Millionaire on $10 a day - Yes

- Millionaire on $10 a day - Yes, here the math

- Millionaire on $20 a day - or started on the path

- What I'm doing personally A. 401K B. Dividend C. Options Trading D. Pokemon

Millionaire on $10 a day - Yes, here the math

This post is based on the Motley Fool Article written on Aug 17, 2025, of a similar title. https://www.fool.com/retirement/2025/08/17/can-you-retire-millionaire-investing-just-10-a-day/

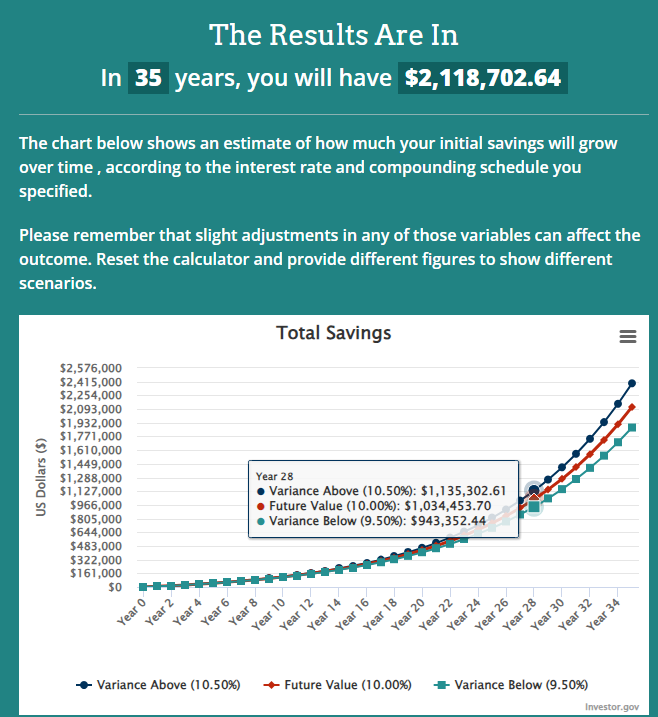

It first asks if you could be a millionaire if you only saved $10 a day. The answer is #YES! In this example, we will start with ZERO dollars and assume you can stick to this PLAN without changing any of the assumptions. - $3650 a year ($10 a day) - Assuming 10% returns (on average). - 35 years of saving $10 a day plus the "compounding".

Millionaire on $20 a day - or started on the path

If you are not starting with zero, or if you can save $20 a day ($7K a year), what would that look like? Simple math will tell you that your answer should be DOUBLE if you are using the same PARAMETER (time and Return rate).

To double-check, I used an online calculator:

We know that if you double the amount, the value at the end would be DOUBLE. But does the time to reach a million dollars get cut in HALF?

No, it does not take 18 years (half of 35 years), but rather it is more likely to be 28 years! The reason is how compounding works.

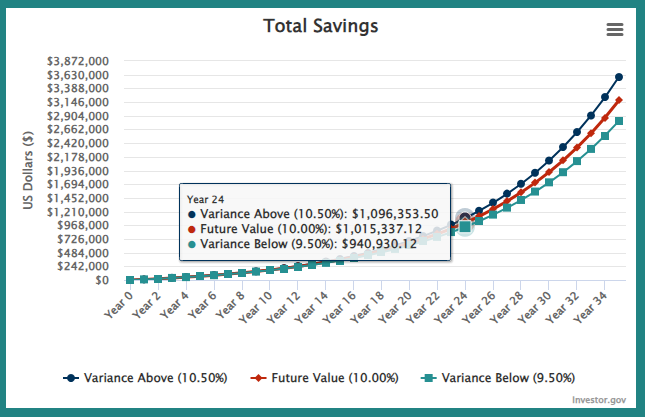

For fun, what if we saved $30 a day? What would that look like?

It would take 24 years at $30 a day, only saving 4 years from $20 a day, and saving 11 years from $10 a day.

