Ford Ex-Dividend (Aug 11)

- What is the Ex-Dividend date

- Aug 11, 2025 (Week 33) Investment Moves

- My thoughts for Aug 11 / BTCS / BMNR

What is the Ex-Dividend date?

Why does it matter?

If I sold my Ford shares on Friday, the new owner of the Ford shares would get the dividend. Selling today, I got more money for my Ford Shares (since it a green for FORD) and I'm entitled to the dividend.

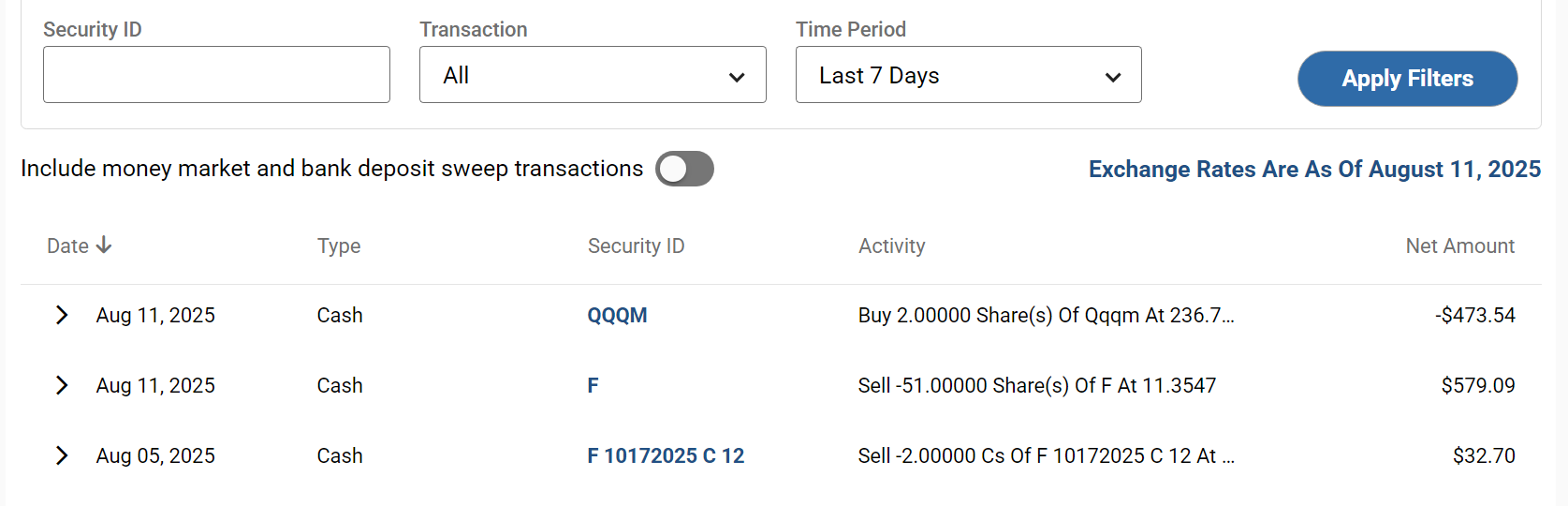

Here is what I did with the cash:

Sold 50 shares of Ford today, got $579.

Use $473 to buy 2 shares of QQQM.

I will still get the dividend for those 50 shares in 3 weeks (or so).

