What is Spark? It's the DeFi engine behind USDS and the modular DeFi protocol enhancing stablecoin utility within the Sky ecosystem. It offers savings, lending, and liquidity infrastructure for USDS and other assets.

We’re entering a new era of open and transparent DeFi, as the protocol drives user-first and truly decentralized finance. That’s what Spark is all about! Not just another DeFi protocol, but a response to the broken, rigged systems of TradFi that were built for the few while the many got left behind.

Spark started in 2023 with a bold vision, and today it stands tall among the top 5 DeFi protocols in the world. With over $8 billion in total value locked, $3.8 billion in loans and borrows, and $186 million distributed as yield.

Spark is already pushing the world closer to a future where finance works for everyone! And now, it’s got a native token... $SPK!

SPK is the lifeblood of the Spark ecosystem. It gives holders a voice in governance and the ability to stake and earn Spark Points. Staking SPK isn't just about rewards — it may eventually help secure the protocol itself.

Here’s the long-term vision! At launch, 10 billion SPK were minted. These tokens will roll out over 10 years, in line with the rules laid out in the Spark Artifact.

Distribution looks like this:

65% to Sky — the community, for SPK farming over time.

23% to the Ecosystem — to fuel innovation and protocol growth.

12% to Contributors — to keep the team aligned and focused on the long game.

It’s worth noting this is a crypto-asset marketing message, and it hasn’t been reviewed by any EU regulator. Still, the mission is clear: Spark is here to rebuild finance — for the many, not the few.

What can you do? Deposit USDS, DAI, or USDC to earn yields via the Sky Savings Rate (SSR). Receive sUSDS tokens, which appreciate over time. Withdraw anytime with zero slippage or fees. Rates are set transparently by Sky governance.

Borrow USDS against assets like ETH, wstETH, rETH, and cbBTC. Enjoy transparent borrowing rates unaffected by utilization, thanks to direct liquidity from Sky. This ensures scalability and capital efficiency.

Spark provides liquidity to DeFi markets, collaborating with protocols like Morpho. This strategy enhances market depth and supports the broader DeFi ecosystem.

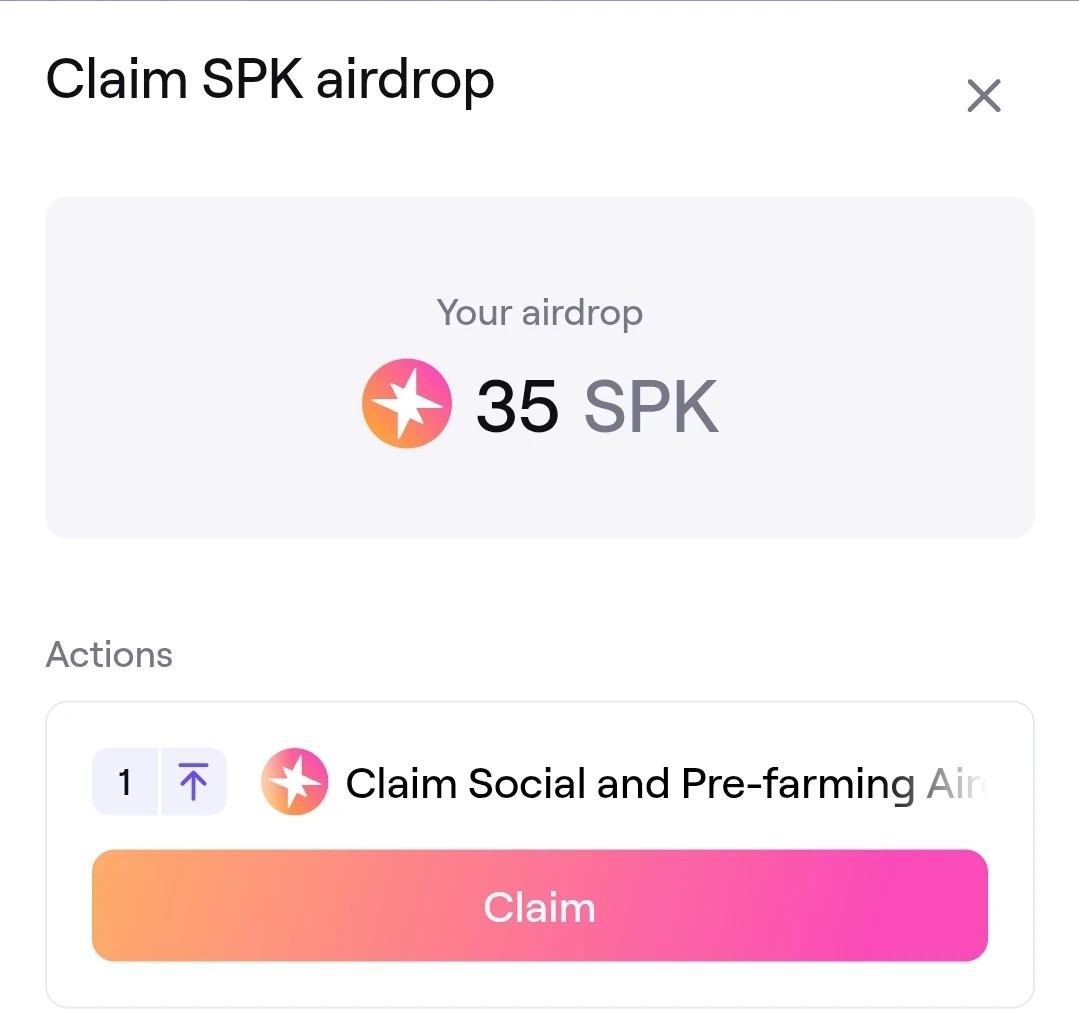

They say $SPK it's your key to it all. But... what I can do with my 35 $SPK I've got? The social and pre-farming airdrop was a joke... not that great for being early! Will I get more from Cookie snapping? Or it's just crumbles?