Falling interest rates often mean lower costs for loans across the board. This boosts spending and investment, which can lift asset prices in unexpected ways. Businesses expand easier, and savers hunt for better returns beyond bank accounts.

In this setup, smart moves shine in areas like stocks, real estate, and bonds. Growth sectors may surge, but you must weigh risks such as rising prices or market bubbles.

As rates drop, opportunities pop up for those ready to adjust. Let's break down what drives these changes and how they touch your investments.

Understanding Declining Interest Rates and Their Impact on Investments

Lower rates reshape the financial world in big ways. They ease pressure on borrowers and nudge money into riskier assets. Understanding this helps you spot where to put your cash next.

Central banks cut rates to spark growth when things cool off. Think of it like oiling a rusty engine—everything runs smoother with less friction from high costs.

How Declining Rates Affect Asset Classes

Bonds react first when rates fall—prices climb as yields drop. A 10-year Treasury might see its value rise by 5-10% in a quick cut cycle, based on past patterns.

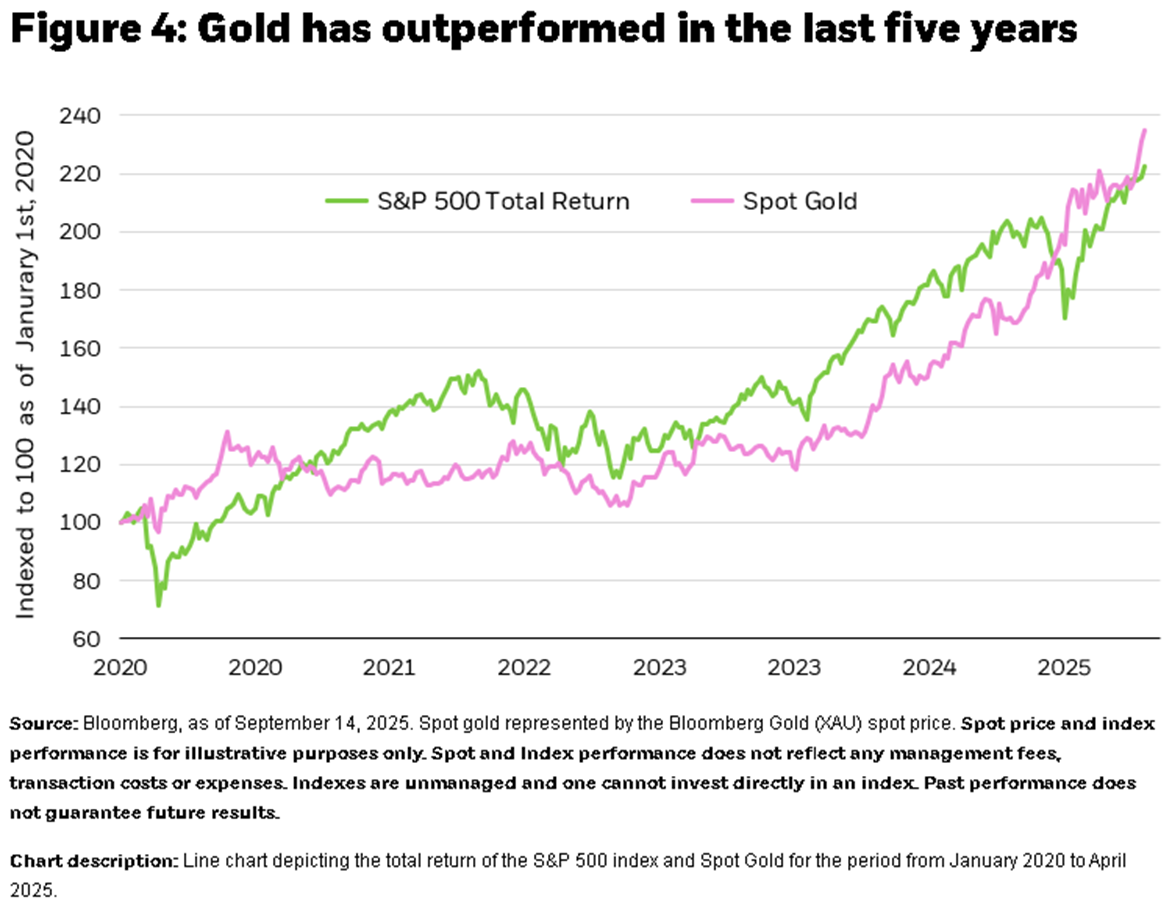

Stocks often follow suit, especially growth names. Cheaper debt lets firms fund operations without squeezing profits. During the 2020 cuts amid COVID, the S&P 500 jumped over 16% that year, defying recession fears.

