Hi Everyone,

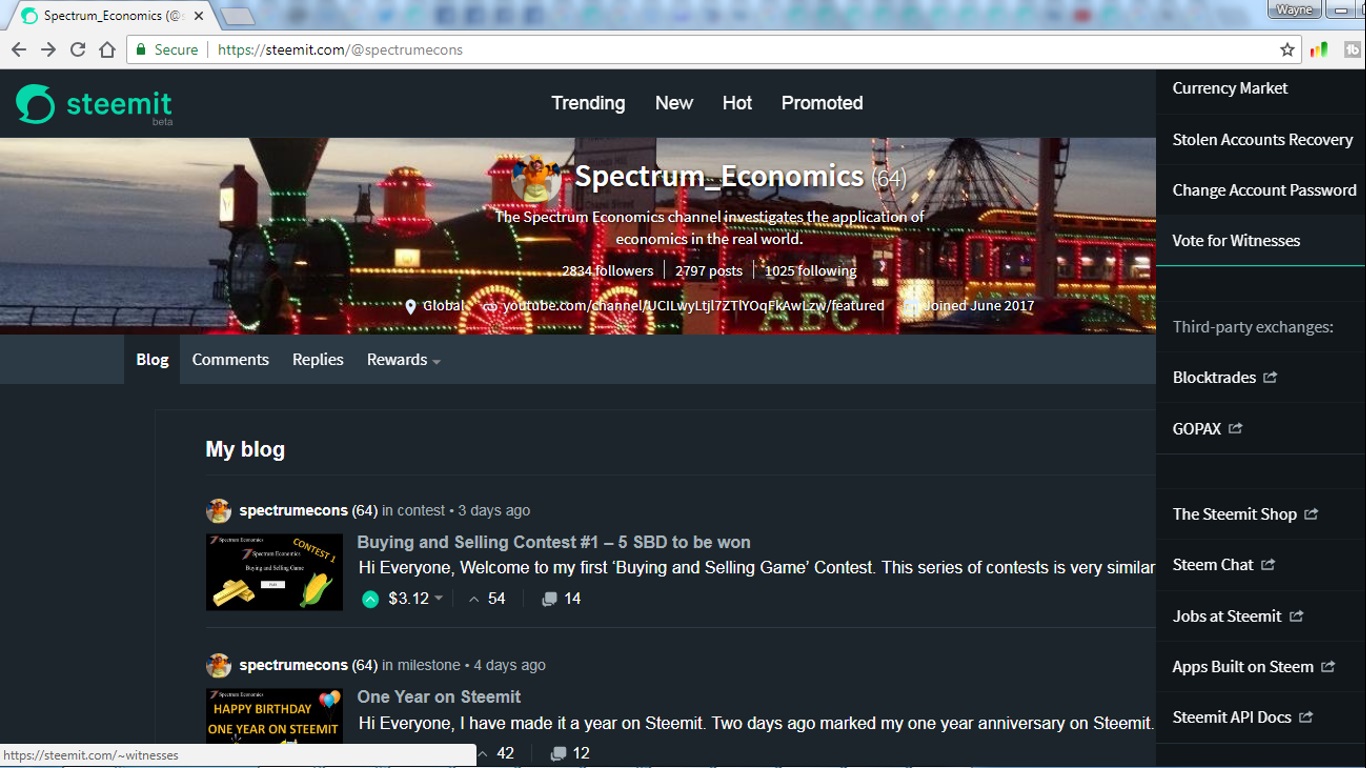

I am Wayne Davies also known as @spectrumecons on the Steem platform. I have been on Steemit for just over a year. My channel @spectrumecons focuses almost entirely on economics and contests. My more recent contests have become themed on economics thus making my channel almost exclusively an economics channel.

In this post I would like to explain Steem, Steemit and the Steem platform to those that are not familiar with it. I will try to be as technically correct as possible but the main gist of this post is to give people new to Steem or have yet to make the leap to join the Steemit community an idea about what Steem and Steemit is and how it functions. I will limit the technical jargon as much as possible. I will also provide some additional insight based on my knowledge and skills relating to economics.

