Philippine Market

The PSE Index still hovers below the 200SMA line, so there is still a risk of a break down. Lacks catalyst to move further up so we will just be in wait-and-see mode.

There are also no buy signals from my broker this week so won't be able to share much charts for now.

I've mentioned about REITS last week, and man... it's been pumping up until now. Wish I have entered earlier before. It looks unstoppable.

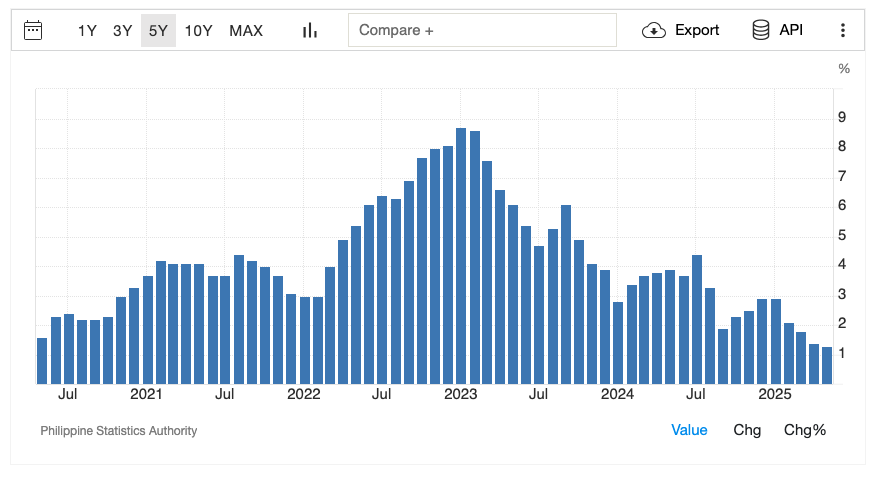

Low Inflation

Inflation numbers has been on the downtrend since 2023 which is generally good. The question now is whether this lowering of inflation is due to sound financial management or cooling down of the economy.

If this happens on the supply side (low inflation on food/fuel), this is great! However, if this is demand driven, then it may signal slower economic growth. I'm hoping for the former. It's a bit weird that we just finished the Midterm elections which should have driven more economic activity and be inflationary.

I don't think this low inflation is felt by the people though. As prices increase over time, low inflation environments does not necessarily bring the prices down. They just maintain at a certain level for a time. This is why I don't think it's good timing to introduce more taxes at this period.

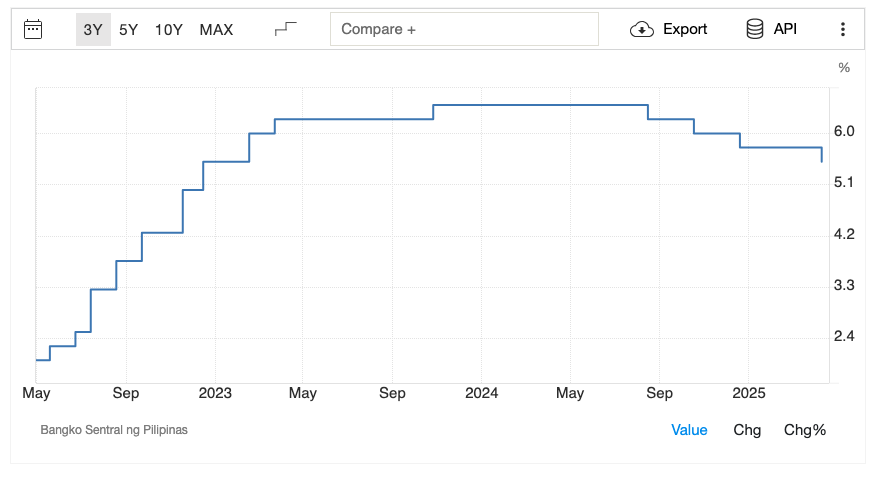

Impending Lowering of Interest Rates

This gives more room for the lowering of interest rates. The Central Bank may consider it anytime soon, as early as June.

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Stock Charts from Investagrams