It would take 24 years at $30 a day, only saving 4 years from $20 a day, and saving 11 years from $10 a day.

Since you can't cut corners on time, and if 35, 28, or 24 is too slow, then you need to increase the SIZE of investments or the ROI you get on your assets.

What I'm doing personally

Now that you see the data, let me explain what I'm doing. - A. 401K (new capital added with each paycheck) - B. Dividends Investing. - C. Option Trading (Covered Call, Iron Condors, etc). - D. Pokémon. - E. Portfolio Assets / Returns.

401K (new capital added with each paycheck)

Over the last 10 years, I saved between 5K-7K in my 401K. My salary is variable and goes up and down, so it's harder to predict than for most employees with a 401K plan. Therefore, my free MATCH is between 2K-4K a year. If we assume the low end with the matching FUND (5K + 2K = 7K), that puts me into the $20 a day prediction MODEL. 401K investments are limited, so I pick something that will mirror the S&P 500.

That means I will hit $2M in 35 years or $1M in 28 years if I had zero today.

Dividends Investing

On my social media post for the last 5 years, I have described my dividend portfolio makes about $12K a year (or 1K a month). That is not enough for me to retire, nowhere CLOSE to it. I would need to make 10x more from DIVIDEND, but that is NOT possible when saving 5K a year. Others on the INTERNET that make 100K-300K a year on dividends were PEOPLE who often make a huge salary and can save 30K-50K a year, or they had stock options that sped up the process. The average American has a hard time saving $4K a year.

In many of my posts around DIVIDENDS, I have suggested that I own stable companies that are in the S&P 500 index. However, making 1%-4% yields on dividends will NOT make me rich. I own Visa, which is a great Dividend Growth Income stock, but that is nowhere near what Nvidia, AMD, or Microsoft produced in the last 5 or 10 years.

You will notice the history of "selling" dividend companies and buying more GROWTH or higher risk assets. The goal was to target investments that will make 11% or more per year. This brings me back to VISA. Visa is growing at over 11% a year, but I use that money to bet on Bitcoin/Ether.

My dividend method is acting like a $30/day income, which I used to ONLY buy things that are riskier than the ASSETS that produced the dividends. This adds a bit more risk than the 401K method, but it works well together.

That means I will hit $3M in 35 years or $1M in 24 years from the new investments I'm making (if I get 10% a year). This portfolio is designed to be much more risky than the 401K investment choices. Bitcoin and ETHER are expected to return over 20% ARR over the next 20 years. Nasdaq 100 should continue to outperform the SP500.

Option Trading (Covered Call, Iron Condors, etc).

For all the Traders out there, I have tracked all my trades and shared them on social media for the last 5 years. I'm doing lots of OPTION trading and I have been profitable each year. My average is about 7K a year from Option trading.

If I did nothing else and kept on trading, this acts like another $20 a day into my portfolio. That means I will hit $2M in 35 years or $1M in 28 years in value from my trading profits.

Now, let's step back a bit and understand what this means. I will need to buy more assets with the profit. I need to try to get to 100 shares, so I can write a Covered Call on that asset. These can be DIVIDEND stocks or non-dividend stocks that I like to add to my portfolio. The key here is the OPTION premium that I can collect.

The second area is adjusting my RISK level from Options. I currently trade using .10 or LESS Delta when selling OPTIONS. That means I win 90% of my trades, but I make LESS dollars per OPTION trade because of the safe BET. I need to move up to around .15 DELTA (or between .10 go .20). That is my GOAL for 2026, to add a bit more RISK, and I would expect my OPTION trading to generate about 10K a year going forward.

