Hey Hivians

I know this topic is quite controversial, but I already had this idea at the last HIVEfest in Split and would just like to present it and hear YOUR opinions, thoughts, and ideas on this topic and discuss them.

The Idea: Linking HBD Interest Rates to Staked Hive Power

Abstract

This idea outlines an alternative reward structure where HBD interest rates are tied to the amount of Hive Power (HP) staked by an account. The goal is to make Hive Power more valuable as a base layer asset, while ensuring that HBD interest payments contribute directly to Hive’s long-term growth and community wellness.

Background

Currently, HBD savings accounts receive a flat 15% APR. This incentivizes users to hold and save HBD, but it also creates a situation where accounts with large HBD holdings (“lurkers”) can benefit disproportionately without actively contributing to Hive’s growth.

Hive Power, on the other hand, represents commitment to the network. It provides governance rights, curation rewards, and resource credits that strengthen the ecosystem. However, compared to HBD’s fixed APR, Hive Power is often seen as the less attractive staking option for passive holders.

This imbalance can be addressed by linking HBD APR eligibility to staked Hive Power, making Hive Power the base collateral for sustainable interest payouts.

Idea 1: HBD APR Scales with Staked Hive Power

HBD APR increases depending on the amount of Hive Power staked:

- 10,000 HP → 10% HBD APR

- 25,000 HP → 12.5% HBD APR

- 50,000 HP → 15% HBD APR

✅ Pros

- Simple to understand: Higher HP = higher APR, easy for users to calculate.

- Direct incentive to stake HP: Creates upward demand for Hive Power.

- Whales stay aligned: Large HBD holders must also be large HP holders to maximize APR.

- Flexible policy: Thresholds can be adjusted over time with community consensus.

❌ Cons

- Potential barrier for smaller users: Newcomers or small stakers may feel disadvantaged.

- Creates “cliff effects”: Crossing from 24,999 → 25,000 HP has a big jump (12.5% APR), which may feel arbitrary.

- Still allows some free-riding: Someone with just below a threshold can still earn high APR compared to their HP.

- Complex implementation: Requires coding tiered APR logic into savings mechanics.

Idea 2: Interest Cap Based on HP Collateral

Instead of scaling APR, the maximum amount of HBD that earns interest is capped based on staked Hive Power.

- Example:

- If a user earns 7,000 HBD interest (15%), they must have 70,000 HP staked to receive the full interest.

- If they only stake 45,000 HP, they only receive interest on 4,500 HBD worth.

✅ Pros

- Fair scaling: Interest payout always matches HP commitment; no arbitrary jumps.

- Reduces passive farming: Large HBD holders can’t benefit without proportional HP.

- Supports long-term HP growth: The larger the HBD position, the more HP is required.

- Dynamic adjustment: By pegging HP to USD value, this naturally adapts to Hive’s market conditions.

❌ Cons

- More complex for users to track: Requires ongoing ratio checks between HP and HBD.

- Smaller savers may get confused: Understanding why only part of their HBD gets interest could be discouraging.

- Implementation complexity: Requires dynamic calculations based on both HBD and HP balances.

- Potential liquidity effect: Could discourage very large HBD holdings if users don’t want to buy/stake matching HP.

📊 Comparison Table

Let’s assume:

- HBD APR = 15% baseline

- Idea 1 thresholds = 10k HP → 10%, 25k HP → 12.5%, 50k HP → 15%

- Idea 2 = Max HBD earning interest is equal to HP/10 (ratio example: 10 HP backs 1 HBD interest capacity).

| User | HP Staked | HBD in Savings | Idea 1 APR | HBD Interest Earned (Idea 1) | Idea 2 Max Eligible HBD | HBD Interest Earned (Idea 2) |

|---|---|---|---|---|---|---|

| Alice | 5,000 HP | 5,000 HBD | 0% (below 10k) | 0 HBD | 500 HBD @ 15% | 75 HBD |

| Bob | 20,000 HP | 10,000 HBD | 12.5% | 1,250 HBD | 2,000 HBD @ 15% | 300 HBD |

| Carol | 50,000 HP | 25,000 HBD | 15% | 3,750 HBD | 5,000 HBD @ 15% | 750 HBD |

| WhaleX | 200,000 HP | 100,000 HBD | 15% | 15,000 HBD | 20,000 HBD @ 15% | 3,000 HBD |

🛠️ Snippet Ideas for Hive Core Code

Hive is coded in C++ (hived) with reward logic in modules like savings, database.cpp, and hardforks.cpp.

