Philippines

A weekly study/review about the Philippine Economic scene (sometimes political) including Crypto markets (Hive, BTC).

Political Scene

In the political scene, there has been a massive reorganization in the Administration's cabinet as the President requested for courtesy resignations from all Department secretaries including the heads of GOCCs (Government Owned or Controlled Corporations e.g. Philhealth, PAGIBIG, etc).

Meanwhile, there are also discussions on how the Senate and Congress are preparing for the upcoming impeachment trial of Vice President Sara Duterte, whose office is being questioned regarding the use of significant "Confidential Funds" which apparently fails government audit. The VP however, seems to still have the number of support from the Senate as the recent midterm elections show Duterte allies gaining additional seats in the upper chamber.

Economic and Market Scene

As for the Philippine Stock Market, the PSE Index is having a hard time breaking the 200 SMA resistance. Trading last Friday also shows huge volume of market transactions but ending with a drop in the index. This could be a bad sign, and now we're preparing to see which would be the Support and if the market can still hold the line or get back to being bearish.

I'm looking at REITS and the Consumer Sector based on recent news and broker recommendations.

I. REITS

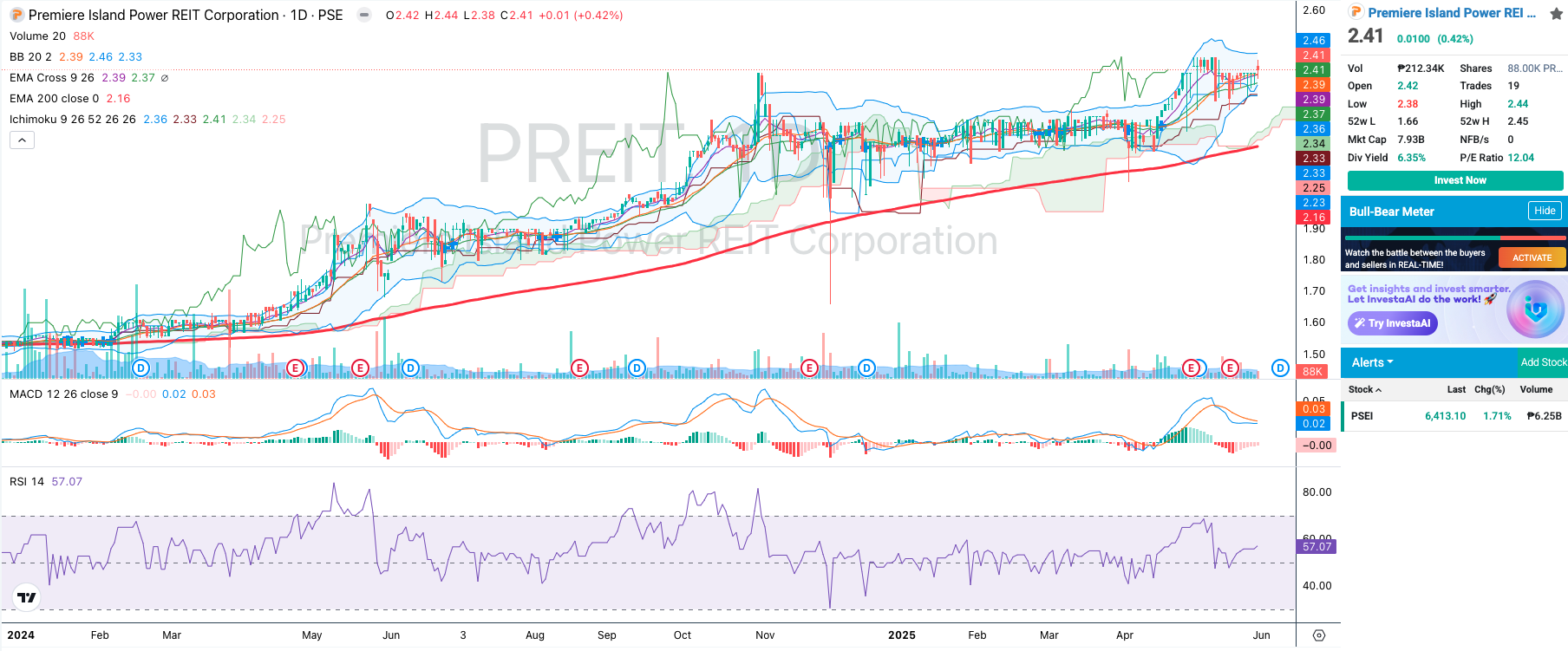

REITS seem to be a very good investment since last year as prices have risen steadily while giving dividends. Question right now is if it's still a good time to enter?

COL Financial lists CREIT and RCR as their recommended choices giving dividend yields above 6%. On the other hand, Accord Capital suggests PREIT with a 6.38% dividend yield. P/E forward ratio is lower at 12 vs 15 for the others so maybe PREIT can be a value play. Looking at its chart history, maybe there can be opportunities to buy when its MACD or RSI rests a bit.