Aug 11, 2025 (Week 33) Investment Moves

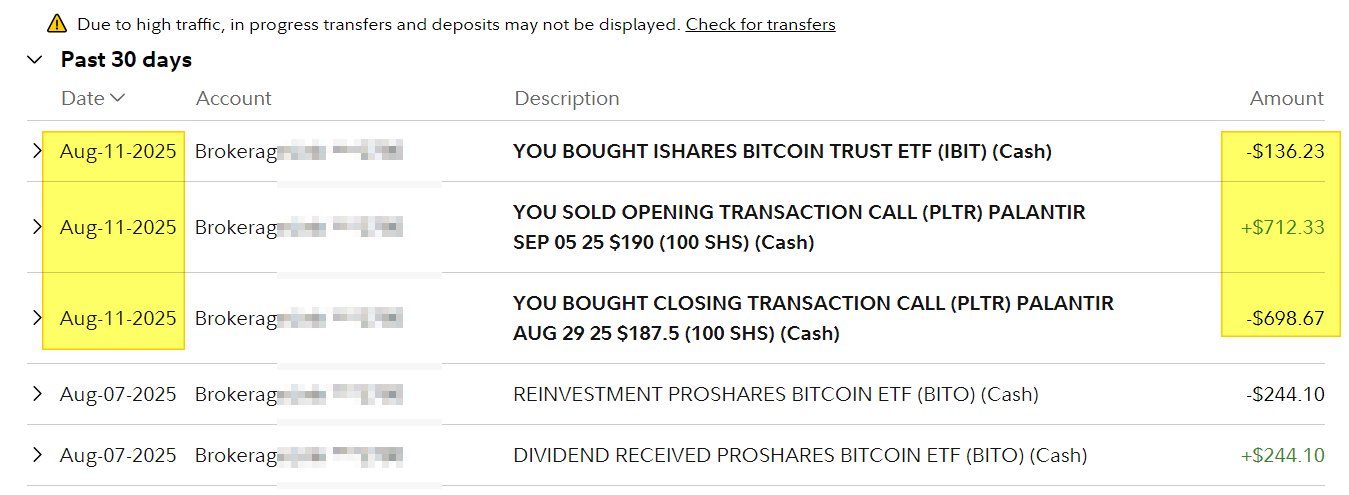

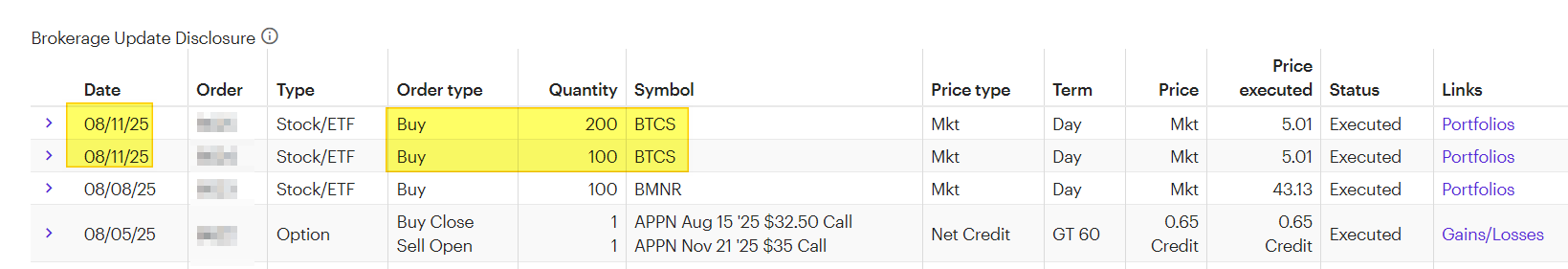

Here is the confirmation from the brokerage accounts:

I rolled my PLTR covered call UP and OUT. This portfolio has made about 600 in premium in the last 2 weeks or 3 weeks. I used $136 to buy 2 more shares of IBIT in this portfolio.

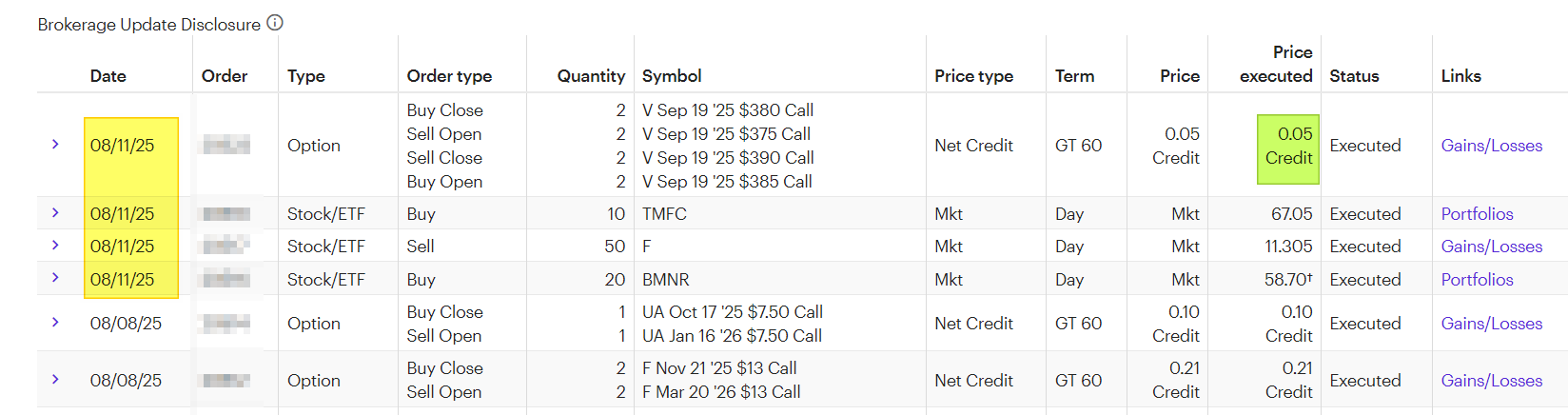

In a different portfolio:

I sold more Ford Shares and used the cash to buy into TMFC. I also added more RISK into the Call side of the Iron Condor for Visa (Sept 19), collecting $4 in premium.

My thoughts for Aug 11

The dividend move is well documented over the last year. I've been doing a portfolio rebalancing, mostly moving away from owning MORE dividend shares and using that CASH to get more GROWTH assets. Today is a clear example of me selling FORD shares since I will get more when the actual Dividend is paid out. I use that CASH to buy IBIT and QQQM, as you can see from two of my portfolios.

In the options world, PLTR is still moving up, and I needed to roll my covered call up in strike price. I will continue to do that as long as I can. I only have a few OPTION positions that expire this FRIDAY, and I will adjust those later this week.

The last thing was adding more positions that will capture the move in ETHER prices. I talked about this on Friday, and I will continue to play this trend. I added another much smaller play "BTCS" into the mix. They have been in the space for over a decade, and they are also calling themselves the Ether Treasuries company. However, they are not as FAMOUS as Tom Lee, and that is why BMNR is getting lots of attention. This is like MSTR with Saylor, and the rest of the industry stock lag behind. As an investor, I need to spread my bets out.

Have a profitable day!

Posted Using INLEO