Below are simplified pseudo-snippets showing where the logic could be added:

1. Current Style (Flat APR)

asset calculate_hbd_interest( const account_object& account, const time_point_sec& now ) {

auto delta_time = now - account.last_interest_payment;

if( delta_time <= fc::days(30) ) return asset(0, HBD_SYMBOL);

double apr = get_dynamic_global_properties().get_hbd_interest_rate(); // currently 15%

return account.hbd_balance * apr * (delta_time.to_seconds() / (365.0 * 24 * 3600));

}

Idea 1: Scaling APR by Hive Power

double get_dynamic_hbd_apr( const account_object& account ) {

uint64_t hp = account.get_hive_power();

if( hp >= 50000 ) return 0.15; // 15% APR

else if( hp >= 25000 ) return 0.125;

else if( hp >= 10000 ) return 0.10;

else return 0.0;

}

// Usage:

double apr = get_dynamic_hbd_apr(account);

Idea 2: Cap HBD Eligible for Interest

asset calculate_hbd_interest_capped( const account_object& account, const time_point_sec& now ) {

auto delta_time = now - account.last_interest_payment;

if( delta_time <= fc::days(30) ) return asset(0, HBD_SYMBOL);

double apr = 0.15; // flat rate

double ratio = 0.1; // 10 HP per 1 HBD eligibility

uint64_t max_eligible_hbd = account.get_hive_power() * ratio;

uint64_t effective_hbd = std::min(account.hbd_balance.amount.value, max_eligible_hbd);

return asset(effective_hbd * apr * (delta_time.to_seconds() / (365.0 * 24 * 3600)), HBD_SYMBOL);

}

4. Governance Parameters

// In config.hpp

#define HBD_APR_TIER1_THRESHOLD 10000

#define HBD_APR_TIER2_THRESHOLD 25000

#define HBD_APR_TIER3_THRESHOLD 50000

#define HBD_APR_TIER1_RATE 0.10

#define HBD_APR_TIER2_RATE 0.125

#define HBD_APR_TIER3_RATE 0.15

#define HBD_INTEREST_COLLATERAL_RATIO 0.1 // 10 HP per 1 HBD

This makes both systems tunable by consensus without rewriting core logic each time.

Benefits (Applies to Both Models)

-

Makes Hive Power more attractive. Staking HP is no longer only about curation or governance, but also directly linked to maximizing HBD rewards.

-

Discourages passive HBD farming. Accounts cannot endlessly stack HBD at 15% without contributing back to Hive via HP.

-

Strengthens Hive’s foundation. More staked HP improves governance, decentralization, and ecosystem security.

-

Adjusts with Hive’s health. As HBD supply and Hive’s inflation evolve, the HP requirements reflect the economic wellness of the blockchain.

Tokenomics Simulation (Using Current Hive / HBD Data)

