Universal Music Group (UMG) owns an estimated one-third of the world's music catalog, including the masters and publishing rights for top artists past and present like Taylor Swift, Drake, The Beatles, and Queen. The company is a high-quality, stable business that resembles a regulated utility but without the regulatory cap on growth. The company converts a significant 85% of operating profits into free cash flow and benefits from a consistent, growing income stream from global music consumption.

Universal Music Group (UMG) owns an estimated one-third of the world's music catalog, including the masters and publishing rights for top artists past and present like Taylor Swift, Drake, The Beatles, and Queen. The company is a high-quality, stable business that resembles a regulated utility but without the regulatory cap on growth. The company converts a significant 85% of operating profits into free cash flow and benefits from a consistent, growing income stream from global music consumption.

UMG's Passive and Powerful Business Model

UMG's core strength lies in its capital-light business model. It doesn't bear the infrastructure costs of streaming and instead it uses platforms like Spotify, YouTube, and Apple Music. UMG simply licenses the music masters and collects royalties. Given that the global average person spends over 18% of their waking hours listening to music, this is an incredibly reliable and scalable revenue source.

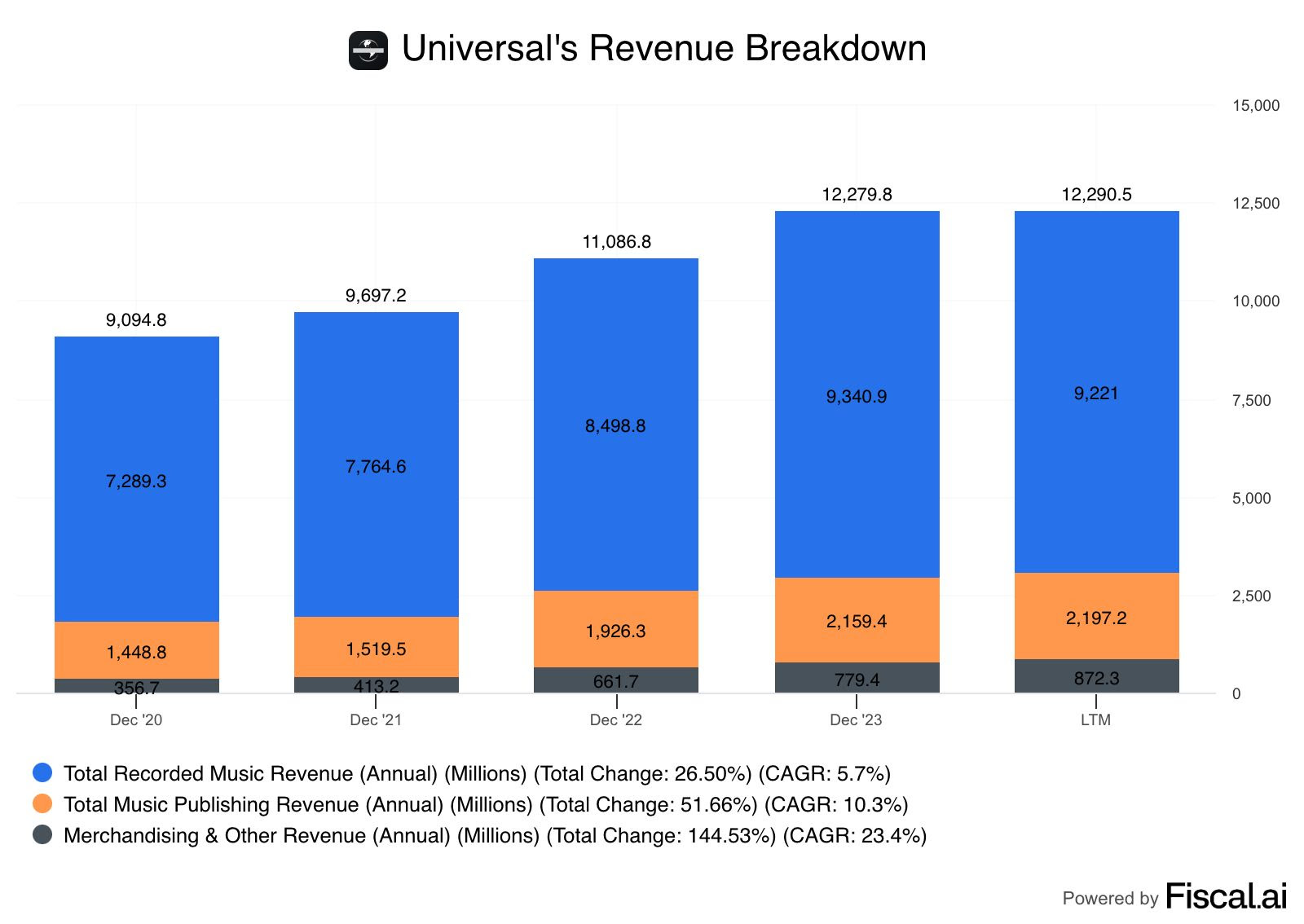

The company's revenue comes from three main pillars:

-

Recorded Music (approx. 80% of sales): UMG owns the master recordings. Every stream, download, or physical sale generates revenue, which is split with the artist after the company recoups its initial investment. Since the marginal cost of an additional stream is nearly zero, this is highly profitable.

