Since posting my introduction on 14 May 2018, my anniversary posts have been an invaluable resource for me (and a reference for a few others?) to quickly get back to any work I have created in the past.

Source: Built on image created by starline on Freepik

For some time now, I have debated whether or not to do this one last time and have obviously elected to go ahead. It takes a lot of work, but ... Worth it in the end!

________________________

Over the years, one of my favorite aspects of engaging on the Hive blockchain was receiving these "milepost" awards from @hivebuzz:

|

|

|

I always get these in August of each year (I actually have a 7-year award), since this is my "official" anniversary. It all began long, long ago, in a land far, far away ...

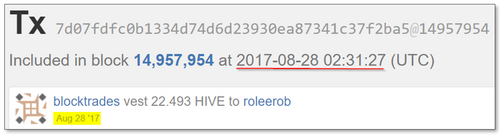

Source: The "Genesis Block" of @roleerob's Steem Hive blockchain "journey"

Here is where it all began. And why, dear reader, you and I ever "met." Hmmm. 22.493 STEEM HIVE ... As all can see, I started out from humble beginnings. If one chooses to go into the blockchain and look, my first transactions were DCA steps into this new "virtual world" ...

________________________

For various reasons, I have not created one of these "index" posts for years 4, 5 and 6. I will take care of that now, putting together a complete picture of what these years looked like, from the point-of-view of my posting. This post will serve as a key reference for me, from now on. And it will always mean a great deal to me, given what it represents.

First Three Years - Looking back ...

Before getting into years 4, 5, and 6, here are quick references to all of the work I put in to years 1, 2, and 3. Each highlights the value I have added to the Hive blockchain.

| Lead Image | Title, Link, & Summary |

|---|---|

|

💥 One Year on the Steem Blockchain! 💥 Part 1 ... I celebrated my 1st anniversary by creating a complete picture of what the year had looked like. I built an index of every post and it has served as an invaluable reference ever since. |

|

💥 One Year on the Steem Blockchain! 💥 Part 2 ... In creating my 1st anniversary post, I managed to break Steem! 😧 I got a dreaded "Exceeds maximum length (65 KB)" error! 😕 So ... Had to break it up. |

|

🎂 💥 Two Years on the Hive Blockchain! 💥 🎂

Pleased with the indexing efforts from my 1st year, I celebrated my 2nd anniversary by again creating an index of every post. Highlights were my "Road to Recovery" trip reflections and the Hive / Steem "breakup." |

|

🎂 💥 Three Years on the Hive Blockchain! 💥 🎂

I celebrated my 3rd anniversary creating an index of every post, with comments. Highlights were returning to my focus on investing and taking a "deeper dive" into Hive's 2nd layer communities. |

________________________

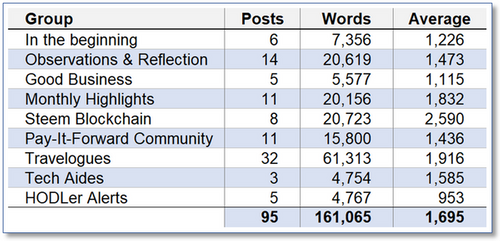

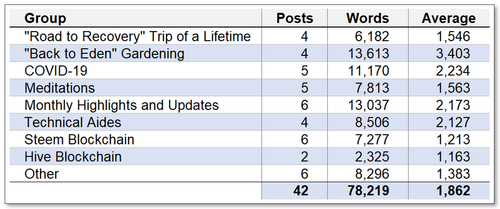

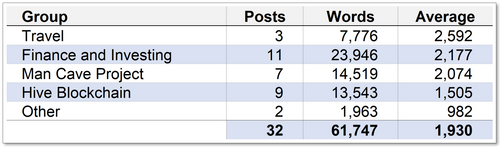

Ever the "numbers guy," at the end of each of these anniversary posts, I put together a brief "Executive Summary" of what I had accomplished.

