I, as have many others, been stacking silver for a while now, however, I am always curious as to where the price is currently and where it might go eventually.

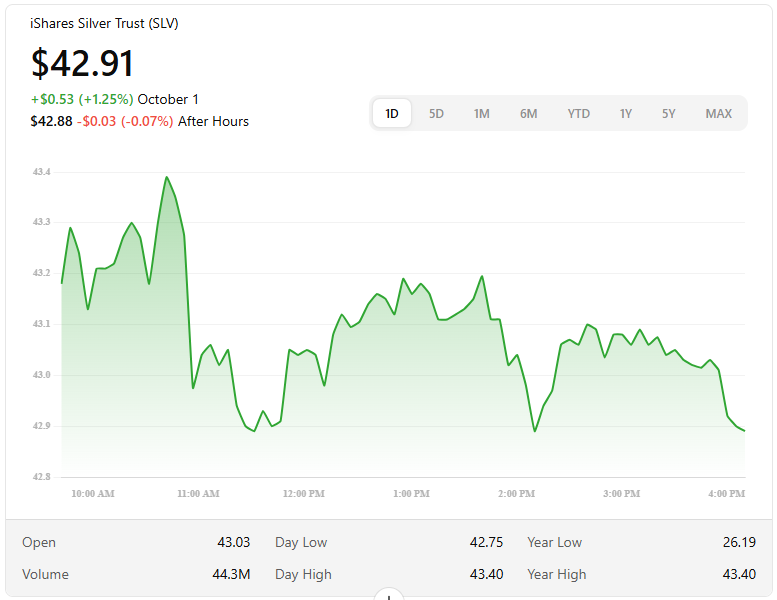

Live Market Snapshot

The iShares Silver Trust (SLV) — a popular U.S.-based exchange‑traded fund tracking silver — is trading around $42.91 USD (price as of today)

In Australia, the spot price of silver is approximately AUD 70–72 per troy ounce (depending on the source and live fluctuations).

So, roughly speaking, silver is trading in the ballpark of US $43 per ounce and AUD ~$71 per ounce at the moment.

What’s Driving Silver’s Price?

Silver is tricky: it sits at the intersection of precious metal (investment) demand and industrial demand. Here are the key factors influencing its current valuation:

-

Monetary & safe‑haven demand: In times of uncertainty, investors flock to precious metals. Gold’s rallies tend to pull silver along.

-

Industrial demand is upward, but sensitive: Silver is heavily used in electronics, solar panels, and green tech. Weakness in industrial activity can cut demand.

-

Supply constraints / deficits: The silver market has been in structural deficits in recent years, where demand exceeds mined supply.

HSBC recently raised its silver price projections for 2025 and beyond, citing strong gold levels and safe-haven pressures. Their forecast implies continued bullish undercurrents even amid some industrial demand uncertainty.

In 2025, silver has already seen a strong upward move, with gains well above most prior years. However, silver tends to be more volatile than gold — because it’s more exposed to industrial demand swings — so dips or corrections can be sharper.

What This Means for Buyers & Investors (Especially in Australia)

If you're considering buying silver in Australia or globally:

- Expect premiums / markups over spot price. Physical dealers will charge extra for minting, transport, storage, and profit margins.

- Choose the right form: bars, coins, rounds — depending on liquidity, cost and ease of resale.

- Mind the AUD–USD exchange rate: as silver is often priced in USD, movements in the currency pair can affect your local cost more than the silver spot price itself.

- Diversification is key: Silver is compelling due to both investment demand and industrial use, but it can sway quickly.

If you’re holding over the medium to long term, power transition technologies (solar, electronics) may bolster industrial demand further.

Outlook & What to Watch

Many forecasters remain bullish on silver for 2025–2027, projecting new highs, especially if gold pushes further upward and industrial demand stays strong.

Thanks for reading.