What is Steemit?

Steemit is a social media website built on the Steem platform. The Steem platform is bigger than just Steemit. There are many other websites and applications that are built on this platform such as DTube, DLive, Dmania, Busy, Utopian-io, Steemhunt, Steepshot, Zappl and many more. All websites and applications on the Steem platform utilises the cryptocurrency Steem as its unit of account and currency. This allows content creators to be paid for their efforts. The Steem platform is also decentralised. There is no central body controlling the supply or distribution of Steem. There is no central body controlling the content on the platform. The Steem community is effectively responsible for the direction and outputs of the platform. The Steem Blockchain enables all this to happen. The Steem Blockchain is covered in more detail later in the post.

The Steem platform is unique to other social media websites and platforms based on what I have described above.

Who pays the content creators?

‘Who pays the content creators?’ is possibly the question I get asked the most from people when I talk about Steem. So I thought I would address this as early as possible in this post.

Content creators receive upvotes for their content. These upvotes are given by members of the Steem community. Members of the community also have the freedom to remove their upvotes as well. Posts get paid out after 7 days. After this point, upvotes do not add rewards to the post. Content creators get between 75% and 100% of the payout of the post. 0% to 25% is paid out to curators in Steem Power. The percentage varies depending on when upvotes were made on the post. Upvotes in the first 30 minutes receive lower curations rewards. I will explain curation later in this post.

Posts are paid out in Steem Power and Steem Backed Dollars (SBD). SBD have been created with the intention of providing content creators with a stable income which can be cashed out at approximately the same value as US$1. This was previously done by pegging the value of SBD to US dollars. Now the SBD has been left to market forces and can fluctuate in value. Content creators can choose to be paid out in 100% Steem Power or 50% Steem Power and 50% SBD.

In order to upvote content, you need to have a Steem account and have Steem Power. Steem Power is an investment of Steem in the Steem platform; I will go into more detail later in the post. Steem Power has the same value as Steem (liquid) but cannot be immediately traded. To fully liquidate Steem Power (power down) takes around 3 months. The disadvantage of the lack of liquidity of Steem Power is offset by its capabilities. Steem Power gives the holder a stake in how the rewards pool (explained later in this post) is distributed. The more Steem Power an account has, the greater the influence that account has on the distribution of the rewards pool. Steem Power also earns interest and can be delegated to other users; I will discuss delegation later in this post. Below are some useful links to help you understand more about Steem and the Steem platform:

-

https://steem.io/

-

https://steem.io/SteemWhitePaper.pdf

Rewards pool

The rewards pool is distributed using upvotes and is the typical source of income for content creators. The rewards pool is also used to pay interest on Steem Power and support witnesses (explained later in the post). The amount added to the rewards pool depends on the current inflation rate of Steem and the block number in the blockchain (the blockchain is made of blocks of data, the block number aligns with the position of the block in the blockchain). At the time of this post, Steem had reached just over 23,536,000 completed blocks.

At block 7,000,000 the annual inflation rate of Steem was 9.5%. Inflation drops by 0.01% every 250,000 blocks. The current inflation rate is therefore (9.5 - (23,536,000 – 7,000,000) / (250,000*100) = 8.84%). At the moment, using this inflation rate and virtual supply of Steem, approximately 50,000 Steem is added to the rewards pool each day; this excludes interest payments and witnesses funding. The inflation rate falls as the supply of Steem grows. This, therefore, limits the growth of the rewards pool but also protects the price of Steem. I believe the aim is keep the growth of the rewards pool close to constant. In about 20 years, inflation will become fixed at 0.95%.

For a detailed mathematical explanation of rewards pool calculation, I recommend you read a post by @penguinpablo. This post can be accessed using this link: https://steemit.com/steem/@penguinpablo/til-how-much-steem-is-added-to-the-reward-pool-per-day.

As more content creators join the Steem platform, more people will be competing for the rewards pool. This will result in lower average payouts per post in Steem but if the price of Steem is higher, which is what those with large investments in Steem are aiming to achieve, the rewards in US dollars will remain attractive. This is another reason why it is important that the price of Steem increases.