Executive Summary at the end of my 1st Anniversary post

Executive Summary at the end of my 2nd Anniversary post

Executive Summary at the end of my 3rd Anniversary post

Each year, I commented on these numbers. At the end of my 1st year's experience, I had wanted to write more posts, with fewer words. How did I do?

Well ...

We have to be true to ourselves. The quality of my work has long been more important to me than the quantity, as it has my "name" on it ... By the end of my 3rd year, it turned out my writing on the Hive blockchain was not going to be an exception.

________________________

With that, let's see what I have accomplished since ...

- For ease of viewing any post of interest, you can click on either the image of the post or the URL to the post, in the tables you will find below. The selected post will then open on a separate tab in your browser.

- Each table record contains a brief description of the post referenced. Where applicable, just below the description, you will find a bulleted list of the subsections the post contains.

4th Year

For various reasons, mostly notably dealing with the relentless time constraints from meeting commitments IRL, my writing on the Hive blockchain dropped off, beginning with my 4th year. A decision made easier with my growing disillusionment with how poorly (IMHO) the "big boys" (and girls!) of the Hive blockchain were handling its inherent limitations. Which, in turn, had a direct bearing on the ROI of my investment into it, both time and $$s ...

As can be seen in the following records of my posts, I confined and focused what I did write on investing - both inside and outside the Hive blockchain.

Investing Outside Hive

In the 4th quarter of 2020 and the 1st quarter of 2021, I had made a considerable investment of time and energy into diversifying my crypto asset portfolio. Specifically, by going beyond simply buying and HODLing these assets and, instead, investing a portion of their overall value into the best DeFi (Decentralized Finance) opportunities I could find.

The objective was to put my principal to work in "money making money." Which would ideally result in the preservation of my principal, while providing some yield I could begin to withdraw for achieving some savings goals IRL.

| Lead Image | Title, Link, & Summary |

|---|---|

|

DeFi Income > MIM "out of the cloud" > IRL Transformed! Shifting to less pure HODLing and more investing into DeFi to generate yield was an important "milepost" on my journey through the virtual worlds of crypto. This post talks about the details. ● Life-changing Decision ● Yield and Principal ● Big Picture re: "Fiat" |

|

Introduction: Earn on Gemini Exchange Compared the "wealth management" rates of return in my fiat account to that of a stable coin in Gemini Earn. Leading to "In one day I had earned more than in one year! ● Gemini Earn ● Trust and Security? |

|

Intro: Rabby Wallet in Synch with DeBank Wallets are essential, but I had long groaned under how poorly designed MetaMask UX. Rabby was a transformational product. This tutorial drew a favorable response from the founder of DeBank (Rabby's "parent")!

● Quick Overview ● Executing Transaction ● Deeper Dive ... ● Resources

|

|

Exploring Routes to the new Cronos Blockchain After deciding to invest in Crypto.org's new blockchain and its CRO token offering, wrote this "how-to" post on routing HODLed $$s into it. ● Initial Considerations ● Bridge Options ● Investment Status |

|

Stacks (STX): Surging Layer 2 Token on BTC! What? Wrote a LeoAlpha review of an impressive L2 token on the Bitcoin blockchain, Stacks (STX), and how to stake it to generate a passive income stream. ● BTC Passive Income Stream! |

|

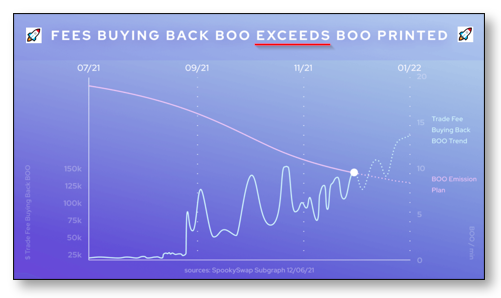

Closer Look: SpookySwap Finance on the Fantom blockchain Finding a deflationary DexFi token on the Fantom blockchain was a discovery worth reporting on, in the search for good passive income stream options. ● SpookySwap Finance |

