Travala has released its October 2025 Monthly Report, and despite the turbulent crypto landscape, the travel booking platform continues to show solid fundamentals and consistent growth.

Key Metrics at a Glance

-

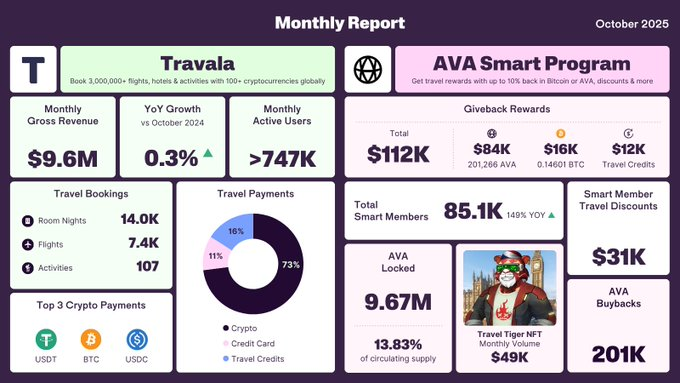

Monthly Gross Revenue: $9.6M

-

Year-over-Year Growth: +0.3% vs. October 2024

-

Monthly Active Users: >747K

-

Total Giveback Rewards: $112K (including $84K in AVA and $16K in BTC)

-

Smart Members: 85.1K (+149% YoY)

-

AVA Locked: 9.67M (13.83% of circulating supply)

Comparing October to Previous Months

After a strong Q3, where Travala saw rising engagement thanks to summer travel and stable crypto prices, October maintained this momentum. While gross revenue of $9.6 million is slightly lower than September’s $9.8 million, the number of monthly active users remained above 747,000, indicating sustained interest despite increasing crypto market volatility.

Notably, Smart Member growth continues to accelerate — up 149% year-over-year, suggesting the platform’s loyalty program remains a key driver for retention and repeat bookings.

Year-over-Year Performance

Compared to October 2024, Travala’s total revenue growth of 0.3% might seem modest, but it’s significant in the broader context:

Bitcoin is currently fluctuating around $107K, testing that level for the fourth time in two weeks.

Broader crypto sentiment remains in “fear” territory due to ongoing market corrections and heavy long liquidations.

Despite this, Travala’s stability in both revenue and user activity suggests that crypto-based travel spending has matured — users are less reactive to short-term market dips.

Shift in Payment Preferences

Travala’s breakdown of travel payments highlights a clear trend:

73% of bookings were paid in crypto,

16% by credit card,

11% with travel credits.

This dominance of crypto usage underscores Travala’s unique position as the leading Web3 travel platform. With over 14,000 room nights and 7,400 flights booked in October, the company continues to blend traditional travel with digital asset adoption.

Smart Member Program and AVA Ecosystem

The AVA Smart Program continues to reward engagement:

$112K in total givebacks — including $84K in AVA and $16K in Bitcoin.

The Travel Tiger NFT community generated a monthly trading volume of $49K, highlighting ongoing collector and investor interest.

Moreover, 9.67 million AVA tokens are locked, representing nearly 14% of the circulating supply — a healthy signal of long-term holder confidence.

Context: Crypto Market in November 2025

As of early November, markets remain volatile. Bitcoin’s repeated tests of the $107K level and over $250 million in long liquidations within hours have spooked short-term traders. However, macro signals are shifting: the U.S. Federal Reserve recently injected $29.4 billion into the banking system via overnight repos, suggesting potential liquidity easing ahead.

This broader financial context could indirectly benefit risk assets like AVA and the Web3 travel sector. If liquidity expands again, Travala might see renewed crypto spending as traders regain confidence.

Conclusion

Travala’s October 2025 report paints a picture of resilience. In a month marked by crypto fear and macroeconomic uncertainty, the platform managed to maintain solid revenues, expand its Smart Member base, and keep crypto payments as the dominant booking method.

With over $2 billion in total travel bookings since inception and a growing AVA ecosystem, Travala remains one of the strongest examples of real-world crypto utility — proving that even in red markets, travel demand doesn’t sleep.