The rewards pool is not created out of thin air. Increasing the supply of Steem (creating a rewards pool) dilutes the stake of existing investors in Steem. This means, if we hold everything else constant, Steem is inflationary in nature. Therefore, allowing a rewards pool reduces the price of Steem if the content created or any other attraction/feature on the Steem platform does not bring in new investment. Those that have the most invested, risk to lose the most from the creation of the rewards pool. This encourages those with the most invested to upvote content that is most likely to encourage investment in the platform. This should indicate that content that is considered popular or high quality is more likely to receive upvotes from those most heavily invested. As a person becomes more financially invested in Steem, their priority shifts from obtaining more Steem Power to working towards increasing the price of Steem.

Roles on Steem

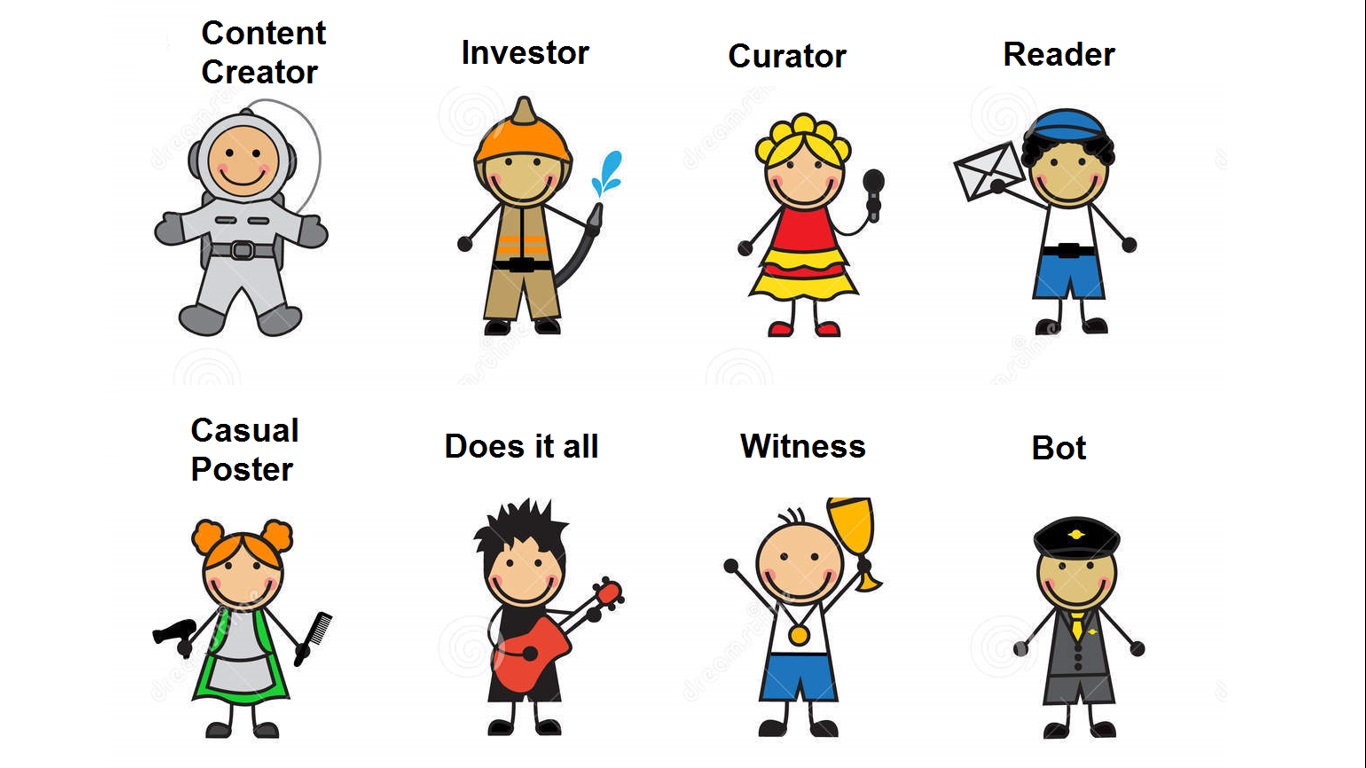

Users on the Steem platform can fall into a number of groups. Most users fall into several groups at the same time (not mutually exclusive). The groups I have identified are as follows (There are several roles I have missed out such as witnesses and developers. I explain the role of witnesses later in the post, developers are beyond the scope of this post; the website https://join.utopian.io/ is worth visiting if you are a developer interested in working on Steem projects.):