Real estate thrives too, with mortgage rates dipping to lure buyers. Property values can swell as demand heats up. Overall, capital flows from safe havens to places promising higher returns.

Risks and Opportunities in Low-Rate Scenarios

Low rates open doors for gains, like capital growth in equities and property. But watch for pitfalls—inflation might creep back if the economy overheats. Or assets could get too pricey, leading to corrections.

History shows patterns. Post-2008, rates near zero fueled a bull market in stocks lasting over a decade. Yet, savers suffered with tiny yields on cash.

To play it smart, spread your bets. Mix bonds for safety, stocks for upside, and a bit of real estate. This way, you catch the ups while cushioning downs.

Top Sectors Poised for Growth in Falling Rate Periods

When rates slide, certain areas light up. Sectors needing capital, like tech and housing, often lead the charge. Let's look at standouts backed by real trends.

Data from past cycles backs this. In 2020, S&P sectors like tech rose 43%, far outpacing the broader index. Low rates poured fuel on innovation and borrowing.

Real Estate and REITs: Leveraging Cheaper Financing

Lower rates cut mortgage costs, drawing more buyers into homes and offices. Property prices tend to climb 5-15% in the first year of cuts, per historical averages.

REITs offer an easy way in—they trade like stocks and pay dividends from rental income. During the 2019-2020 period, REIT indexes gained about 20% as rates eased.

Technology and Growth Stocks: Fueling Innovation

Tech firms love cheap money—it funds research without debt pain. Lower rates let them pour billions into AI or cloud services, driving stock pops.

Take Apple or Amazon: in low-rate stretches like 2010-2020, their shares multiplied many times over. Easier credit helped scale operations fast.

Utilities and Dividend-Paying Stocks: Stability in Uncertainty

Utilities act like a rock in shaky times. Lower rates boost the value of their steady future earnings, since discount rates drop.

In the early 2000s rate cuts, utility stocks returned over 10% annually while the market wobbled. They pay reliable dividends, often 3-4%, for income seekers.

Fixed-Income Strategies for a Low-Yield World

Bonds lose appeal when yields shrink, but tweaks can help. Shift to spots that gain from falling rates, not just hold steady.

The 2024 Fed signals sparked a bond rally, with long-term yields dipping below 4%. This lifted prices for holders who timed it right.

Shifting from Traditional Bonds to Duration Plays

Longer-term bonds shine as rates drop—their prices jump more than short ones. A 30-year bond might gain 20% if rates fall 1%, thanks to duration math.

Build a bond ladder: spread maturities from 5 to 30 years. This locks in yields now and grabs upside later. It keeps your money working without big risks.

Corporate and High-Yield Bonds: Higher Returns with Caution

Lower rates tighten spreads on corporate debt, making them yield more than Treasuries. In the 2010s, high-yield bonds returned 7-9% yearly post-cuts.

Junk bonds offer even bigger pops, but pick wisely. Look for BBB-rated ones to dodge defaults. During recoveries, they've doubled in value over cycles.

Diversify across issuers. This way, one flop won't sink your ship.

Alternative Investments Thriving in Declining Rates

When bank yields fade, alternatives step up. Gold, startups, and lending platforms draw cash seeking juice.

Post-2020, BlackRock noted a 20% jump in alternative allocations as rates hit zero. Investors chased returns outside stocks and bonds.

Commodities and Gold: Inflation and Safe-Haven Appeals

Falling rates can signal trouble, pushing folks to gold as a haven. It rose 25% from 2008-2012 amid easy money.

Commodities like oil or metals follow economic rebounds. Low rates spur demand, lifting prices.

Grab exposure with ETFs—no need to store bars. Track 5-10% of your portfolio here for hedges.

Private Equity and Venture Capital: High-Growth Potential

Cheap capital floods startups in low-rate eras. Private equity funds bet on buyouts that pay off big later.

Interval funds let everyday folks join, with returns hitting 10-15% in good cycles. Post-2020, venture deals boomed.

Portfolio Strategies and Risk Management

Tie your picks into a solid plan. Rebalance often to ride the rate wave without wiping out.

Adjust based on your goals, like retirement or growth.

Diversification Tactics Across Global Markets

Look abroad—emerging spots like India benefit from U.S. rate drops. Their growth stocks can outpace locals.

Index funds cover Europe or Asia cheap. Add 20% international to spread risk.

Conclusion

Declining interest rates flip the script for investors who adapt. From real estate booms to tech surges, fixed-income tweaks, and alternative hunts, chances abound to grow wealth.

To your success,

Thomas Moore

Disclosure: The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Posted Using INLEO