the derivatives with a moat, we are able to continually scale our profits. The profits are used to buy more LEO and scale our balance sheet. The scaling balance sheet leads to larger markets (since we can scale existing + launch new derivatives).

At a tiny scale and with only LEO Cross-Chain pairs, we are already nearly covering the SURGE dividend yield just from market making. As this scales, it will create an economic river of capital that flows to LeoStrategy's balance sheet to not only fund dividends but also fund new derivatives which exponentially increases market making profits and creates a reflexive loop to grow LeoStrategy's Balance Sheet and therefore; LSTR's value.

Base Bridge & LeoDex Inflows

The Base Bridges for LSTR & SURGE have a fee attached to them. This fee is likely to be something like 1.5-2.5% per bridge TX. This bridging fee is absorbed by the LeoStrategy balance sheet and can either be used to: 1. Fund dividends for SURGE 2. Swap to LEO and add more LEO to our balance sheet (which leads to balance sheet expansion -> more products/service -> more derivatives to market make -> more profits -> more LSTR price appreciation -> more capital raises to fund more dividends)

It is irrelevant how we use the Bridge Inflows as the end result is the same: more capital is available to fund SURGE dividends either directly or indirectly through new products/services/tools made possibly by an ever-expanding LeoStrategy Balance Sheet.

LeoDex Inflows come to us from our sLEO stake. If LeoDex makes $1,000 USDC per day and LeoStrategy owns 1/3rd of all sLEO staked on LeoDex, then we will earn $333 USDC per day. Right now, LeoDex consistently makes between $100-$500 USDC per day and this figure continues to grow. LeoStrategy's portion of the sLEO stake is likely to be 1/3rd and grow over time as well.

The use case for these USDC inflows by LeoStrategy (similar to MM Profits / Bridge Fees): 1. Swap to LEO and expand our balance sheet 2. Pay SURGE Dividends directly

The goal will be to use the majority of inflows by LeoStrategy (whether its MM Profits, Bridge Fees or USDC from LeoDex) to scale our balance sheet. In a bad scenario, we need to do #2 (use inflows to pay SURGE yield directly).

Our economic models show that we can continually scale our balance sheet with inflows and utilize that scaling balance sheet to raise additional capital to pay dividends + acquire more LEO simultaneously. The flywheel effect of using inflows to scale our balance sheet will more than cover the dividends; it will allow us to continuously and relentlessly acquire more LEO over time.

Since we are a permanent buyer of LEO and the LEO token is a scarce asset, the LEO Price grows over time and that also has an effect of growing the USD value of our balance sheet which inherently leads to more market making potential as the whole USD value of the LEO/LSTR/SURGE ecosystem grows.

4. ATM Issuance

ATM issuance is how MicroStrategy funds the dividends on their $6 Billion (yes, with a B) stack of Preferred issuances: 1. STRK 2. STRC 3. STRD 4. STRF

MicroStrategy issues their common stock (MSTR) as well as the 4 preferreds "At the Market" and sells them to raise additional capital.

This additional capital is used to fund more BTC purchases (like the $22.1M BTC buy they did yesterday) and also used to pay dividends on STRK, STRC, STRD and STRF.

While LeoStrategy has the capability to do these same ATM issuances; we prioritize fueling the LSTR/SURGE flywheel by launching profitable products/services/tools that generate profits that are then used to purchase LEO. Expanding our balance sheet and creating more revenue and capital generation than is needed from ATM issuances.

LeoStrategy is unique compared to Microstrategy for a number of reasons. Probably the largest is that we have almost no overhead. This means that $1 in profit for LeoStrategy is $1 added to the bottom line.

For Microstrategy, they could build their software business and generate $10M per month and probably still lose money or break even at best. Why? Because they have rampant overhead, a lot of staff, etc.

LeoStrategy is uniquely positioned because of its size and the fact that we are fully onchain and using bleeding edge blockchain technology / automation to focus on profitable enterprises with low-to-no overhead.

ATM issuances of existing assets (LSTR and SURGE) is always a possibility for us. It is important for us to keep this option open. However, unlike Microstrategy; it is not the first option for us to consider when it comes to raising capital.