- Content creator

- Casual poster

- Investor

- Curator

- Reader/viewer

- Combination of any of the above

Content creator

The Steem platform because of its reward system attracts content creators. Content is, theoretically, rewarded based on the value it is perceived to add to the platform. The content creators that produce the best or most popular content will eventually receive the highest rewards. As Steem is new, there are less content creators and therefore good content creators are identified faster than on other social media platforms such as YouTube or Facebook. This does not mean great content creators are going to be rolling in rewards. It takes time to become established and recognised by the community for quality content. Every account has a reputation score. A higher reputation can attract more readers and viewers and therefore higher rewards.

The Steem platform is also censorship resistant. There is no central body that can come along and censor content deemed not appropriate (Steemit Inc. holds a very large proportion of Steem Power but does not perform any censorship role). The community itself can choose to downvote/flag content that the community deems inappropriate. Downvotes remove rewards from posts, those with more Steem Power have more powerful downvotes. Downvotes can be triggered by clicking on the flag to the right side of the post. On clicking the flag, a list of reasons for downvoting/flagging are provided.

If the value of the post falls below zero it will be hidden from view but there is still an option for readers and viewers to reveal this post. Downvotes can be removed from a post. This sometimes happens when the creator of the post amends any aspects of the post deemed offensive to the downvoter; for example, use of wrong tags. Many content creators especially in alternative media have struggled against censorship on social media platforms such as YouTube and Facebook.

Causual poster

The Steem platform is also a nice place for the causal content creators who just want to share some content once in a while. The rewards are most likely to be small but that’s better than nothing. The casual poster can eventually become a regular or more committed Steem user as they get more immersed in the platform.

Investor

I will define an investor as someone who buys Steem and converts this Steem into Steem Power. Investments can vary in magnitude as I will explain later in the post. Investors want a good return on their investments.

As the Steem platform is new (Steemit is still a Beta version) it is in a high growth phase. A lot of changes are taking place to improve the quality and efficiency of the platform. These changes can be expected to increase the value of the platform also known as the market capitalization of the platform.

The market capitalization is equal to the price of Steem multiplied by the supply of Steem. The supply of Steem is increasing as explained earlier in the post. Therefore, investors will want the market capitalization to increase faster than the supply of Steem so that the price of Steem increases and therefore earn a return. To increase the value of their investment, investors will also want to curate good quality content to attract more readers, content creators and other investors. Supporting witnesses that add value to the Steem platform is also an important factor to increasing the value of the platform.

Curator

I would expect everyone in the Steemit community to be involved in curation of content at some point. Curation is essential to helping the platform grow. It is the community’s way of identifying posts that deserve rewarding. We curate when we upvote posts. If you have sufficient Steem Power you can adjust the strength of your vote between 1% and 100%. Those with very little Steem Power can only vote at 100%; this is because the value of the upvote is so low that it cannot produce any value at low percentages.

There is no set criteria anyone needs to follow when curating content. There is incentive to promote good or popular content as early as possible. Upvoting posts rewards the upvoter with curation rewards. These curation rewards vary depending when you upvote and what content you upvote. If you upvote a post early and this post receives many high value upvotes after you have upvoted (indicating the post is popular with investors) your curation rewards will be higher.

In addition to upvoting, users can also comment and provide feedback on posts. Providing honest and genuine feedback is normally well received. Sending spam comments is not recommended. These comments are often downvoted. Comments can also be upvoted if the community feels the comments add value to the post or to ongoing discussions. Comments also facilitate further engagement with the community. Most of Steem’s best content creators respond to many of the comments they receive.

