The Bitcoin community is once again divided — bulls see more room to grow, while bears insist the peak is already behind us. In his latest commentary, PlanB, creator of the famous Stock-to-Flow (S2F) model, weighed in on the debate, offering a nuanced view that challenges the traditional four-year cycle narrative.

🐻 Bears vs. Bulls: The Battle for $100K

Many bearish analysts argue that Bitcoin’s recent rise to $126,000 marks the cycle’s top. They expect the market to cool off, possibly dipping below $100K as early as 2026 — following what they see as the “natural rhythm” of Bitcoin’s four-year halving cycle.

PlanB strongly disagrees. According to him, this interpretation is a “big misunderstanding.”

“Yes, there is a 4-year halving cycle that doubles the S2F ratio, and 6 months before until 18 months after a halving was very profitable last 3 cycles. But 3 cycles are not enough for a reliable pattern.”

In other words, just because Bitcoin has behaved a certain way in the past three halvings doesn’t mean it will continue to do so forever. Statistical reliability requires far more data — and Bitcoin, being only 16 years old, simply doesn’t have enough historical precedent.

📈 The Role of the Stock-to-Flow Model

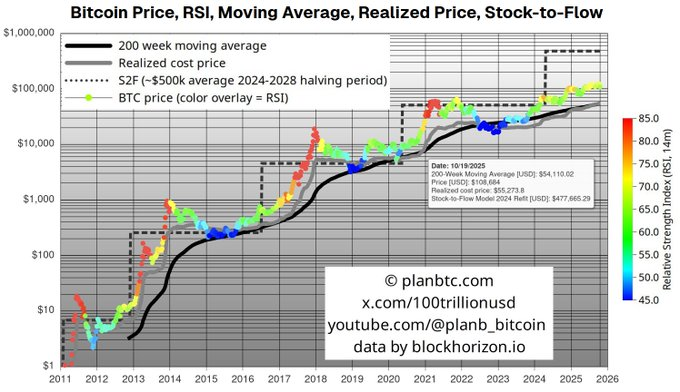

The S2F model, originally inspired by the scarcity dynamics of gold, doesn’t predict exact tops or bottoms. Instead, it estimates the average price level for each halving cycle. The key assumption is that Bitcoin undergoes fundamental “phase transitions” over time — shifts in how the market values scarcity and utility.

“S2F says nothing about tops or bottoms, only about the average price level in a halving cycle, assuming a fundamental phase transition,” PlanB explains.

He adds that no such phase transition has yet occurred in the current cycle. Supporting metrics like the Realized Price and the 200-week moving average (200WMA) have not yet diverged — a behavior historically seen before major bull runs. The RSI has also not reached the overheated zone above 80, another sign that the market has not yet hit euphoric levels.

🧩 Two Scenarios: Both Bullish

According to PlanB, there are two likely outcomes for the current cycle:

The Big Jump Is Still Ahead

Bitcoin could still see a dramatic rally once a new wave of capital enters the market.

Institutional adoption, ETF inflows, and macro liquidity could trigger this phase transition.

A Stable Institutional Era

Bitcoin might be transitioning into a more mature market, driven by institutional portfolios with fixed mandates (e.g., 1–10% BTC allocation).

These funds rebalance automatically — selling during pumps and buying during dumps — creating a stabilizing force that could keep Bitcoin in a more consistent upward channel.

Both scenarios, PlanB notes, are bullish in the long term.

“There cannot be a big bear market without a big jump,” he concludes, emphasizing that the explosive phase typical of previous bull runs has not yet happened.

🔮 Looking Ahead: 2026–2028

If PlanB’s interpretation holds true, the top of this cycle might not arrive until 2026, 2027, or even 2028. That would challenge the long-held belief that Bitcoin’s behavior strictly follows a four-year rhythm tied to halvings.

In this case, we might be entering an entirely new macro phase — one defined by institutional discipline rather than retail frenzy.

💬 Final Thoughts

PlanB’s latest insights serve as a reminder that Bitcoin is still evolving. Whether the next explosive move comes in 2025 or 2027, the underlying trend remains the same: Bitcoin’s scarcity-driven growth model is intact, and institutional maturity could amplify its long-term resilience.

As the saying goes in crypto:

“Time in the market beats timing the market.”

Patience, it seems, might be the most valuable asset of all.

🧠 Sources

PlanB on X (@100trillionUSD), October 2025 Stock-to-Flow and S2FX Model: planbtc.com

Posted Using INLEO