As you've seen with LSTR: we have the ability to do ATM issuances but we have done no ATM issuances of LSTR to-date. We have no need to dilute common shares to raise immediate capital as there are better ways for us to generate capital and profits (such as launching SURGE, @lstr.voter, HE Market Makers, Cross-Chain Market Makers, etc.).

Expect a future where LeoStrategy is able to generate incredibly accretive capital without tapping the LSTR ATM.. but the option always remains on the table, if needed.

Optionality for a treasury company is the key. You can listen to interviews of Michael Saylor where he discusses this idea.

LeoStrategy has immensely more optionality than a company like Microstrategy. We have far more flexibility and far less overhead.

The Math

Right now, 69% of the SURGE presale is sold out. This means that HODLers own 345,557.615 SURGE.

The per year dividend obligations on this SURGE are $51,833.64.

The per week dividend obligations on this SURGE is $996.80.

The 6 month initial runway of SURGE dividends is secured which means we have 6 months to get the profit centers generating more than $1000 per week to fund the SURGE dividends.

Profitable Inflows:

1. Permanent Capital Vehicle -> LSTR is growing at ~8% per week in terms of LPS. This economic value as LEO's price climbs will create hundreds of thousands of dollars in value in the near-term and tens of millions of dollars in value over long timeframes. Run the math simply: if LEO's price 2x's to $0.26 from here and LeoStrategy has 3M LEO (what we own today, not including our 30k-60k+ daily purchases); then our fund grows by 3M * $0.13 = $390,000 in value. This additional value will be directly accretive to LSTR holders and represents 7.5 years worth of SURGE dividend obligations

2. Market Maker Profits -> the HE and Cross-Chain (LEO) Market Makers are LIVE and generating ~$100 per day in profits already. These are still in the early stages of tweaking and will only get more efficient and effective. They represent $36,500 in yearly inflows at the infant stage they are today. This is also WITHOUT the LSTR/SURGE cross-chain pairs which are yet to be released on Base. $36,500 = 70% of the current SURGE dividend obligations. As MM operations grow, we expect this to be hyper profitable and lead to massive balance sheet expansion (prioritizing LEO buys on our balance sheet) which will lead to more products/services/derivatives which leads to more MM profits

3. Base Bridge & LeoDex Inflows -> Base Bridges for LSTR & SURGE will generate 1.5-2.5% fees on every Bridge TX that happens. These fees can be used to either fund more LEO purchases or fund SURGE dividends. We suspect we'll have more than enough capital from other means for SURGE dividends so we will utilize the inflows to fund more LEO Purchases and expand our balance sheet which will lead to more products/services/derivatives which leads to more MM profits

4. ATM Issuances -> MicroStrategy funds all of their dividend obligations through ATM issuances. We believe ATM issuances should be the method of last resort when it comes to funding dividend obligations. It is far more valuable to utilize ATM issuances (if you do any at all) for immediate accretion to common shareholders (holders of LSTR in our example). Immediate accretion simply means doing ATM issuances to grow LEO Per Share (LPS) as opposed to pay obligations. To-date, we have done 0 ATM issuances though the LSTR market Cap = $550,000 USD and the SURGE Market Cap = $500,000 USD (once the presale sells out). This is over $1,050,000 USD that could potentially be leveraged for ATM Issuances in the same manner as MSTR. Again, prioritizing the other inflows above and beyond this is our unique Strategy. We focus on economic inflows and drive more and more accretion to LSTR = fuel the flywheel

The Purpose of This Post:

SURGE yield isn’t magic—it’s math. Weekly dividends are backed by a blend of profit engines: LSTR’s permanent capital vehicle, LeoDex USDC fee share, cross-chain market making, bridge inflows, and optional ATM issuances. A 6-month onchain runway guarantees payouts while these engines scale. The result: a sustainable, floor-protected preferred share with upside exposure to LSTR’s growth.

We wrote this post as a document that anyone can reference back to when they try to determine where SURGE yield comes from. Please feel free to share this / run it through AI for quick summaries on how SURGE Yield Works.

Posted Using INLEO