Trump’s Wealth Skyrockets From Crypto

President Donald Trump once laughed off Cryptocurrency and even may have referenced Bitcoin as a scam. While many condemned cryptocurrency back then you can kind of let it slide.

But the latest financial information being published shows Trump has made a hefty win from Cryptocurrency. In 2025, the Trump family’s net worth has ballooned on the back of cryptocurrency with estimates showing billions in new wealth tied directly to digital assets. Trump is definitely one of the sectors biggest winners!

USD 1.3 Billion in a single Week!

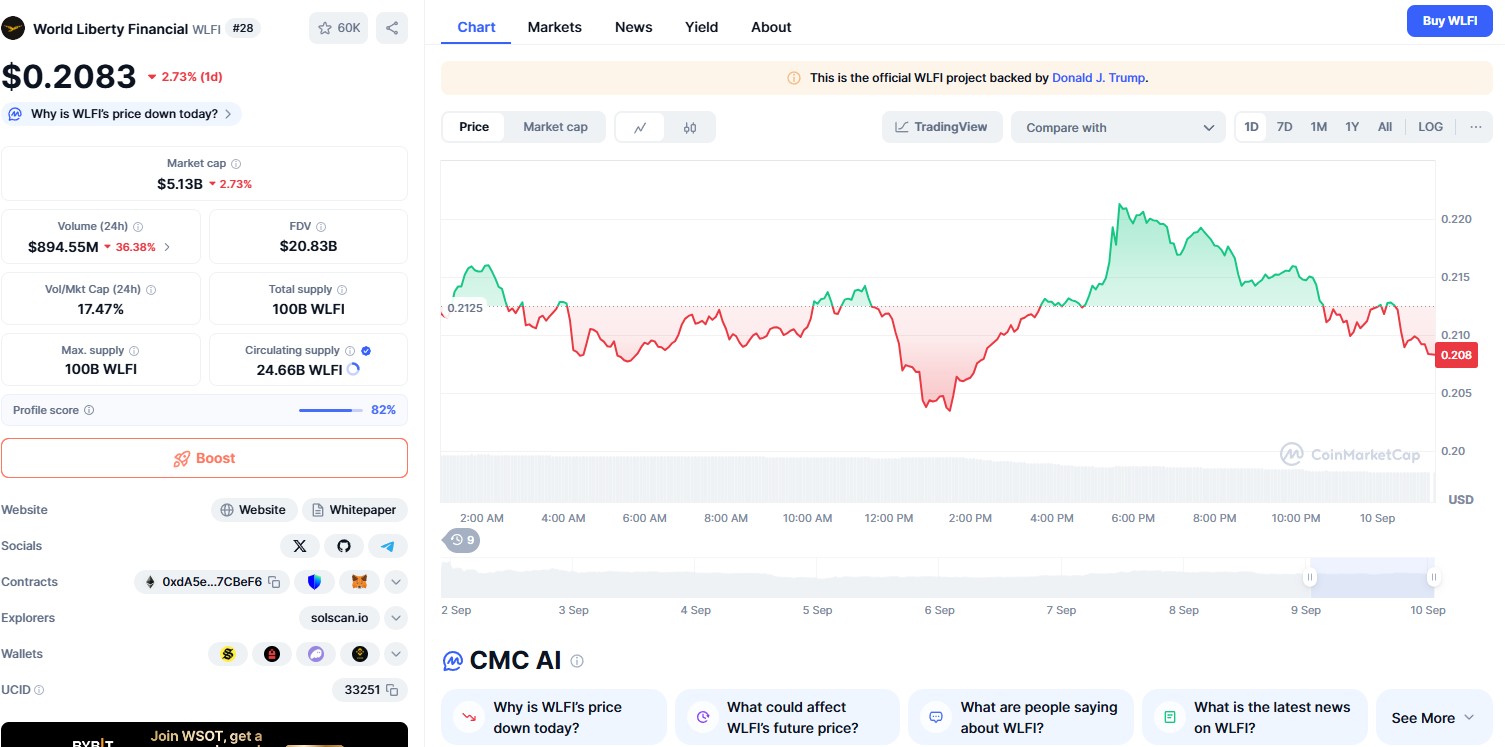

Published by Bloomberg the Trump family’s collective wealth surged by US 1.3 billion (AU 1.97 billion) in early September 2025. This sudden boost came after the public trading debuts of two Trump linked projects: American Bitcoin (ABTC) and World Liberty Financial (WLFI).

With WLFI alone contributed US 670 million (AUD 995 million) to the Trump balance sheet. Eric Trump’s stake in ABTC was valued at more than US 500 million (AU 742 million) when shares briefly touched US 14 (AU 20.76).

Although WLFI’s token has experienced high volatility falling more than 30% since launch and facing complaints from investors about locked tokens. the sheer scale of its rollout has placed it at the centre of the Trump family’s financial growth.

Even after excluding billions in WLFI tokens still under lock-up, the Trump family’s wealth now exceeds USD 7.7 billion (AUD 11.43 billion).

The WLFI Effect: Paper Wealth of USD 5 Billion

The real game changer has been World Liberty Financial (WLFI). Launched in late August WLFI opened trading with the fanfare of a Silicon Valley IPO. At one point the family notched as much as USD 5 billion in paper wealth from the venture.

WLFI rolled out 24.6 billion tokens, with trading volume surpassing USD 1 billion (AUD 1.49 billion) in its first hour. Despite volatility prices dropped over 40% before a token burn was announced WLFI still holds enormous value for the Trump family.

Some have raised concerns with the projects conflict of interest given Trump’s active role in politics and his influence on U.S. regulatory frameworks. For supporters, his direct participation signals newfound legitimacy for crypto in the American mainstream.

Not everything has been smooth sailing. Investors such as Ethereum 2.0 developer Bruno Skvorc and TRON founder Justin Sun have claimed WLFI tokens were frozen, sparking backlash about fairness and transparency. The price swings combined with a lack of clarity on token distribution have also drawn scepticism about the project’s long term sustainability.

But as we can see, Trump is no small time player when it comes to Crypto and it appears that he might be the worlds biggest winner.

image sources provided supplemented by Canva Pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using INLEO