Endgame ahead - That's where we are now. We've gone from the days of fantasizing back in 2017 and the years that followed, up to realistic scenarios of how things will probably really play out. Which we can see in the way that some of the most powerful people have already been getting involved and playing the Bitcoin game.

Instead of an extremely small country like El Salvador and a small company like MicroStrategy four years ago - which was somewhat like a sensation back then - we now have the most famous politician ever and the biggest asset manager ever on board. And in fact both of them previously had a completely different and opposing position, which has now changed after they realized being wrong. The incentives have changed and suddenly the world has become a different one.

x.com/TheBTCTherapist

x.com/TheBTCTherapist

ETFs on the one hand, and Donald Trump's presidency on the other, represent the final catalyst and key element that will finally set the whole thing on a path that can no longer be reversed.

With just under a month until election I want to provide reasons to vote for Trump. The insights gained are important for this election and there is still some stuff to consider after his appearance at the Nashville Bitcoin conference a few months ago. Not only that - he has also almost been shot down twice in the meantime, got supported extremely strongly by Elon Musk as well as by the two ex-Democrats Tulsi Gabbard and Bobby Kennedy Jr, who even gave up his own candidacy for this and who was a pro-Bitcoin candidate much earlier, but one who had no chance - Trump now on the other side has a good chance to become the first pro-Bitcoin-President in history and I think everyone who has the chance should help make that happen. The story appears to be very exciting to follow and it feels like the most important election in history.

From all of Trump's statements so far and all the information I have gathered about Bitcoin and the monetary system, we can derive an overall picture for the upcoming final and how it will be going with the money in the world. That doesn't necessarily mean Trump will manage to do so - we can't know that yet - it's more about the context in which his positions as president and those of the Republicans should be viewed.

What will we do now in this piece? * Putting several of Trumps statements into context (where does this come from and where is it going?) * highlight the role of stablecoins and Bitcoin for America's and the Dollars supremacy * finally looking at the connection of Trump and Bitcoin with freedom and democracy values

In the speech at the conference in Nashville, Trump was the first president ever to actually address every conceivable important point when it comes to "Bitcoin and Crypto" - in a way that fits in with his political plans and positions same as the role of his nation - and also fitting into his usual style of speech. Which makes it actually quite authentic.

Maybe you can't do much during four years of office, but you can become a key element in the great chain of events that has been playing out here for 15 years. When it comes to actual nation state strategic Bitcoin reserves, it will probably take someone innovative enough to start the process somewhere in the world. After that, other leaders can get on with it. Trump will probably be essential for this. One El Präsidente Bukele of El Salvador is not enough.

The “Crypto”-President

Well I must say it is a little weird but I am still glad it is not the “Blochchain”-President.

„I will ensure that the future of crypto and the future of Bitcoin will be made in the USA.“

However, it could hardly have gone better. No one would have been better suited for finally bringing Bitcoin into global stage - this guy is somehow the best politician ever. I mean in terms of how he has staged himself in public and literally turned himself into a meme and an icon, and probably the most known and polarizing person on the planet. There's hardly anyone else who can do this in such a fascinating and impressive way. It would take ages for someone to do something like this again. A lot of effort is put into the marketing of political actors in America and over there you play on a completely different level. We in Germany are nothing like that and we can just watch and try to encourage you to get this guy into office while our own fake news mainstream media acts as a contraindicator for the fact of him being the best choice.

https://www.youtube.com/watch?v=diniBC70rdI

You also have to keep in mind that some of the statements Trump makes are simply exaggerated or his typical style of rhetoric, staging and humor. Which is essential for such an outstanding candidate. I think that's what you get when a democracy moves into the digital age and it's really fascinating. Critics and Bitcoin fans, who have never seen a speech by this guy, of course don't understand this and have their problems with it, especially since they are skeptical of all politicians in general. That makes it even more complicated to interpret some of his statements he made regarding to Bitcoin and "Crypto" - most of which he spoke out at the conference in Nashville:

- make the USA energy-dominant and become a Bitcoin mining superpower

- the national debt may one day be settled with a crypto check

- do not sell any BTC, but keep it as a strategic reserve

- banning CBDC

- protect self custody rights

- Promote stablecoins and spread the US dollar

- have fun with your bitcoins, your cryptos and everything else you play with

https://youtube.com/watch?v=1HHQPD-Lb5o

What seems good to me is he talks the way you know from him, with his personal touch and his humor. That gives the whole thing credibility. But even more important is how the several addressed topics would actually fit into his politics or the politics of his fellow members. And that's what we want to look at.