|

New Year 2022: SpookySwap and Tomb Finance on the Fantom blockchain Reported on SpookySwap's impressive crossing of the $1B TVL threshold and my 1st look at a new value proposition on Fantom called Tomb Finance. ● SpookySwap Finance ● SpookySwap Finance |

|

Intro: 💰> $1,000 💰 Airdrop on New Crescent Network! 🚀 Airdrops are typically over-hyped all but nonevents. Had fun reporting on this notable exception - my Crescent Network (CRE) airdrop! Two thumbs up! 👍 ● Launch of and Airdrop ● Crescent Network's DEX ● DYOR Resources |

|

JUNO "Whale Story" Takes Dark New Turn ... How about two thumbs down?! 👎 Ugly story, reminiscent of what many of us went through with the Hive-Steem drama, about how NOT to do it ... "stealing" $36M, as part of JUNO's airdrop ... ● JUNO Governance ● "Whale Story" and Major "Choke" |

What a "roller coaster ride" some of these early investments proved out to be over time! They definitely reinforced that investing in crypto is not for the ... "faint of heart."

________________________

Investing Inside Hive

Starting with my power down from the Steem blockchain, I made no bigger decision than the one in late June 2020 to go my own way and get away from the "echo chamber" of the main Hive blockchain and focus, instead, on some of its "second layer" communities and tokens.

The following posts were written about one in particular, LeoFinance and its LEO token (which I first wrote about here and here), while steadily building my investment in it up to the "Lion" level (+50,000 LEO):

| Lead Image | Title, Link, & Summary |

|---|---|

|

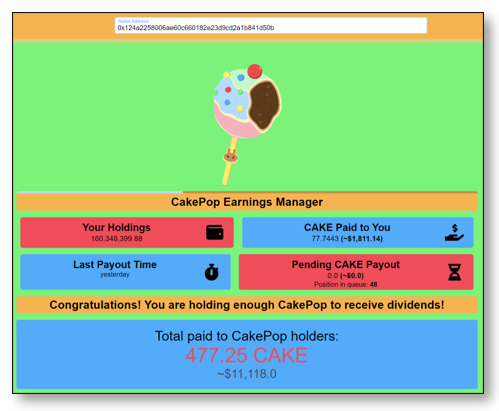

CubFinance's 1st IDO: Are CakePop Payouts "Provably Fair?" As part of my decision to invest in CubFinace, created by LeoFinance, I elected to "do my fair share" in investing in CakePop to "burn CUB and make it more valuable. How did that go? ● Provably Fair? ● Nope! ● Edit on 1 Sept 2021 |

|

"Demographics" of PolyCub's 1st Vote Helping out, at a pivotal moment, I provided a summary and detailed look at the results of 555 Accounts participating in PolyCub's 1st vote. ● Demographic Summary ● Demographic Detail |

|

AskLeo: Airdrop Over => 25,000 PolyCub => Now What? Elected to utilize the community's new AskLeo option to answer a big question toward the end of a very disappointing experience with PolyCub. ● What to do with 25,000 PolyCub? ● Caveat #1 ● Caveat #2 |

As it is pointless to go into any depth and detail here, I will summarize my experience with LeoFinance's PolyCub protocol, closely followed by repeated failures of their bridge, to say it resulted in my completely removing my investment related to LeoFinance, having incurred one of the largest losses of my time investing in crypto.

- "Salt in the wound?" My "forensic investigation" into transaction history showing prominent members of the Leo community saying one thing, while doing something else entirely - all to their benefit (and your expense), of course ...

5th Year

Fresh from the experiences briefly touched on above, I entered this year seriously questioning why I had not acted on the Sell Alert (highlighted here) published by the investment service introducing me to Steem Hive, in the first place.

The communities ... The relationships ... I stayed on, limiting the investment of my time to curating, for the most part ...

<