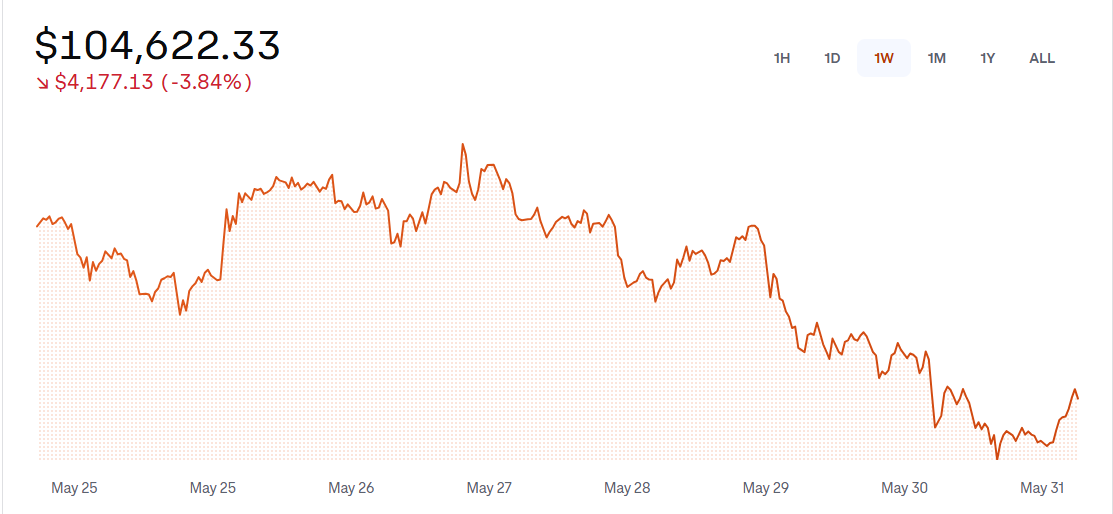

Bitcoin has experienced a pull backduring the past couple of days after its recent bullish mood that witnessed it hit another new ATH of just under $112,000 on the 22nd May. Since then Bitcoin has been in a very buoyant mood hovering around the $107-$110k position until now. Take a look at where we are right now in the chart below.

As you can see very clearly from the graph the picture is a downward movement. Unfortunately Bitcoin is down 4% on the weekly close. Profit grabbing is probably the most likely culprit for the drop in price.

So what does this mean overall and where exactly are we in the cycle? The latest correction has neared $9,000. Even though in the past few hours Bitcoin has made a small recovery, up from $103,500 yesterday, I would imagine a deeper correction whilst not inevitable is likely. Don't be too surprised or disheartened if BTC drops back below $100k.

This shouldn't worry us too much really as the overall context for Bitcoin right now is a positive picture for sure and the bull run sentiment has not evaporated. All the indicators are still looking very solid. I would look at this pullback as a temporary setback and nothing more.

It has been great to see the return of the bull market but we are still going to have to wait longer for Bitcoin to hit that magic $120k threshold if we want to see any chance of an altseason.

Keep those fingers crossed.

Peace!