Week 28 (Week ending July 12) - Investment Update

- Options / Dividend (Week 28)

- July 401K/brokeragelink update (returns since 2023 - 137K+)

- New Buys over the last few weeks

- Plan for the rest of 2025??

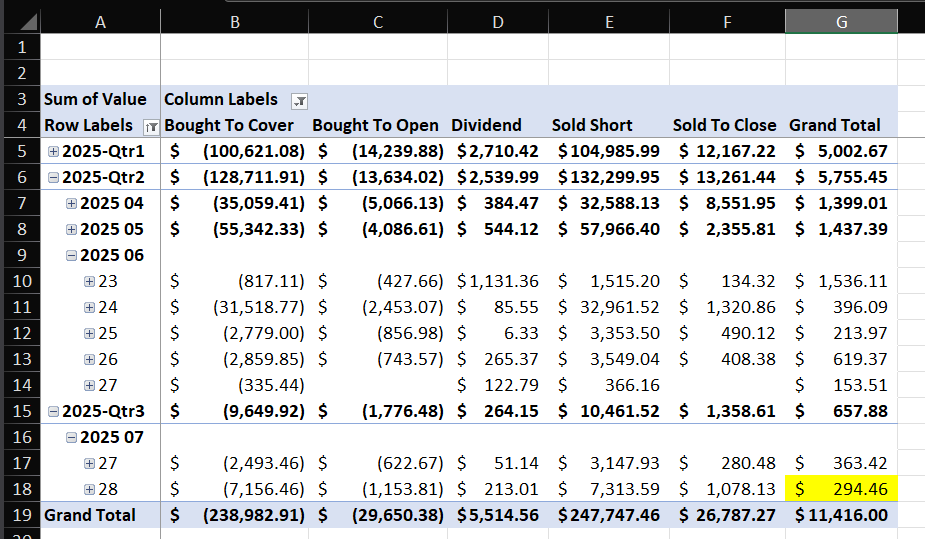

Options / Dividend (Week 28)

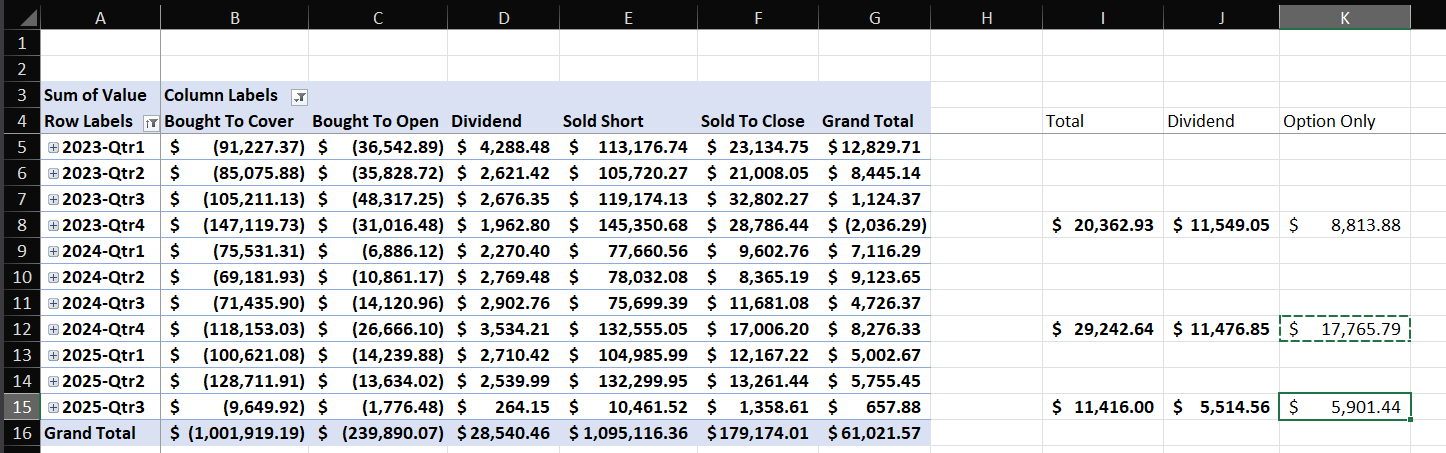

Q3 is off to a slow start (Week 27/28). I got $264 from #dividends and less than $400 in profit from #options trading. The beauty of TRACKING data over a long period, the trend will be "smoothed" out naturally. The highs and lows are less important, and the average is what counts.

