We always hear of the Dollar-Cost Averaging (DCA) method in investing. In short, it means investing a fixed amount of money in a financial instrument at regular intervals, regardless of the asset's price. This is often done with the belief that the investment will yield positive returns in the longer term.

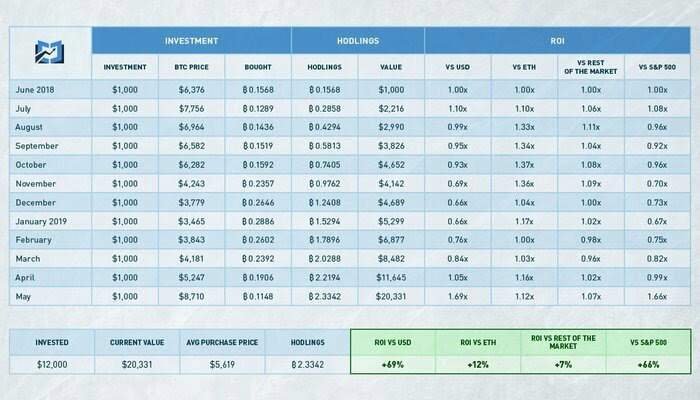

A team of crypto enthusiasts did a hypothetical DCA investment of Bitcoin with $1000 at the end of each month, starting last June 2018, for 12 months. The experiment ended 29th May 2019. Comparisons were made against $ETH, rest of crypto market, and the widely-used benchmark US-S&P500 index.

With the $12,000 total investment, you would have accumulated 2.33 BTC, which is worth around $20,331 at the time of writing. Despite the impressive 69% return, your investment would have been underwater for most of the strategy (8 months), with the ROI dipping all the way to 0.66x at its lowest point. This is not too surprising if we consider that 2018 was a very tough bear market for Bitcoin, and was undoubtedly difficult for people that have opted for a buy and hold strategy with BTC.

Interesting results indeed.

When the equity markets started correcting in late October 2018 - December 2018, $BTC actually performed worse. Was it the crypto winter that had shaken investors' confidence in Bitcoin? Or were investors playing defensive, deciding to remain more liquid in fiat?

The equity markets started rebounding in early January 2019 and returned as much as >25%. This was also around the time that trade talks were initiated. It started off amicably and positively with both presidents of USA and China meeting, smiling for cameras in front of the whole world.

When trade talks started going south, equity markets begin tanking too. This was when $BTC returns started climbing relative to the S&P500 index. It climaxed in May 2019 (1.66x) when both countries started the real tariff war on each other.

Was the interest in $BTC ignited because of fundamentals, institutional involvement, and/or an alternative hedge against uncertainty?

Please feel free leave your comments below. Let's explore the plausible causes for $BTC's rise, and how the cryptocurrency space may evolve going forward.

Full credits to Jon Nielsen on coincodex for the DCA experiment on Bitcoin.

Posted using Partiko Android