Trading volatile tokens can be profitable, but carries risk. One such trading opportunity exists on Hive-Engine with two new RWA tokens TTLSA and TGLD. As in all cases of trading do your own research, and only trade what you can aford to lose.

Introduction: Swing Trading TTSLA and TGLD

(LeoStrategy's RWAs (Tokenized Tesla = TTSLA, Tokenized Gold = TGLD) as easy-profit trading opportunities.)

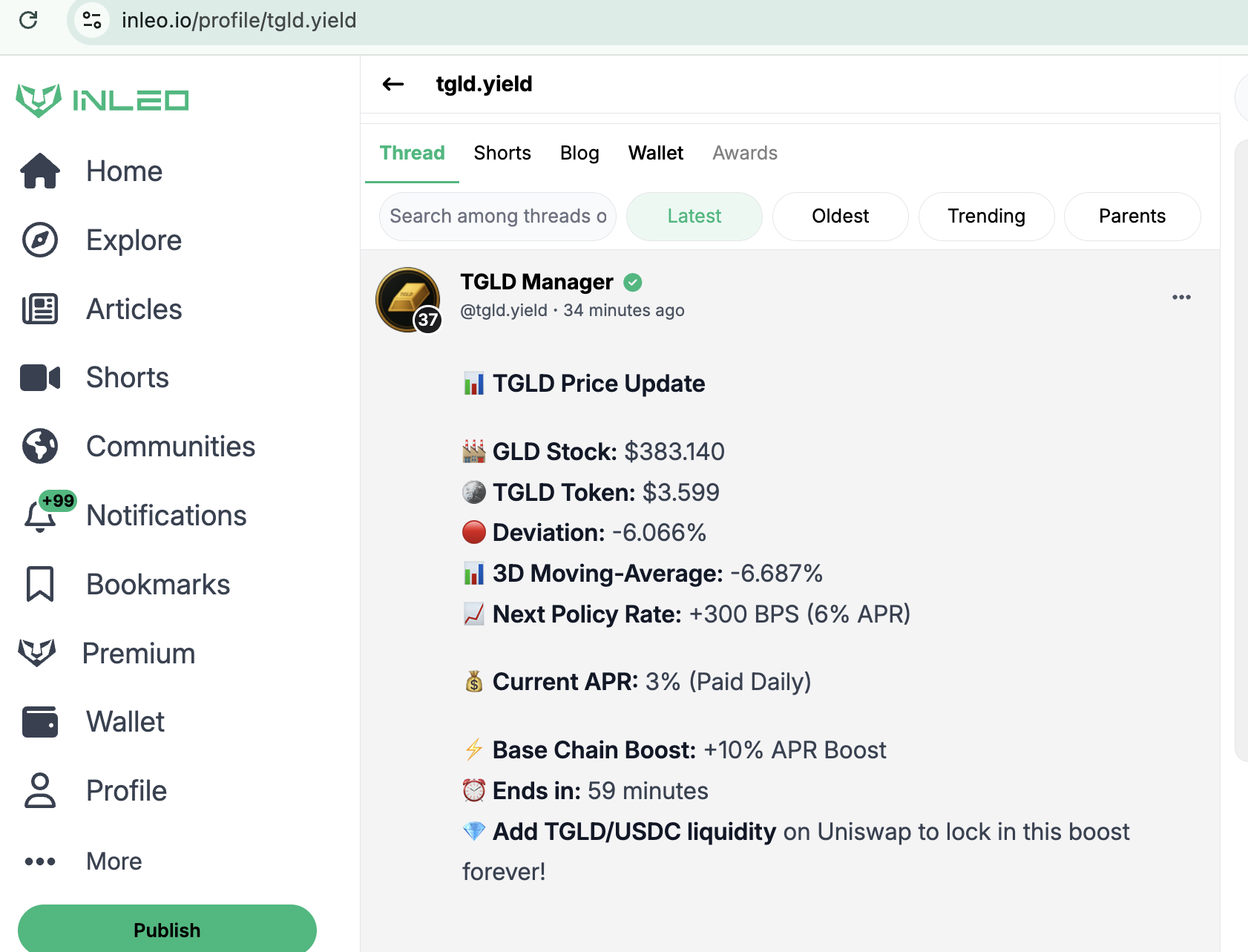

- These tokens aim for a 1:100 peg (correlation) with their real assets: TTSLA tracks TSLA stock price (e.g., if TSLA is $4.18, TTSLA targets ~$4.18), and TGLD tracks GLD gold ETF (e.g., GLD at $380 means TGLD ~$3.80). They yield daily APR (currently ~3% at peg, adjusted weekly based on 3-day deviation average) for holders, paid in HBD/USDC or auto-compounded.

