ETH vs BTC - Aug 13

- Bold statement from Tom Lee (Fundstrat)

- How to play this?

- Option Trades for 8/13 (as of 10:45 am EST)

Bold statement from Tom Lee (Fundstrat)

Tom's making bold statements, and let's see how this prediction plays out.

ETH to 10K or 12K or even 16K is not exciting news for those who follow BTC. Why? ETH has underperformed for so many years that even with the recent run-up, it is still not in the same "LAP" as Bitcoin. Yes, Bitcoin has "run laps around" the second or third best.

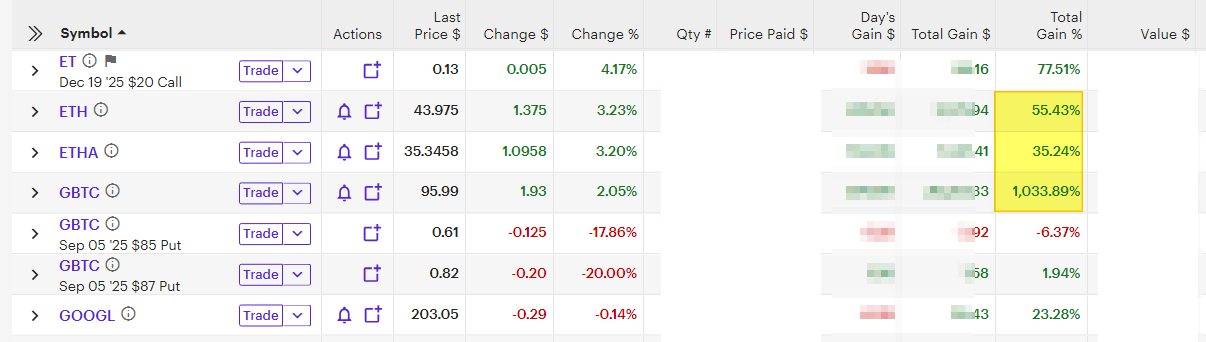

In my portfolio, GBTC has 10x while ETH is far behind.

How to play this?

First, do not sell #BTC or anything that is a BTC proxy. If you have to sell other assets to get into ETH, then do that. ETH could return more than 10% a year, so selling an asset that is "dead money" is a good risk/reward to take on. - Add ETH directly via exchange and move it into a wallet. - Add #BMNR. If you believe in the leverage treasury play. - Add spot ETF (like #ETH or #ETHA) if you have a brokerage account.

In a race, there can be multiple winners. It's not an "either or" but you can own BOTH. The question is, will ETHER finally move up faster than BTC, or will BTC stay in the lead? This is what we will be tracking going forward.