The thing that fits most with Trump's plans, which he announces almost every time he speaks, is his support for the mining industry. Especially as this is already beginning to materialize in the USA. From Germany where you have the dumbest politicians on earth(our foreign minister can’t even speak English properly or generally speak at all) we are far away from that and you can just jealousy watch to the USA - my country seems only to exist that Trump can make fun of our electricity costs and that the whole world can laugh at us for selling our Bitcoin holdings.

„We will be creating so much electricity that you will say please Mr President we don't want any more electricity … we have enough … we will be Energy-Independent and Energy-Dominant … with the lowest energy cost on earth we will be a Bitcoin mining powerhouse … we will be the Bitcoin superpower of the world … I want it to be mined in the US.“

Bitcoin mining fits in perfectly with the support for the energy industry and this was simply picked up and integrated correctly here. There's not much more to say - Bitcoiners knew for years that mining would synergize with energy industrie and now it's finally happening and we're being proven right by former and future presidents. His wish that “All remaining Bitcoin should be mined in the US” is of course in line with his usual over-the-top rhetoric.

The Bitcoin network is slowly but steadily becoming intertwined with the energy and financial industries. Trump is a catalyst for this process, that would happen anyway, but probably much faster and better with him.

„The US government is among the largest holders of Bitcoin … if I am elected it will be the policy of my administration to keep 100% of the Bitcoin the US government currently holds or acquires into the future … this as an effect will serve as the core of a strategic national Bitcoin stockpile.“

The same applies to taking over or retaining existing Bitcoin in government custody. In theory the introduction of these plans should meet with little resistance. This is because nothing will actually change, except that it will be labeled and handled differently from an administrative point of view. The step is too logical for it not to be made. You don't even need to buy new Bitcoin to start the process of a national reserve.

These things are actually pretty obvious, especially since the first state pension funds have already started with Bitcoin diversification and the first states have passed the “right to mine” into law. The regulation that makes this possible will develop best with Trump which should be enough of a reason for Bitcoiners to cast their vote. But let's move on to the stuff that probably not many have thought about so far.

CBDC, Stablecoins and national debt

Trump has also addressed stablecoins and CBDC and let's be honest - when Trump says “crypto”, he primarily means Bitcoin and stablecoins. What he does in terms of NFTs and DeFi will basically be a marketing gag to impress parts of the crypto community or to make money, or of course both at the same time - but this is unlikely to have any real political consequences later on. But policymakers and economists are in fact far more interested in Bitcoin, CBDCs and stablecoins.

„I will never allow the creation of a central bank digital currency.“

„As part of our referent to provide regulatory clarity we will create a framework to enable the safe responsible expansion of stable stablecoins - does anybody know what a stablecoin is? … Allowing us to extend the dominance of the US Dollar to new frontiers all around the world.“

This statement is actually the most important for my overall theory here and I can even imagine that “stable stablecoins” is a reference to unbacked or unstable stablecoins like Terra Luna, whose collapses show that regulations are needed in this area.

„This administration caused the biggest inflation in the history of our country … You understood Inflation better than anybody else - if they just listened to you.“

Bitcoiners and many others don't want CBDC and inflation is part of their main narrative - at the same time there is a 35 trillion dollar “debt problem” - and how to approach all of this at the same time - that's probably not so much about future Bitcoin reserves but about “stablecoins” coming into play and providing a powerful monetary tool.

