Trump’s trade war against the rest of the world, but in particular China, contains within it grave dangers for a heavily indebted global economy. In 1930 the US Congress passed the Smoot-Hawley Tariff Act which greatly exacerbated the developing Great Depression through several interconnected mechanisms. We should not forget that the Great Depression was instrumental on putting the world on the path towards World War Two.

Bearing this in mind it’s worth casting our minds back to the last global trade war in the 1930s which exacerbated the Great Depression and which directly led to World War Two. Does it bear any lessons for us today?

Smoot Hawley Tariff Act

Impact on global economy 1930s.

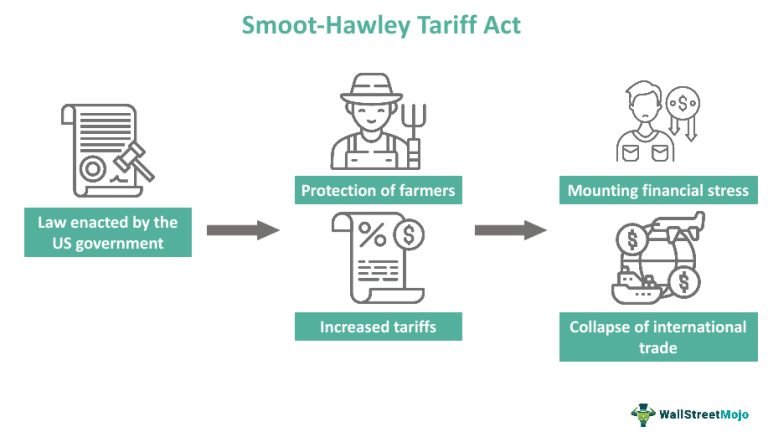

The Smoot-Hawley Tariff Act of 1930 significantly exacerbated the Great Depression through several interconnected mechanisms. It shook the global capitalist system to its core unleashing revolutions, civil wars and wars between nations.

Retaliatory Tariffs and Trade Wars

The Smoot Hawley Tariff Act raised U.S. tariffs on over 20,000 imported goods to protect domestic industries and protect American jobs and farmers.This act provoked other nations such as Canada, Europe and Mexico to retaliate with their own tariffs on American exports. This led to a vicious cycle of protectionism, reducing global trade volumes by as much as 66% between 1929 and 1934.

Decline in International Trade

Following retaliatory tariffs from other nations U.S. exports plummeted, dropping 61% between 1929 and 1933, from $7 billion in 1929 to $2.5 billion by 1932 worsening the Depression. Industries reliant on exports, such as agriculture and manufacturing, faced severe downturns, leading to mass unemployment, catastrophic levels of poverty and economic hardship.

Agricultural Sector Collapse

Despite aiming to protect farmers, the Smoot-Hawley Tariff Act backfired as foreign nations imposed tariffs on U.S. agricultural products.

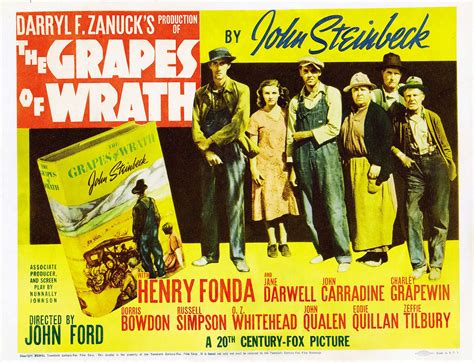

American farmers lost international buyers, leading to surpluses, plummeting prices, and widespread rural poverty. Farm income fell from $10 billion in 1919 to $4.1 billion in 1932, leaving rural America in crisis leading to hundreds of thousands of small farmers going bankrupt and leaving the land.

John Steinbeck’s epic novel The Grapes of Wrath vividly illustrates the devastating impact on rural America.

Banking Collapse

Over 1,350 American banks collapsed in 1930, followed by another 2,293 in 1931. By 1933, over 11,000 banks (40% of the total) had failed. U.S. Bank deposits fell from $49.3 billion in 1929 to $32.3 billion in 1933, wiping out the savings of millions of ordinary people.

Aggravation of Deflation and Unemployment

The reduced trade between the US and other nations deepened deflationary pressures, as overproduction and falling demand led to price drops.