📊 Current Data / Assumptions

| Metric | Value | Source |

|---|---|---|

| Circulating HIVE supply | ~ 487,770,000 HIVE | CoinGecko |

| Circulating HBD supply | ~ 35,000,000 HBD | CoinGecko |

| HBD APR baseline used in simulation | 15% APR | (current flat rate) |

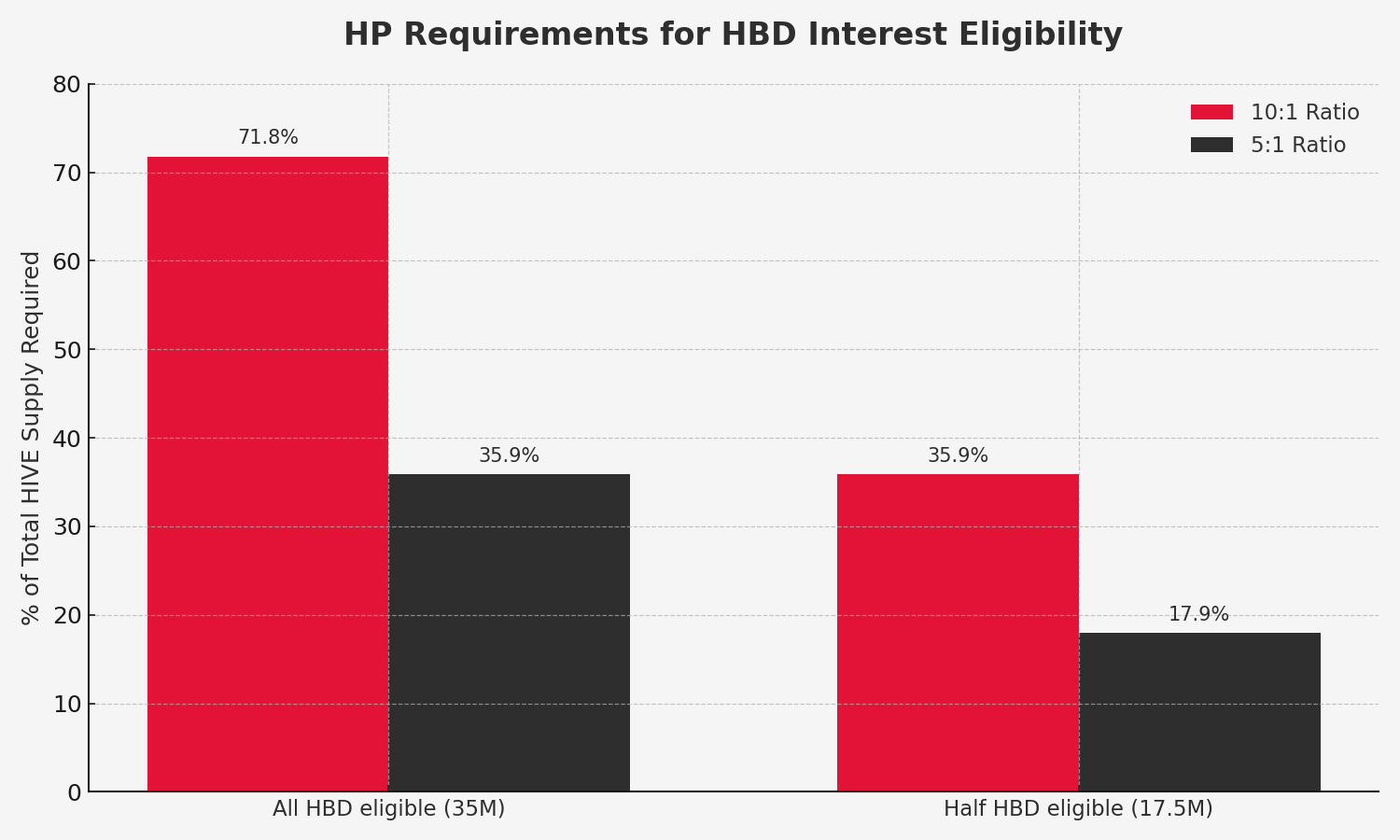

🔍 Idea 2: Required Hive Power Locked (Staked) for Full Interest Eligibility

Rule: 10 HP staked per 1 HBD eligible for interest.

- If all ≈ 35,000,000 HBD in savings are to earn interest fully, required HP staked would be:

35,000,000 HBD × 10 HP/HBD = 350,000,000 HP

- That equals about 350 million HIVE in staked/locked Hive Power.

⚙️ % of Total HIVE Supply Implications

| Scenario | HBD Earning Interest | Required HP Staked (10:1 ratio) | % of Circulating HIVE Supply (~ 487.8M) |

|---|---|---|---|

| All HBD (≈ 35M) earn full interest | 35,000,000 HBD | ≈ 350,000,000 HP | ~ 72% |

| Half of HBD eligible (≈ 17.5M HBD) | 17,500,000 HBD | ≈ 175,000,000 HP | ~ 36% |

💡 Insights & Possible Adjustments

- Requiring ~ 72% of total HIVE to be staked is likely not immediately realistic; many HIVE are liquid, on exchanges, or otherwise not powered up.

- For full interest eligibility today, many users would lack enough HP, meaning large parts of HBD wouldn’t earn APR under this strict ratio.

- To make the model more feasible:

- Lower the HP:HBD ratio (e.g. from 10:1 to 5:1), cutting the required staked HP roughly in half.

- Tiered ratios – e.g. first X million HBD require 5:1, higher amounts require 10:1.

- Phased rollout – start with 5:1 and gradually increase as more HP gets staked over time.

Conclusion

Both ideas tie HBD interest distribution directly to Hive Power staking, ensuring that those who benefit from HBD rewards also strengthen the Hive ecosystem.

Idea 1 (Scaling APR) is easier to understand and implement but risks being less precise.

Idea 2 (HP-Collateralized Cap) is fairer and more balanced but more complex to track and implement.

👉 Discussion Point for the Community:

Should Hive adopt a scaling APR model or an HP-collateralized interest cap?

Both achieve the same end goal—making Hive Power the backbone of HBD rewards—but differ in complexity and fairness. But in general i would love to see where your Pain-Points could be and have the Discussion about it.

all the best, RivazZz