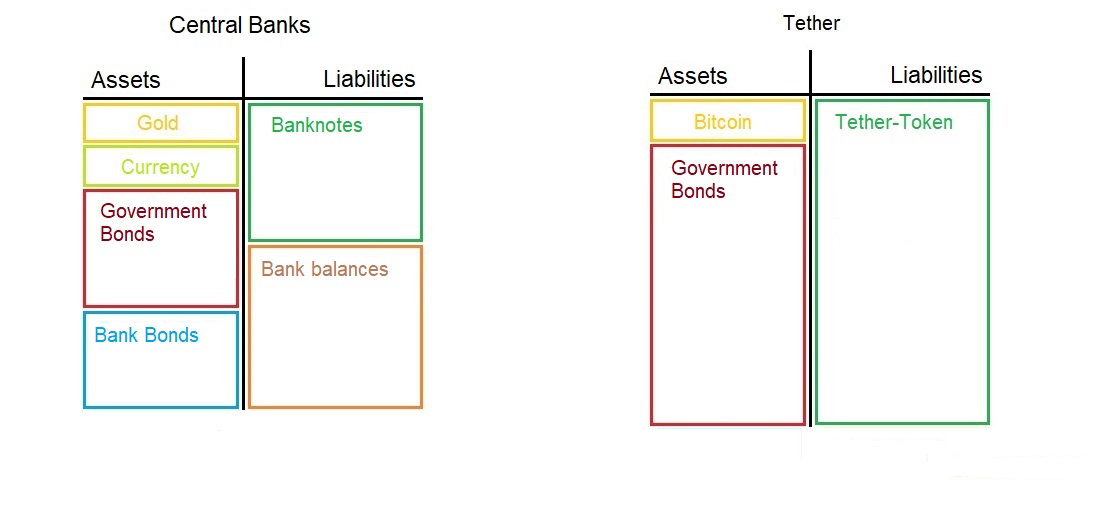

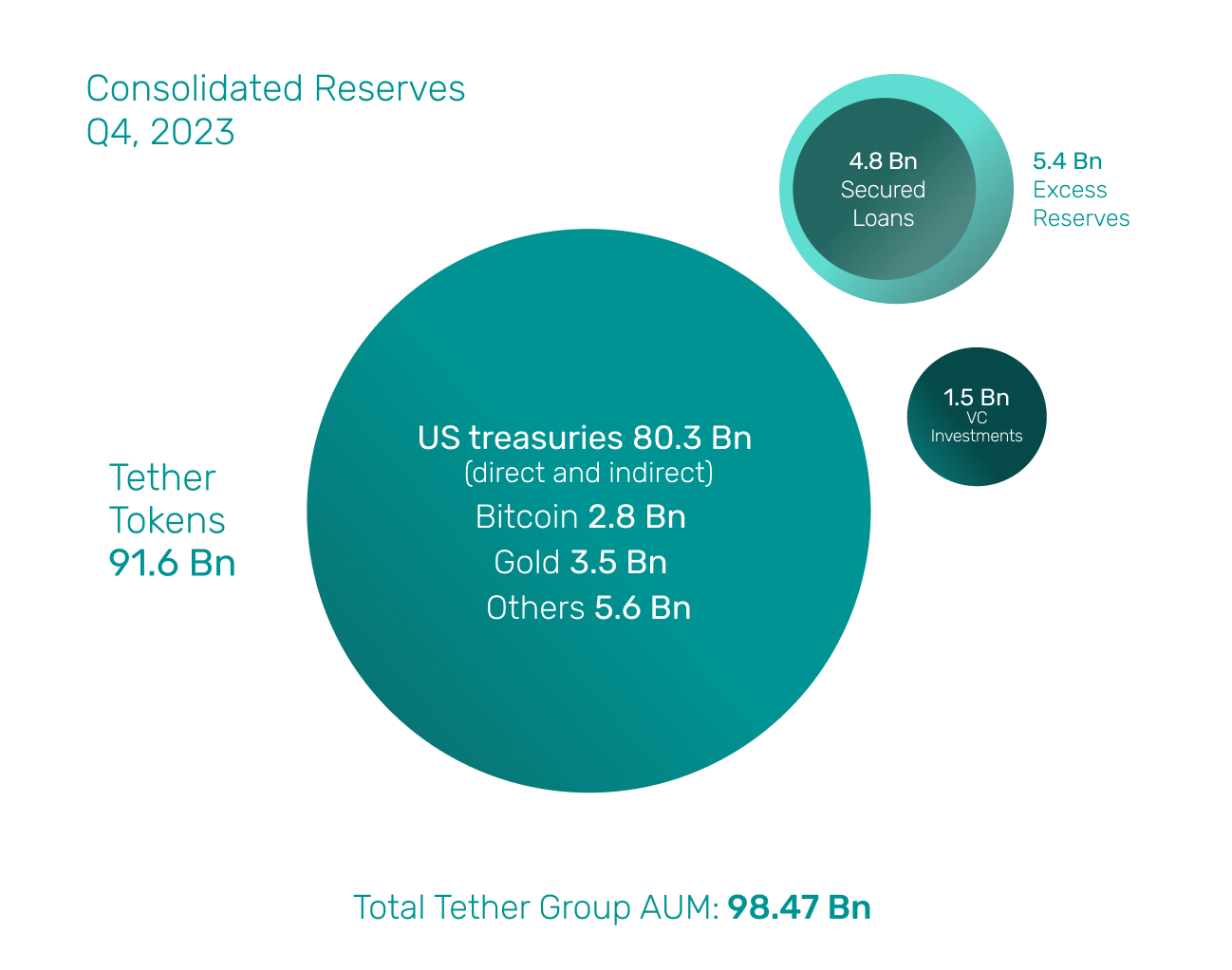

Listening to all this I came to the conclusion that Donald Trump or his advisors and fellow campaigners have probably correctly recognized how “crypto” or stablecoins could create demand for US bonds and at the same time make it easier to spread the dollar across the world keeping up it’s supremacy. For that you don't need a CBDC if you can just let the tech companies take over that task on an international level - because Tether dollars are digital dollars backed by US bonds. Nothing else is central bank money, if we compare the balance sheets of Tether Holdings and a typical central bank:

From Tether's perspective every Tether dollar token issued is a liability, while the government bonds and Bitcoins in Tether's holdings back these liabilities as assets. Just as all banknotes from the printing press are a liability from the perspective of a central bank.

( simplified and not on scale )

( simplified and not on scale )

It almost seems as if we have something like a central bank here, which only issues digital dollar notes backed by US bonds and also holds Bitcoin as a reserve instead of gold. So in some way there is already something like a central bank that has bitcoins in its treasury. Let that sink in - a tech company has simply copied the central bank's business model! This is because there is a demand for digital dollars, but the FED itself does not serve this demand (which they will not be allowed to do!). It is fascinating how far we've already come and how crazy this is!

“Theoretically” you can go to a central bank with banknotes and then get government bonds (or bank bonds or gold) in return. It sounds weird but basically this is how “fiat money” is backed - by itself, by debt. USDT can be seen as a new kind of central bank money - it can do everything a CBDC is supposed to do. Let's call it a CBDC equivalent - digital dollar notes in cyberspace! - So then why should we do the whole thing ourselves again? Let's just get a few more issuers on board to make the Coinbase dollar, the PayPal dollar, the Visa dollar, the BNY Mellon dollar, the JP Morgan dollar, etc. and then we'll just let them distribute the dollar digitally all over the world, internationally, on the Internet, in cyberspace and of course in America itself. As long as they always back it with US treasury bonds, it's a win-win-win situation for America!

„We keep the US-Dollar as the world reserve currency. … We will spread the Dollar across the world and there will be billions and billions of people coming into crypto and storing their savings in Bitcoin.“

I don't know what Trump complainers (like here) expected or how Nashville can be considered disappointing. After all, you can't stand up as president and position yourself against your own currency and the supremacy that comes with it. And that is not even necessary. It would also be foolish to assume that the dollar can be challenged directly. Especially as these two things are completely opposing and complementary forms of money. They can coexist.