-

Music Publishing (approx. 18% of revenue): This covers the compositional rights (lyrics, melody, sheet music). UMG collects royalties when a song is covered, remixed, broadcast on radio/TV, or performed at live concerts, providing an inflation-linked revenue stream that can last decades.

-

Merch: A small but growing part of the business, primarily through its Bravado segment, which sells apparel, special-edition vinyl, and organizes experiential fan events. This allows UMG to monetize superfans more deeply.

Strategic Moat and Industry Dynamics

UMG’s century-long lineage (starting with Decca Records in the 1930s) and subsequent mergers solidified its dominant position. It stood strong during the Napster era and bet on digital distribution, ultimately becoming the largest player in an oligopoly (alongside Sony and Warner Music Group) that controls 98% of the top 1,000 singles.

This scale creates a wide moat:

-

Negotiating Leverage: UMG's catalog is essential. The brief takedown of UMG music from TikTok in 2024 proved that platforms need Universal's music more than Universal needs any single platform. This gives UMG significant power in licensing negotiations with Big Tech, streaming platforms, and other licensees.

-

Artist Value Proposition: UMG creates value for artists by running the "business" of stardom—funding recordings, marketing, brand building, collecting complex royalties, and planning tours. By taking on the upfront financial risk and providing these services, UMG justifies its substantial cut of lifetime royalties.

