Sept 23, 2025 Investment moves

- Market Conditions

- Week 39 Dividends

- Sept 23 Option Trades

- Portfolio Rebalance Update (Sept 2025)

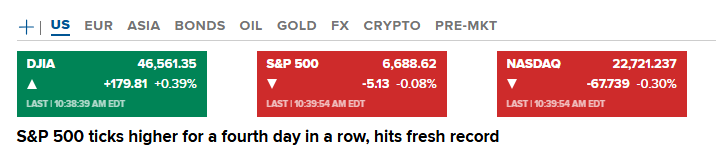

Market Conditions

Markets are at all-time highs.

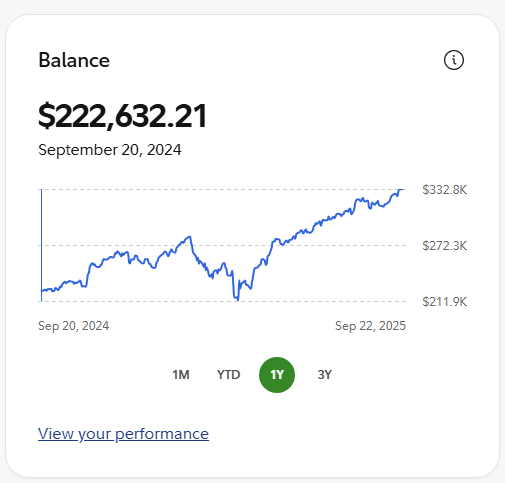

Here is a view of my portfolio growing from 222K (Sept 2024) to over 330K (Now), while only adding in about 8K of new cash (401K contribution) over that time.

The larger your portfolio, the greater the size of "unrealized gains" you will see in your account. This is why I continue to invest

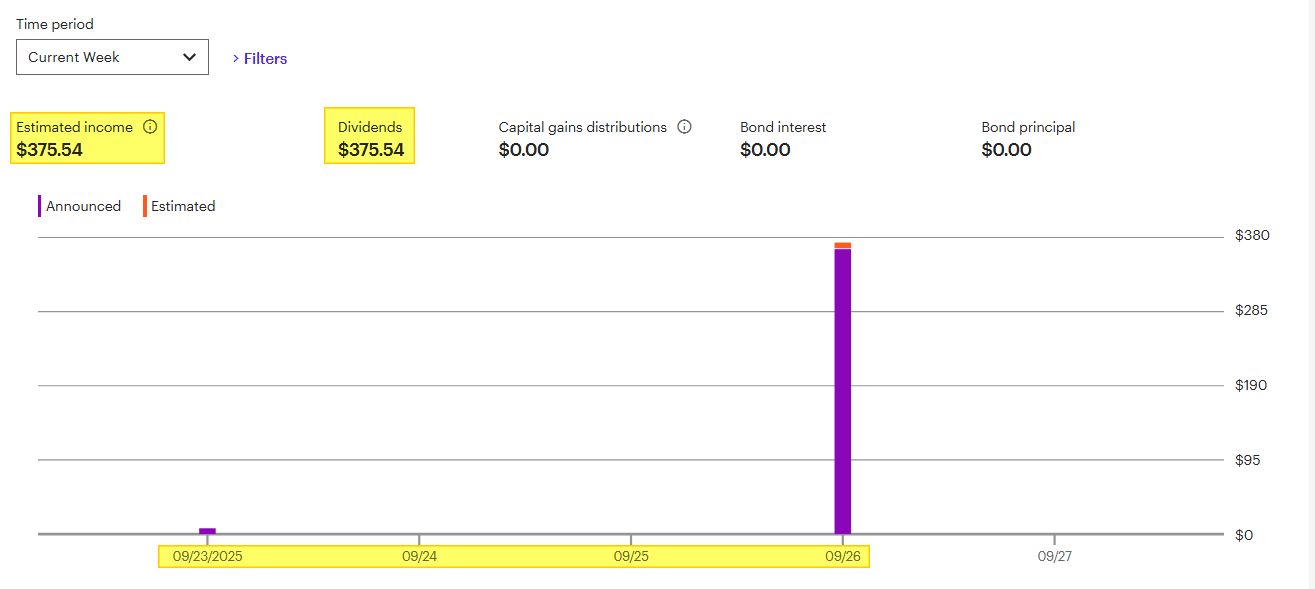

Week 39 Dividends

This week's dividend is over $370, which is often "close" to what some folks save/invest per month. I have plenty of friends who invest about $500 a month (or $ 6,000 a year). So, the dividends added to my portfolio give me plenty of ability to buy new holdings or add to existing positions.