II. Consumer

As for the Consumer sector, there were interesting corporate news lately. Specifically with Gokongwei-led comparines.

Universal Robina Corporation (URC)

A relatively large active fund, Capital Group, has invested around 5% on Universal Robina Corporation (URC), mostly known for consumer products like the Jack & Jill snacks and C2 Green Tea beverages. Foreign Fund flows is very important to the Philippine market as it can easily raise the tide of the market in general, more so with a specific stock. Looking at its chart below, price now sits comfortably at the 200SMA level and still above MACD Zero. This may be interpreted as a support so might be a good opportunity to accumulate at these levels. AP Securities set a Target price of 99.67 which gives an upside of around +18%.

Robinson Retail Holdings (RRHI)

There has been a significant buyback of shares by RRHI from its partner through a special block sale. This was worth around Php15B and consists of 22.2% ownership of the company which will now be added to its treasury. It is worth noting that the price bought was at Php50 per share versus the current market price of Php37.8. This is at a premium of +32% which shows the company's confidence on its own.

The chart below shows the significant volume transaction; however, momentum is still not yet on their side so we might need to wait a little bit more.

Hive

On the other hand, Hive token price is a disappointment as it has been trading within a tight band until it got recently been broken down and now finding a new support, now even below the kumo.

Bitcoin

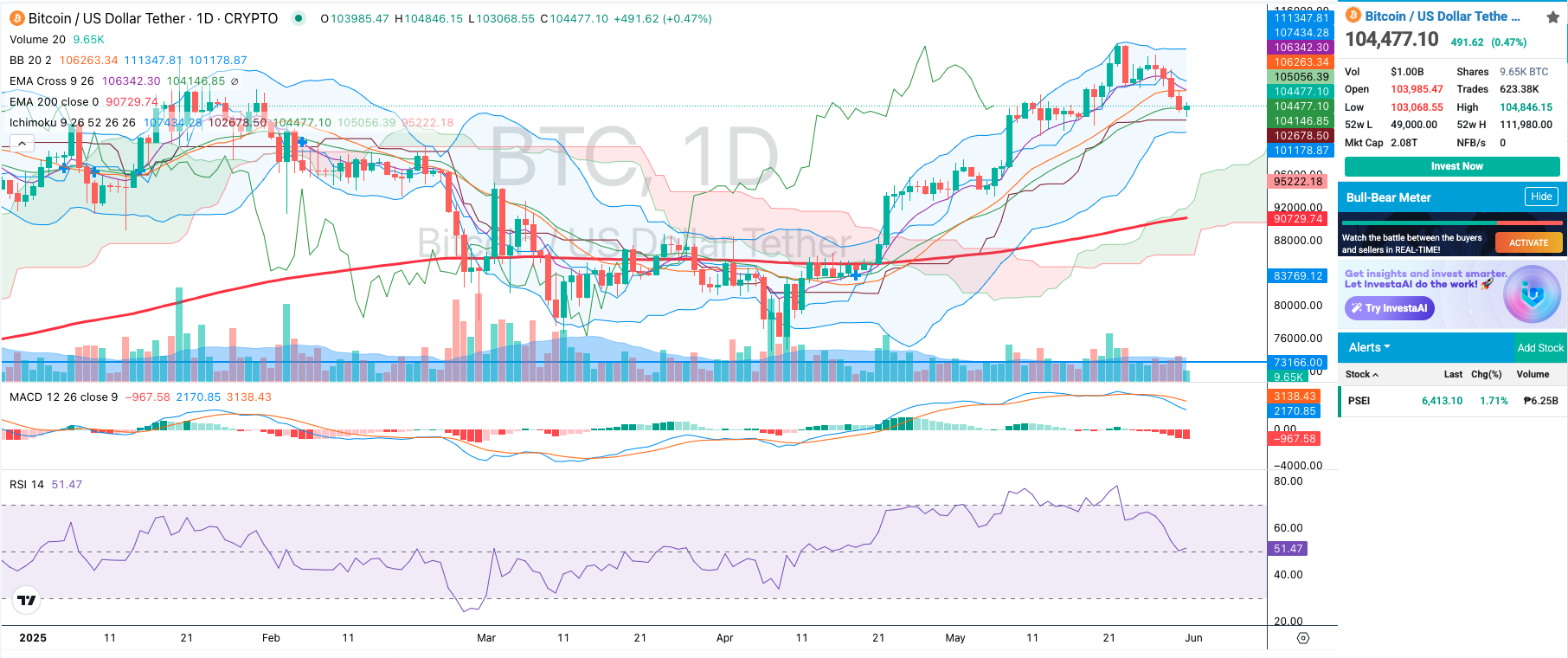

Happy to see that I made the right decision of selling on the top (~108k) as we see BTC getting some correction. I'm not much of a swing trader so we'll see if I get to buyback sometime soon or use the USDT to buy other tokens.

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Stock Charts from Investagrams