Introduction

Bitcoin is a new form of digital money, a medium of exchange, and a truly revolutionary store of value that moves in the opposite direction from traditional government-issued currencies. Instead of being devalued over time, its value tends to increase, protecting the stored value of your labor better than any conventional currency.

What makes bitcoin special?

This essay is a brief exploration into what makes bitcoin special.

What makes this resistance to devaluation possible and sets Bitcoin apart is its lack of centralized ownership; it is not controlled by any single government, corporation, or individual.

Bitcoin is a response to the Financial Fragility of Modern Money.

Bitcoin was created during a global financial crisis, and as a result, it was molded by the forces of those times to be better then the existing forms of money.

Money is the storage form of your time and energy, saved tfor your future when you can no longer work, and it is meant to sustain you in your twilight years, and it is meant to help your children have a better life then you did.

But Modern Economic Systems devalue or reduce it's value! So Bitcoin was created to fight this devaluation of your hard earned time and money.

Bitcoin is, as many of its supporters believe, a profound innovation born from the mind of the enigmatic entity known only as Satoshi Nakamoto.

The original Bitcoin whitepaper was published on October 31, 2008, in the immediate aftermath of the global financial crisis.

This timing was no coincidence. The crisis exposed the fragility of centralized financial institutions and eroded public trust in the established monetary order. Satoshi's anonymity underscores Bitcoin's radical decentralization, ensuring no single point of control or failure.

Bitcoin is not just a better form of money

Bitcoin is not merely a better form of money; it is arguably one of the most significant monetary innovations humanity has ever conceived.

Its architecture is not just designed to survive the manipulation and devaluation common to traditional currencies; it is built to thrive amidst it.

For instance, after starting at virtually zero, Bitcoin reached nearly $20,000 in late 2017 and surpassed $60,000 in 2021.

Despite its volatility, it has consistently established higher price floors over time, a stark contrast to the continuous erosion of purchasing power experienced by government-backed money.

The Core Principles

The very principles of its existence are antithetical to the centralizing forces that have historically undone every previous monetary system:

Decentralization:

Unlike central banks, no single entity can dictate Bitcoin's monetary policy. Transactions are verified by a distributed network of participants, making it incredibly resilient to attacks or manipulation.

Censorship-resistance:

Governments cannot easily prevent transactions or seize funds on the Bitcoin network.

This offers financial sovereignty to individuals, especially in times of economic instability or capital controls.

Immutability:

Once a transaction is recorded on the blockchain, it cannot be altered or reversed. This provides unprecedented transparency and finality.

Scarcity:

With a fixed supply capped at 21 million coins, its value is protected from the inflationary pressures that plague currencies that can be printed without limit.

While critics often point to Bitcoin's price volatility or the energy required for its network, these concerns are often viewed by proponents as necessary trade-offs.

The volatility is a characteristic of a new global asset finding its true market price, and its energy use secures an incorruptible financial network for the entire world—a function that is arguably more efficient than the vast resources consumed by the traditional banking system.

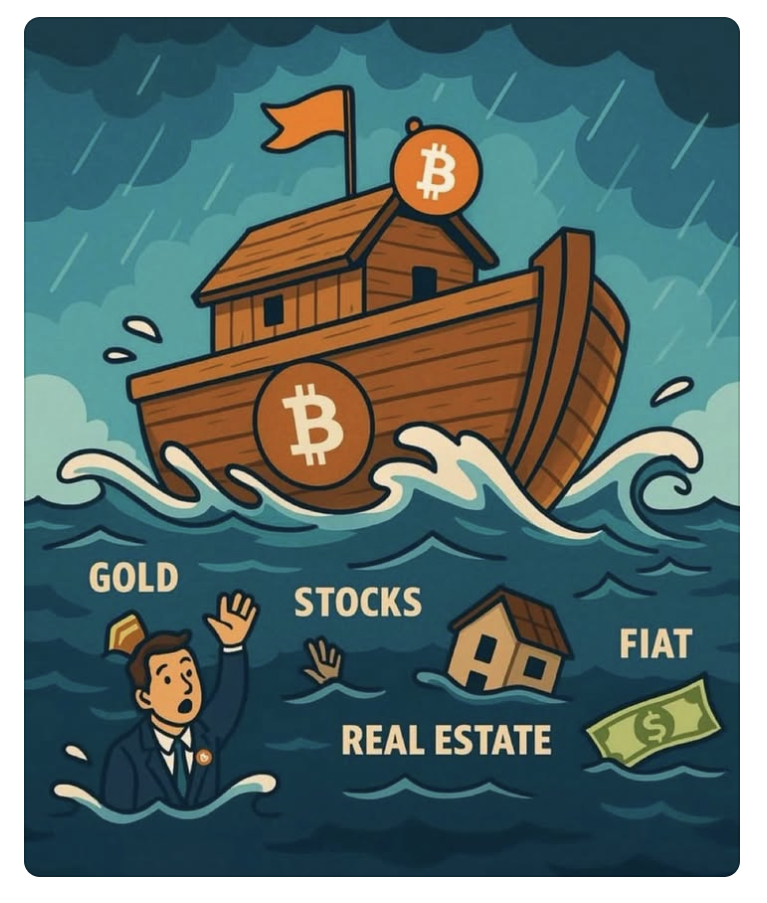

A Digital Ark

For many observers, a major correction in our global monetary system is no longer a question of "if," but "when."

The current model, fueled by unsustainable debt and unprecedented money printing, shows clear signs of systemic strain.

As global debt-to-GDP ratios climb to historic highs, the stability of the system is increasingly questioned.

Historically, the decay of a monetary standard has led to societal breakdown and conflict.

Bitcoin offers a peaceful, digital alternative.

For the first time, it provides a mechanism for civilization to potentially transition from a failing monetary system to a sounder one without the cataclysmic collapse that has often accompanied such shifts in the past.

It is an ark, a digital vessel ready to carry value across the turbulent waters of financial uncertainty.

By providing a truly scarce, verifiable, and uncensorable store of value accessible to anyone with an internet connection, Bitcoin allows individuals to preserve their wealth and transact freely.

Countries like El Salvador have even adopted Bitcoin as legal tender, demonstrating a tangible shift towards this new financial future.

It offers a blueprint for an economy built on immutable mathematics, not the shifting sands of political expediency.

In a world increasingly defined by currency devaluation, Bitcoin stands as the ultimate counter-force—a digital preserver of value designed to secure humanity's financial future.

Posted Using INLEO