Nov 6 - Palantir/AMD/Nvidia and my investment moves - AI bubble/correction - Options on PLTR - Nov 6 Options trades

AI bubble/correction

On Nov 4, news hit the wire that Mike Burry is shorting some AI names.

You can read the story here.

This news impacted the AI, Chip, and other related industries.

What does this mean for me?

If you’re a long-term investor in Palantir or Nvidia, you may not need to take any immediate action. Many Nvidia shareholders have already seen extraordinary gains — ranging from 500% to as much as 2,000%–5,000% — simply by holding their positions over time.

Additionally, I frequently use options, such as covered calls or Put credit spreads, to "reduce" the overall risk of my core underlying position.

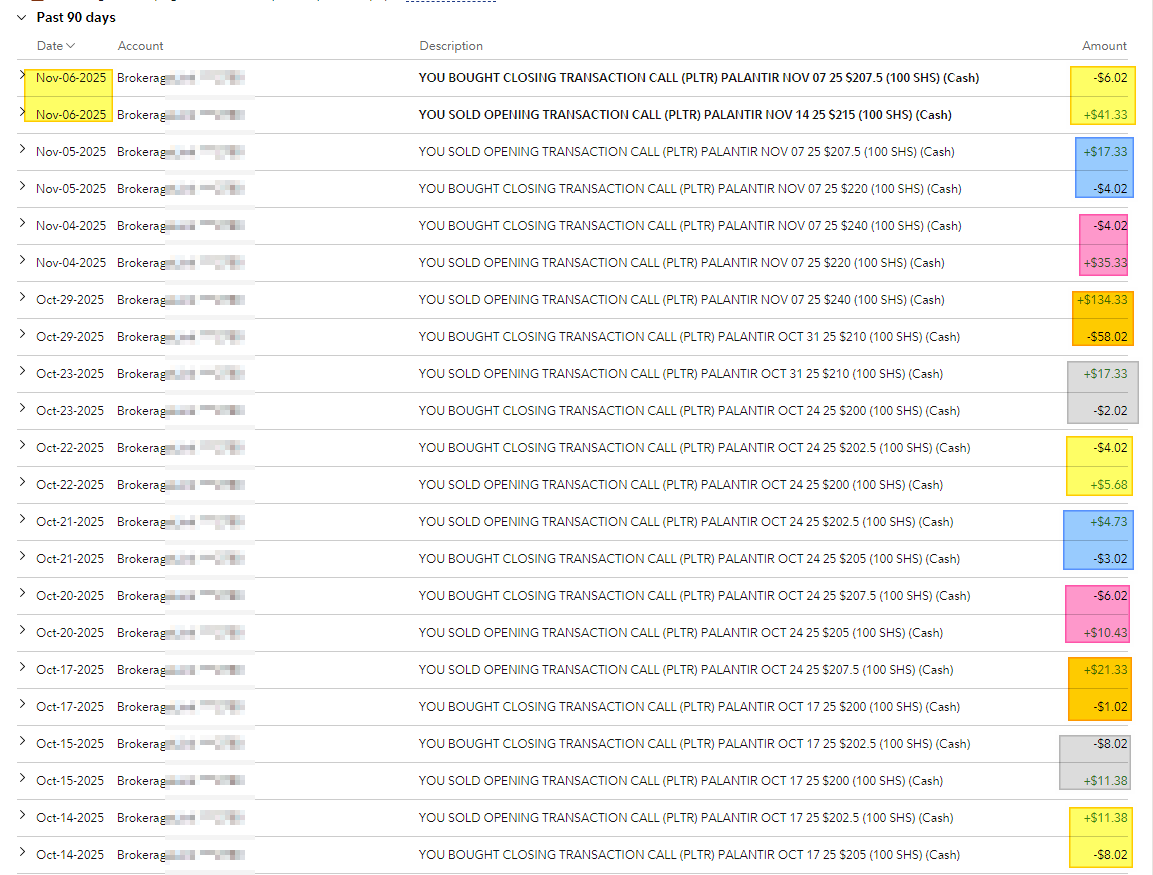

Options on PLTR

If you look at my trading history on Palantir Covered calls, you can see I have been making money on it. I welcome the "correction" since I prefer a slow and steady move upward, which makes covered calls more profitable over that period of time.

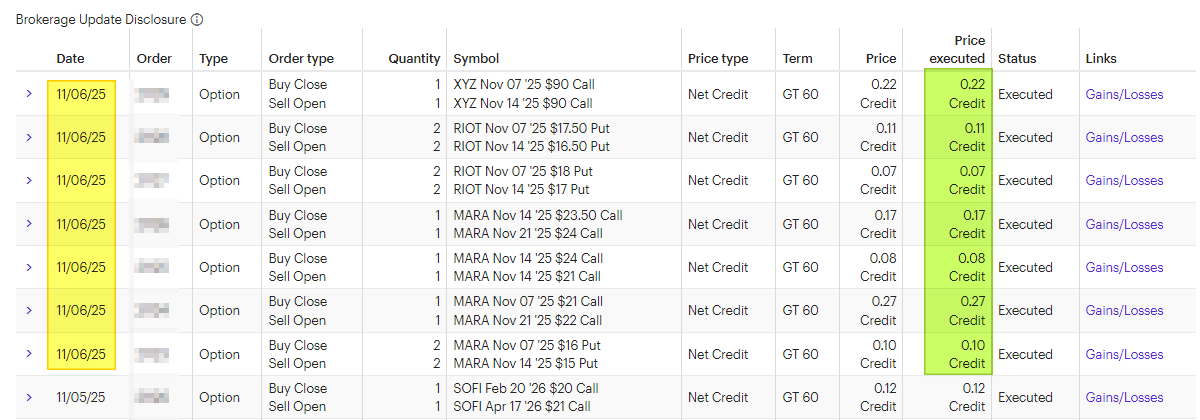

Nov 6 Options trades

Here are my trades for today:

Adjusting positions, mostly moving covered calls and cash-secured puts.

On my AMD, I still need to: - Roll my covered call up since they are ITM. - Use other AMD options to make money for covered calls adjustments.

On my NVDA, I will HOLD the stock.

On my PLTR, I will need to: - Hold the stock. - Used Covered call for income, but being cautious on the delta since it can have a bounce back or a big move up any day.

On my Visa, I will need to: - Use a short date Iron Condor for income. - Use profit from other Visa trades to pay for the ITM covered call that needs to be rolled UP and OUT. - Hold the stock, but sell off the dividends if the stock is above $300.

On BTC/ETH proxy: - Add more IBIT, BITO, and other holdings. - Adjust covered call up. - need to use cash from other trades to move the strike price up faster to the market price.

Have a profitable day!