Will I sell more Boring stock this week? As of right now, I don't have plans to do so, but let's see what happens. I might wait until next week to make a move.

Sept 23 Option Trades

Here are the adjustments that I'm making today. Most of my covered calls around Bitcoin Proxy had to be adjusted upwards since the Bitcoin Mining stock has been moving up over the last 2 weeks. I'm ITM on many of those Covered calls, and they needed to be rolled up and out.

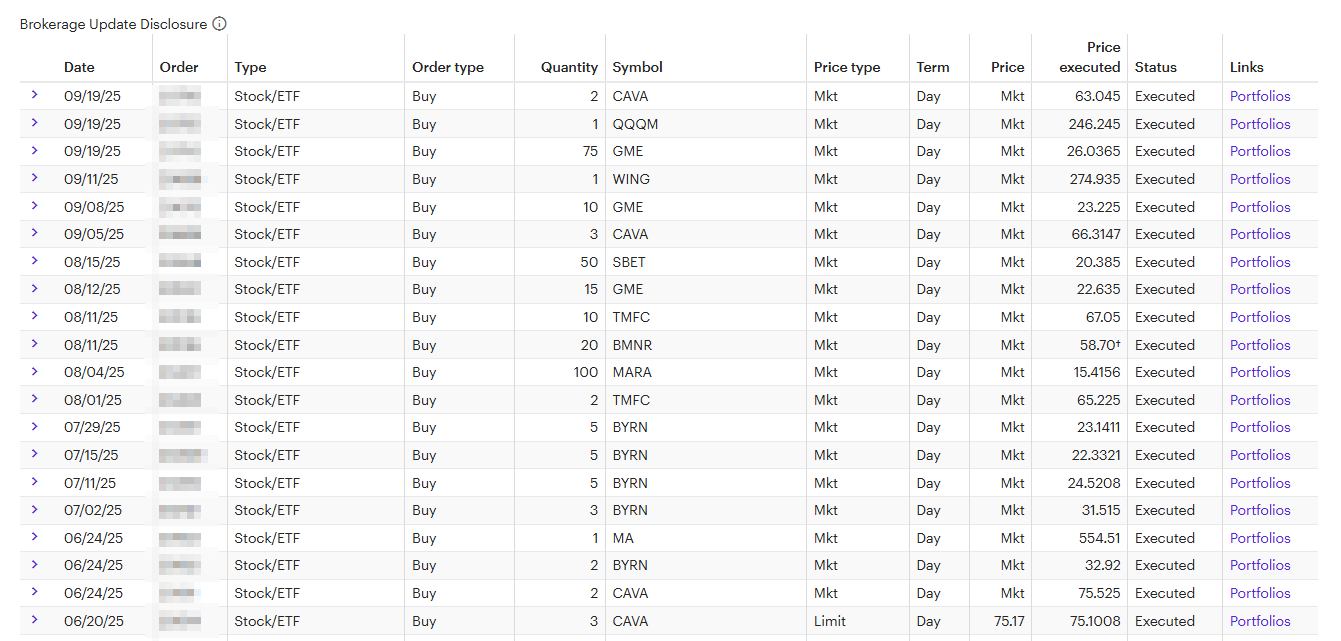

Portfolio Rebalance Update (Sept 2025)

I'm still using dividends received as a source of cash to invest into new shares of: - IBIT / MARA (Bitcoin exposure) --> est 25% ROI per year. - SBET/ BMNR (Ether Treasury) --> est 25% ROI per year. - QQQM / TMFC (AI/Tech/Mag 7/10 Titans) --> est 13% ROI per year. - GME (Gamestop) --> stock should be trading between $30-40. - CAVA/Wingstop --> looking for the next CHIPOTLE stock.

These purchases are only from SELLING my dividends!! I am selling VISA, RTX, GILD, and a bunch of other companies.

Having a profitable day!