Trading strategy:

Buy when below peg (undervalued, high yield attracts demand to pull it back up). Sell when at/above peg (overvalued, take profits as yield drops and price corrects). Pocket yield during holds—it's "free" passive income on the volatility. TGLD just launched and is holding peg tightly post-presale (at $3.79 vs. GLD's $380). TTSLA is slightly below ($3.55 vs. ~$4.18 target) but drifting closer. Track real-time via @tgld.yield or @ttsla.yield on InLeo Threads for prices/deviations.

What is the historical volatility of the token prices for this trade?

The historical price data for TTSLA and TGLD on Hive-Engine (via LeoStrategy's cross-chain MMs) supports this peg-trading strategy as viable.

Both RWAs launched below their 1:100 pegs (TTSLA at ~$3.40 vs. $4.17 floor; TGLD at $3.375 vs. ~$3.80) due to presale discounts and market flips, creating buy-low opportunities.

Prices then drifted upward toward pegs amid crypto volatility (e.g., post-BTC dip from $120k), with TTSLA hitting $4.33 and TGLD $3.79 soon after—yielding 12-20% quick profits for sellers.

The design reinforces it: deviations trigger APR hikes (e.g., TTSLA's from 3% to 17.5-20% on 3-day moving average), drawing buyers and compressing spreads (typically <2.5%).

Hourly threads from @ttsla.yield and @tgld.yield show this pattern playing out predictably.

Yield (daily, 3%+ base) cushions holds, making it low-risk for short swings. Track deviations via those accounts for entries/exits.

## How many tokens would you need to have to make $100 dollars per day on this trade?

To earn $100 daily trading TTSLA or TGLD peg deviations on Hive-Engine (buying below 1:100 peg, selling above, plus yield), volume depends on spread size and frequency.

TTSLA

Current prices: TTSLA ~$3.55 (peg $4.17, ~15% undervalue); TGLD ~$3.79 (peg $3.80, near peg).

Assuming 10% average daily round-trip profit (historical post-launch swings: TTSLA +12-20%, TGLD +12%):

TTSLA: ~227 tokens ($800 buy/sell volume, $80 profit + ~$20 yield at 2.5% APR).

TGLD

TGLD: ~264 tokens ($1,000 volume, $100 profit + yield).

Track @tgld.yield or @ttsla.yield for hourly pegs. Use LeoDex or Hive-Engine for low-fee trades. Scale based on your risk/volatility tolerance.

More details on trade

The calculation assumes you're trading peg deviations on TTSLA/TGLD (buy below 1:100 peg like TSLA/GLD ratio, sell above) while earning daily yield, targeting $100 net profit. It's based on recent data: TTSLA ~$3.55 (15% below $4.17 peg), TGLD ~$3.79 (at ~$3.80 peg). Historical swings show 10-20% quick round-trips post-launch, plus 3-17.5% APR yield.

Breakdown for TTSLA ($100/day):

Average daily profit: 10% round-trip (e.g., buy $3.55, sell $3.91; historical +12-20% in days amid crypto dips).

Yield addition: 2.5% APR daily on held position ($20 on $800).

Tokens needed: ~227 TTSLA (buy/sell ~$800 value each way; $80 trade profit + $20 yield = $100).

Volume: 1-2 trades/day, low fees on Hive-Engine/Base via LeoStrategy MMs. Scale with liquidity (current 24h vol supports it).

For TGLD ($100/day):

Similar 10% round-trip (e.g., buy $3.79 dip, sell $4.17; +12% post-presale).

Yield: 3% APR daily ($30 on $1,000, policy-adjusted weekly via 3D moving average).

Tokens: ~264 TGLD (buy/sell ~$1,000; $100 trade profit + yield buffer).

Edge: TGLD's new mechanics favor HODLers with permanent boosts, reducing flips but enabling yield-hedged trades.

Track @ttsla.yield/@tgld.yield hourly for peg devs. This isn't guaranteed—volatility (e.g., BTC correlation) can widen spreads. For details: TTSLA Live, TGLD Strategy.

How to minimize losses trading TTSLA/TGLD peg deviations on Hive-Engine:

Set stop-losses: Exit if price drops 5-10% below buy-in (e.g., TTSLA under $3.20 from $3.55), limiting downside amid crypto volatility like BTC dips.

Size positions small: Risk only 1-2% of capital per trade (e.g., $100-200 on $10k portfolio) to survive 10-15% peg swings (historical post-launch range).

Hold for yield if near peg: If deviation <5% (TTSLA ~15% under now, TGLD at peg), stake for daily APR (3-17.5% boosted) instead of forcing sells—reduces opportunity cost.

Diversify chains: Split trades between Hive-Engine and Base (via LeoDex) for arb opportunities; monitor @ttsla.yield/@tgld.yield hourly updates on deviations/APR.

Avoid leverage: Trade spot only—no margin to prevent liquidation in fast moves (e.g., TGLD's 12% post-presale rise).

Track metrics: Use 3D moving average for weekly APR policy; buy on expanding deviations (>10%), sell on compression.

