It has been exactly 3 months since my last post related to markets. Market has been flat for quite some time and I got a bit busy in other aspects in life. There have been lots of interesting topics that I could write about, but I guess it would really depend on my mood. Hopefully, I get back to the grind in terms of writing and sharing more insights.

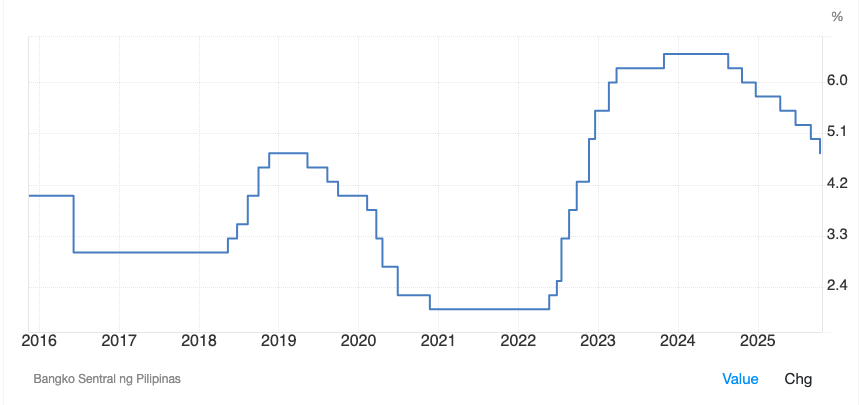

Interest Rates have lowered -- can still continue to lower!

I believe interest rates would continue to be lowered as part of inflationary policy to help boost the economy. Our Central Bank may approach this a bit conservatively in the coming months, but the trend is clear.

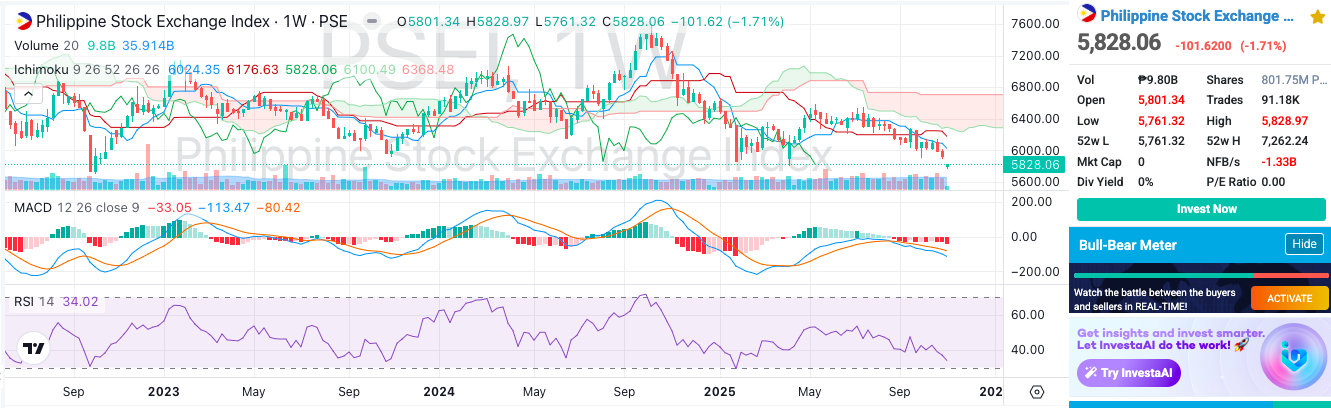

Philippine Stock Market: Not Looking Good

The weekly chart of the PSE Index is not looking good though. For months, it has been trading within a range, it eventually broke down around the end of August. This is the period when infrastructure corruption became the highlight, which led to the devolving credibility of the current government: bi-cam Legislature (congress and Senate) including the Executive (President). As of Nov 3, there is also a noticeable gap down on this first day of trading after the All Saints'/Souls' Day break. This does not look good, and would also mean this is just a start. We'll have to wait for a reversal and that may take months from now.

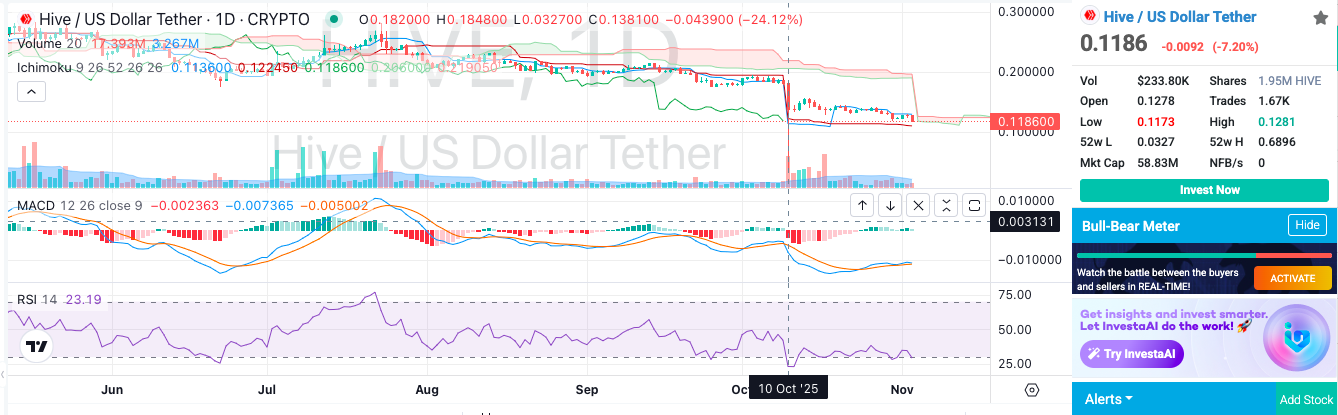

October 10 Crypto Flash Crash

BTC

HIVE

Apparently, US President Trump's tweet threatening 100% tarriffs against China caused this. This reignited the US-China Trade War fears. It was a deleveraging event, as the crypto market was overheating and a lot were trading with leverage. While the Trump tweet might look minor, it being a trigger toppled and caused some kind of domino effect.

BTC and other coins seem ok and trading within range; howeve, HIVE wasn't able to get back to former levels and seemed to have formed a new base. HIVE looks undervalued and so I'm willing to buy more.

Some personal notes: DMC - Upcoming ex-date for Dividend (4.35%) on Nov4. Should I sell or just leave it for dividend play? CEB - should have sold earlier, but maybe a chance to buy undervalued?

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Stock Charts from Investagrams