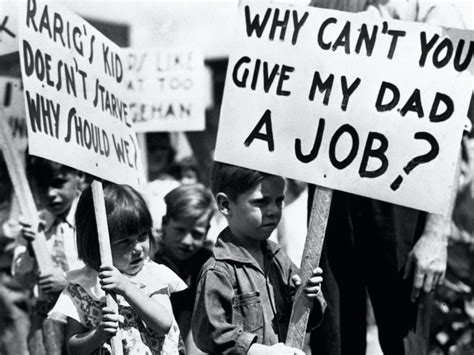

Companies across the board cut wages and jobs, creating a downward spiral of reduced consumer spending and further economic contraction. U.S. unemployment rose from 8% in 1930 to 25% by 1933, while global industrial production dropped by 33% putting millions of workers around the world out of work.

Retaliatory tariffs raised prices for imported goods, burdening US consumers. For example, U.S. farmers faced higher costs for machinery and inputs due to retaliatory tariffs. Real incomes fell for most Americans, exacerbating poverty during the Depression which witnessed massive homelessness and widespread hunger.

Protectionism shielded inefficient industries in America, reducing incentives for innovation. The U.S. textile and agriculture sectors became less competitive long-term. Economic resources were diverted from dynamic sectors of the economy such as the car industry, hindering economic recovery.

Global Economic Fragmentation and Geo-Political Turmoil

The act undermined international economic cooperation, fostering distrust and isolationism.

This fragmentation hindered coordinated responses between nations to the economic crisis, prolonging the Great Depression.

Countries reliant on exports, such as Germany and Latin American nations, faced deepened economic crises, fuelling unemployment and political instability. In Germany unemployment rocketed to over 6 million which played a major factor in the Nazis rise to power in January 1933.

The economic crisis was felt in the geopolitical arena. As the famous German military theorist Von Clausewitz once said;

War is merely the continuation of domestic politics by other means.

The economic crisis led to the emergence of fascist dictatorships in Germany, Spain and Japan - along with military dictatorships across most of Eastern Europe.

These countries sought to increase the profitability of big business by the destruction of the labour movement. Besides this, they embarked on a series of foreign military adventures in a search for foreign markets and raw materials which culminated in the outbreak of World War Two in 1939.

Most modern economists cite the Smoot-Hawley Tariff Act as a warning from history to caution against economic protectionism, emphasizing the interconnectedness of global markets and the value of cooperative trade policies.

While the Smoot-Hawley Tariff was not the sole cause of the Great Depression, it critically worsened the crisis by stifling global trade, inciting retaliation, and undermining economic stability. Its legacy underscores the dangers of protectionism and the importance of international cooperation in economic policy.

The global economy is slowing at a time when it is far less resilient than in 1930 to weather an economic storm. Neil Dutta, head of economic research at Renaissance Macro Research, has noted that global manufacturing is slowing down;

The weak level is notable...The last time we saw a trade-war, [in the 1930s] manufacturing started from a much stronger base with much stronger momentum than it is now. There’s less of an economic buffer this time around.

Following a massive sell off in US treasury bonds the Trump regime has been forced to halt its universal trade tariffs for 90 days. If the sell off in US government bonds had continued at the same rapid pace then the Fed would most likely to have been forced to make an emergency intervention and launch another round of QE bond purchases. As it stands many Wall Street speculators such as Hedge Funds, engaging in arbitrage on U.S. treasury debt, have already taken billions in losses.

Numerous titans/gangsters of Wall Street; from Jamie Dimon, head of JP Morgan the biggest bank in America; to Larry Fink, CEO of the world’s biggest investment fund Black Rock, have talked up the grave dangers posed by Trump’s trade war. Both are warning that the current climate of anxiety and uncertainty is similar to the 2008 Global Financial Crisis when the financial system almost shut down.

Meanwhile look out for Several governors of the U.S. Federal Reserve, the most powerful central bank in the world, who have expressed major concerns that the tariffs will drive up inflation and slow the economy. For despite the 90 day pause in the universal tariffs on 75 nations the U.S. effective tariff rate is 27% which is the highest since 1903.

Whilst it is smart to have a knowledge of history, let’s hope it’s not a case of history repeating itself.