What is ybHIVE?

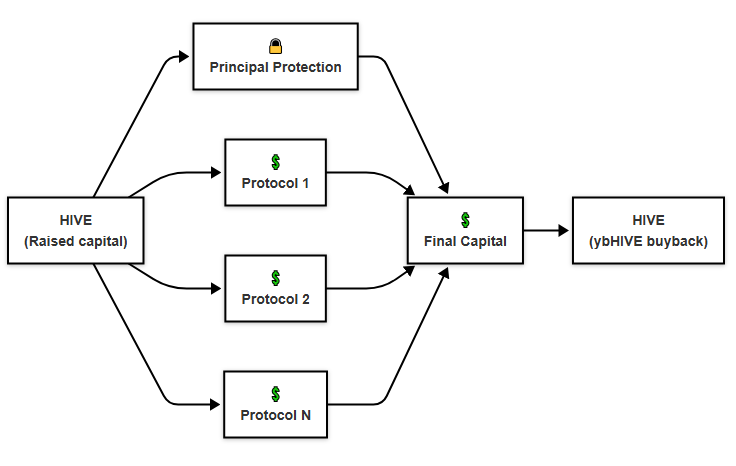

ybHIVE is a yield-bearing token on the Hive Engine. Season 1 raises 40,000 HIVE by selling 1,600 tokens at 25 HIVE each. During the six-month term, capital is deployed into DeFi strategies targeting predictable, fixed or low-volatility returns while preserving the principal value in HIVE. At maturity, the project repurchases (and burns) ybHIVE from investors at the issue price of 25 HIVE plus earned yield, less a 5% performance fee. Early exits incur a tiered exit fee that redistributes back to remaining holders, encouraging long-term investors.

Key information

| Project length | 6 months |

| Issue price | 25 HIVE |

| Tokens circulating | 1,600 (8,000 max) |

| Target | 40,000 HIVE |

| Purchase with | HIVE or major stablecoins |

| Performance fee | 5% of net profit |

| Early-exit fee | Tiered 50–40–30–20–10–10% by 30-day intervals |

| Principal protection | Full hedge to 25 HIVE per token |

| Redemption | Buyback at maturity |

| Trading | Freely tradable on Hive Engine |

| Additional issuance | Possible, at premium |

Token schedule

- Sale period (~7-14 days)

- Operating period (6 months)

- Redemption and burn period (~7-14 days)

Hive Engine trading and new tokens issuance

ybHIVE can be freely tradable on Hive Engine throughout the project time, enabling investors to speculate on token value by trading based on the expected implied yield of the token. Additional tokens may be issued at a premium above 25 HIVE, based on remaining project time, current NAV, and market conditions. Issuance boosts total AUM.

Yield strategies & principal-protection mechanism

- Hedge strategy locks in 25 HIVE issue value

- Fixed-rate lending

- Yield trading

- Basis trading

- Delta-neutral trading

- No exposure to high-volatility meme tokens or highly leveraged strategies

- Redemption price = 25 HIVE + Net profit - Performance fee

Fees

-

Performance fee: 5% of net profit, deducted only at maturity.

-

Early-exit fee:

- Days 1–30: 50% of profit

- Days 31–60: 40%

- Days 61–90: 30%

- Days 91–120: 20%

- Days 121–150: 10%

- Days 151–180: 10%

Exit fees are redistributed to remaining holders, increasing NAV and token value.

Token supply

Circulating: 1,600 Max: 8,000 (in case of additional issuance)

Conclusion

ybHIVE offers a principal-protected way to predictable DeFi yields on Hive Engine, integrating multiple strategies and new form of yield-bearing tokens on Hive Engine. Join the ybHIVE Discord to stay informed. Trade ybHIVE on Hive Engine right now.