Hello hivers Happy Sunday to you all. Today I wrote about USD/EUR pair, which is also called EUR/USD.

EUR/USD is what I concentrate on, because it is the most traded currency pair in the world that depicts the competition between the US and Eurozone economies. I have observed how they constantly go for a tug of war: when the dollar goes up, the euro comes down, and vice versa. To know this relationship has really been indispensable for me when it comes to trading and shaping my trades.

The USD/EUR pair tells us how many dollars one can get in exchange for a euro. I was not clear in the beginning why a stronger dollar meant a weaker euro. In forex you always buy one currency and at the same time sell another. To buy EUR/USD means you are betting on a stronger euro and a weaker dollar; to sell it expects the opposite. This see saw effect is what the forex market revolves around.

The main reasons for this are the differences in the interest rates between the Federal Reserve (Fed) and the European Central Bank (ECB). In June 2025 for example, the ECB lowered its rate to 2.15% while the Fed stayed at 4.5%, making euro assets less attractive. Investors rush to the dollar and therefore, EUR/USD falls to 1.1348 at the end of May. The higher US rates make the demand for the dollar increase thereby the euro weakens. When the Fed gave the signal for a reduction of 50 basis points in September 2025, the dollar was weakened and the euro went up.

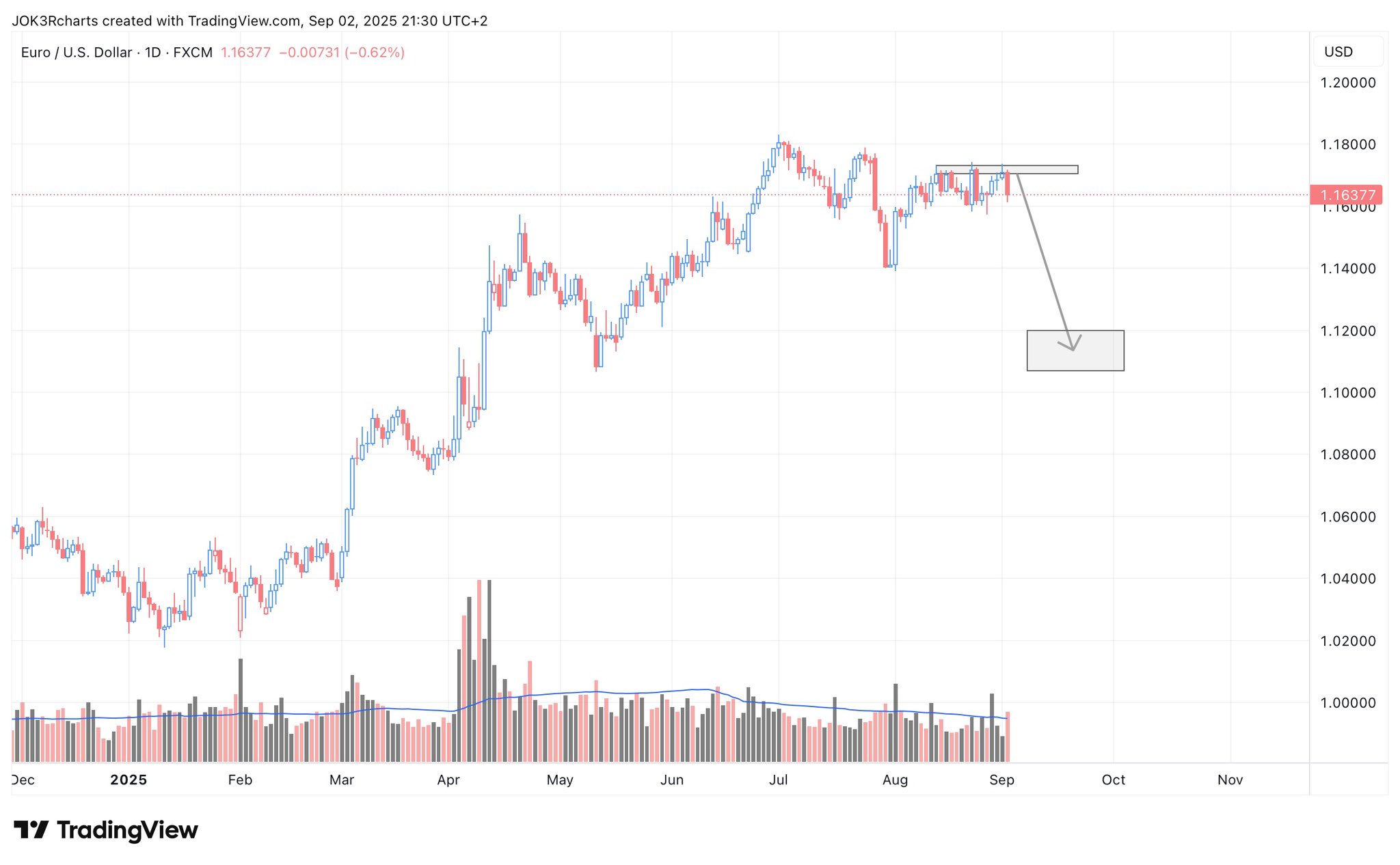

This currency pair is also influenced by economic data. I very closely watch the US Nonfarm Payrolls (NFP). The release of a weak report of only 22K jobs in August 2025 caused the dollar to fall and this in turn moved the EUR/USD to a level higher than 1.1700. The release of strong data such as the creation of 100K jobs or more willpower the dollar, consequently, the euro will struggle. The euro gains in the Eurozone if there is GDP growth or if inflation shoots up, however, it gets weakened with energy crises because the region's heavy reliance on the importation of energy is the reason why the euro is affected by oil prices.

The dollar is a safe harbor in times of geopolitical turmoil and therefore it is difficult for the euro to compete under those conditions. In a scare caused by geopolitics in 2024, the dollar shot up since traders were looking for stability. I keep an eye on the X to know what the market is thinking at the time so I do not get caught by surprise when it suddenly turns.

When one decides to trade USD/EUR in Nigeria, he/she must have determination because he will still have to deal with power outages and expensive data that will test his/her patience. I really like the pair because of its liquidity and tight spreads, but the volatility still needs my patience and discipline. I use stop loss orders during volatile NFP or ECB releases and technical tools such as the Relative Strength Index and pivot points around 1.1640 1.1660 help me to visually identify the trend. I am a young trader and still have a lot to learn but why the dollar and euro move in an opposite direction that is rates, data, and global events really gives me an advantage. In Lagos’ hustle, perseverance is my proof that every trade can be turned from volatility into profit.

Posted Using INLEO