Reader or viewer

The reader or viewer of content is a greatly underestimated role. If the reader has invested in Steem Power they can curate content and reward content creators. Readers that have a Steemit account but not invested can offer support with upvotes (even though theses upvotes have a very low value); these numbers still have value. Even readers that do not have a Steemit account are welcome. If these readers like the content they might join or encourage other people to join. On top of that, Steem platform content is getting more attention; gaining more attention is a key to success. If the content created is good, this attention can be valuable in terms of attracting investors and adding further value to the Steem platform.

Combinations of any or all of the above

Most of us that join the Steem platform will fall into most of the above groups. Content creators become investors by not selling their rewards. Investors become content creators by posting interesting information. Everyone with an account should be curators looking for good content to attract more people that fall into any of the above categories. Essentially everybody should work together to grow the platform in one way or another. Content creators have incentive to produce good content to gain a larger stake in the platform. Investors have incentive to curate good content to increase the value of the platform and raise the price of Steem.

Reputation

Reputation is an indication of the quality of content produced by a content creator. Reputation can vary from negative values to values above 80 (highest reputation at the moment is 80). Repuation increases with high value upvotes and upvotes from content creators with a high reputation. Reputation decreases from downvotes, larger downvotes from those with a high reputation are more harmful to the reputation score.

If reputation falls to zero or less, content is hidden until upvoted sufficiently to become visible. A reputation this low is an indication of very low quality content or an indication that a user has been acting in a manner deemed to be harmful to the Steem community. Once a post has been paid out for an account that has reputation of below zero, content becomes hidden even if the post received many upvotes. These posts can be viewed as users have an option to unhide them. A negative reputation massively effects the amount of exposusre an account gets but does not completely censor it.

Vests and Rankings

When someone buys Steem Power they are awarded something know as vests. Vest are your stake in the Steem platform, it is like owning shares in a company. 1 unit of Steem Power is equivalent to slightly more than 2000 vests or 0.02 Million Vests (MV); the exact ratio is not fixed. Steem Power/Vests determine your rank in Steemit. There are 5 ranks. They are as follows with their corresponding required Steem Power and MV:

- Whales (500,000+ Steem Power or 1,000+ MV)

- Orcas (50,000 – 500,000 Steem Power or 100 – 1,000 MV)

- Dolphins (5,000 – 50,000 Steem Power or 10 – 100 MV)

- Minnows (500 – 5,000 Steem Power or 1 – 10 MV)

- Red Fish (0 – 500 Steem Power or 0 – 1 MV)

Keep investing in Steem and you can move up the ranks. The ranks provide a sense of pride in regards to your level of ownership of the platform. They also look cool on the steemiitboard rewards page.

