In the quest to find 100 bagger stocks you must look at less known small capitalization stocks. These companies historically outperform their large capitalization peers because the small cap space is much less efficient with fewer analyst publishing research papers and fewer investors digging into the financials.

Examples of Small Caps turning into big winners

Pool Corporation ($POOL) traded at $0.92 in 1995 and is worth $307 today. Constellation Software ($CSU) traded at $18 in 2006 and is worth $4568 today (30,000% gain). Monster Beverage ($MNST) traded at $0.01 in 1996, became a 100 bagger in 10 years and has continued to gain value since.

Finding a 100 bagger is like Venture Capital investing. Out of a portfolio of 100 securities some will go bankrupt, some will break even, some will double or triple and the one lucky bet will increase by 100 times or more.

Six Secrets to 100 Baggers

- Small Cap is where competition is weak "To outperform the market, go where competition is weak." - Warren Buffett Size hurts performance since it is easier to increase value from $1 million market cap to $2 million verse $1 trillion to $2 trillion.

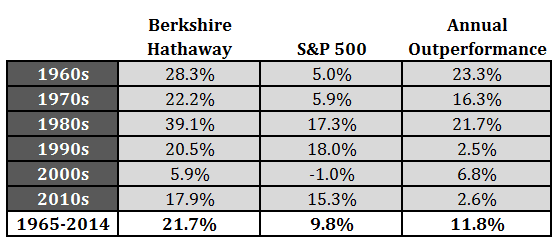

This is exemplified by looking at all the legendary money managers over time. They are on fire during their early career and as the assets under management increases they begin to perform just like an index fund.

Buffett is a primary example. As Berkshire Hathaway increase in market capitalization his outperformance verse the S&P500 decreased.

- Let your winners run Warren Buffett's two famous rules of investing are: Rule No. 1: Never lose money. and Rule No. 2: Never forget Rule No. 1

You must be like a gardener trimming the weeds (cut losses early) and letting the flowers bloom (let winners run).

- Small capitalization stocks outperform

Fama and French data indicates an average outperformance of about 2.85% per year since 1926.

Every small percentage outperformance over the long term leads to a large difference in wealth created due to the power of compound interest.

An investment of $1,000 in large-cap stocks, with an average growth rate of 10% Source: Ken French data library, in 1926 would be worth approximately $12 million today. An investment of $1,000 in small-cap stocks, with an average growth rate of 12.85% Source: Ken French data library, in 1926 would be worth approximately $157 million today.

The investment in small cap stocks would have provided 13x more money.

- Micro-cap Stocks

To boost the performance further you could invest in Micro-caps, although there is a much greater risk of investing in companies who go bankrupt at this stage.

Micro-cap have historically provided 3.2% return greater than Large-cap stocks. Source: Ken French data library

An investment of $1,000 in micro-cap stocks, with an average growth rate of 13.2% Source: Ken French data library, in 1926 would be worth approximately $214 million today.

- Quality small-caps

Within the small-cap universe, a focus on quality stocks leads to further improvement. Quality stocks are companies with strong fundamentals and a history of stable, consistent performance.

- 100 Bagger screen

Market Capitalization less than $3 billion. Healthy balance sheet: Low debt High insider ownership High profitability ROIC greater than 15% Revenue & EPS growth greater than 10% Lower the share dilution the better Company should have plenty of opportunities to reinvest profits Low valuation: low starting PE ratio (you want to see faster EPS growth and a rising PE ratio during ownership) Owner Operators: If the founder is still involved in day to day operations then they will have a long term mindset which compounds over time verse the short term thinking of most companies trying to beat the quarterly numbers.

To your success,

Thomas Moore

Disclosure: The author has no plans on being long any mentioned company at this time. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Posted Using INLEO