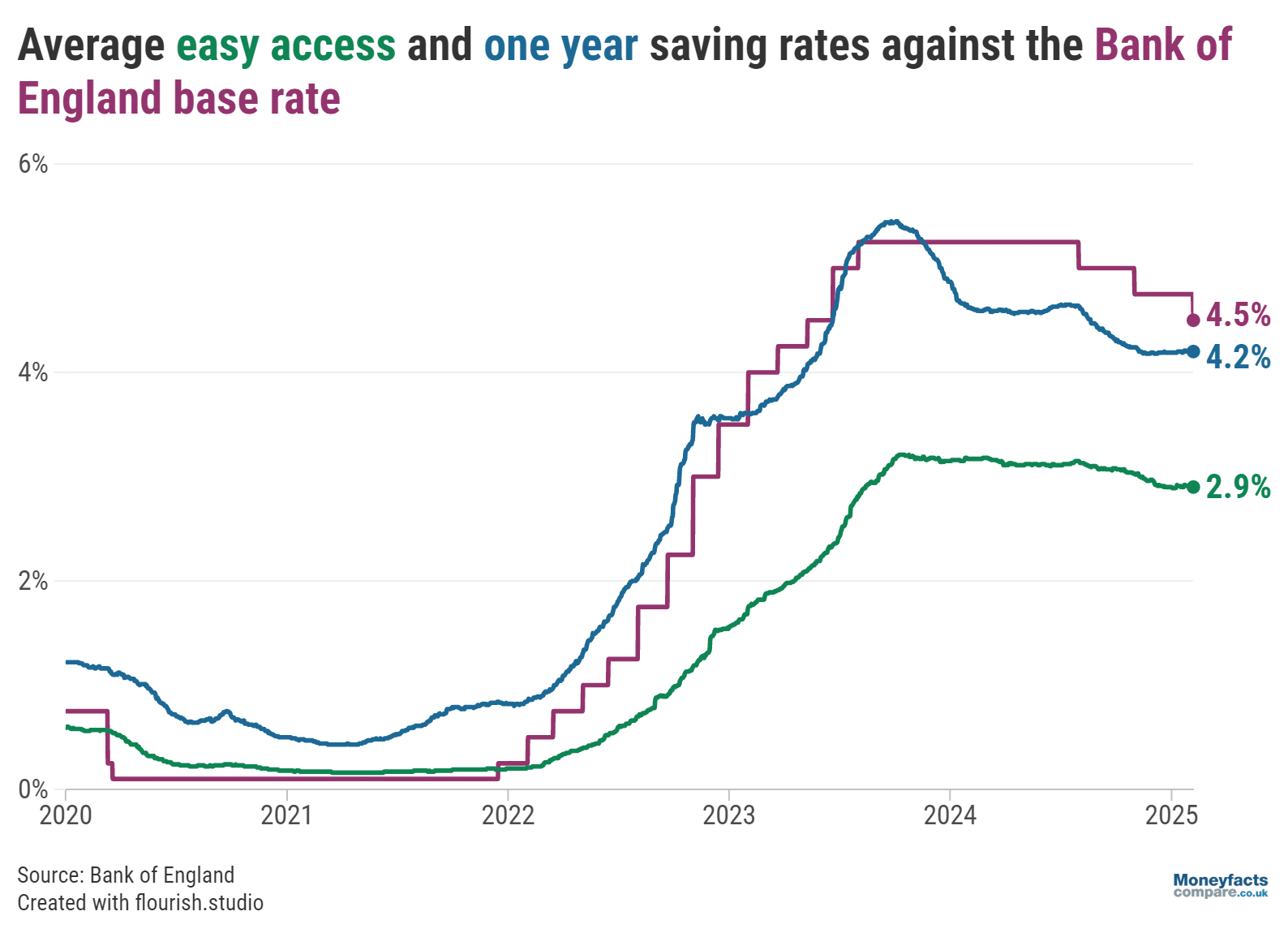

The Monetary Policy Committee of the Bank of England cut interest rates by 0.25% to 4% last month, and some commentators are viewing this as a risky move with inflation well above target, wages still high, and the old mechanisms whereby rate reductions stimulate the economy perhaps no longer effective.

They've done this because they believe UK economic growth is too sluggish, while inflation is steady.

A risky move...?

The UK's target inflation rate is 2%, but it's been floating around 4% for most of the last year, driven mainly by the staples: food and energy.

Wage growth in the UK also remains elevated at 5% which adds to cost pressures for businesses, obviously not helped by the government's recent NI and minimum wage hikes.

So that's two pretty major reasons to NOT decrease the base interest rate as in traditional economic theory lower interest rates increase inflation by boosting spending!

But maybe that correlation doesn't work so much anymore...?

The traditional mechanism by which cheaper policy rates lower mortgage rates and thus boost household consumption is losing steam. Most households are locked into fixed-rate deals; others are not mortgage holders. Thus the magnitude of the short-run consumption boost might thus be limited.

Also, financial market rates (long-term yields) have been rising, hence borrowing is relatively expensive, so a rate cut may not do that much to increase borrowing.

Where this could be heading

One would expect The Bank of England BoE to delay further cuts With the risk of wage, food, supply chain inflation, and long-run interest rates continuing upward. They've little room for manoeuvre...

Possible inflation surprises to the upside from food, energy, global trade tensions, or supply chain breakdown may cause the MPC to fall back or delay reduction.

Final thoughts...

Inflation remains far from under control, but with the economy stuck one gets the rate cut!

It just goes to show that in today's economic climate our economic institutions are running out of options, possibly we're just going to have to suck up higher inflation and higher borrowing costs going forwards...?!?