Introduction to LeoStrategy and Surge

What is LeoStrategy?

LeoStrategy: The "MicroStrategy of LEO"

-

LeoStrategy is a Hive blockchain-based investment vehicle designed to function as a permanent capital fund. Its core mission is to continuously acquire and permanently stake LEO, the native utility token of the INLEO social ecosystem. By doing so, it aims to become the "MicroStrategy of LEO," offering its own token, LSTR, as a way for investors to get leveraged exposure to the LEO token's value.

-

All LEO acquired by the fund is instantly staked as LEO POWER. This action generates a yield, estimated at 10-20% annually, which is reinvested to buy even more LEO. This creates a compounding effect, which the project calls "accretive value" for LSTR holders.

-

The project's strategy is founded on a strong belief in LEO's long-term potential, citing its limited supply, growing user adoption of the INLEO platform, and strategic partnerships with projects like Thorchain, Maya Protocol, and Dash.

The Two-Token System: LSTR and SURGE

- LeoStrategy uses a dual-token system to manage its capital and provide different investment options.

* LSTR (LeoStrategy):

-

This is the fund's primary token, with a maximum supply of 1 million tokens. The project utilizes an At-The-Market (ATM) Strategy, a method of raising capital by issuing new tokens when market conditions are favorable.

-

The funds raised from these sales are used to buy more LEO. While this can dilute existing holders, the project argues that the value of the new capital and the compounding LEO yield will lead to a net increase in value for each LSTR token.

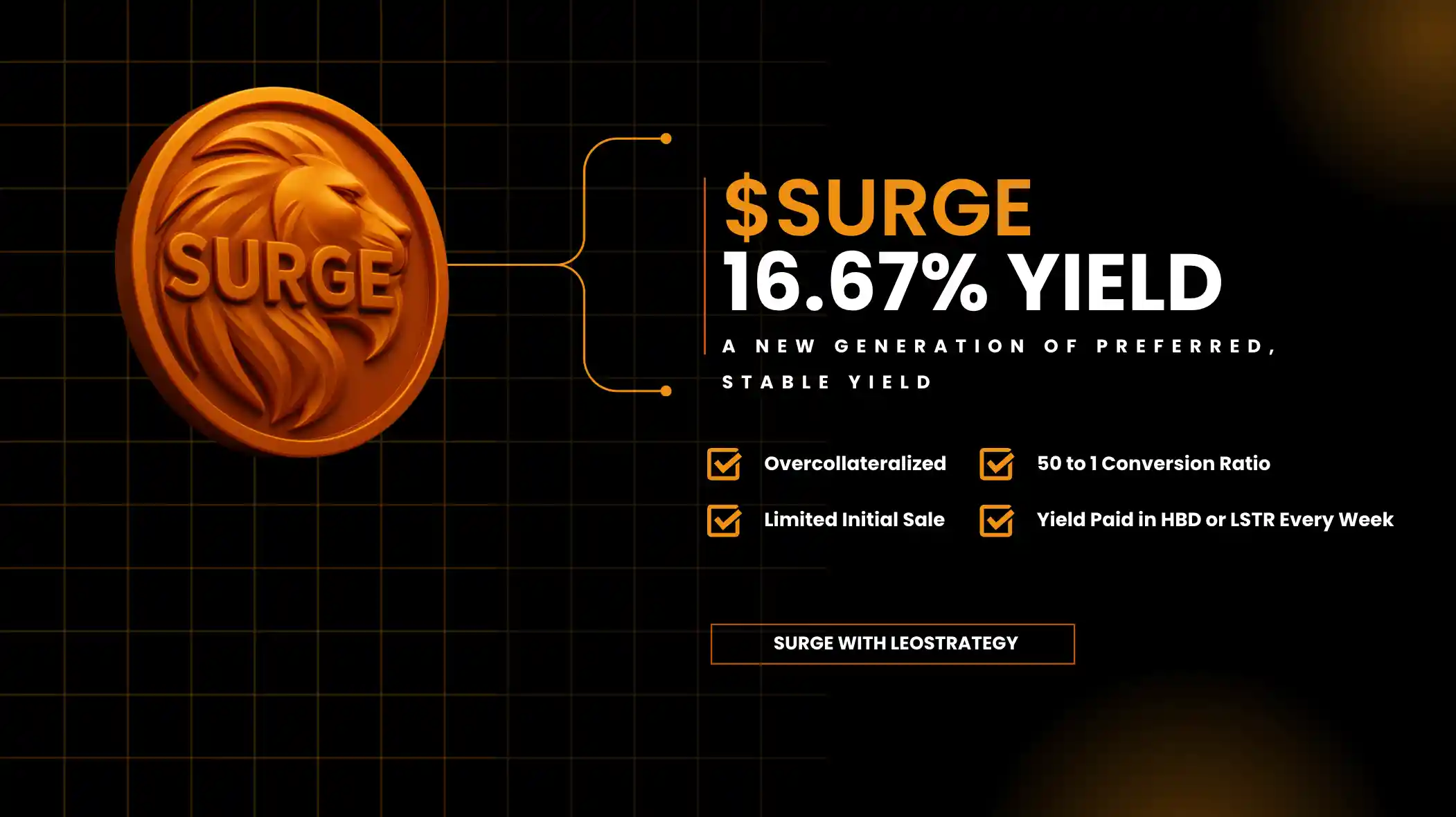

#### * SURGE:

- This is a perpetual preferred token, designed as a hybrid of debt and equity. It serves as a financial instrument to fund LeoStrategy's operations while providing a unique opportunity for investors, especially LEO holders.

Key Features of SURGE

-

- 15% Stated Yield: SURGE pays a 15% annual yield, distributed weekly in Hive-backed Dollars (HBD). Investors who participated in the initial sale at $0.90 received a higher effective yield of 16.67%.

-

- Downside Protection: SURGE has a $1 liquidation preference, meaning that in the event of a liquidation, holders are at the top of the preference stack and are guaranteed a return of $1 per token. This makes it a risk-mitigated way for LEO holders to lock in profits while still participating in future LEO and LSTR price movements.

-

- Unlimited Upside: Holders can convert 50 SURGE tokens into 1 LSTR at any time. This conversion becomes economically sensible when the price of LSTR exceeds $50. At this point, the value of SURGE will move in lockstep with LSTR's price, acting like a perpetual call option.

-

- Capital Raising: The initial SURGE sale was designed to raise HIVE to fund a large-scale LEO acquisition. Additional SURGE tokens (up to a maximum of 2 million total) can be issued through the ATM strategy to fund future acquisitions.

The Value Proposition

LeoStrategy offers a clear value proposition for investors in both tokens:

#### * For LSTR Holders: The token provides leveraged exposure to LEO.

- The fund's revenue-generating activities and compounding LEO POWER yield are designed to make LSTR's value grow faster than LEO's. LSTR holders also benefit from the LEO POWER yield without the 28-day lockup period that comes with staking LEO directly.

* For SURGE Holders:

-

SURGE offers a unique combination of limited downside risk (with its $1 floor price), a stable weekly yield, and unlimited upside potential through the LSTR conversion option.

-

It is positioned as a way for investors to hedge profits from recent crypto gains without missing out on future growth.

Last Words

- The entire LeoStrategy model is built on the belief that having a massive, growing LEO treasury allows the project to generate additional revenue from volatility harvesting and market-making activities. This revenue is then reinvested, creating a continuous cycle of value accrual for all token holders.

Posted Using INLEO