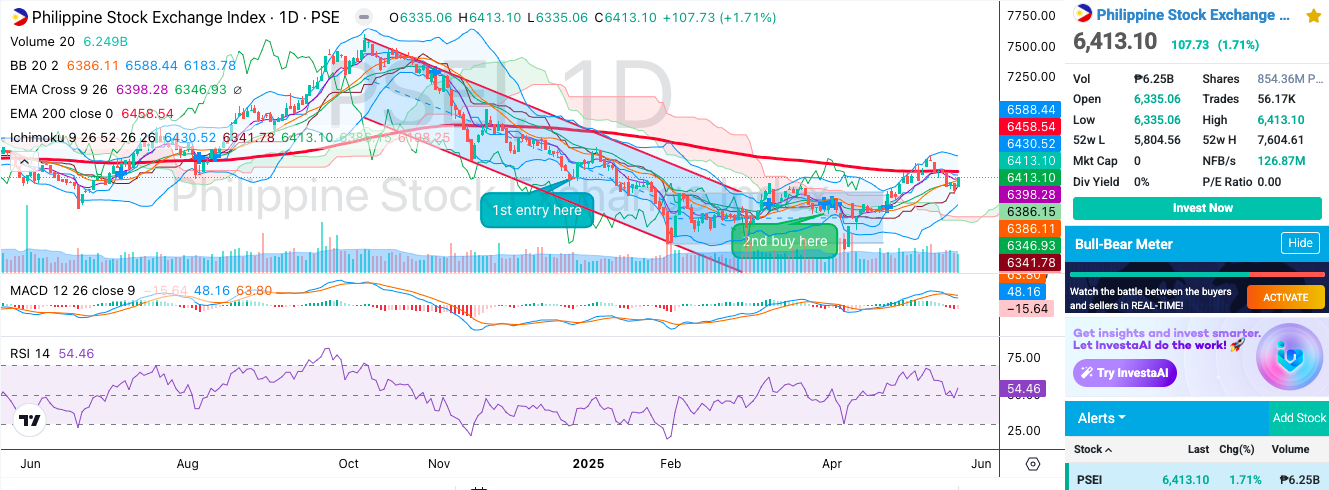

Philippine Market (PSE Index)

My previous post was just right after the elections. The results were interesting but I'll save that for possibly another discussion.

The PSE index levels last week haven't changed much as it is still trying to break out of the 200 SMA. There have been retracements along the way, but seems like momentum is still upwards! Let's see though if the 200SMA will serve as a solid resistance line.

Watchlist:

GTCAP - After just breaking out of the kumo. Similar to PSEi, prices are currently just below 200MA. I'd be interested to buy after a slight correction. However, since I have exposure with MBT, this is not yet a strong buy for me.

Speaking of MBT, maybe I need to buy more as prices retraced back to my earlier buy prices.