Making 20% in one trade or losing $2K in a bad trade can be an emotional rollercoaster. When I zoom out and look at the trade data for the yearly patterns, that tells a better story:

One thing you will notice is that the dividend is NOT growing. Normally, the dividend payment will grow because of dividend increases and because of DIVIDEND #reinvestments. I have been "selling" off the shares because I wanted to add more #RISK to my portfolio.

Option trading is mostly to "reduce" risk by using covered calls for #income, and some protective puts (or using puts) to offset the covered calls.

I'm 100% long in my 401K. Zero Bond in 401k. I'm 100% long in my IRA/Roth IRA.

Options can be used for many reasons, and in flat or DOWN markets, my portfolio goes down. So I designed this to try to generate income in all conditions, so I can use that "income" to buy stock all the time.

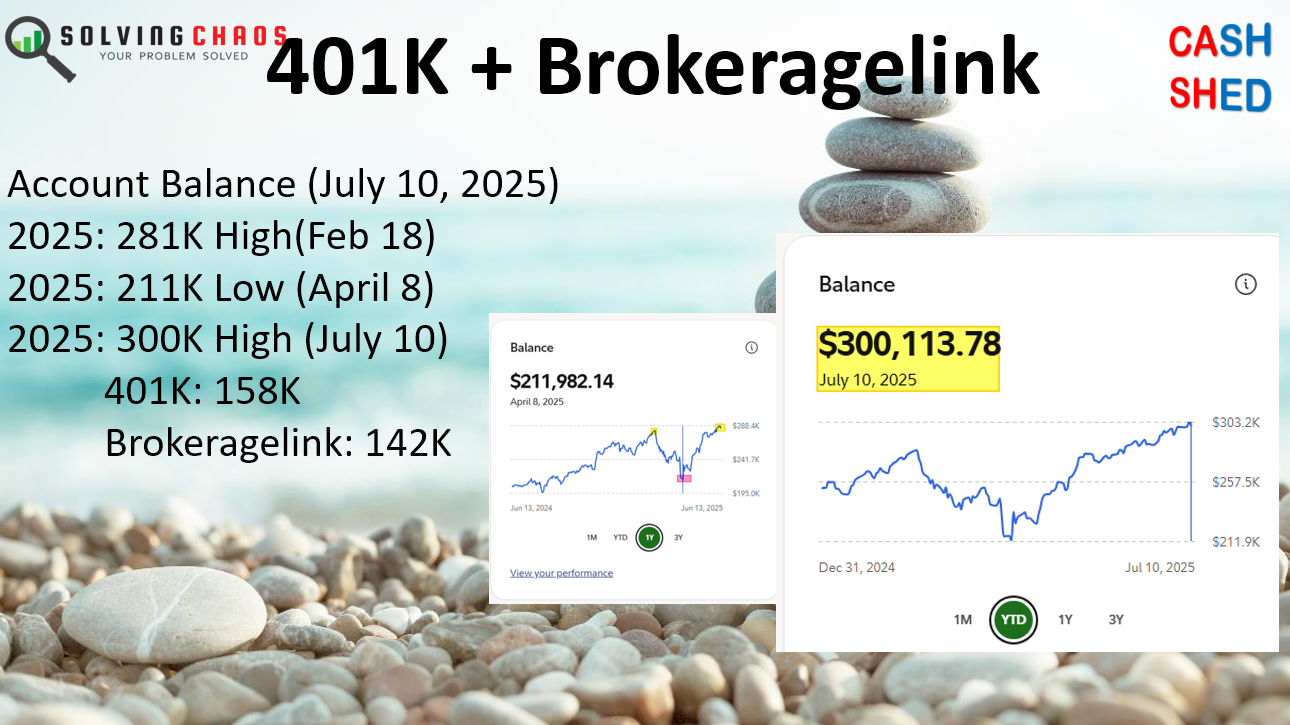

July 401K update

Here is what I created on July 11.