Pokemon

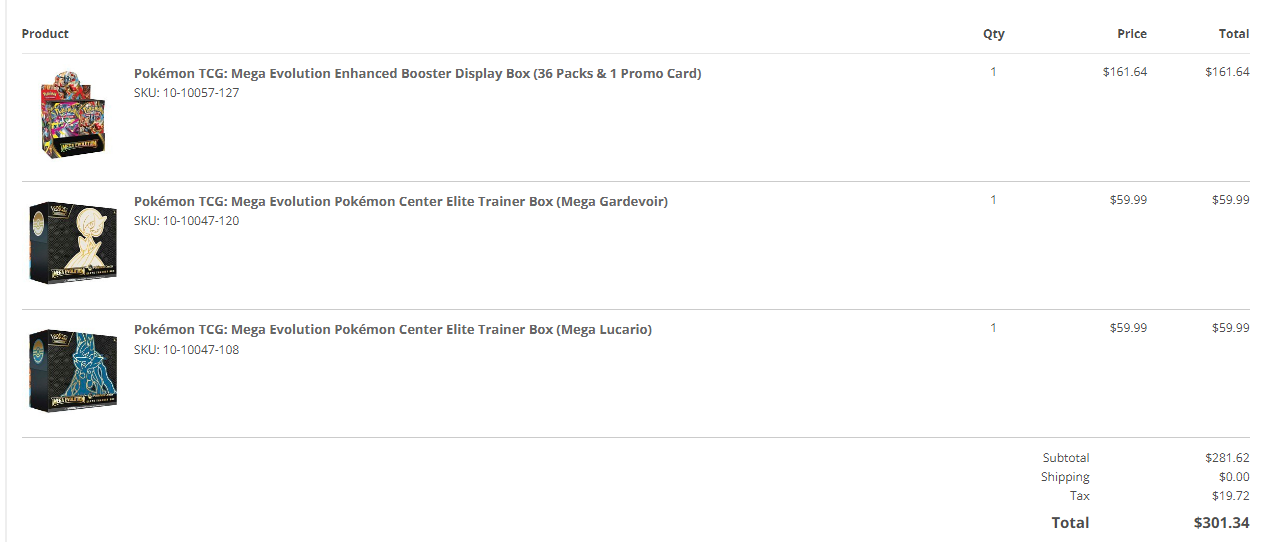

Collecting Pokémon is more of a hobby for me since I'm still focused on Option Trading and other investments. Pokémon shares some of the same things I used, which is to buy and hold assets for multiple years or longer. There is something fun about buying an ITEM at Target for MSRP and knowing that it is worth more than that on the open market.

Getting exclusive items from the Pokémon Center is one way to get stuff at MSRP, and it's over worth 2x in pre-order (eBay) before the items are released. That is part of the fun/or frustration. But knowing that it is possible to do without a special skill is what draws lots of people into the hobby.

The hobby has a natural market cycle just like the stock market. When everyone makes money, everyone is happy. When the market is impossible to FLIP the products, then it is much harder to survive. This is no different from a real estate FLIPPER that buys a 200K property, which he needs to sell for 320K or more. Selling at 250K-280K is a loss when you factor in the REPAIR of 50k-80K, the carrying cost, the commission, and real estate fees.

Because this is a hobby for me, I'm not buying #CASES of anything. I'm just a casual collector for now. Will this change? Not sure. I can switch into an #INVESTOR from a #collector if I can make 20% ARR without too much work.

Portfolio Assets / Returns

Finally, let's talk about assets/investments and returns. The key here is to use a low-cost ETF like the SP500 or the Nasdaq 100. This is a good baseline to make 10% a year over the next 30 years. The Nasdaq-100 (#QQQM) is a better choice for those who can handle the extra risk and has beaten the SP500 over the last 20 years.

Bitcoin has returned over 50% ARR, and is expected to return over 25% ARR over the next 20 years. #MSTR has returned 30x in the last 5 years, more than #NVDA.

The key here is to understand how risk/reward should be used. There is nothing wrong with owning dividends, but if you have too many, it will DRAG your overall returns much lower.

Have a profitable day! Solving-Chaos

Posted Using INLEO