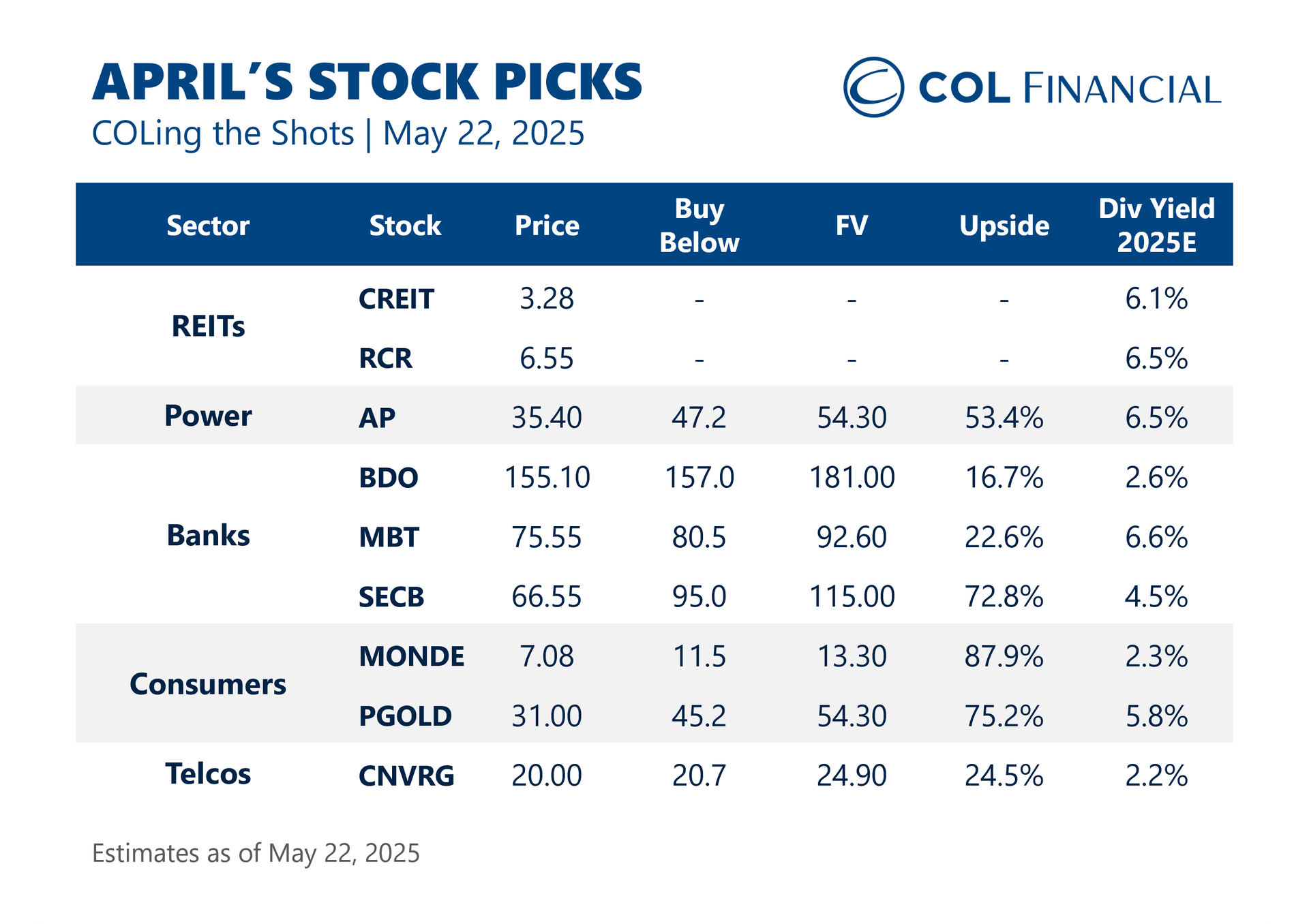

COL Financial's Picks:

COL is an online broker and they show undervalued stocks are mostly within Banking and Consumer industry. Trying to see if I can enter in one of the consumer stocks; however, recent price movements doesn't seem encouraging.

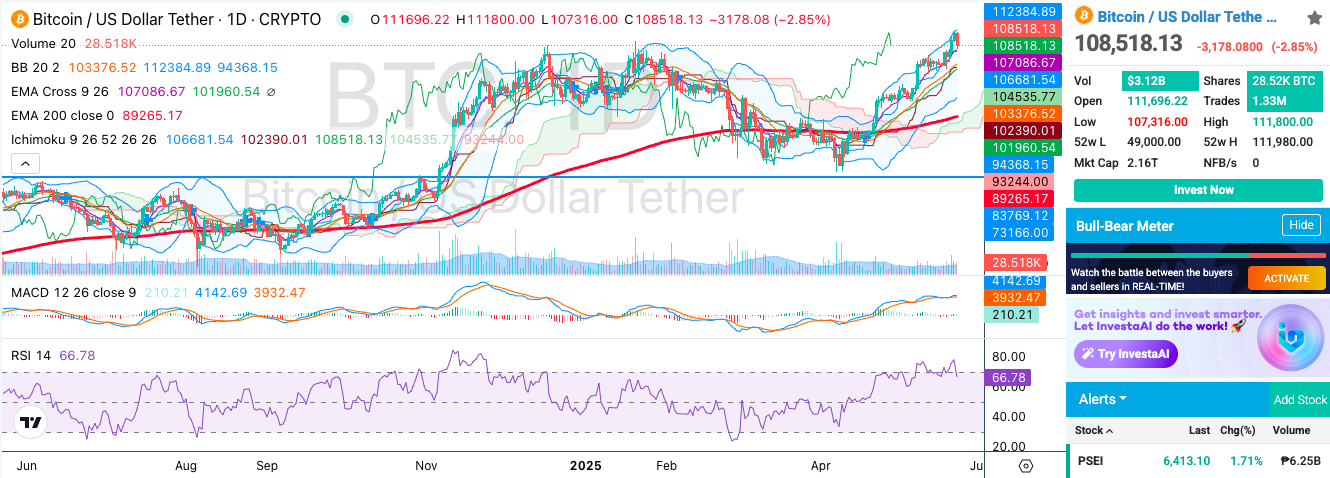

Crypto (Bitcoin All Time High)

BTC's ATH seems to be abrupt. I'm leaning towards taking profits right now as it needs to rest. So, I just sold my BTC for a realized gain of 27%

Hive

As BTC reached its All-Time High, I checked on other crypto which may possibly be a bit delayed but correlated with BTC. I like how the Hive chart looks like right now, given prices are trading within the upper Bollinger band. It's trading above the kumo which for me is positive. Seems like it's just waiting for a massive buyout/burning of SPS.

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Stock Charts from Investagrams