My 401K value is hitting new highs. My brokeragelink account is hitting new highs. The recent lows were on April 8 when this was worth $211K, or down 70K in a few weeks.

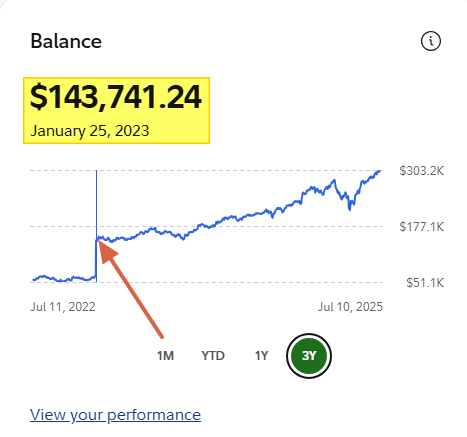

What folks don't know is this was only $143K on Jan 2023. I only add about 6K-8K a year into my 401K. Meaning that I only added about 20K of new cash since January 2023.

143K (starting value in Jan 2023) 20K (new 401K cash added from 2023-2025) 300K (July 10, 2025) Meaning 300K-163K= 137K profit from market growth.

Since February 2025, I added Option trading to my brokeragelink account. I would only expect to make about 2K a year in this account.

New Buys over the last few weeks

What am I buying in my portfolios?

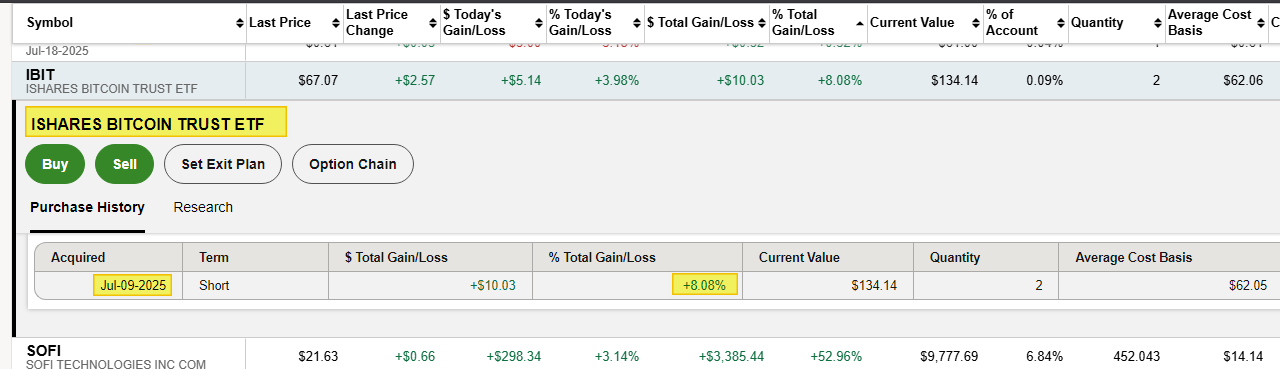

I've been buying #Bitcoin Spot ETF for the last 18 months now. In my brokeragelink account, I am using option income to buy IBIT.

In my other portfolio that I share on social media (last 5 years):

This portfolio uses the "dividends" paid, and I sell that and use the CASH to buy other stocks. That what I tag as a pair trade (the selling of one stock and buying of another replacement stock).

Plan for the rest of 2025??

- 401K continues to buy Large cap ETF.

- IRA - Use dividends to buy QQQM, IBIT, BITO, CAVA, etc.

- Sell dividends over the next 2-5 years, complete rebalancing.

- Brokeragelink - Use Option income to buy IBIT only.

- Start researching what to buy for 2026.

- 2021: PLTR (Palatir), AXON (Taser Maker)

- 2022: NET (Cloudfare), SOFI (FinTech)

- 2023: RIOT, MARA (Bitcoin Mining), JEPI (Testing Income)

- 2024: Bitcoin ETF, BYRN (pepper gun)

- 2025: WING (Wingstop), CAVA

- Consider selling off Banks, Healthcare stocks.

Have a profitable day, Solving Chaos