#

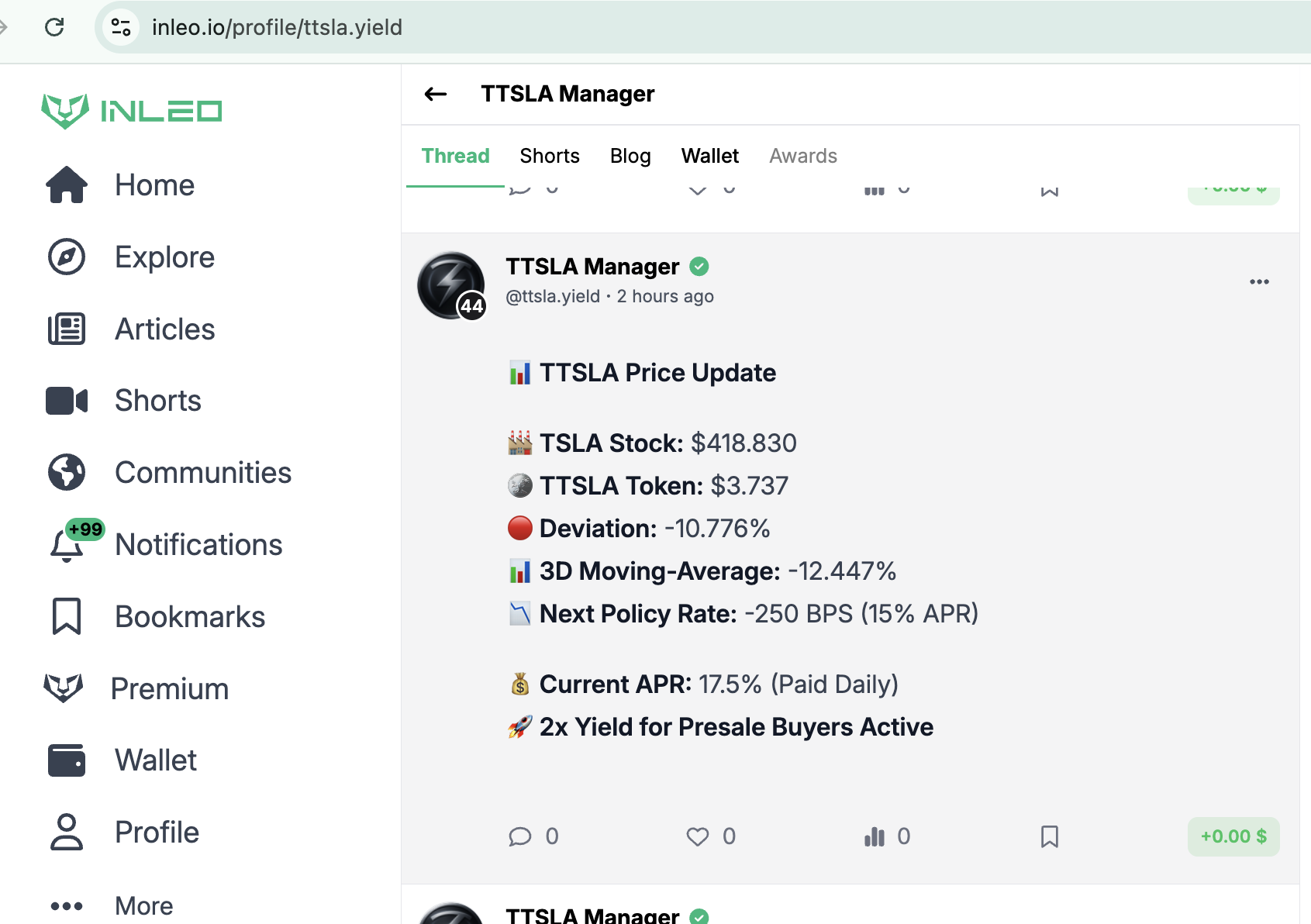

@ttsla.yield is the official on-chain AI agent for TTSLA yield management, posting hourly updates on InLeo Threads. It tracks:

TSLA stock price vs. TTSLA token price (1:100 peg, currently ~$417.78 TSLA means $4.18 TTSLA target; TTSLA at $3.55, ~15% under).

Real-time deviation and 3-day moving average (guides weekly APR policy; next rate predicts +1,450 BPS to 17.5% APR from 3% base).

Current APR (daily yield paid to holders; presale buyers get 2x boost). Active boosts and payout options (HBD/USDC default or auto-compound TTSLA).

Follow @ttsla.yield for real-time data. Use !TTSLA Me command to check your yield.

Source: https://inleo.io/@leostrategy/ttsla-is-now-live-how-yield-policy-works-20-apr-hrk

Remember Do Your Own Reseacrh

This is my journey and my risks. i need to write what I am thinking to fully comprehend and learn. These are my risks and my rewards / Losses also. If you try this yourself be prepared to own both the wins and the losses.

Posted Using INLEO