While many people interact with Roku products daily, the company’s stock has fallen by nearly 90% from its 2021 peak, highlighting a disconnect between its consumer popularity and its financial market performance. Roku has been a leader in the shift from traditional cable to "smart" TVs powered by operating systems. Yet despite its strong market presence, with one in three U.S. TVs running its OS, the company has struggled to translate this dominance into consistent profitability.

The Aggregator Behind Your Screen

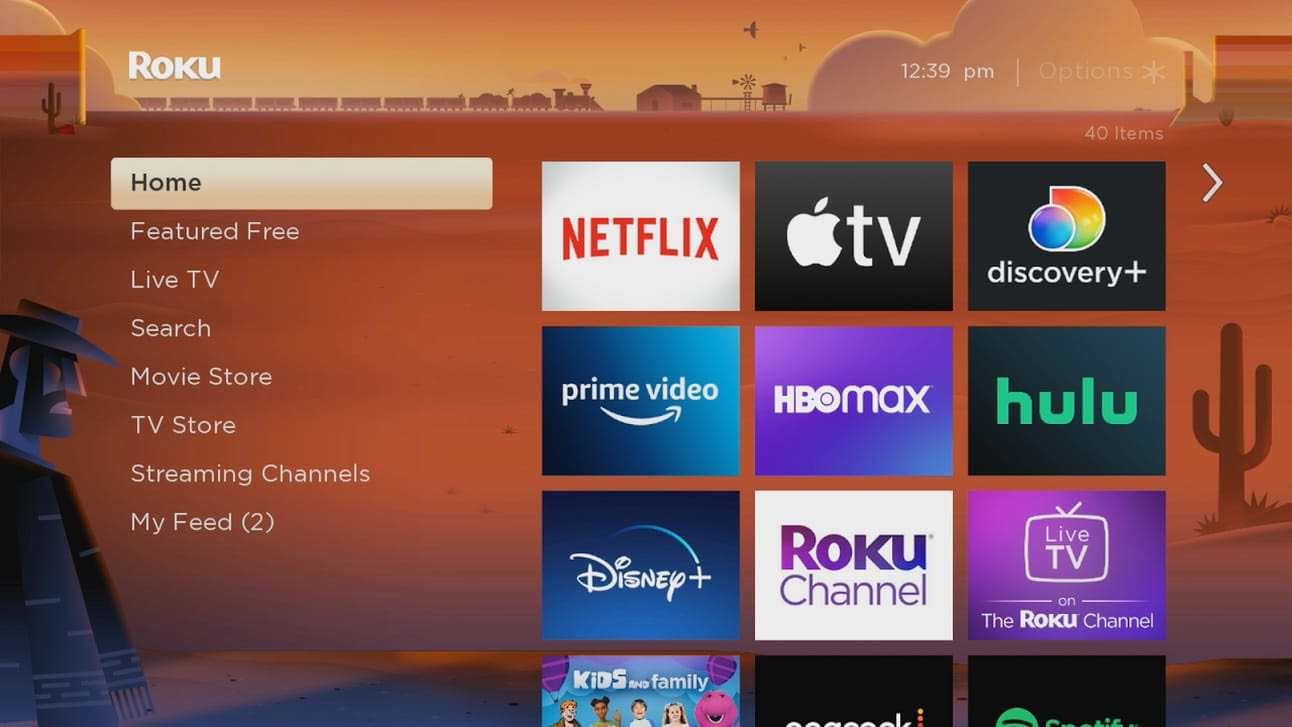

Roku's primary business model is not creating content, but rather aggregating it. While the company is known for its streaming sticks that make older TVs smart, its true value lies in its operating system (OS), which is embedded directly into millions of new televisions. This OS is the first thing users see when they turn on their TV, giving Roku a powerful position. It can prioritize content, sell ad space on the home screen, and take a cut of subscription fees when users sign up for services like Max directly through Roku. The company also monetizes this real estate through features like its "Sports Zone" and sponsored home screen takeovers, like the recent one by Apple for its show Severance.

The biggest prize for Roku is programmatic advertising. By owning the first screen, Roku's home page and the famous "Roku City" screensaver become valuable digital billboards. Major companies like Disney+ and Apple pay Roku to promote their content to millions of users, transforming the TV into a new ad platform.

In addition to its aggregation and advertising business, Roku has also developed its own free, ad-supported content hub called The Roku Channel (TRC). This channel licenses content and serves ads, a model that doesn’t require massive studio budgets. TRC has become the second-most popular app among Roku users, demonstrating the company’s ability to drive traffic and monetize its platform even with more generic content.

Why Investors Are Pessimistic

Roku's financial struggles are rooted in its two main business segments: Platform Revenue and Devices Revenue. The platform side, which includes advertising and content distribution, is a high-margin business that accounts for most of Roku's income. However, the device segment—the physical hardware like streaming sticks and TVs—is a loss leader with negative gross margins. Roku sells these devices at a loss to grow its user base, which it then hopes to monetize on the more profitable platform side.

This strategy has been a major point of contention for investors. Roku has prioritized market share and user growth over profitability, and the company’s decision to venture into TV manufacturing with high input costs has made the device business even more unprofitable. Investors have questioned whether Roku can ever become consistently profitable if it continues to operate this way.

The company also faces intense competition. Giants like Amazon, Google, Apple, and Walmart all offer their own competing TV operating systems and devices. These competitors have powerful advantages, such as Amazon's control over device distribution through its retail marketplace and Walmart's ability to prioritize its own Vizio TVs in its stores. This creates significant headwinds for Roku, which lacks the same kind of powerful ecosystem or brand loyalty as its rivals. While Roku has held its position as the top TV OS in the U.S. for years, its ability to maintain this lead against such well-resourced competitors is a serious concern for the market.

Ultimately, while the market is focused on Roku’s unprofitability and competition, some optimists believe the company’s massive user base and dominant position as the primary touchpoint for millions of TV consumers present a significant, yet undervalued, opportunity.

To your success,

Thomas Moore

Disclosure: The author has no plans on being long Roku at this time. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Posted Using INLEO