It is possible to enter an era in which the US dollar continues to be used as the global currency for several decades and beyond while the US government continues to profit from it, but at the same time Bitcoin (including those in the treasury) continues to steadily and unstoppably gain in liquidity and value.

Amount of circulating USDT in the past 4 years

USD debt in the past 4 years

In Q3 2020, the amount of tether issued was equivalent to 0.05% of US debt. Now it is already 0.35% - why shouldn't this increase in orders of magnitude again? And then add stablecoins from other major financial institutions? This thing could be on its way to becoming a relevant demand driver for government bonds. Somewhat like a CBDC in a roundabout way, which is not a CBDC as such but acts as one in economic terms! Contrary to other dollar equivalents such as book money or the offshore- or euro-dollar, which can be created outside US jurisdiction and do not lead to any direct demand for US bonds. That is why it might be important for the US to spread an alternative across the globe in the form of stablecoins, which it does very well:

- is not an official means of payment and does not fall under any jurisdiction

- Can be used anywhere on several networks and cannot be tied down, requires no authorization by banks and no or almost no fees

- Is not issued by a public institution but rather by a company

- is backed by US bonds and therefore creates demand for them

- Has gained 350 million users in 10 years https://btctimes.com/tether-celebrates-10-years-of-global-success-with-350-million-users/

This gives us something like an offshore CBDC equivalent, which can be used off-shore and in the digital space or basically anywhere, but which leads to relevant demand for US bonds. Financial institutions could be legitimized to issue stablecoins instead of the FED creating a CBDC and so the originally intended CBDC would be there in the guise of stablecoins and at the same time the business model of the banks would be saved, which would be attacked by an actual real CBDC from the central bank. The various banks that issue stablecoins also ensure a certain level of decentralization.

https://x.com/woonomic/status/1836940977124335966

Looking at the massive profits that Tether is generating, it can only be expected that this business model will be copied and adopted by other fintechs and major financial institutions. Tether with 50 employees makes more profit than Blackrock! Demand is obviously there. In addition, a CBDC ban is already reality in several states and in the Republican platform. Tether has struggled with a lot of FUD for a long time and had to find its way through these problems - others will easily follow - similar to Grayscale with Bitcoin-ETFs as soon as Blackrock got involved. As soon as a pioneer from the new world gets a powerful imitator from the old world, a critical milestone is set.

The first attempt was Facebook Libra.

A huge consortium of companies can't manage to launch a stablecoin backed by a mixed basket of currencies, but a small tech company with 50 employees manages to steadily grow a stablecoin backed by US government bonds?

I think the strong resistance at the time back then also had to do with the fact that a basket of different currencies was intendet to be used to back Libra/Diem. The ladies and gentlemen from the government are probably more in favor of a solution that involves full backing by US bonds. A major US bank will certainly face less resistance if they implement something like this and imitate Tethers business model.

Both Bitcoin and the non-CBDC-but-stablecoin-dollarization aimed by Trump can evolve hand in hand - through the spread of USDT and perhaps other stablecoins, the money multiplier (here the ratio of government debt to total money supply) could decrease - USDT acts like cash in circulation and theoretically can be attributed to M1 - a higher demand for central bank money or for government bonds is necessary to maintain the same M2 or M3 money supply. It means the monetary base is used more directly, instead of first being sent into the banking system where it enables the creation of more credit money (just like when physical dollar bills are used directly as such, instead of digital M2 credit money from the banking system) - therefore more government spending could be made with lower resulting M2 and M3 and therefore causing lower inflation, which can be “corrected” again anyway by fake / adjusted consumer price index data - in other words, it would be easier to continue as usual and as always with money printing and government spending.

So from that view the theory is that with the help of stablecoins all will continue as it is! You don't want a crash, you don't want a recession, you want everything to continue to run smoothly while keeping the reserve currency. With money printing and slowly rising debt!

https://www.youtube.com/watch?v=rDXdrYE41iY

Furthermore, this means the best thing a country can do is to acquire bitcoins and then continue to push the price drivers of bitcoin itself (i.e. print money) and ensure that this simultaneously generates as much demand as possible for treasury bonds. And you can do this best if

- you already have bi