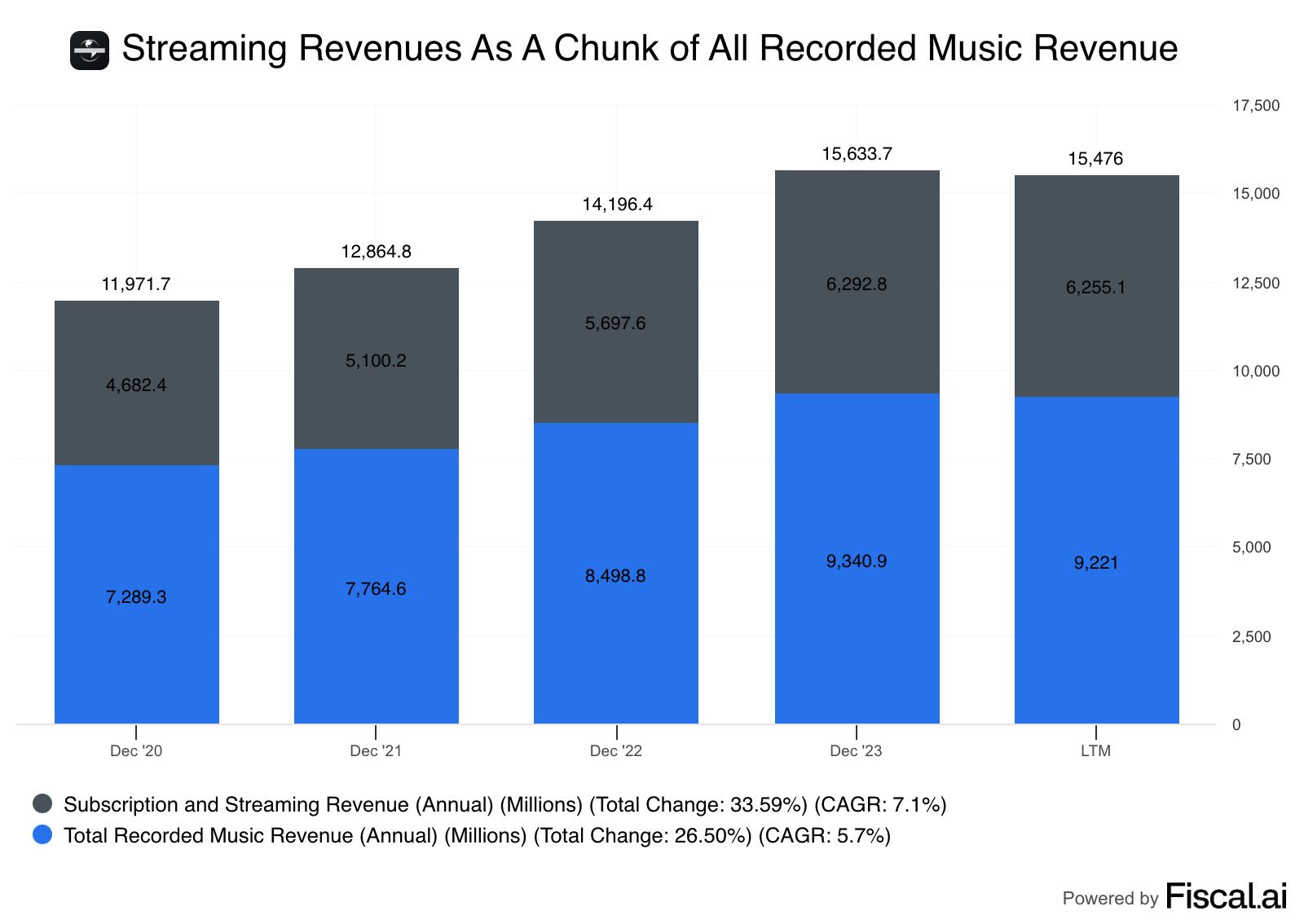

The rise of streaming has been a significant tailwind, flattening revenue from spiky album cycles into a consistent annuity. Revenues from streaming now comprise over two-thirds of UMG's total sales. Furthermore, 70% of all music streams are over 18 months old, showing that social media and streaming algorithms act as free marketing, constantly driving dormant IP back into heavy rotation.

Financial Profile and Valuation

As a publicly traded company since 2021, UMG is still in the early stages of life as an independent compounder. In the most recent year, UMG generated nearly $12.3 billion in revenue and a 16.4% operating margin, with a 46% average return on equity over the last five years.

The company is committed to returning capital, paying out at least 50% of adjusted earnings annually as a dividend, which provides a current yield of over 2% and is effectively indexed to earnings growth.

While the stock is not cheap, I consider the valuation very reasonable with an expected annual total shareholder return of 7-9%. The thesis is that UMG is a low-risk, bond-like bet on a globally growing royalty stream. The predictable and increasing global demand for music—driven by rising paid streaming penetration in developing markets and increasing subscription prices—makes UMG a stable and reliable holding, even if it is not expected to be a multi-bagger. You should consider adding this to your stock portfolio as a way to reduce risk from your more volatile companies.

To your success,

Thomas Moore

Disclosure: The author has no plans on being long UMG at this time. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Posted Using INLEO