The UK pensions system is under growing pressure, with millions of people at risk of financial hardship in later life. Recent research has discovered that 25% of defined-contribution pension schemes worth £1.3 trillion are falling behind.

Simultaneously, inflation is gradually eroding the purchasing power of saved funds. Even those who have played by the rules — paying regularly into work-place pensions — are finding that the returns simply do not add up to anything like a decent pension pot!

The government's answer, the so-called "pot for life" reform, which is meant to simplify things. Instead of workers opening a new pension each time they switch jobs, they would have one account throughout their working life.

There is only one minor problem with this idea: while it would reduce some expenditure on admin, it wouldn't address the fundamental problem that Brits simply are not paying enough towards their pensions!

The Hard Stats...

The statistics are stark. The average retirement pot is a mere £107,000, which means a retirement income of around £12,000. This is significantly lower than the level needed to sustain even a modest standard of living in retirement. For context, the Pensions and Lifetime Savings Association estimates that a person will need at least £23,300 a year for a "moderate" retirement.

This gap means that a great many will be subject to poverty, or hardship in later life. It is not a personal issue but social: under-funded pensions place further pressure on state welfare systems, and therefore pose a broader economic challenge.

Meaningless statistic aside....

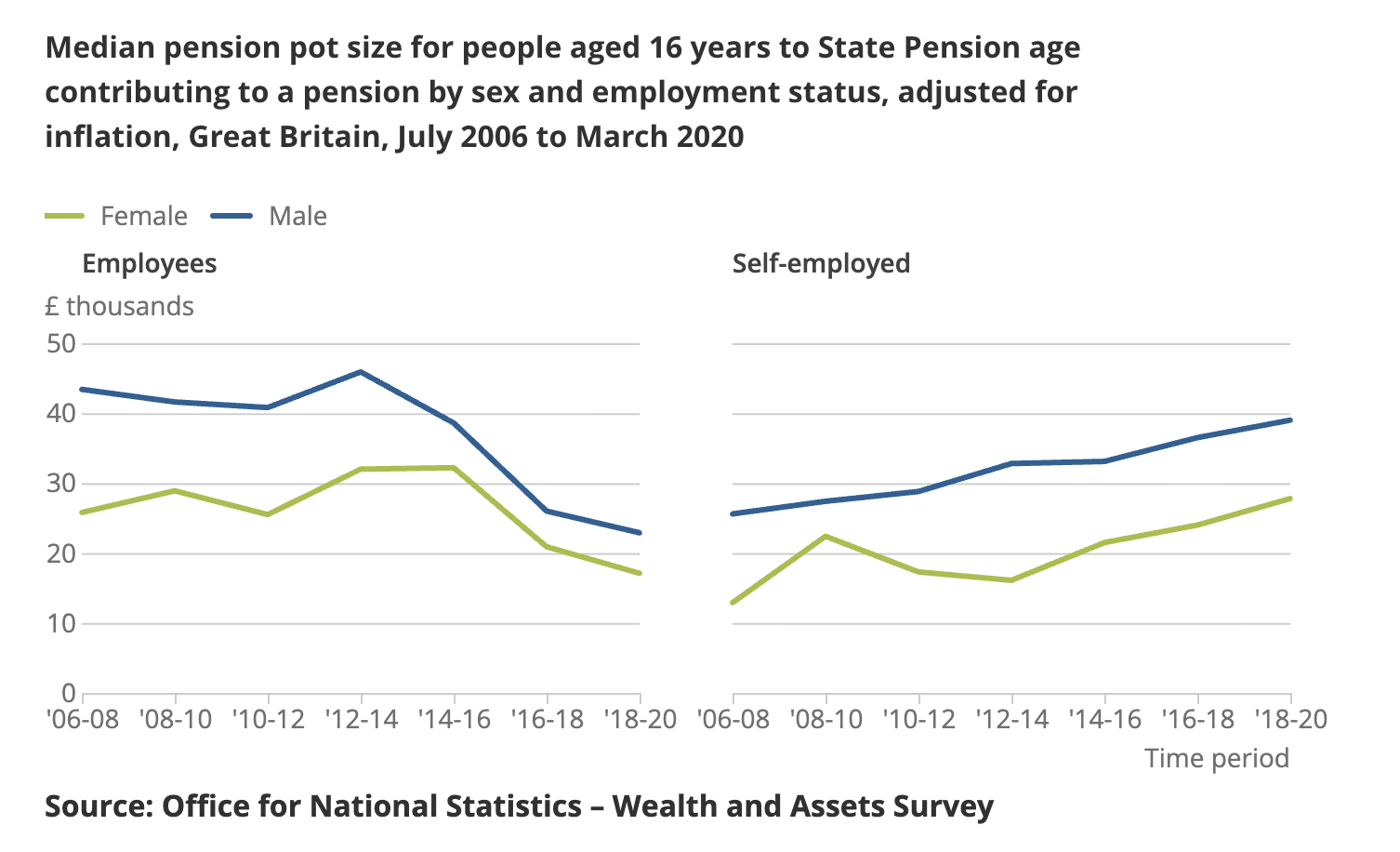

I found this on the ONS pensions' data site, struggling to see the point of it - OFC people in their 20s are going to have very low pension pots compared to people in their 60s.

To my mind we want to know how much the pension pot is for people in the years just before retirement, say 55 and over.

Towards Smarter Pension Investment

Merely exhorting citizens to save is not enough. Workers need to feel confident that their savings are being invested wisely and are giving healthy returns. Numerous pension plans have fallen into a "risk-averse torpor" sitting in cash in low-return government bonds rather than taking a higher-growth bet.

If the UK is to avoid a pensions crisis, funds must be harnessed to drive long-term economic growth, including in infrastructure, green power, and technology investments. This would not only drive returns on investment for savers but also national prosperity.

Final thoughts....

The Pension Time-Bomb is ticking.... and the longer we leave remedial action the harder it's going to blow up in the future, leaving millions of retirees in misery.