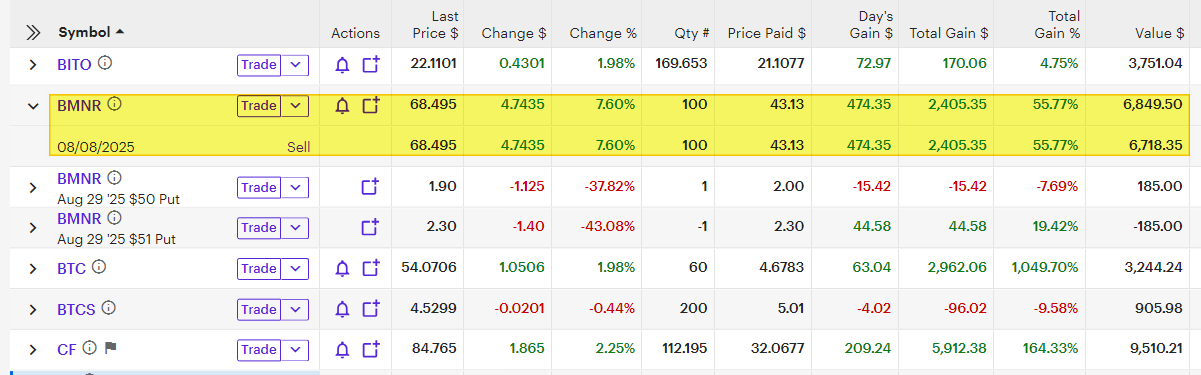

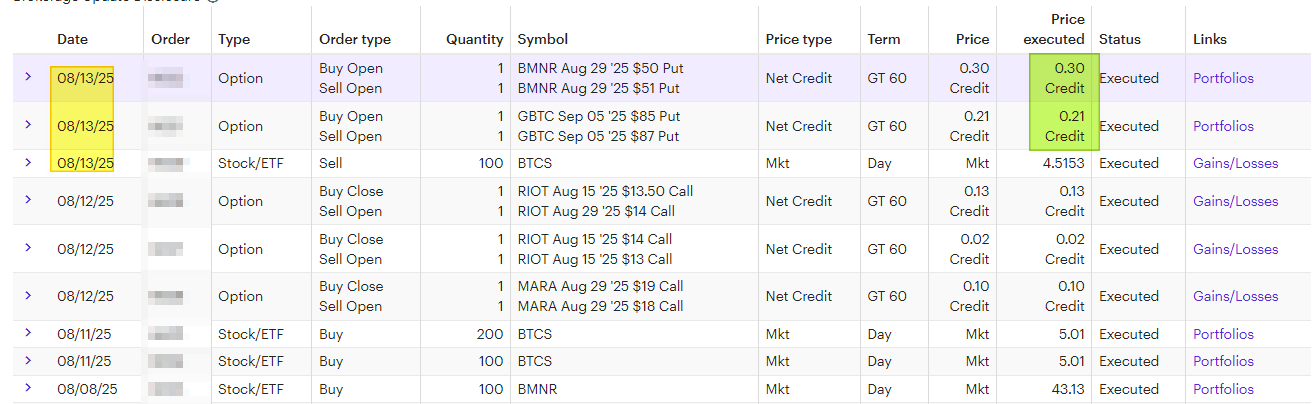

I added #BMNR last week on 8/8 and already up 56% so far. If this can follow #MSTR, then the return of 10x-30x is what it will be measured against. If we are early, this small investment will continue to grow.

Bonus Tip: Dividend Stocks.

If you don't want to sell your dividend stocks, you can wait until ex-dividend and then sell off enough shares that represent the dividend that is coming in. This works fine if you have hundreds or thousands of shares in a company. I have been selling off FORD shares (and a bunch of other holdings) and moving that money into QQQ, WING, CAVA, and IBIT.

Option Trades for 8/13 (as of 10:45 am EST)

Here are my trades:

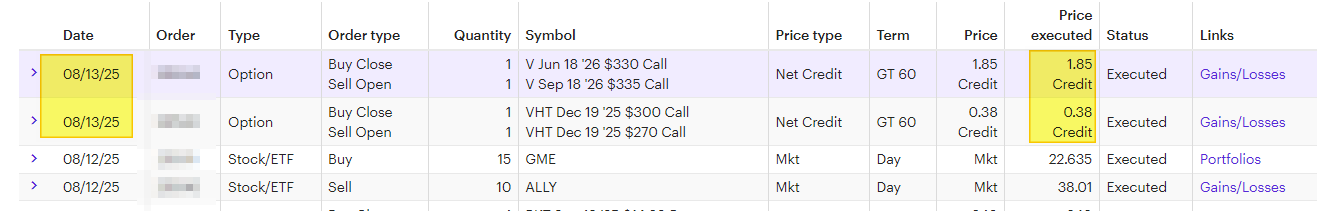

Selling ALLY shares to get into GME (that was yesterday trades)

Rolled up a Visa Covered call by $5 strike price and added 3 months. I got $185 today for that adjustment.

Rolled down VHT covered call (adding RISK) into the trade by lowering the STRIKE price to $270. I got $38 today for that adjustment.

And:

Added some put credit spread to try to make some income while letting those positions continue to RUN upward.

Have a profitable day!

Posted Using INLEO