Witnesses

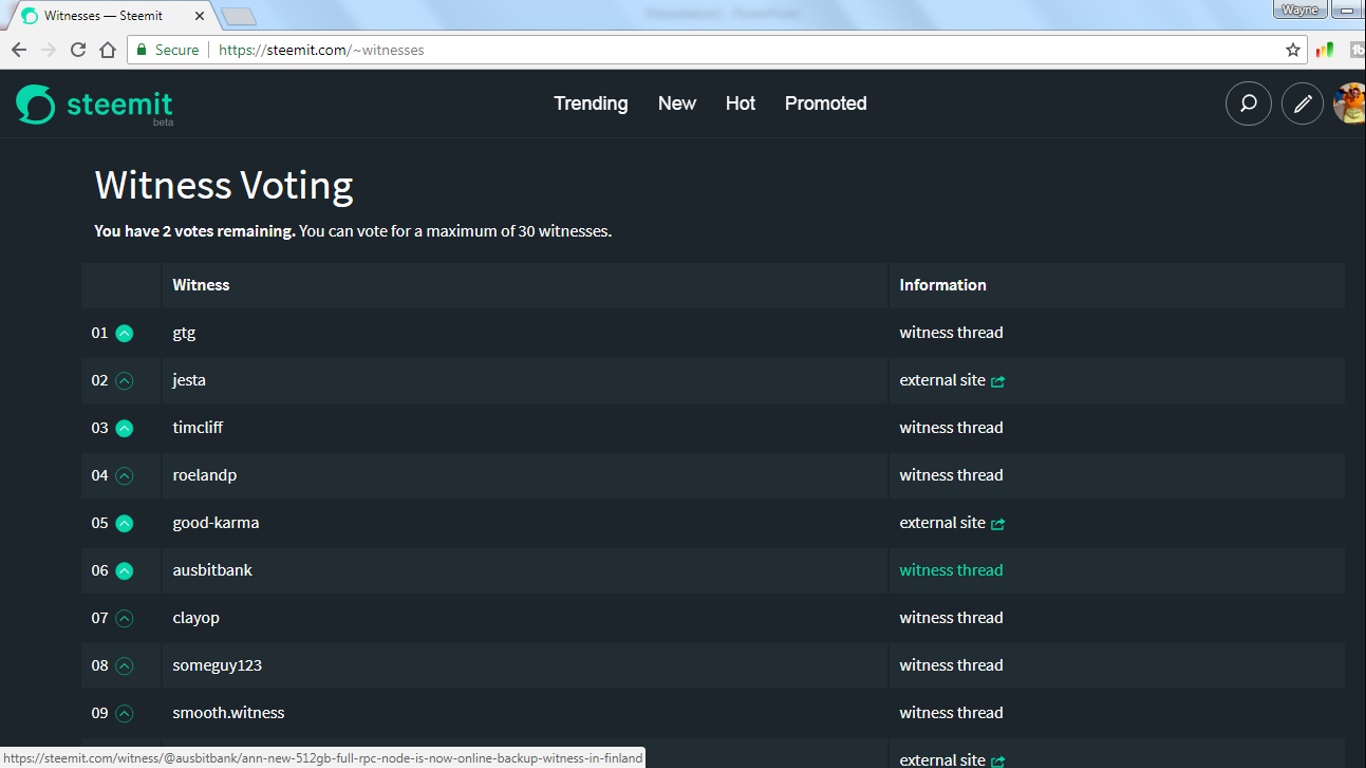

Witnesses are a critical part of the Steem world. It is important than everyone invested in the Steem platform takes the time to look at what each witness is working on. You can vote for your witnesses from your account page on Steemit, see screenshot below.

Witnesses run various initiatives, you can find out more about these initiatives by clicking on the links provided on the Steemit witness page. Some of the witness have posts outlining what they are working on while others have external websites. The more support a witness gets the more funds become available to support their proposed initiatives. Selecting the right witnesses shapes the future of the platform. See screenshot below of the available links to witness initiatives.

The role of a witness extends beyond just initiatives but to taking care of the blockchain, which contains everything that happens on the Steem platform. I do not know the details of the role but it is important. For more information on witnesses click on this link: https://steemd.com/witnesses.

Promotion

There are many ways to promote your Steem content. You can post links to your posts on Steem.chat or discordapp. You can have your post resteemed on another accounts page. Resteem basically means your post is posted again on another person’s account. Steemit has resteem services which involves paying a fee to another account in order to resteem your post.

You can make use of other social media platforms to share your content. I would recommend sharing to Reddit, Twitter, Facebook, and Linkedin. Steemit makes it easy to share to these websites with the apps at the bottom of posts. Just click on these apps and follow the instructions.

Sharing your content externally may not reap rewards immediately as most of the people seeing your content will not have Steem accounts, therefore cannot upvote or comment on your posts. But you still gain exposure and so does Steem. Some of those people that are impressed by your content may sign up or even tell their friends and family. This could lead to the growth of the platform as a whole.

Use of bots

Bots are all over Steemit. There are welcome bots, bots for detecting spam, bots for identifying plagiarised work, bots giving out random rewards and many other types. The bots to be most aware of are bots for promotional activities. Content creators can bid for or buy upvotes from bots to promote posts. Buying upvotes from bots will normally give an upvote worth slightly more than the value of the payment at the time of purchase. Bidding from bid bots is gene